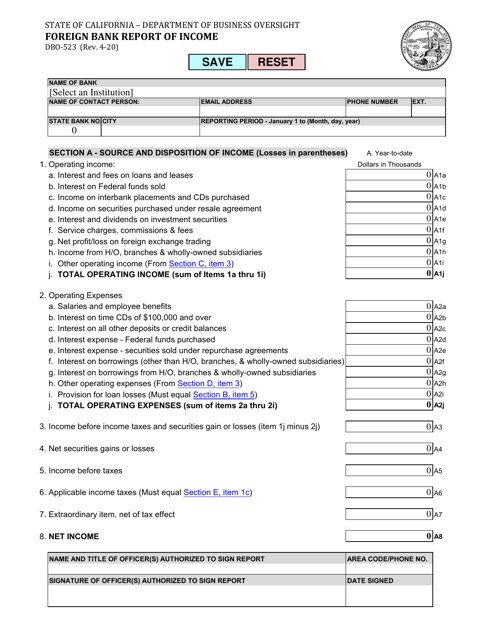

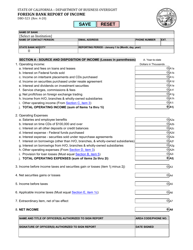

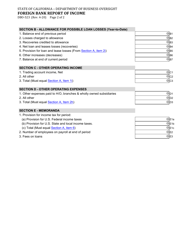

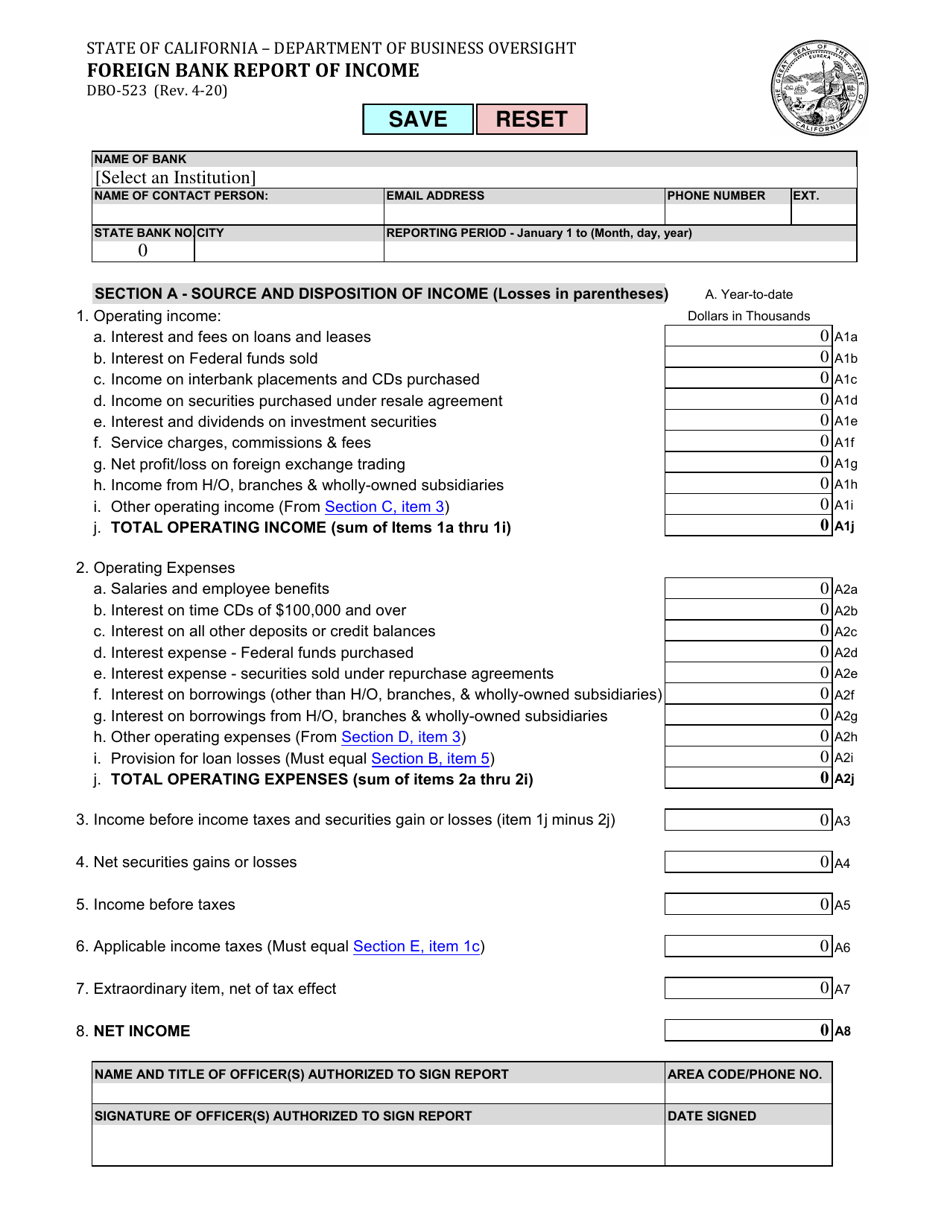

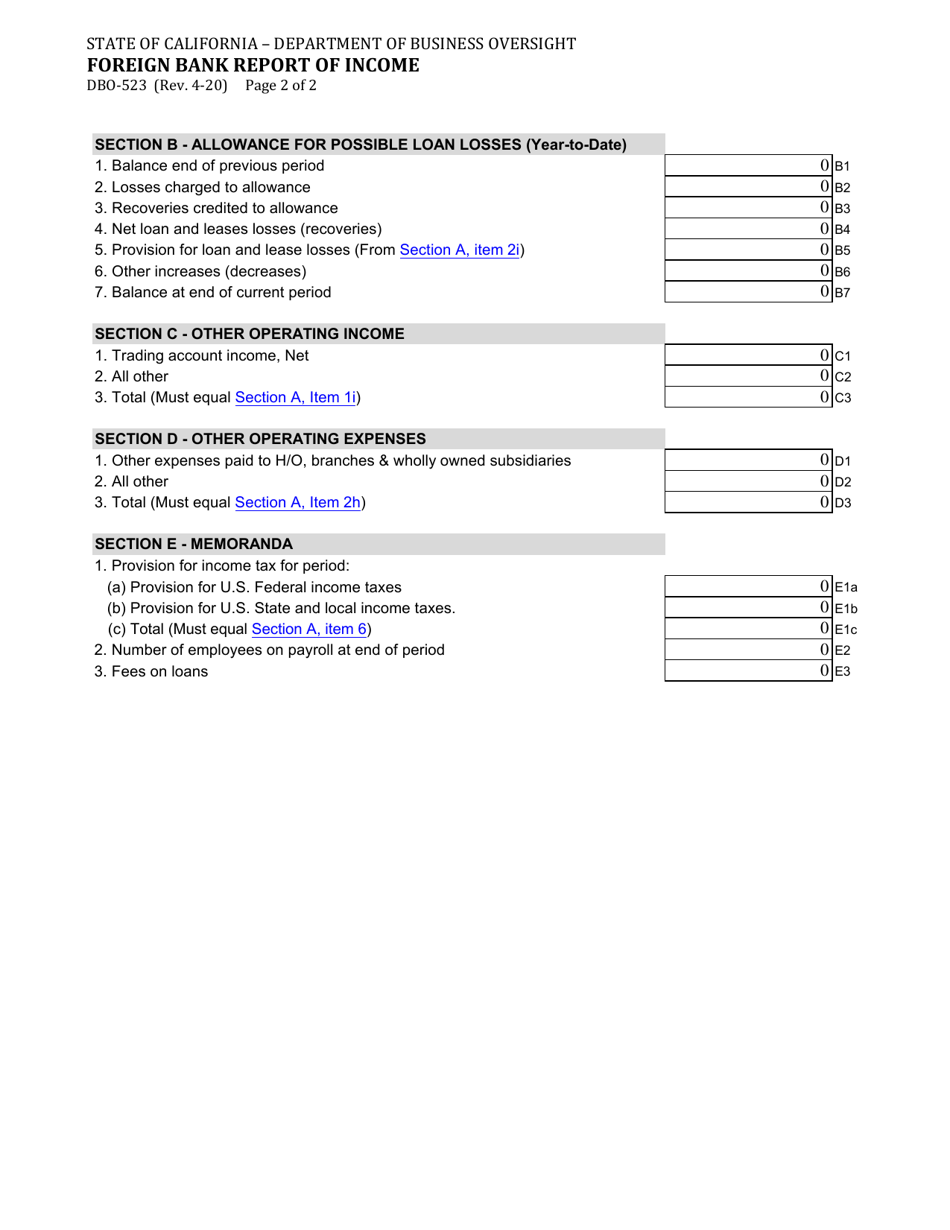

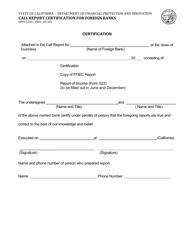

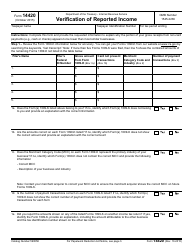

Form DBO-523 Foreign Bank Report of Income - California

What Is Form DBO-523?

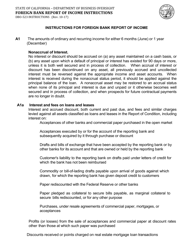

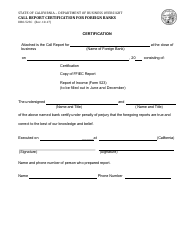

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DBO-523?

A: Form DBO-523 is the Foreign Bank Report of Income form used in California.

Q: Who is required to file Form DBO-523?

A: Any person or entity that has an interest in, or signature or other authority over, one or more foreign financial accounts and meets the filing requirements must file Form DBO-523.

Q: What is the purpose of Form DBO-523?

A: The purpose of Form DBO-523 is to report income from foreign financial accounts and to disclose the existence of such accounts to the California Department of Business Oversight.

Q: When is Form DBO-523 due?

A: Form DBO-523 is generally due on April 15th of the year following the calendar year being reported.

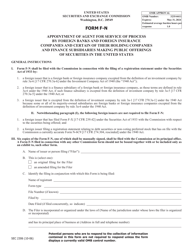

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-523 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.