This version of the form is not currently in use and is provided for reference only. Download this version of

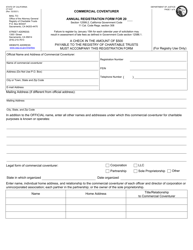

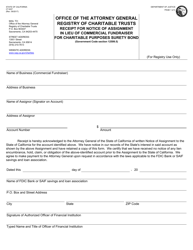

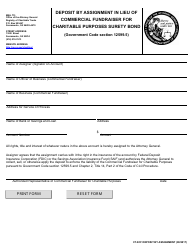

Form CT-6CF

for the current year.

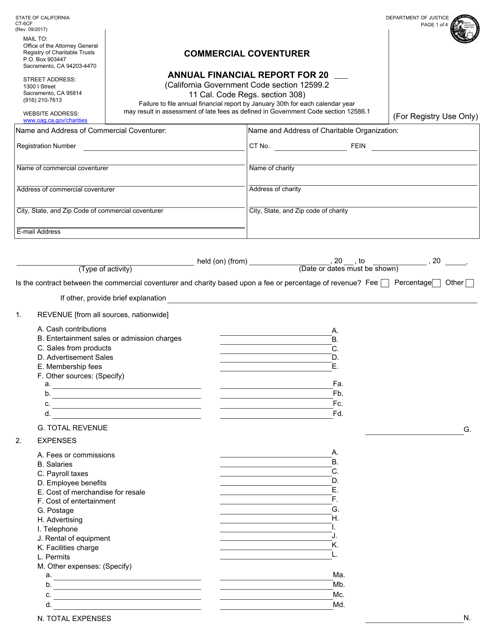

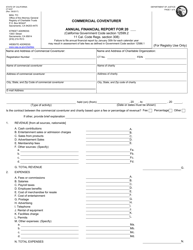

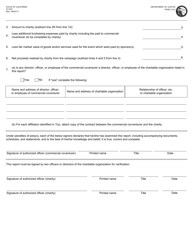

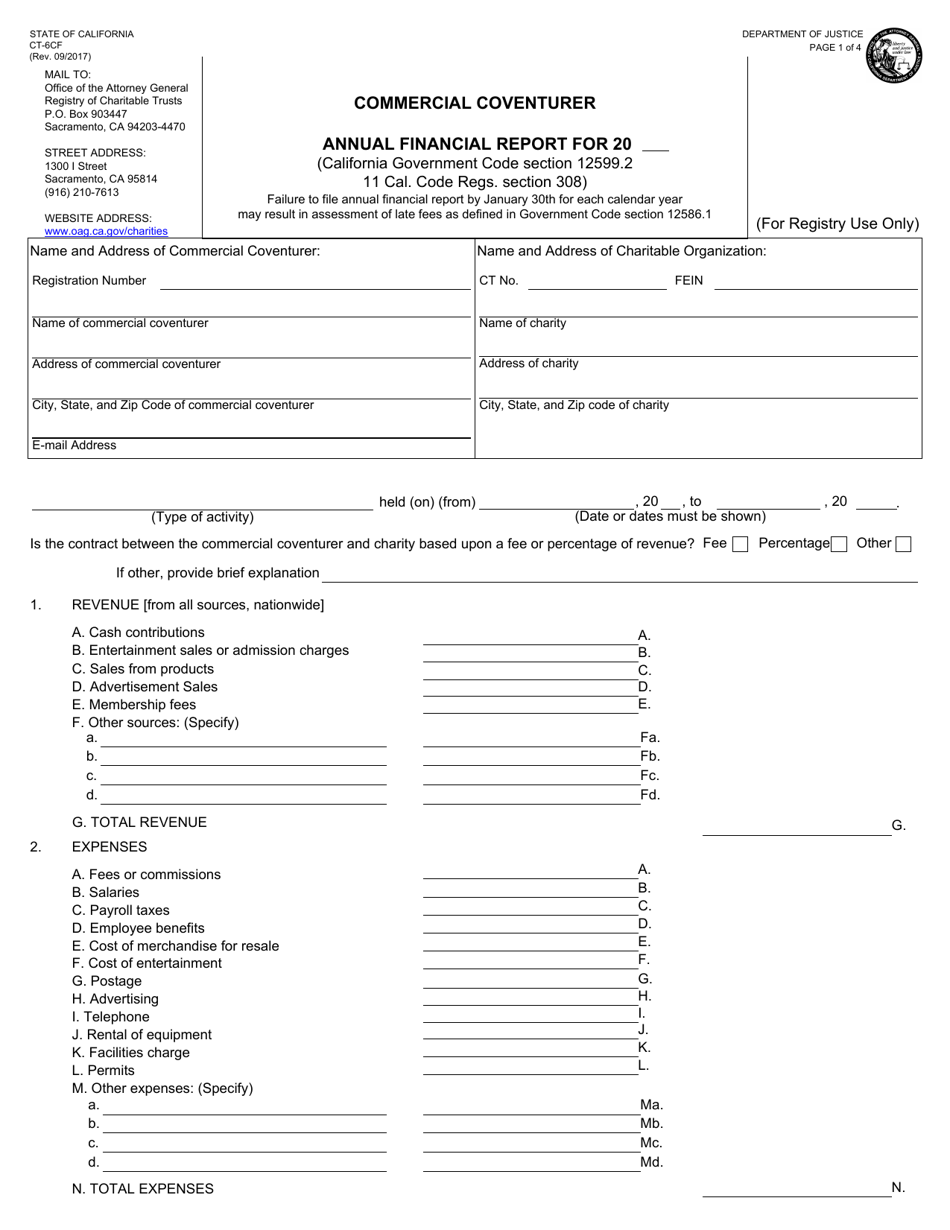

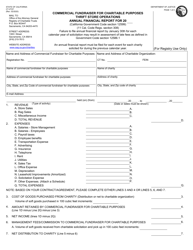

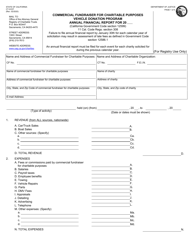

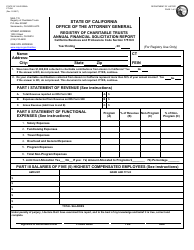

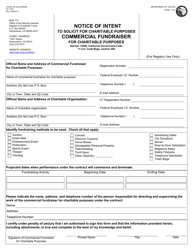

Form CT-6CF Commercial Coventurer for Charitable Purposes Annual Financial Report - California

What Is Form CT-6CF?

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-6CF?

A: Form CT-6CF is the Commercial Coventurer for Charitable Purposes Annual Financial Report.

