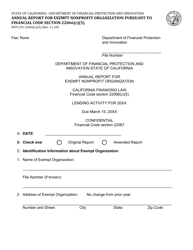

This version of the form is not currently in use and is provided for reference only. Download this version of

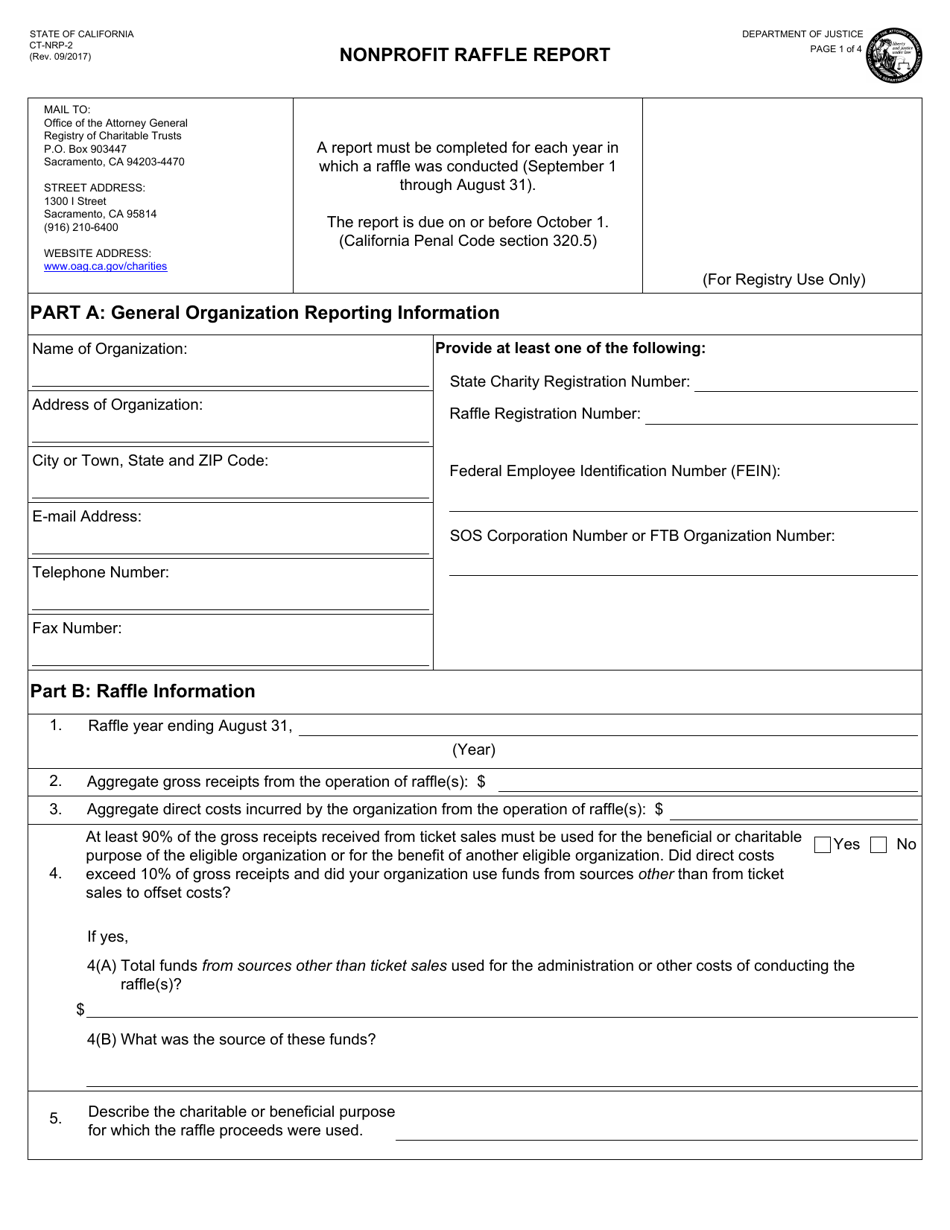

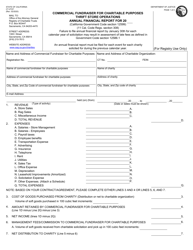

Form CT-NRP-2

for the current year.

