This version of the form is not currently in use and is provided for reference only. Download this version of

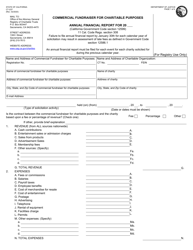

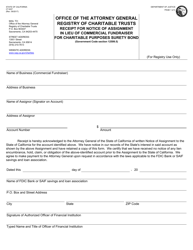

Form CT-1CF

for the current year.

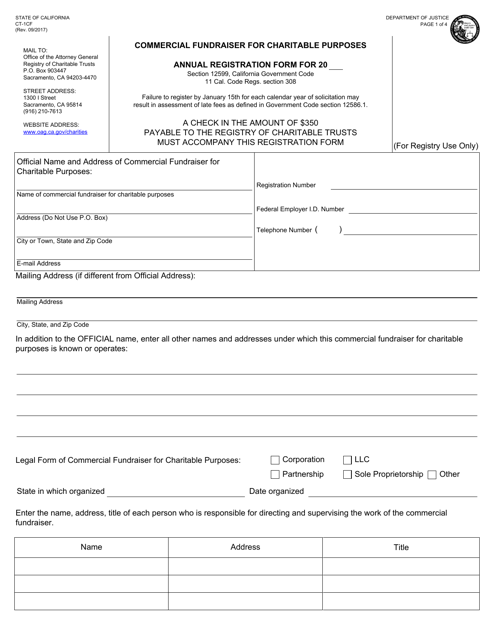

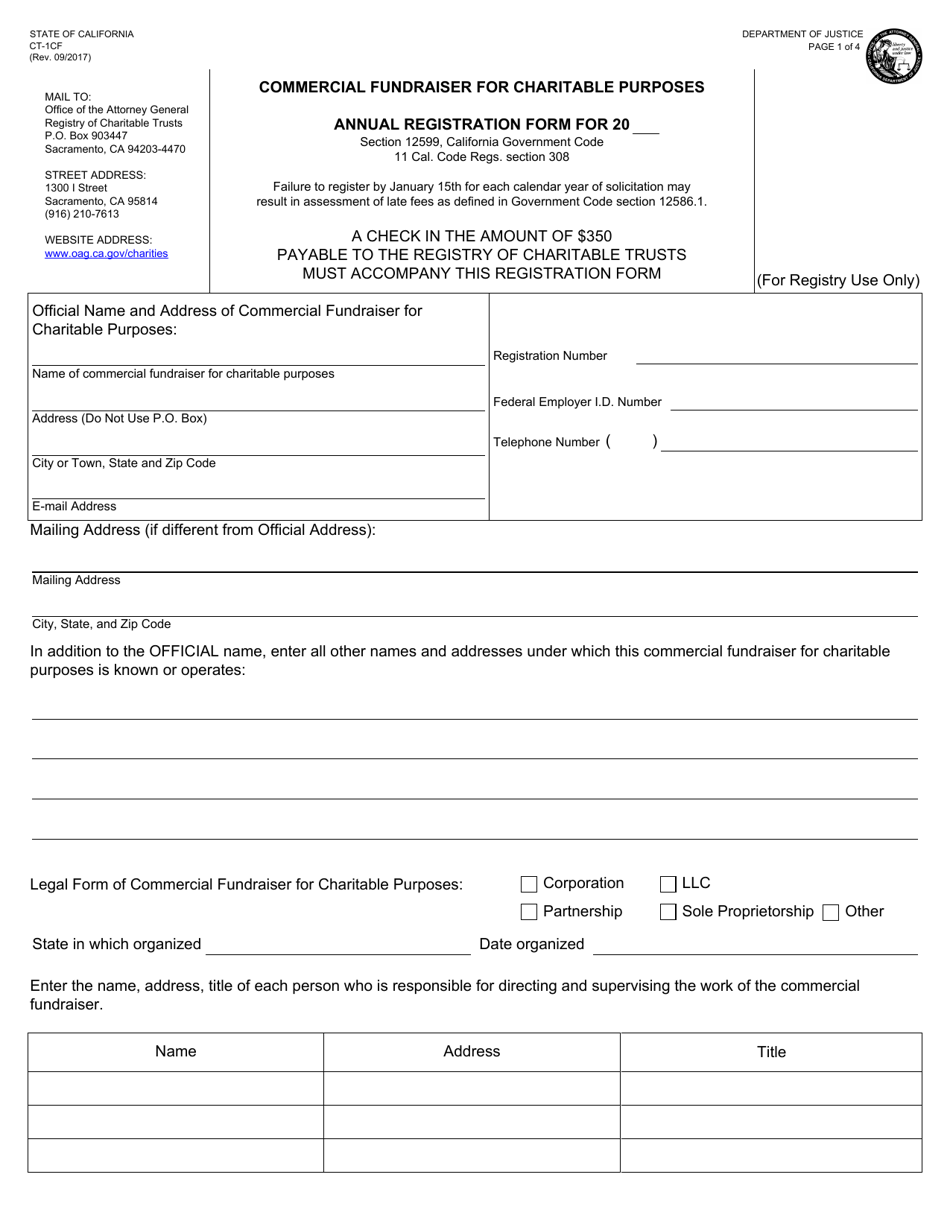

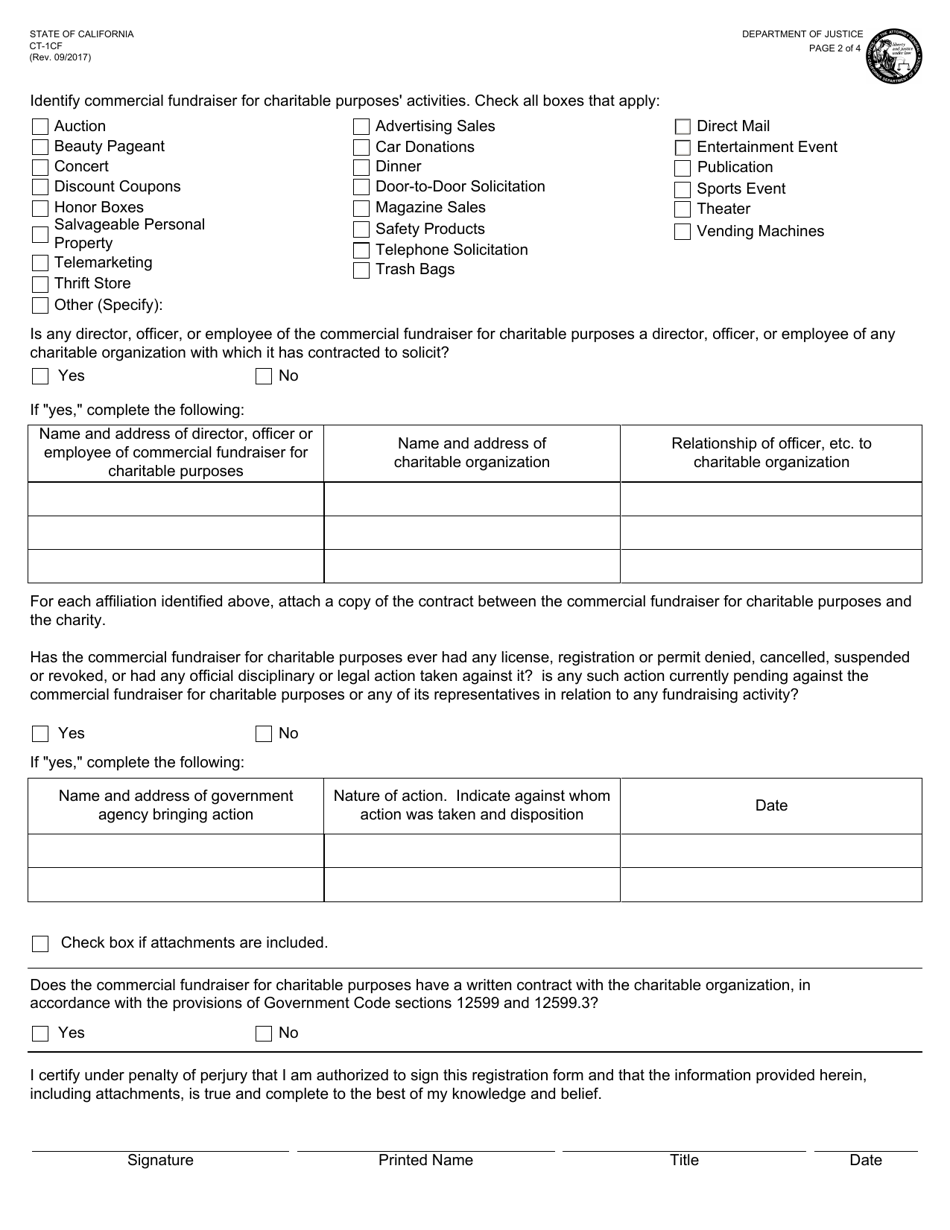

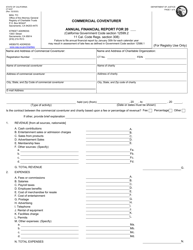

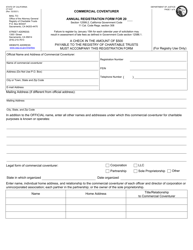

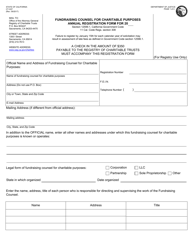

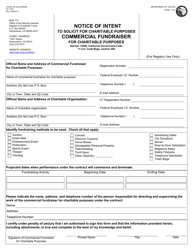

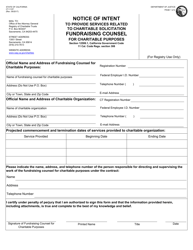

Form CT-1CF Commercial Fundraiser for Charitable Purposes Annual Registration Form - California

What Is Form CT-1CF?

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1CF?

A: Form CT-1CF is the Commercial Fundraiser for Charitable Purposes Annual Registration Form in California.

