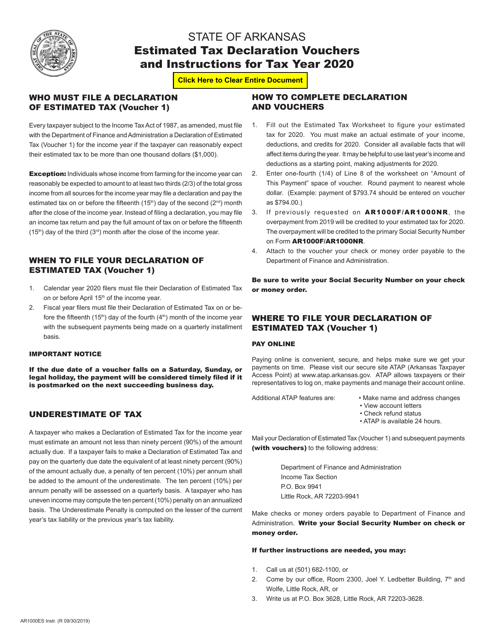

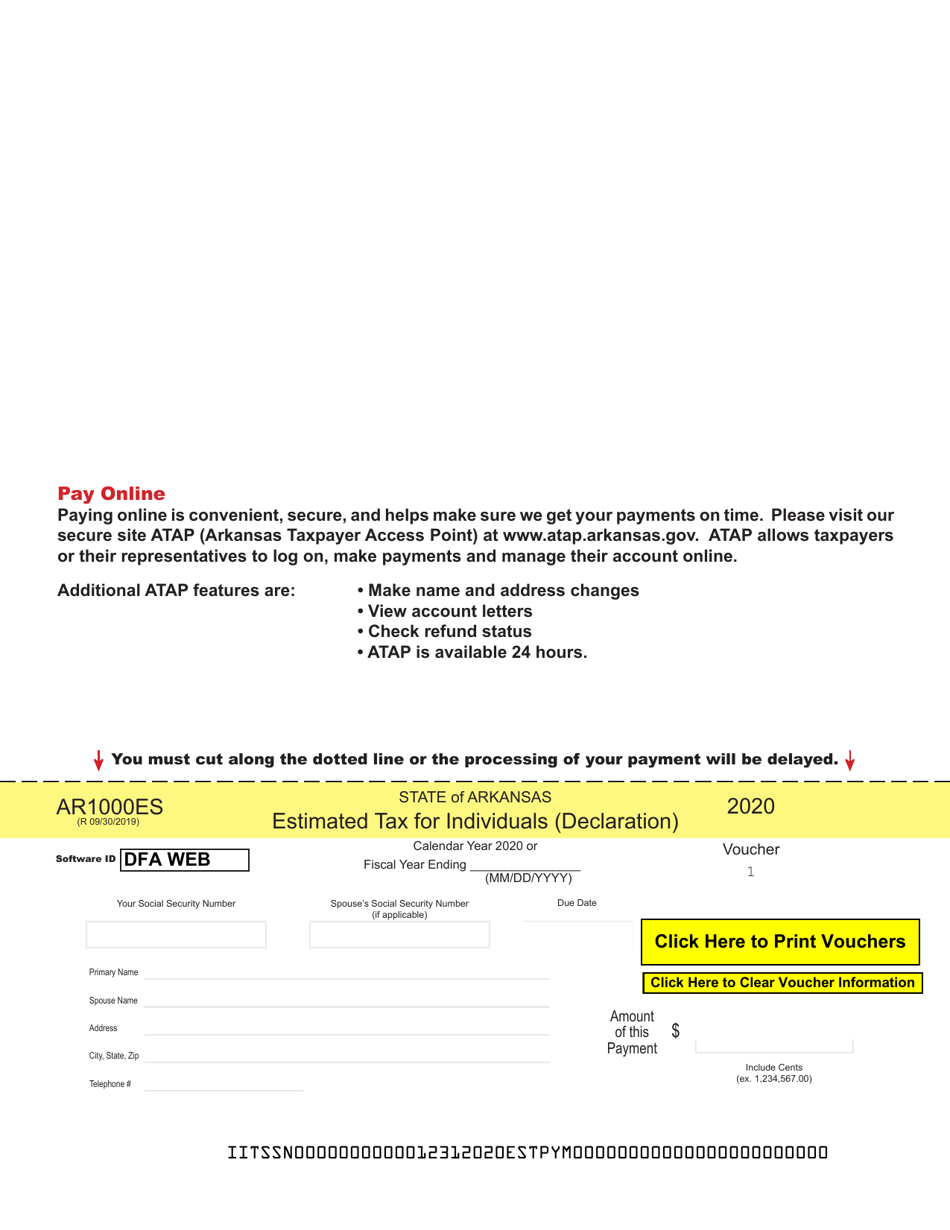

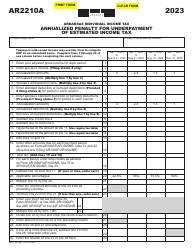

Form AR1000ES Individual Estimated Tax Vouchers - Arkansas

What Is Form AR1000ES?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000ES?

A: Form AR1000ES is a voucher used to make estimated tax payments in Arkansas for individuals.

