This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-NRP-1

for the current year.

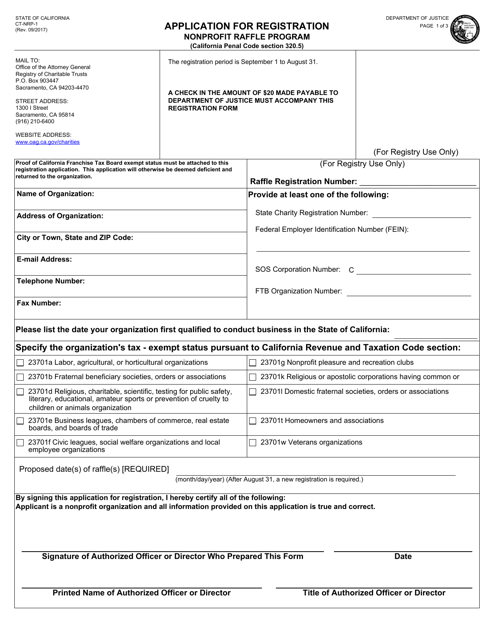

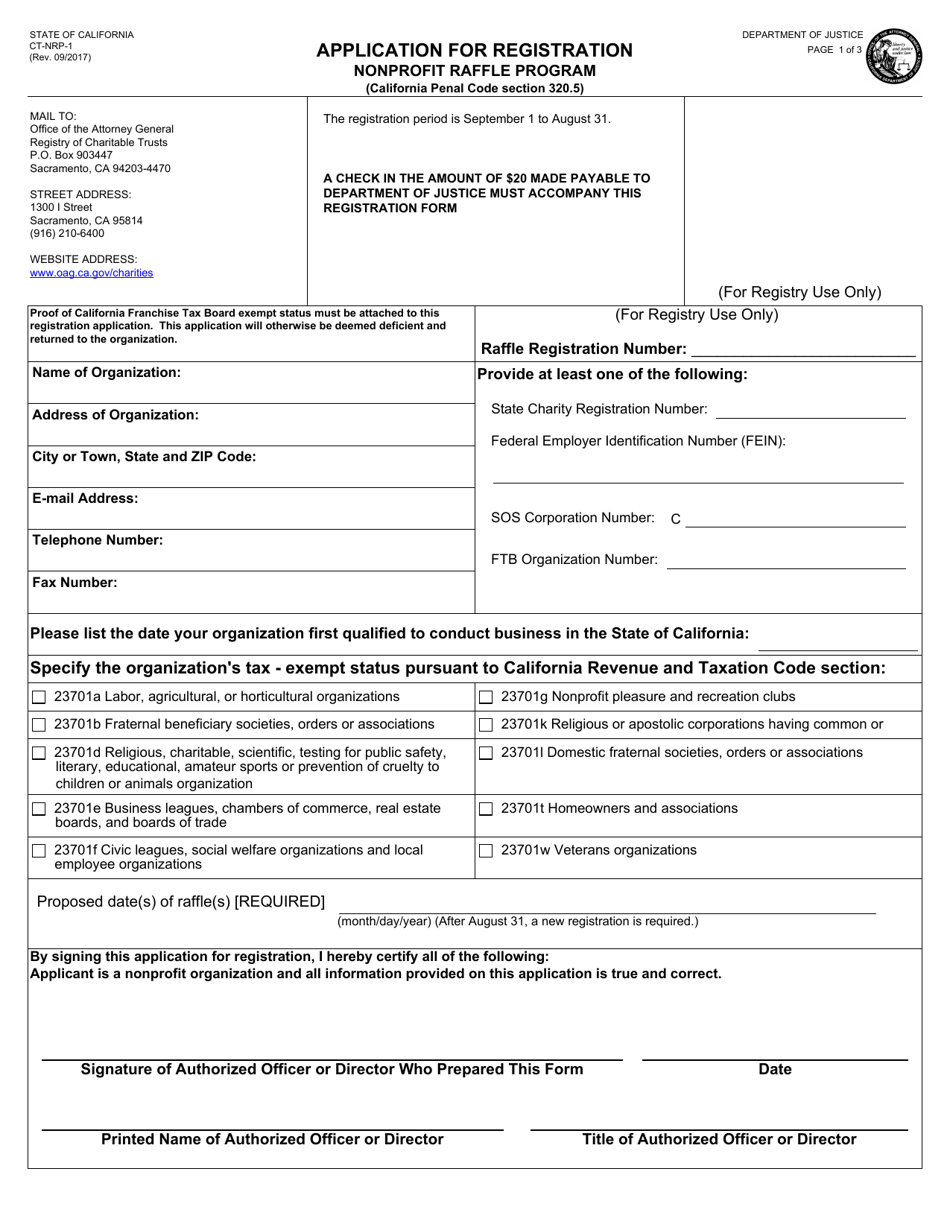

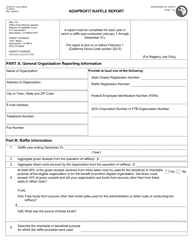

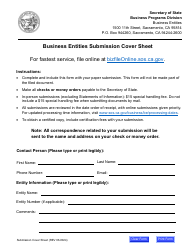

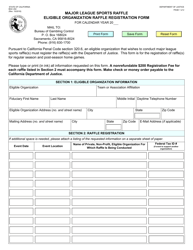

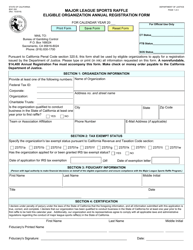

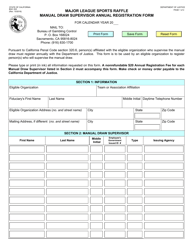

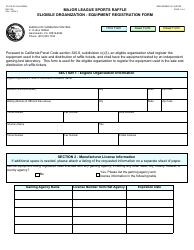

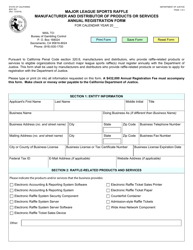

Form CT-NRP-1 Nonprofit Raffle Registration Form - California

What Is Form CT-NRP-1?

