This version of the form is not currently in use and is provided for reference only. Download this version of

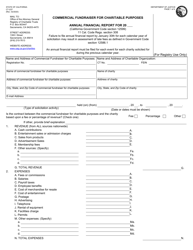

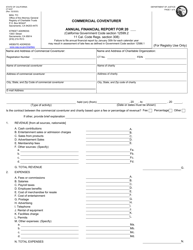

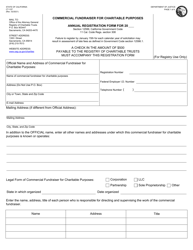

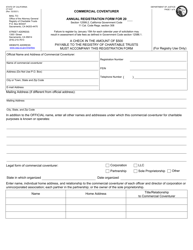

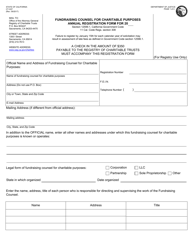

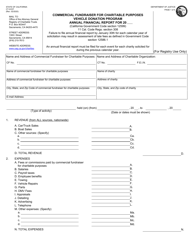

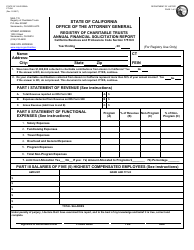

Form CT-2TCF

for the current year.

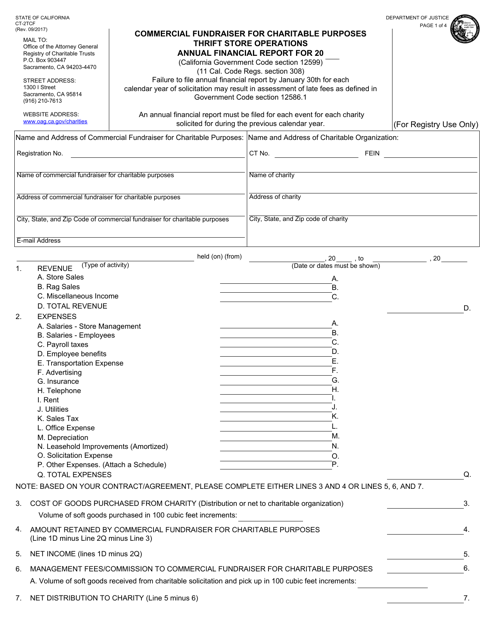

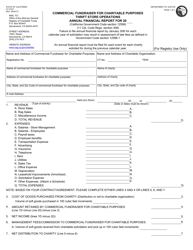

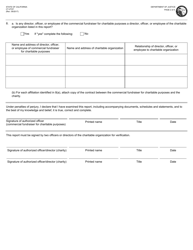

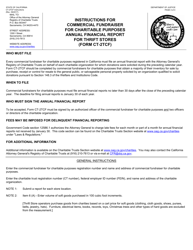

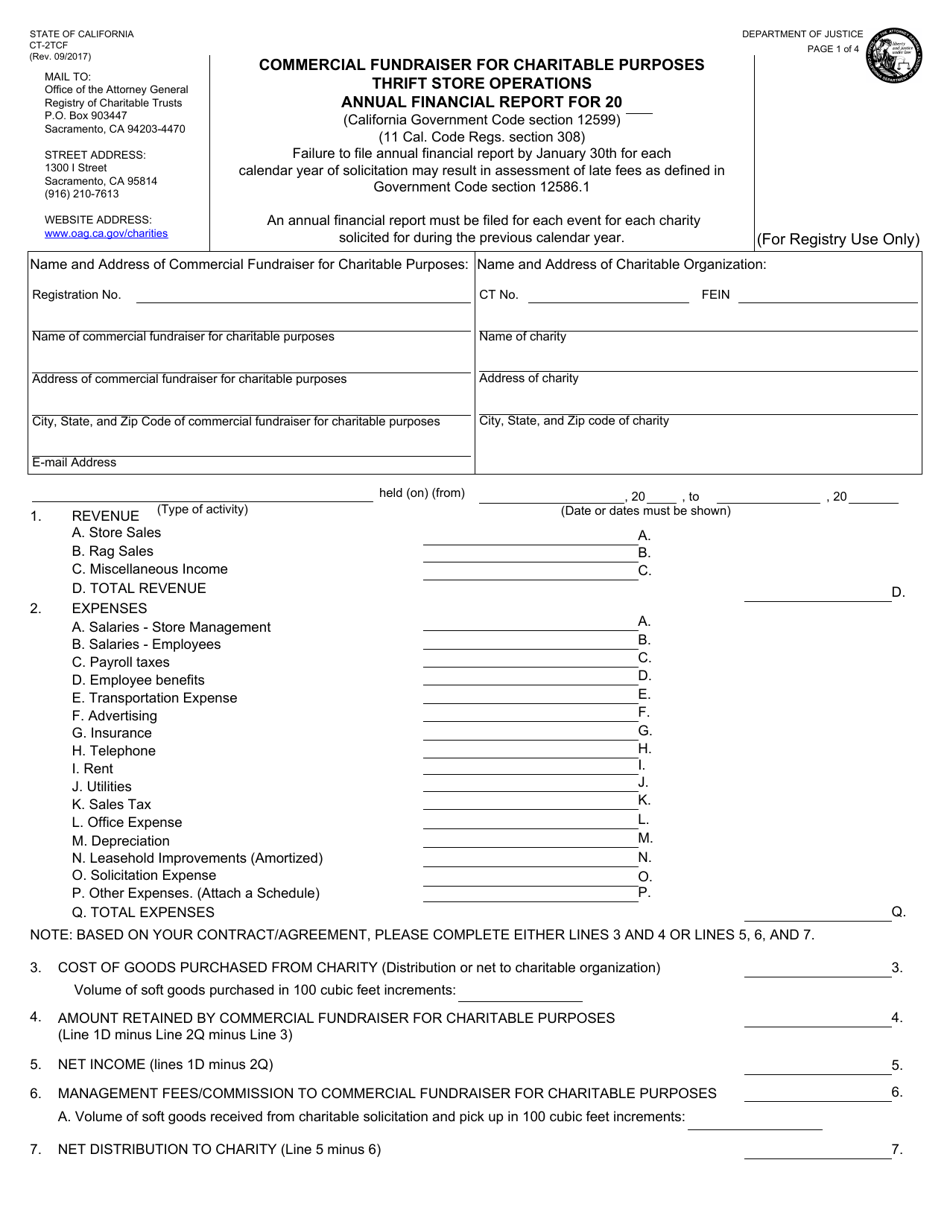

Form CT-2TCF Annual Financial Report - Thrift Stores - California

What Is Form CT-2TCF?

