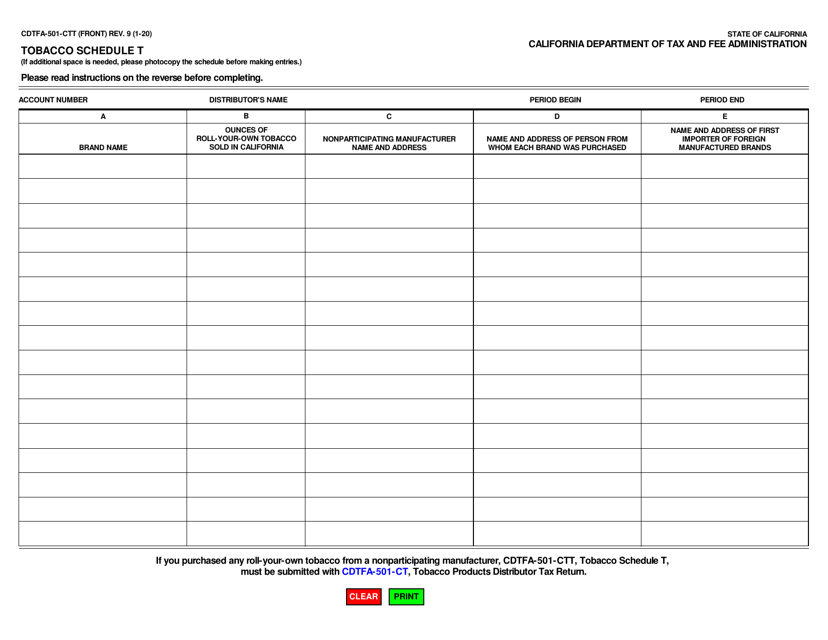

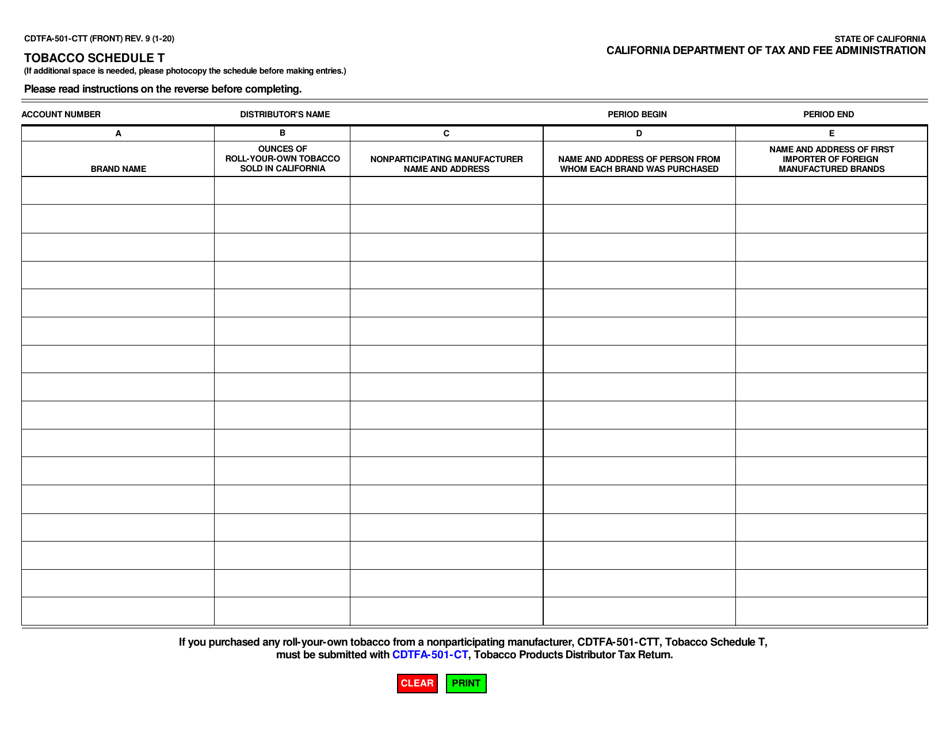

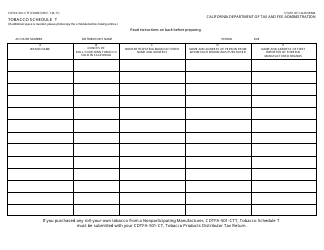

Form CDTFA-501-CTT Schedule T Tobacco - California

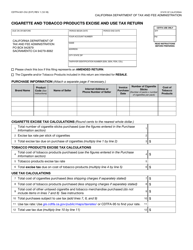

What Is Form CDTFA-501-CTT Schedule T?

