This version of the form is not currently in use and is provided for reference only. Download this version of

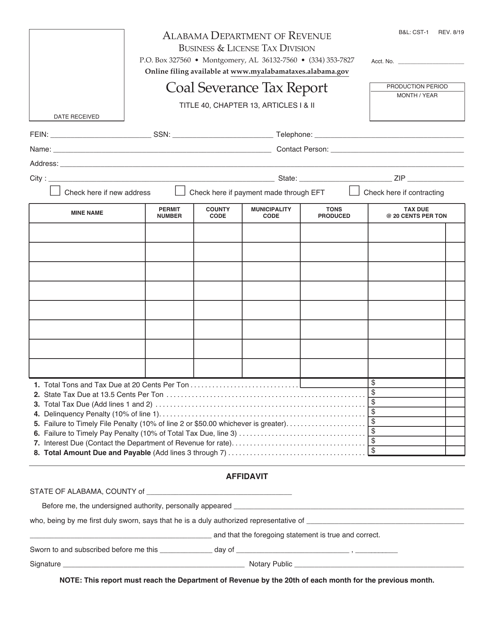

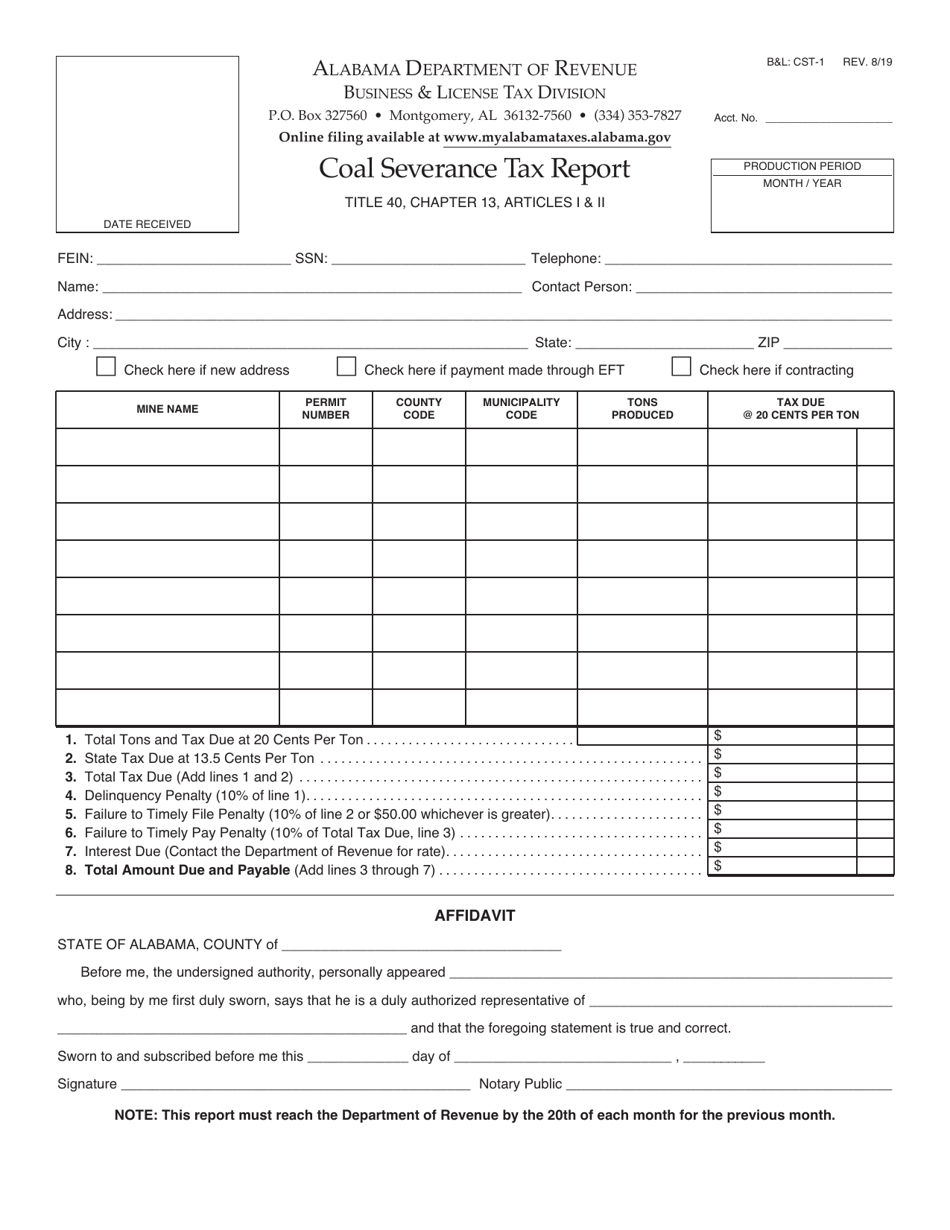

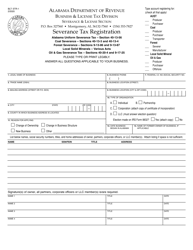

Form B&L: CST-1

for the current year.

