This version of the form is not currently in use and is provided for reference only. Download this version of

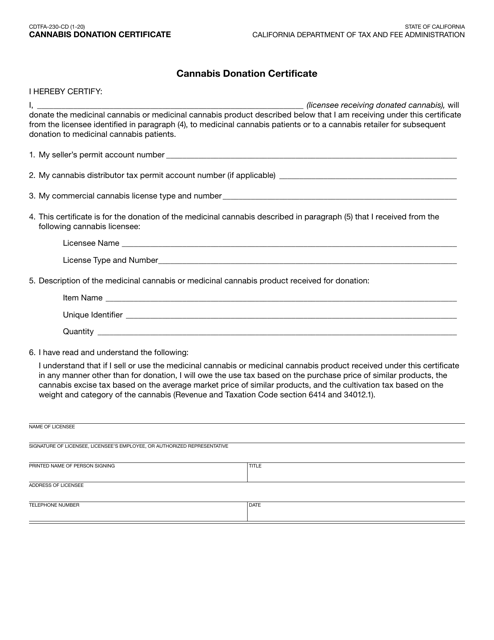

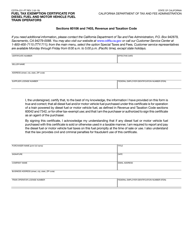

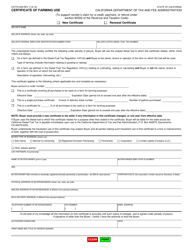

Form CDTFA-230-CD

for the current year.

Form CDTFA-230-CD Cannabis Donation Certificate - California

What Is Form CDTFA-230-CD?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-CD?

A: Form CDTFA-230-CD is the Cannabis Donation Certificate in California.

Q: What is the purpose of Form CDTFA-230-CD?

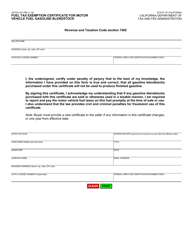

A: The purpose of Form CDTFA-230-CD is to provide proof of the donation of cannabis or cannabis products.

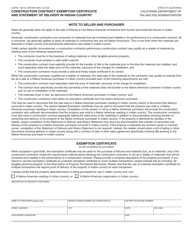

Q: Who is required to use Form CDTFA-230-CD?

A: Any person transferring cannabis or cannabis products as a donation is required to use Form CDTFA-230-CD.

Q: What information is required on Form CDTFA-230-CD?

A: Form CDTFA-230-CD requires information such as the donor's name and address, recipient's name and address, the quantity and description of the donated cannabis or cannabis products, and the date of the donation.

Q: Is there a fee for filing Form CDTFA-230-CD?

A: No, there is no fee for filing Form CDTFA-230-CD.

Q: When should I file Form CDTFA-230-CD?

A: Form CDTFA-230-CD should be filed within 30 days of the donation.

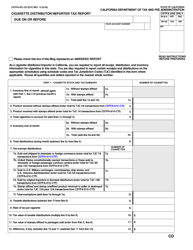

Q: What happens after I file Form CDTFA-230-CD?

A: After you file Form CDTFA-230-CD, you will receive a copy of the certificate for your records. The CDTFA may also conduct audits or request additional information as necessary.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-CD by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.