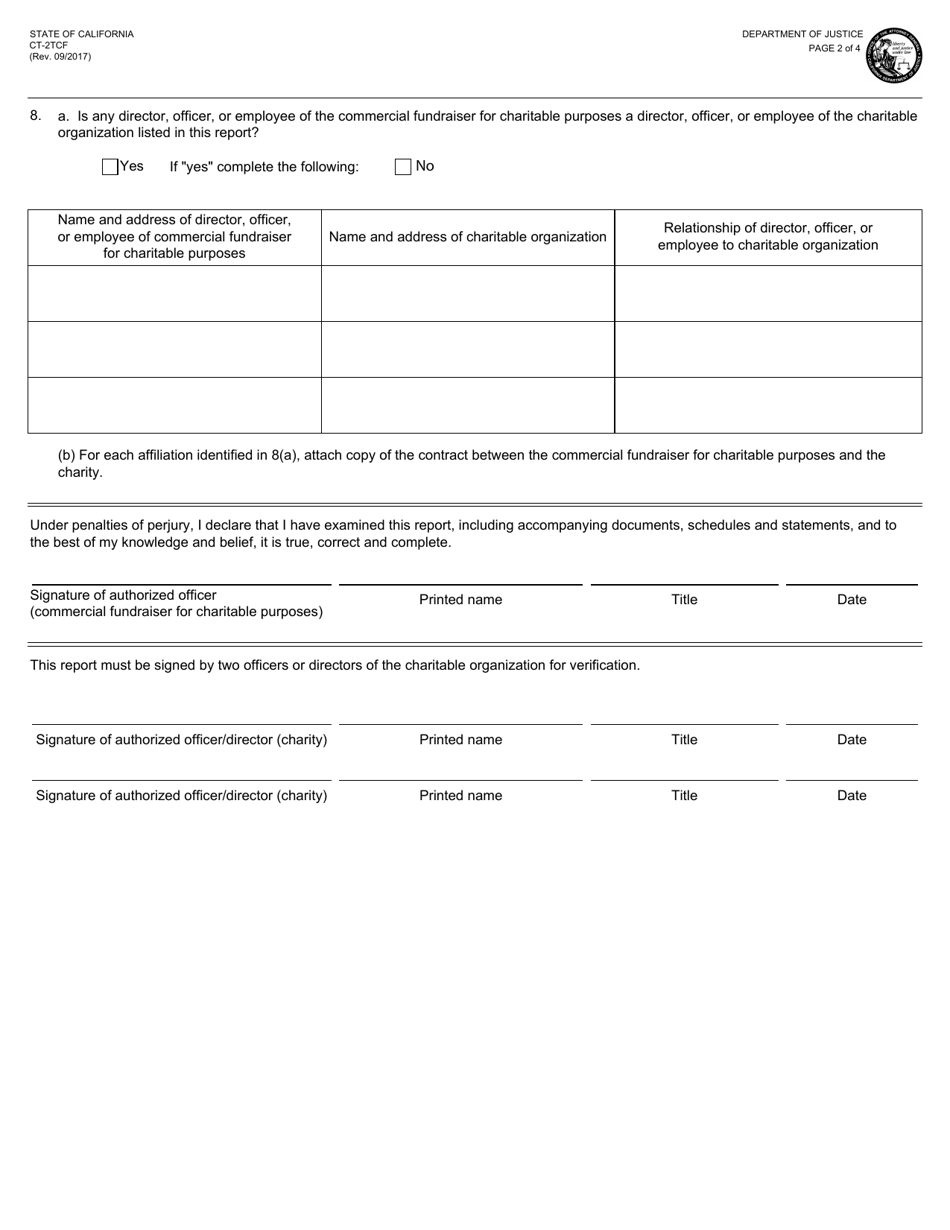

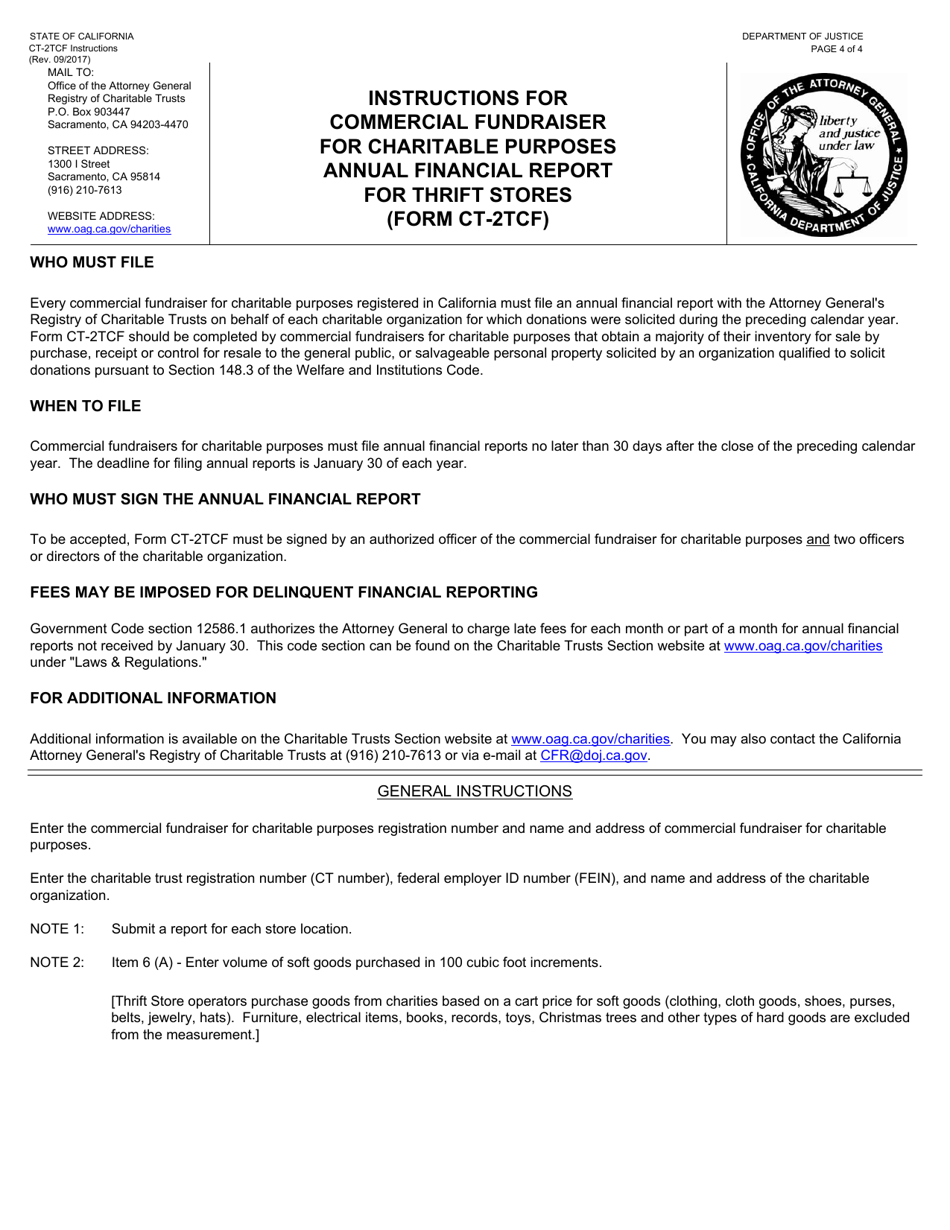

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-2TCF?

A: Form CT-2TCF is the Annual Financial Report for Thrift Stores in California.

Q: Who needs to file Form CT-2TCF?

A: Thrift Stores in California are required to file Form CT-2TCF.

Q: What is the purpose of Form CT-2TCF?

A: The purpose of Form CT-2TCF is to report the financial activities of Thrift Stores in California.

Q: When is Form CT-2TCF due?

A: Form CT-2TCF is due on the 15th day of the 5th month following the close of the thrift store’s fiscal year.

Q: Are there any penalties for not filing Form CT-2TCF?

A: Yes, there can be penalties for not filing Form CT-2TCF, including fines and potential loss of tax-exempt status.

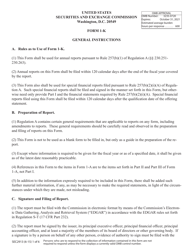

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2TCF by clicking the link below or browse more documents and templates provided by the California Department of Justice.