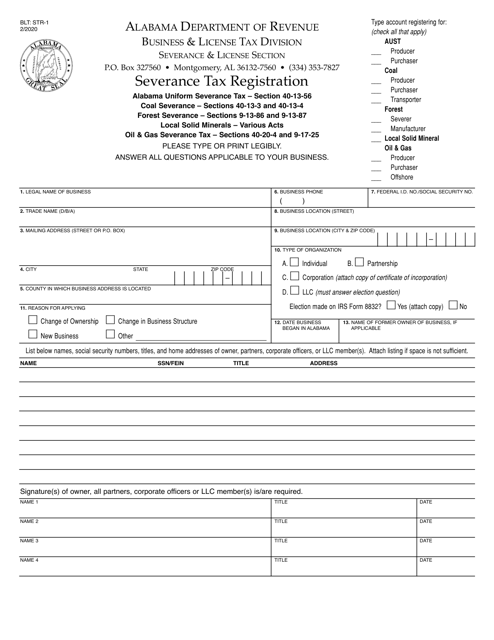

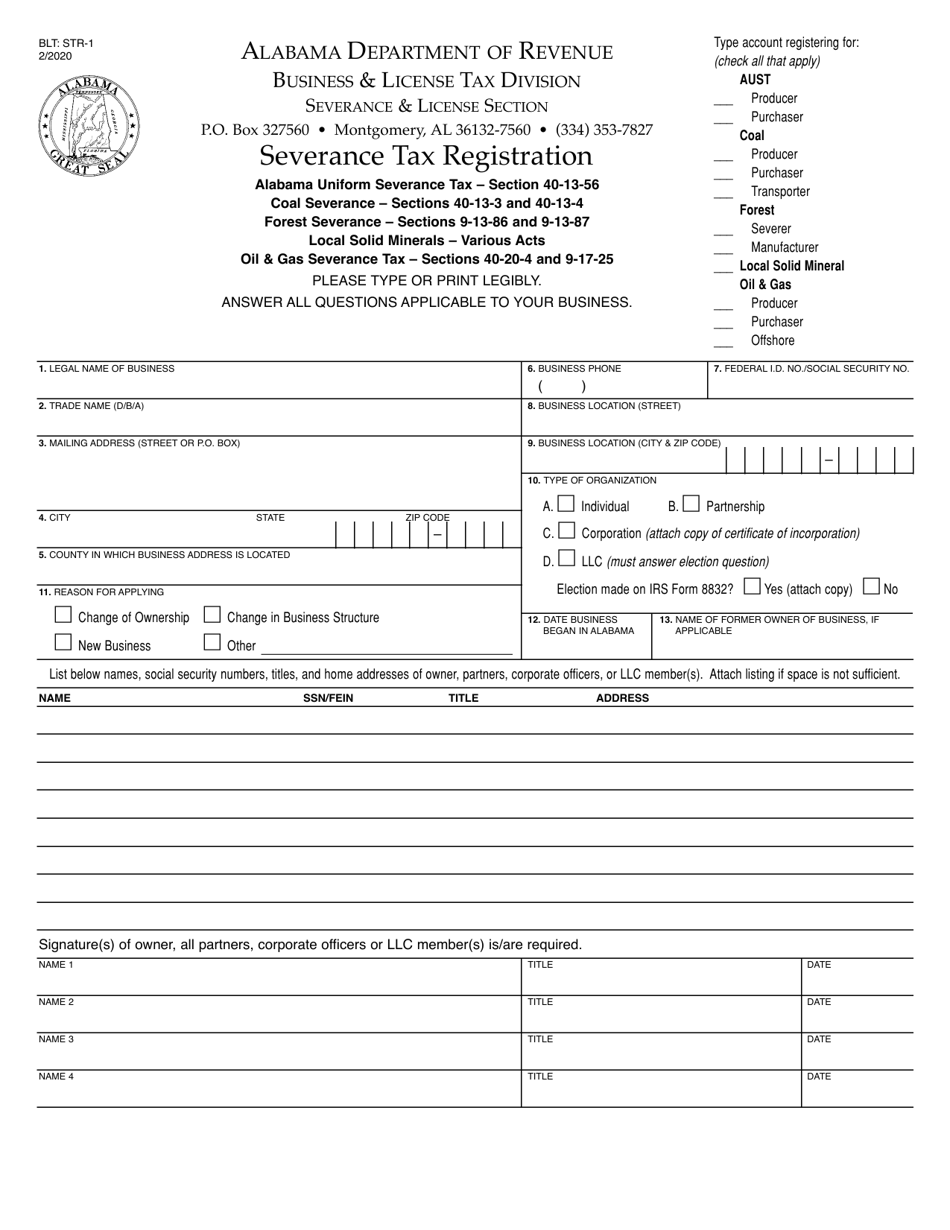

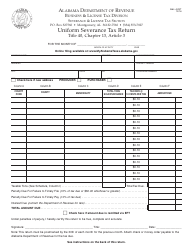

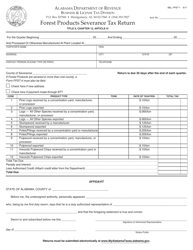

Form BLT: STR-1 Severance Tax Registration - Alabama

What Is Form BLT: STR-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BLT: STR-1?

A: Form BLT: STR-1 is the Severance Tax Registration form for the state of Alabama.

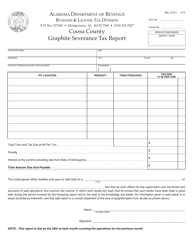

Q: What is severance tax?

A: Severance tax is a tax imposed on the extraction or production of natural resources such as oil, gas, or minerals.

Q: Who needs to complete Form BLT: STR-1?

A: Anyone engaged in activities that involve the severance of natural resources in Alabama needs to complete Form BLT: STR-1.

Q: What information is required on Form BLT: STR-1?

A: Form BLT: STR-1 requires information such as taxpayer identification numbers, contact information, and details about the natural resources being severed.

Q: Are there any filing fees associated with Form BLT: STR-1?

A: No, there are no filing fees associated with Form BLT: STR-1.

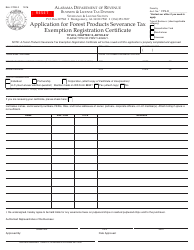

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BLT: STR-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.