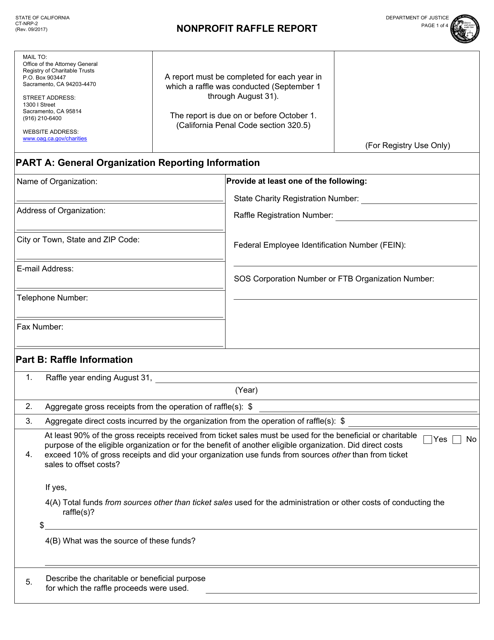

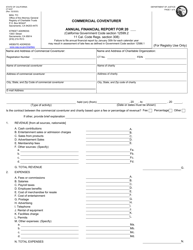

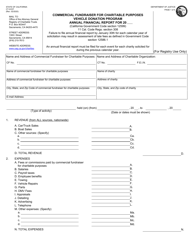

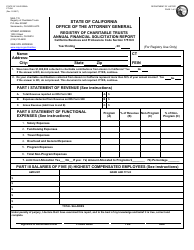

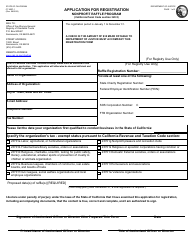

Form CT-NRP-2 Nonprofit Raffle Report - California

What Is Form CT-NRP-2?