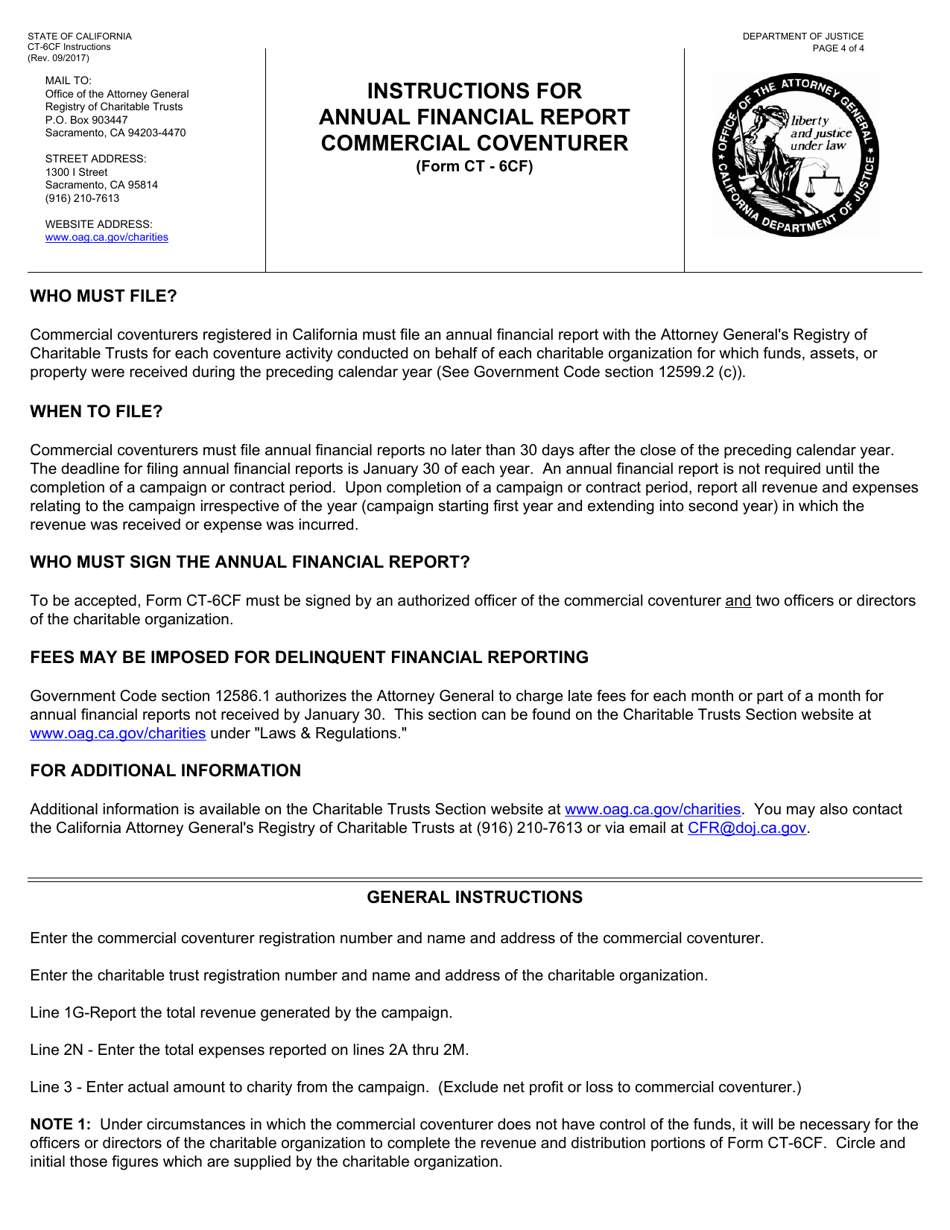

Q: Who is required to file Form CT-6CF?

A: Commercial coventurers engaged in charitable purposes activities in California are required to file Form CT-6CF.

Q: What is a commercial coventurer?

A: A commercial coventurer is a person or entity that conducts a business involving the sale of goods or services and participates in a charitable sales promotion.

Q: What is a charitable sales promotion?

A: A charitable sales promotion is a campaign where a portion of the purchase price of goods or services is donated to a charitable organization.