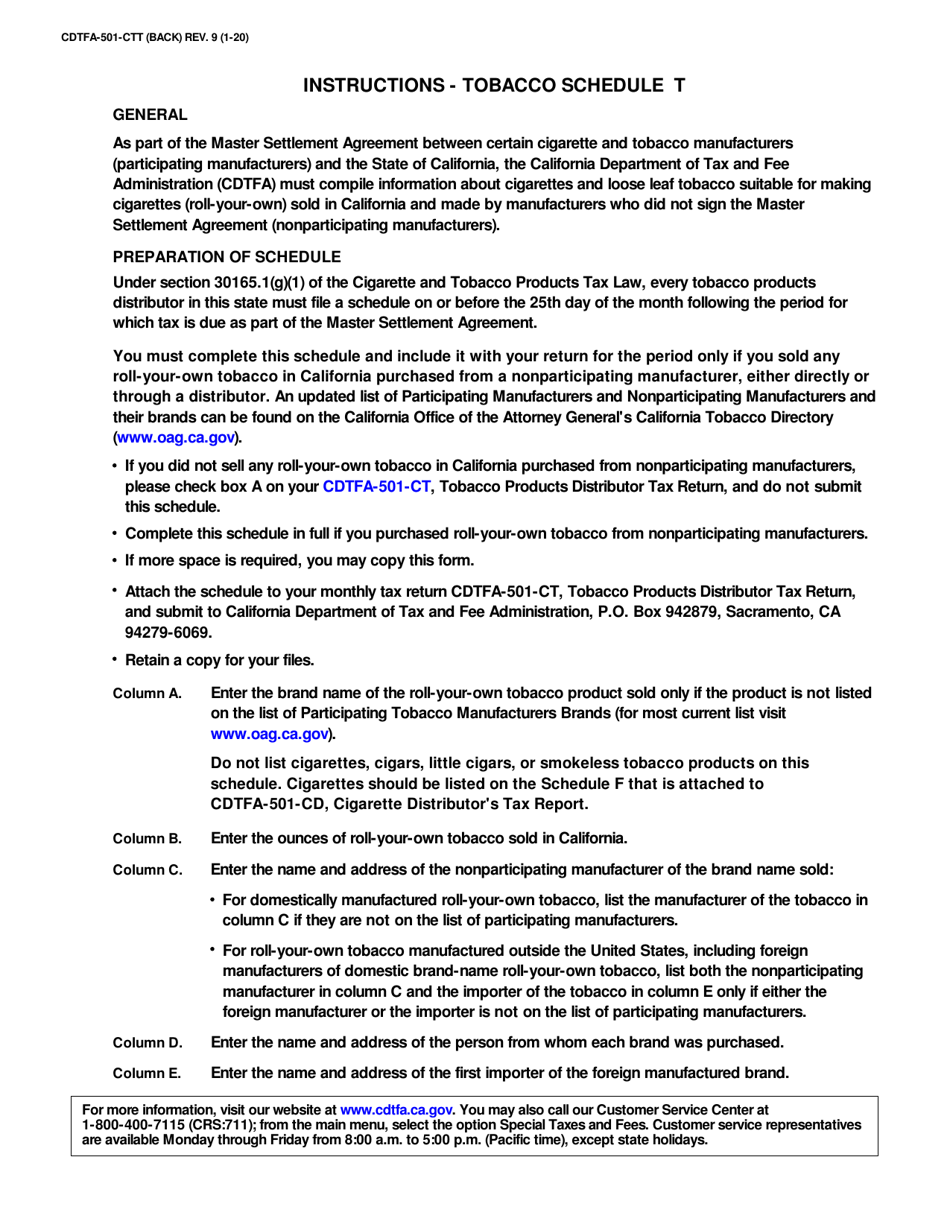

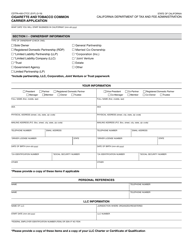

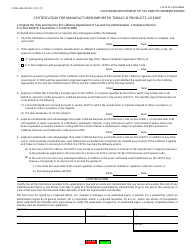

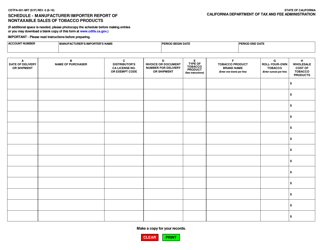

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California.The document is a supplement to Form CDTFA-501-CTT, Tobacco Schedule T. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-CTT Schedule T?

A: Form CDTFA-501-CTT Schedule T is a tax form used in California for reporting tobacco-related activities.

Q: Who needs to file Form CDTFA-501-CTT Schedule T?

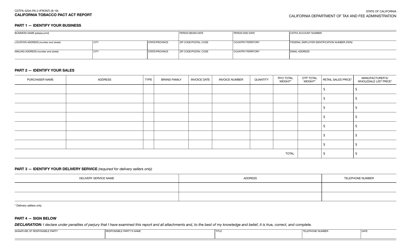

A: Businesses engaged in the sale, use, or storage of tobacco products in California are required to file Form CDTFA-501-CTT Schedule T.

Q: What information is required on Form CDTFA-501-CTT Schedule T?

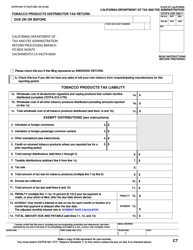

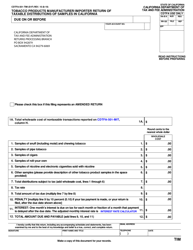

A: Form CDTFA-501-CTT Schedule T requires businesses to report details such as the quantity and value of tobacco products purchased, sold, or used during a specified reporting period.

Q: When is Form CDTFA-501-CTT Schedule T due?

A: Form CDTFA-501-CTT Schedule T is typically due on a quarterly basis, with specific due dates provided by the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-CTT Schedule T by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.