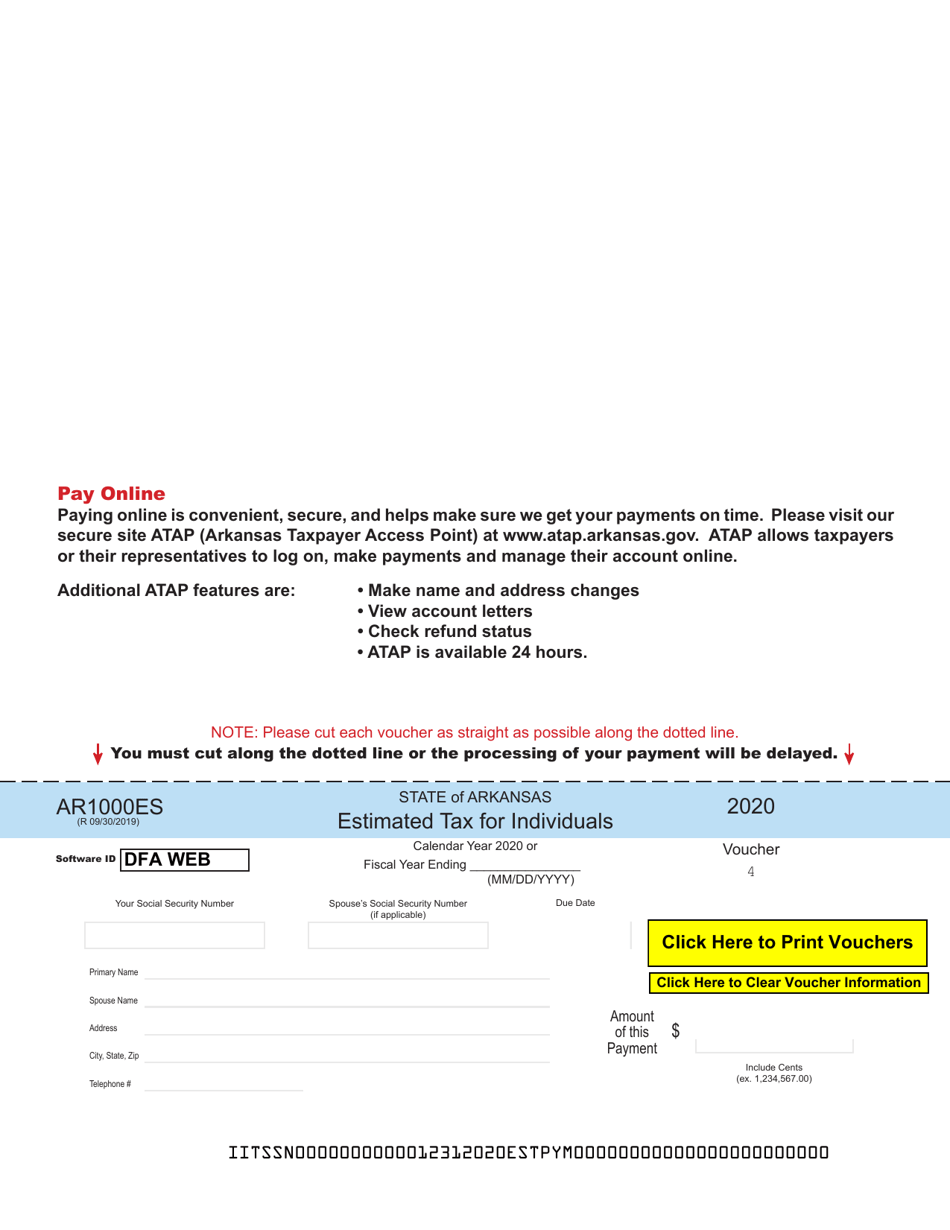

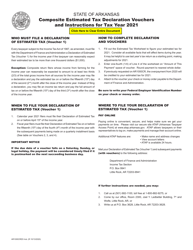

Q: Who needs to use Form AR1000ES?