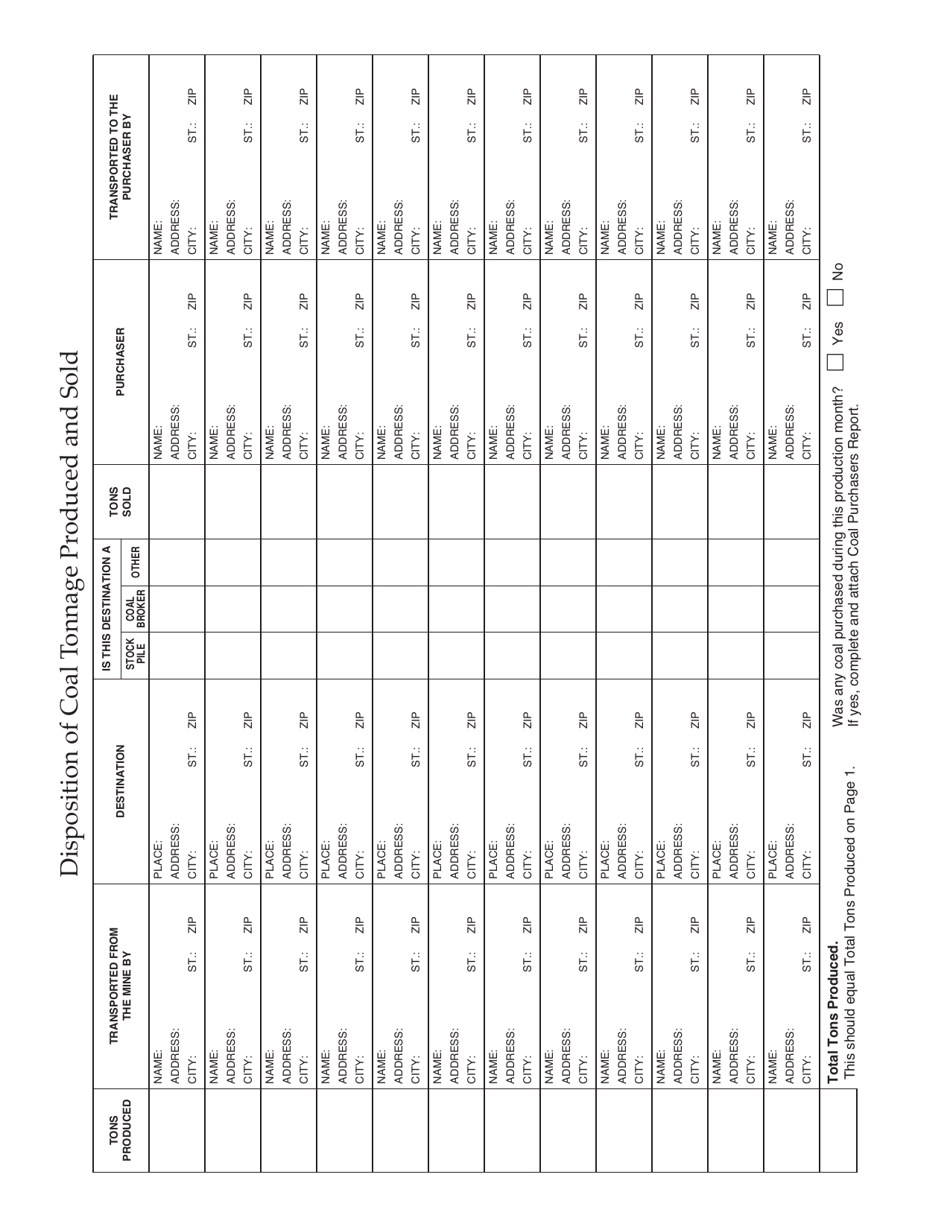

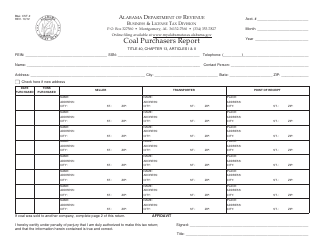

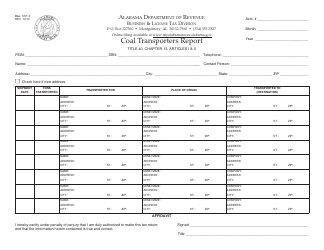

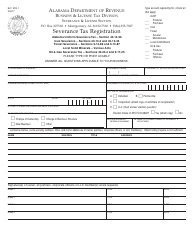

Form B&L: CST-1 Coal Severance Tax Report - Alabama

What Is Form B&L: CST-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the B&L CST-1 Coal Severance Tax Report?

A: The B&L CST-1 Coal Severance Tax Report is a form used to report and pay the coal severance tax in Alabama.

Q: Who needs to file the B&L CST-1 Coal Severance Tax Report?

A: Any person or entity engaged in coal mining operations in Alabama is required to file the B&L CST-1 Coal Severance Tax Report.

Q: When is the deadline to file the B&L CST-1 Coal Severance Tax Report?

A: The B&L CST-1 Coal Severance Tax Report must be filed on a monthly basis, with the due date falling on the 20th day of the month following the reporting period.

Q: What information is required to complete the B&L CST-1 Coal Severance Tax Report?

A: The B&L CST-1 Coal Severance Tax Report requires information such as the owner or operator's name, the mine's location, and the quantity of coal severed during the reporting period.

Q: Are there any exemptions or deductions available for the coal severance tax?

A: Yes, there are certain exemptions and deductions available for the coal severance tax in Alabama. It is best to consult the Alabama Department of Revenue or a tax professional for specific details.

Q: What are the consequences for late or non-filing of the B&L CST-1 Coal Severance Tax Report?

A: Late or non-filing of the B&L CST-1 Coal Severance Tax Report may result in penalties and interest being applied to the unpaid tax amount.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B&L: CST-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.