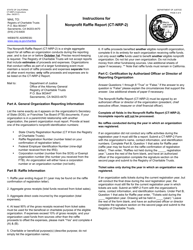

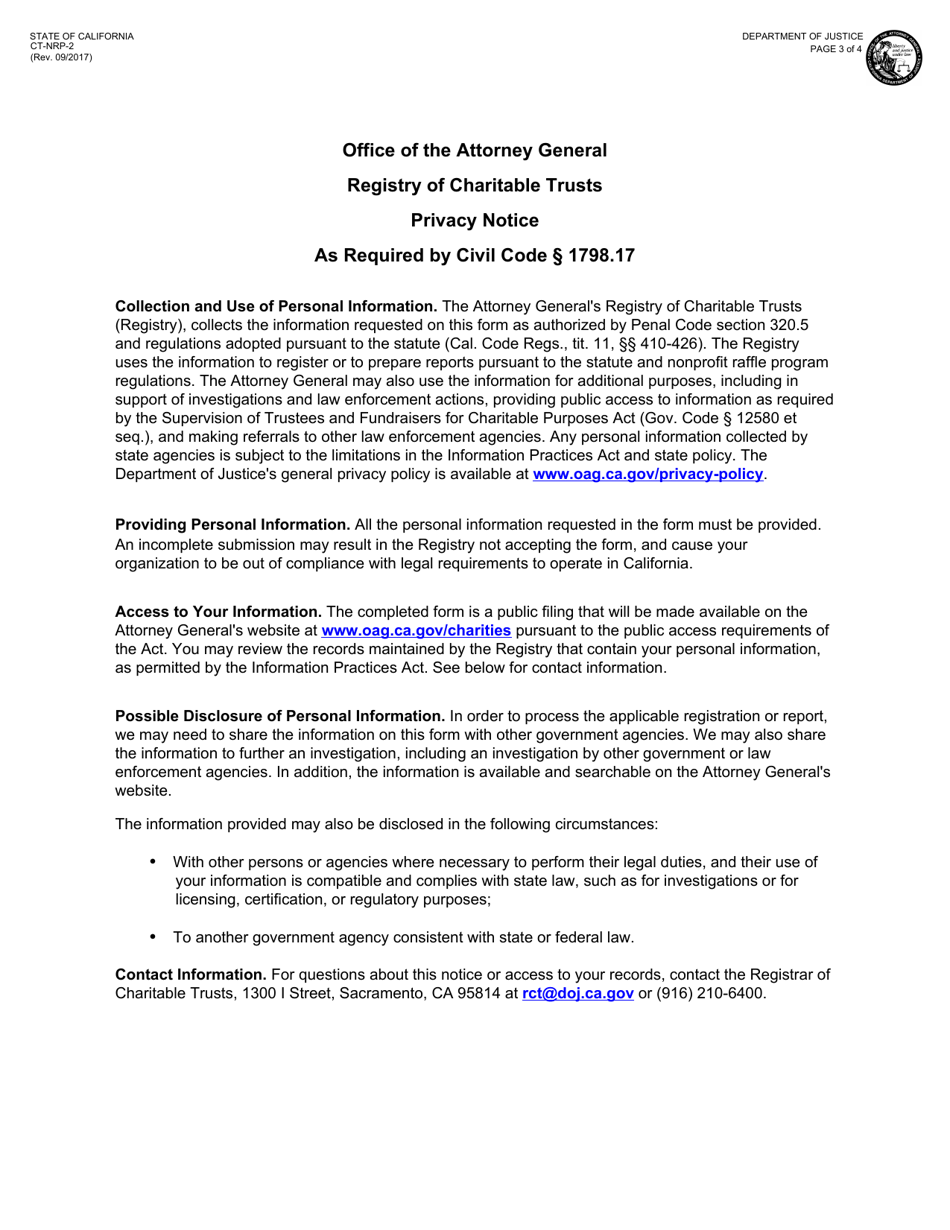

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

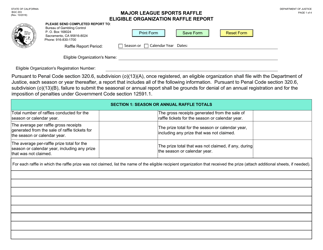

Q: What is Form CT-NRP-2?

A: Form CT-NRP-2 is the Nonprofit Raffle Report form in California.

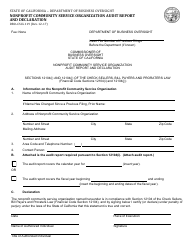

Q: Who needs to file Form CT-NRP-2?

A: Nonprofit organizations conducting raffles in California are required to file Form CT-NRP-2.

Q: What is the purpose of Form CT-NRP-2?

A: The purpose of Form CT-NRP-2 is to report the details of nonprofit raffles conducted in California.

Q: When is Form CT-NRP-2 due?

A: Form CT-NRP-2 is due on an annual basis, with the due date being determined by the nonprofit organization's fiscal year-end.

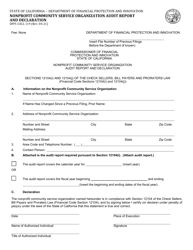

Q: Are there any filing fees associated with Form CT-NRP-2?

A: No, there are no filing fees associated with Form CT-NRP-2.