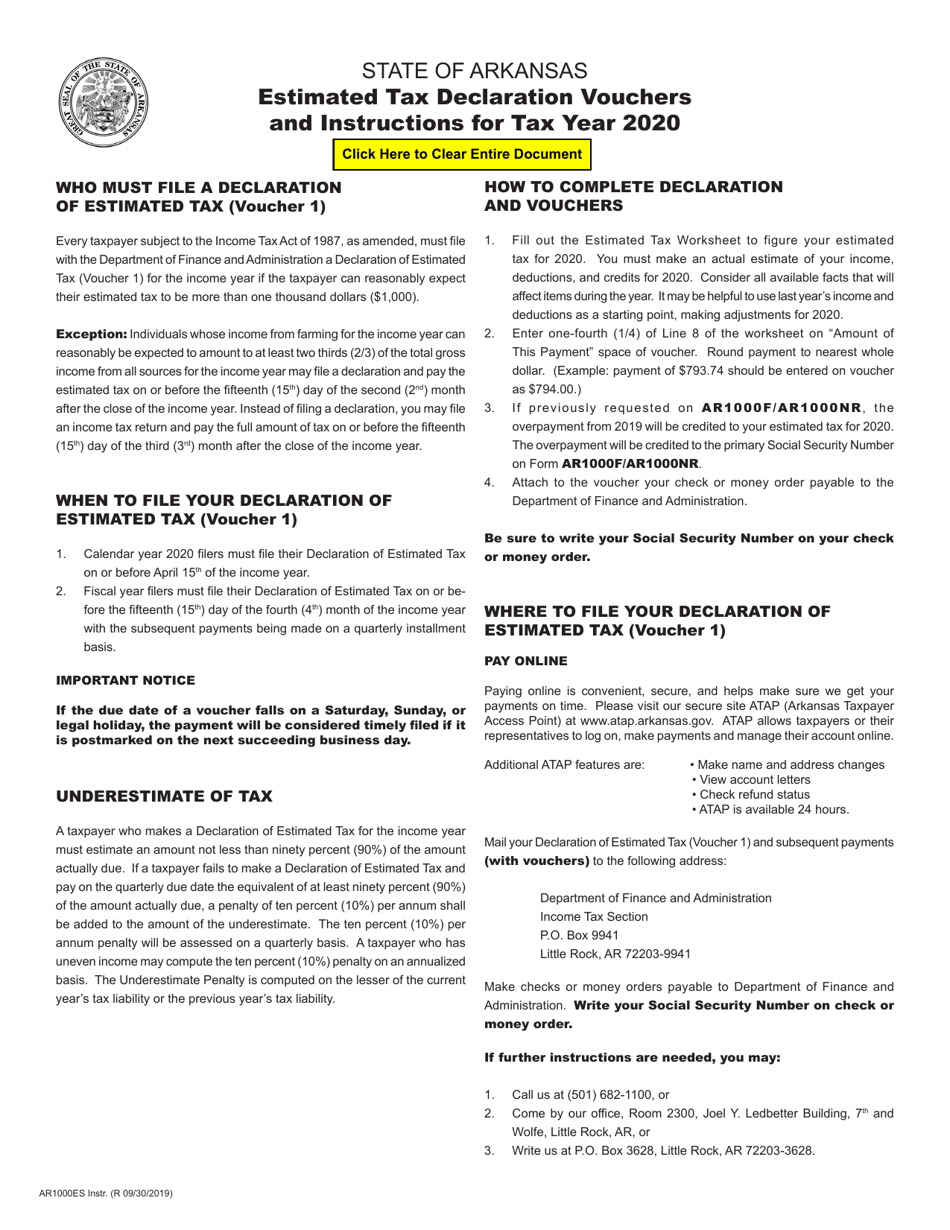

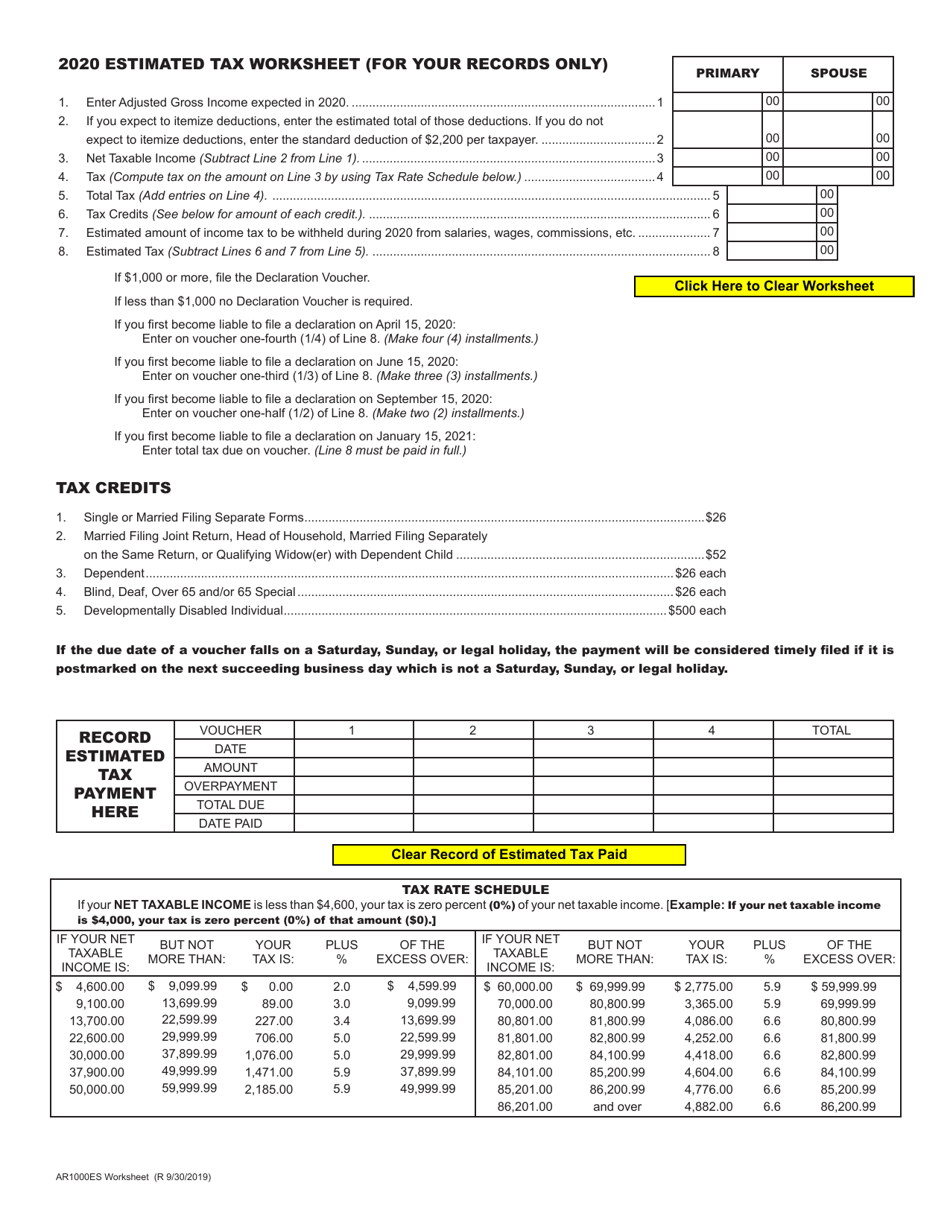

A: Individuals who expect to owe at least $1,000 in Arkansas income tax are required to make estimated tax payments using Form AR1000ES.

