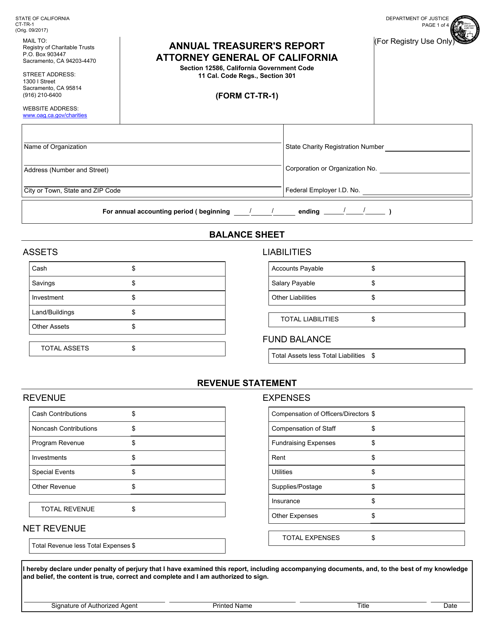

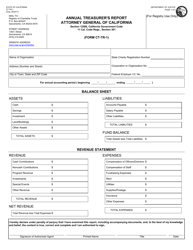

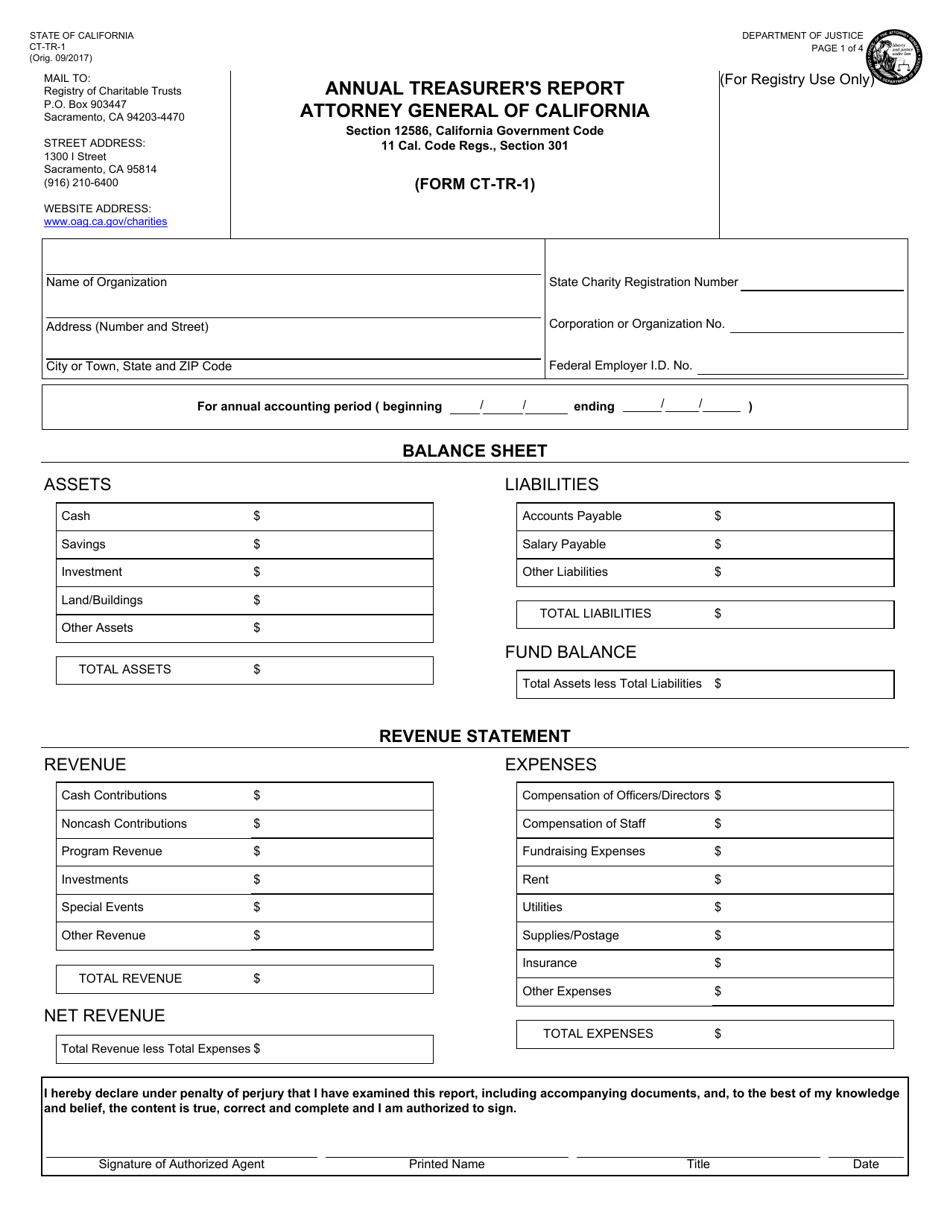

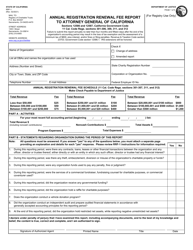

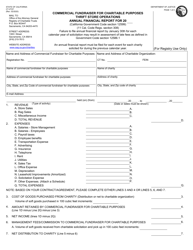

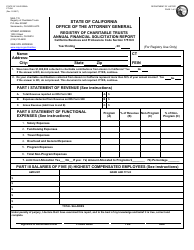

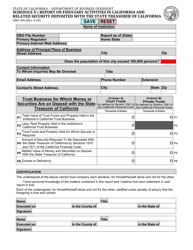

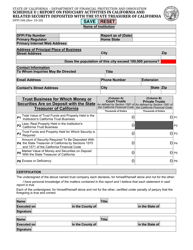

