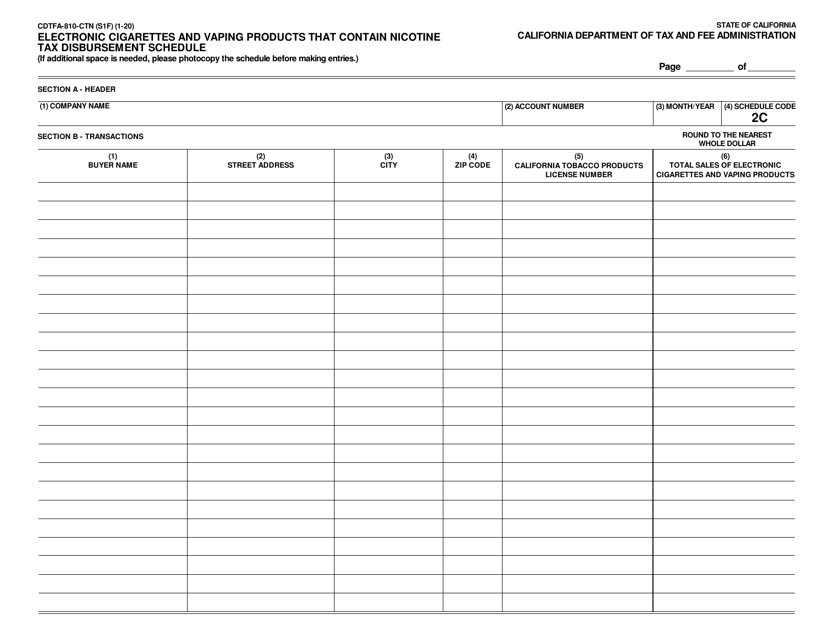

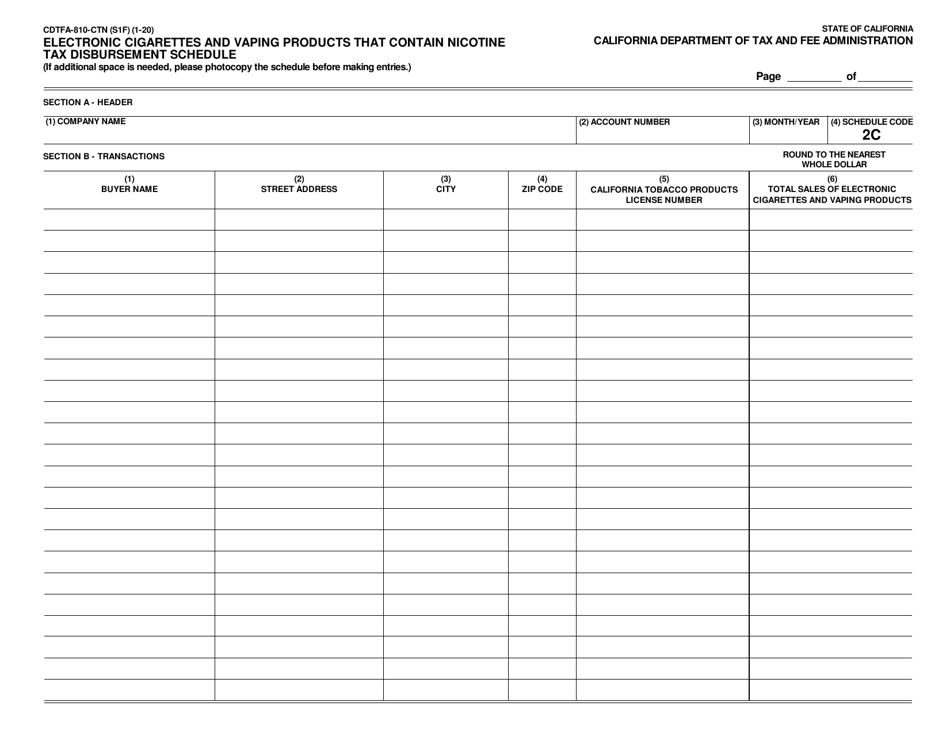

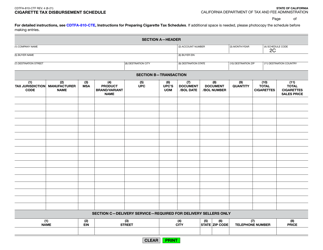

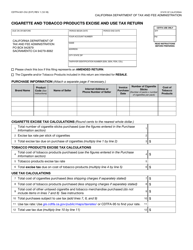

Form CDTFA-810-CTN Electronic Cigarettes and Vaping Products That Contain Nicotine Tax Disbursement Schedule - California

What Is Form CDTFA-810-CTN?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-810-CTN?

A: Form CDTFA-810-CTN is a tax disbursement schedule for electronic cigarettes and vaping products that contain nicotine in California.

Q: What does this form apply to?

A: This form applies to electronic cigarettes and vaping products that contain nicotine.

Q: What is the purpose of this form?

A: The purpose of this form is to report and pay the tax on electronic cigarettes and vaping products that contain nicotine.

Q: Who needs to file this form?

A: Anyone who sells electronic cigarettes and vaping products that contain nicotine in California needs to file this form.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-810-CTN by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.