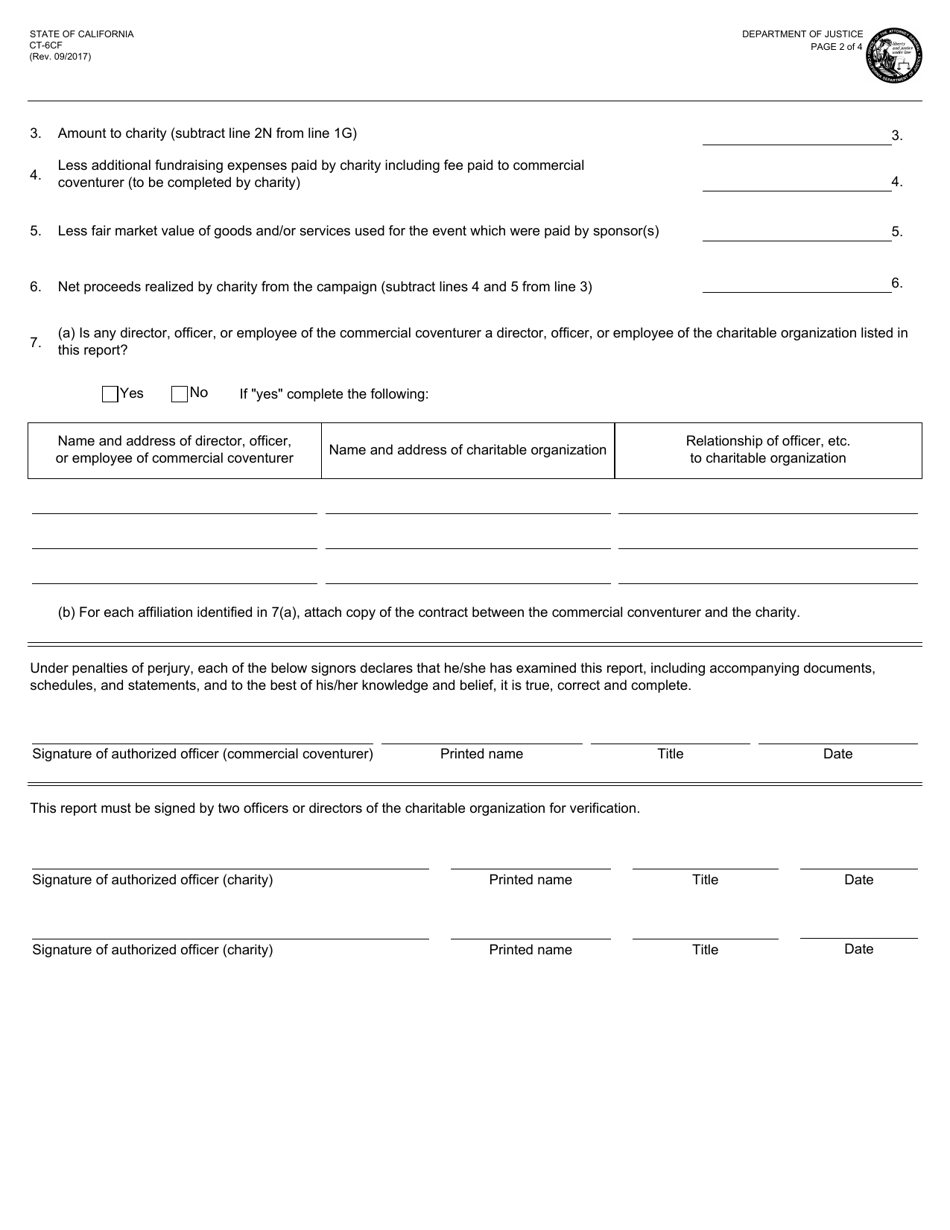

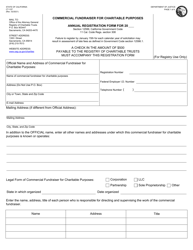

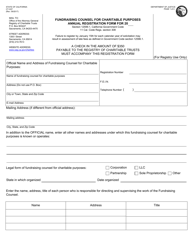

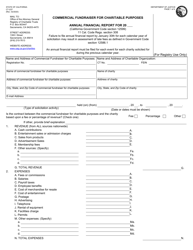

Q: What information is required on Form CT-6CF?

A: Form CT-6CF requires information about the commercial coventurer, the charitable organization benefiting from the promotion, and financial details of the campaign.

Q: When is Form CT-6CF due?

A: Form CT-6CF is due on or before the 15th day of the fifth month following the close of the commercial coventurer's fiscal year.

Q: Are there any penalties for not filing Form CT-6CF?

A: Yes, failure to file Form CT-6CF may result in penalties and interest charges.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-6CF by clicking the link below or browse more documents and templates provided by the California Department of Justice.