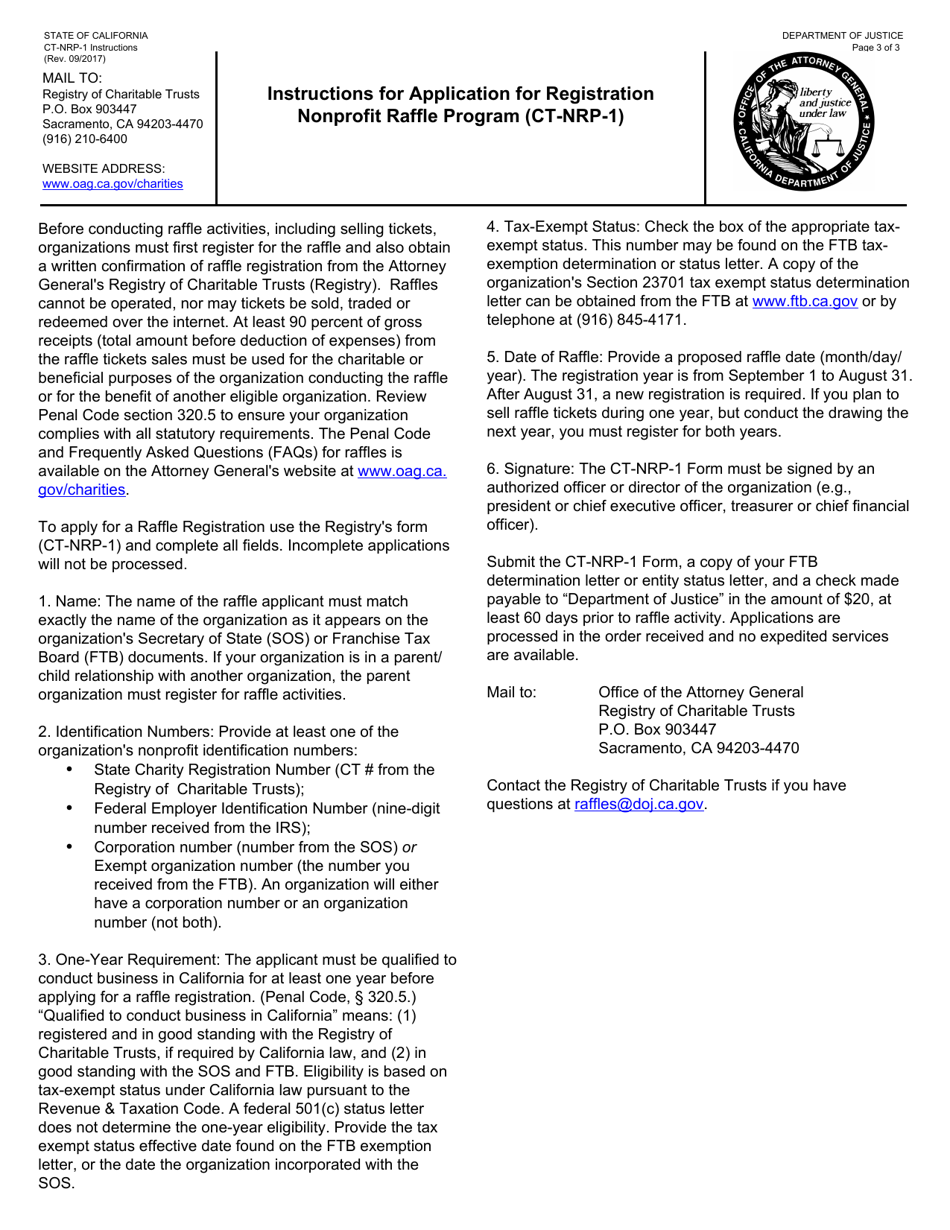

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-NRP-1?

A: Form CT-NRP-1 is the Nonprofit Raffle Registration Form used in California.

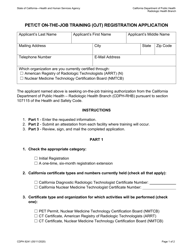

Q: Who should use Form CT-NRP-1?

A: Nonprofit organizations in California conducting raffles should use Form CT-NRP-1.

Q: What is the purpose of Form CT-NRP-1?

A: Form CT-NRP-1 is used to register a nonprofit raffle with the state of California.

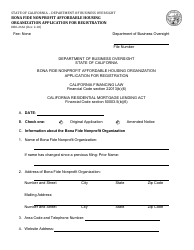

Q: Is there a fee for filing Form CT-NRP-1?

A: Yes, there is a registration fee that must be paid when filing Form CT-NRP-1.

Q: What information is required on Form CT-NRP-1?

A: Form CT-NRP-1 requires information about the nonprofit organization, the raffle event, and the prizes offered.

Q: When should Form CT-NRP-1 be filed?

A: Form CT-NRP-1 must be filed at least 30 days before the scheduled date of the raffle event.

Q: Are there any additional requirements for conducting a raffle in California?

A: Yes, there are additional requirements, such as maintaining records and conducting the raffle in compliance with state laws.

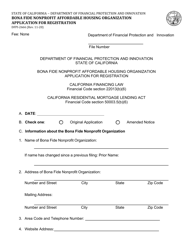

Q: What happens after filing Form CT-NRP-1?

A: After filing Form CT-NRP-1, the nonprofit organization will receive a registration number from the California Department of Justice.

Q: Is Form CT-NRP-1 the only form required for nonprofit raffles in California?

A: No, there may be additional forms and permits required depending on the specific circumstances of the raffle.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-NRP-1 by clicking the link below or browse more documents and templates provided by the California Department of Justice.