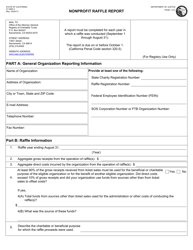

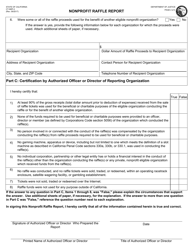

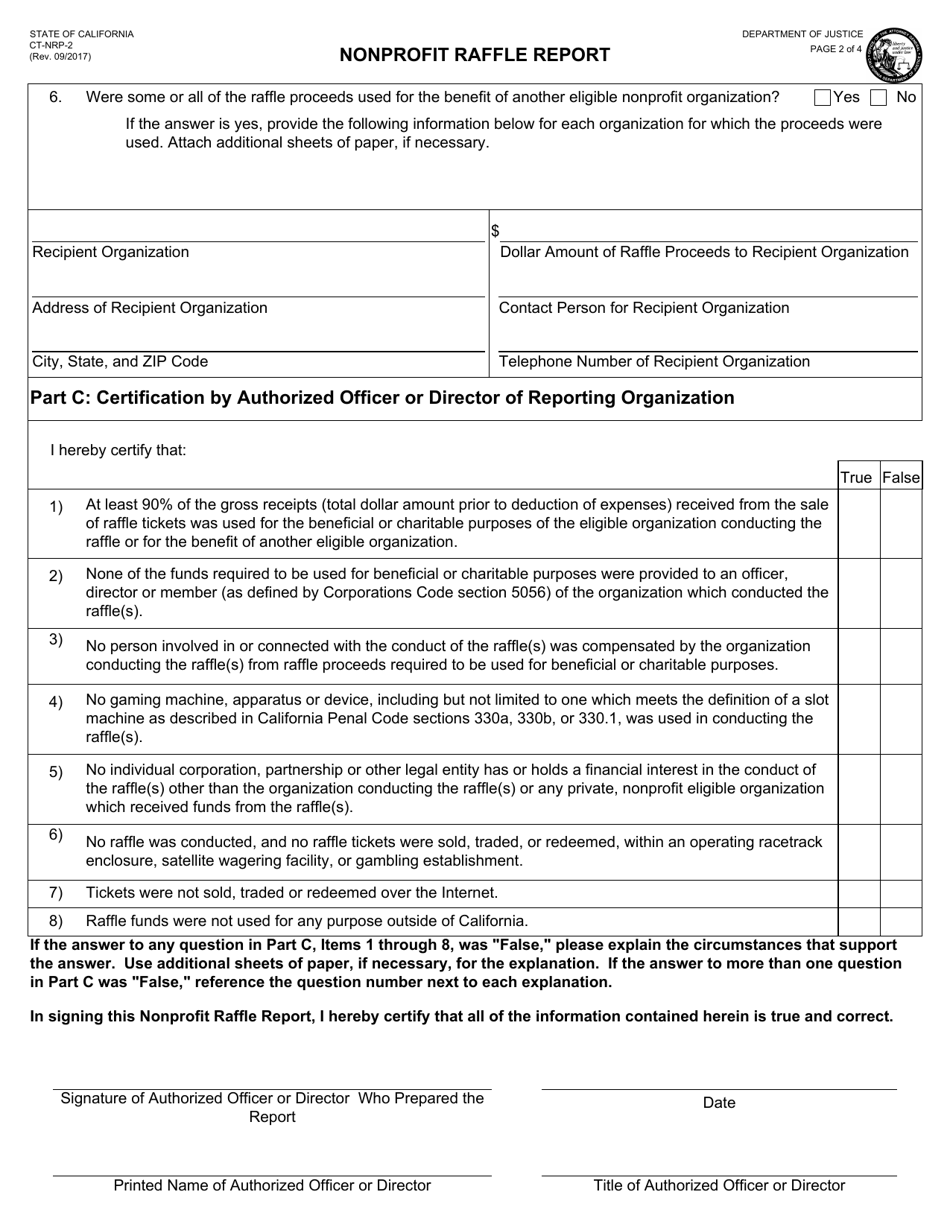

Q: What information is required on Form CT-NRP-2?

A: Form CT-NRP-2 requires information such as the total gross receipts from raffle ticket sales, the total cash prizes awarded, and the total operational expenses of the raffle.

Q: Are there any penalties for not filing Form CT-NRP-2?

A: Failure to file Form CT-NRP-2 or filing a false report may result in penalties or the revocation of the nonprofit organization's raffle registration.

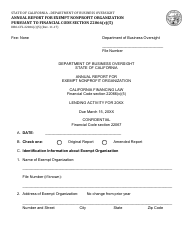

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-NRP-2 by clicking the link below or browse more documents and templates provided by the California Department of Justice.