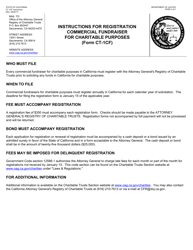

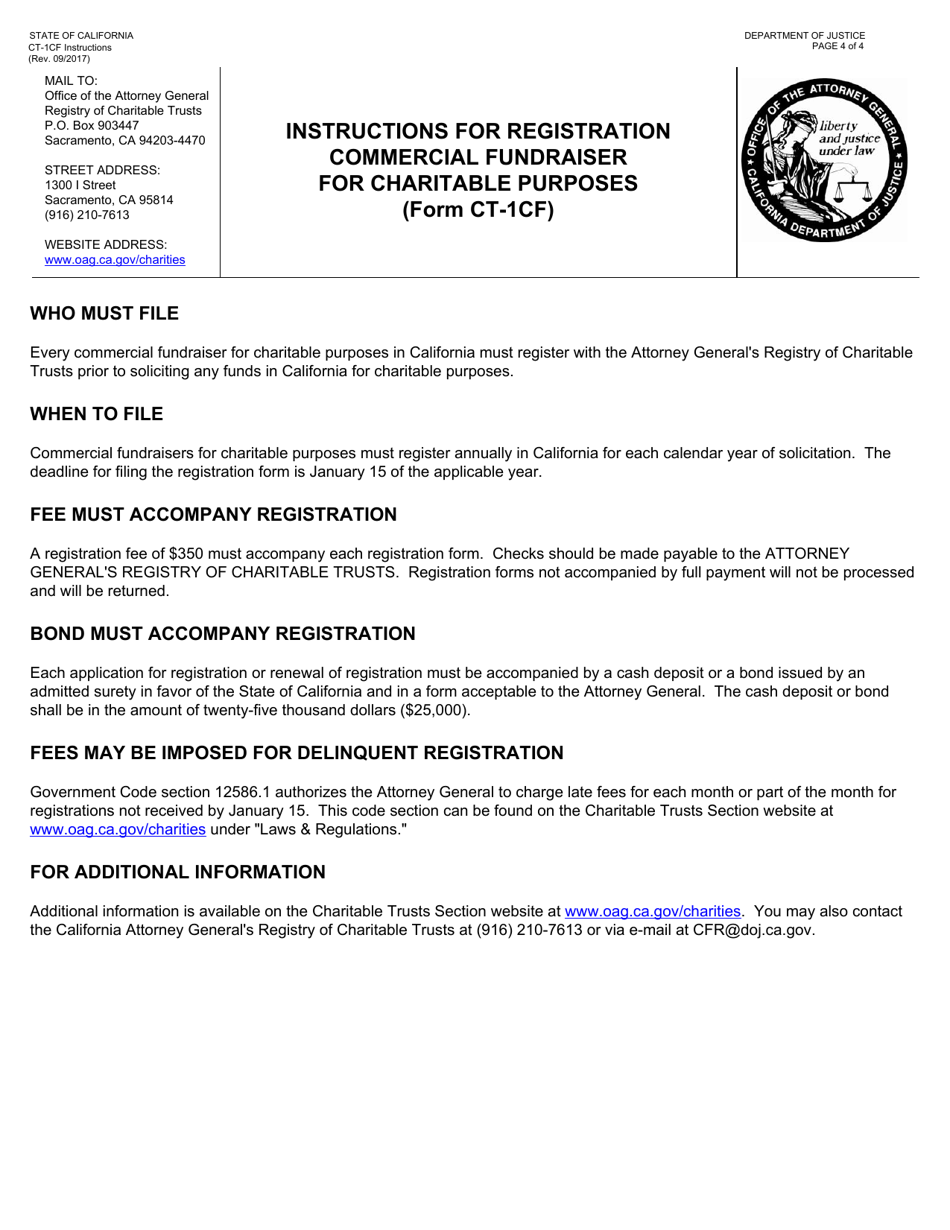

Q: Who needs to file Form CT-1CF?

A: Commercial fundraisers who operate in California and raise funds for charitable purposes need to file Form CT-1CF.

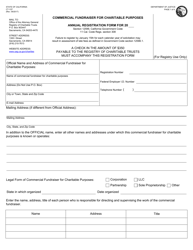

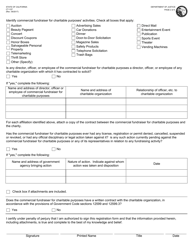

Q: What is the purpose of Form CT-1CF?

A: The purpose of Form CT-1CF is to register commercial fundraisers and provide information about their activities and financial arrangements in relation to fundraising for charitable purposes.

Q: What information is required on Form CT-1CF?

A: Form CT-1CF requires information about the commercial fundraiser's organization, activities, contracts, and financial arrangements related to fundraising.

Q: When is Form CT-1CF due?

A: Form CT-1CF is due within 30 days of commencing operation in California, and then annually by the 15th day of the 5th month following the close of the organization's accounting period.

Q: Are there any fees associated with filing Form CT-1CF?

A: Yes, there are fees associated with filing Form CT-1CF. The fees vary depending on the amount of gross revenue collected through fundraising activities in California.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-1CF by clicking the link below or browse more documents and templates provided by the California Department of Justice.