Form CT-TR-1 Annual Treasurer's Report - California

What Is Form CT-TR-1?

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-TR-1?

A: Form CT-TR-1 is the Annual Treasurer's Report form in California.

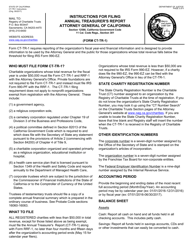

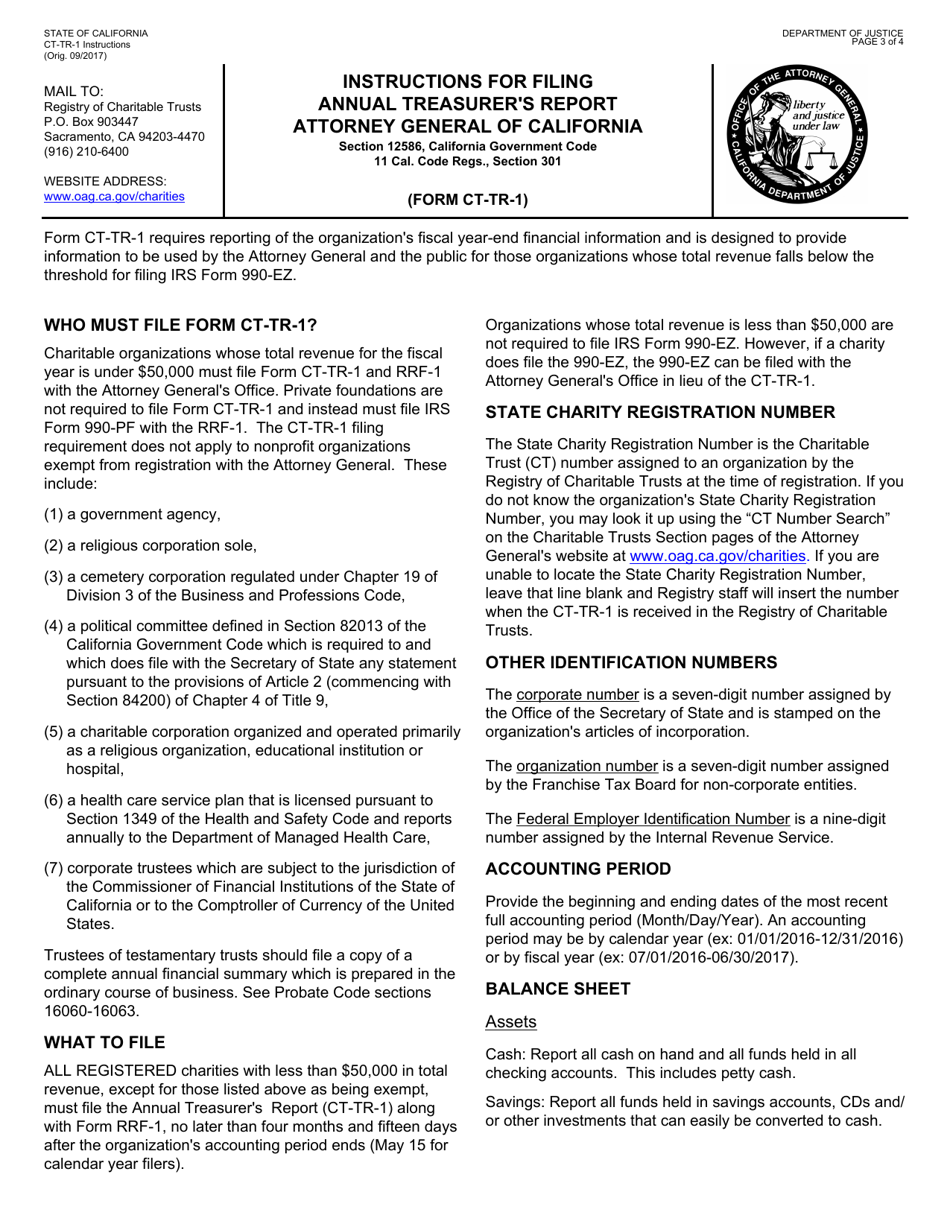

Q: Who is required to file Form CT-TR-1?