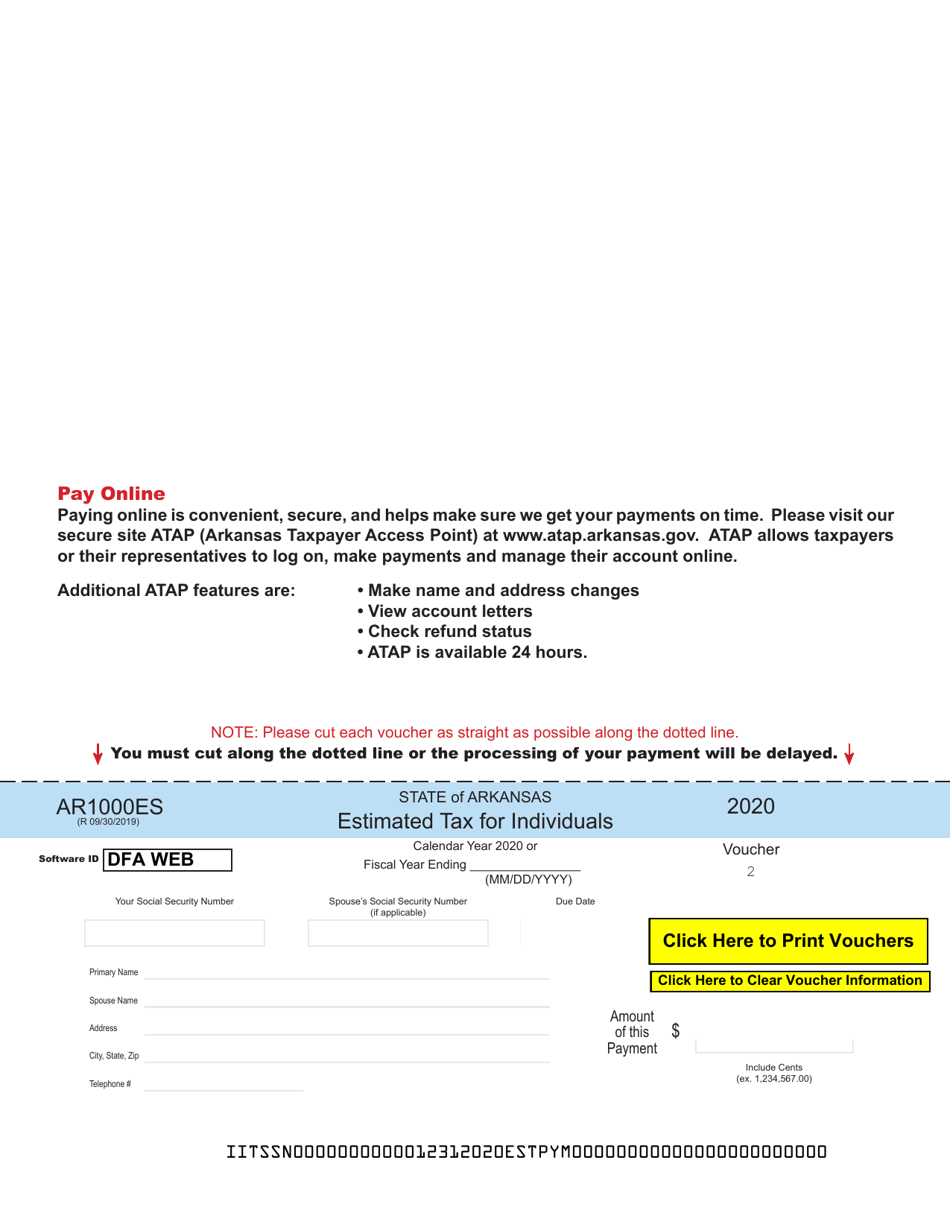

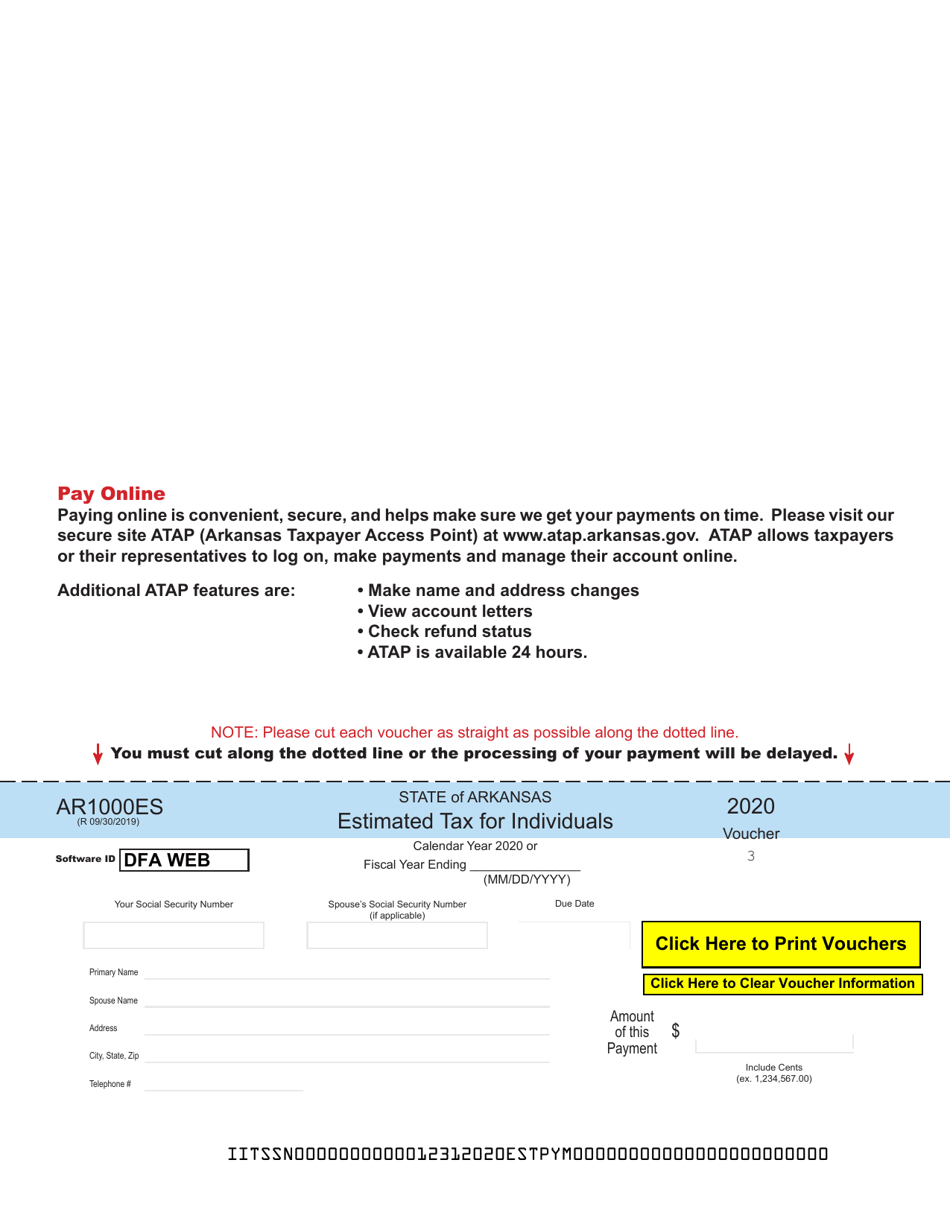

Q: How often do I need to file Form AR1000ES?

A: Estimated tax payments using Form AR1000ES need to be made quarterly. The payment due dates are April 15, June 15, September 15, and January 15 of the following year.

Q: How do I submit Form AR1000ES?

A: Form AR1000ES can be filed electronically using Arkansas Taxpayer Access Point (ATAP) or by mail.

Q: What information is required on Form AR1000ES?

A: Form AR1000ES requires the taxpayer's name, Social Security number, estimated tax amount, and payment method.

Form Details:

- Released on September 30, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000ES by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.