A: Treasure of corporations and non-profit organizations in California are required to file Form CT-TR-1.

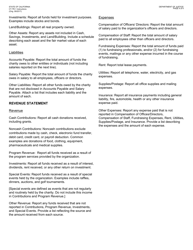

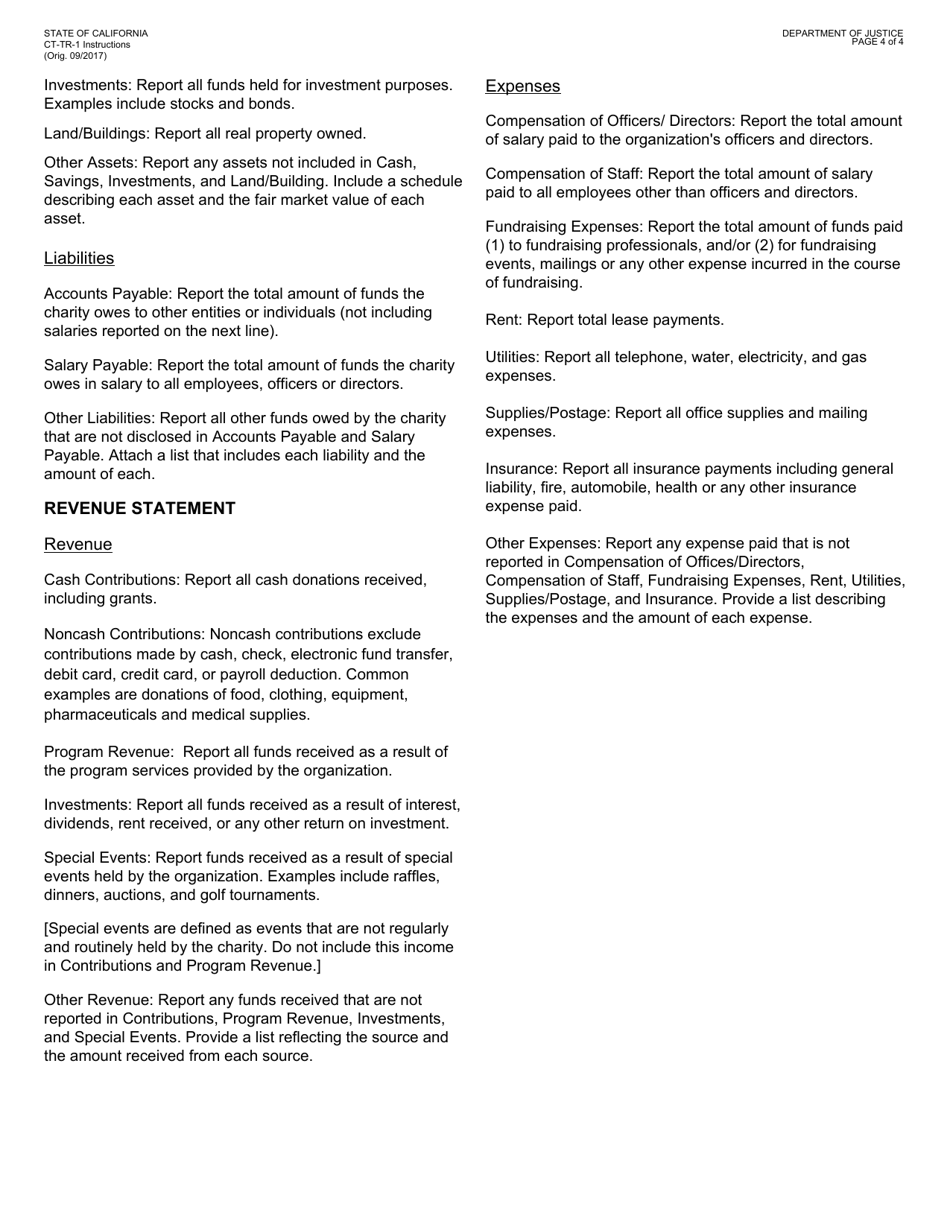

Q: What information is required on Form CT-TR-1?

A: Form CT-TR-1 requires information such as the organization's name and address, a report of account balances, and details of income and expenses.

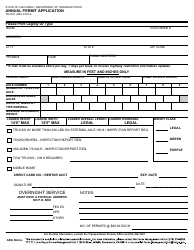

Q: When is Form CT-TR-1 due?

A: Form CT-TR-1 is due on or before the fifteenth day of the fifth month after the close of the organization's fiscal year, unless an extension is granted.

Q: What are the consequences of not filing Form CT-TR-1?

A: Failure to file Form CT-TR-1 may result in penalties, such as late filing fees or loss of corporate status.

Q: Can I request an extension to file Form CT-TR-1?

A: Yes, you can request an extension to file Form CT-TR-1 by contacting the California Secretary of State's office.

Q: Can I amend Form CT-TR-1?

A: Yes, you can file an amended Form CT-TR-1 to correct errors or update information.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-TR-1 by clicking the link below or browse more documents and templates provided by the California Department of Justice.