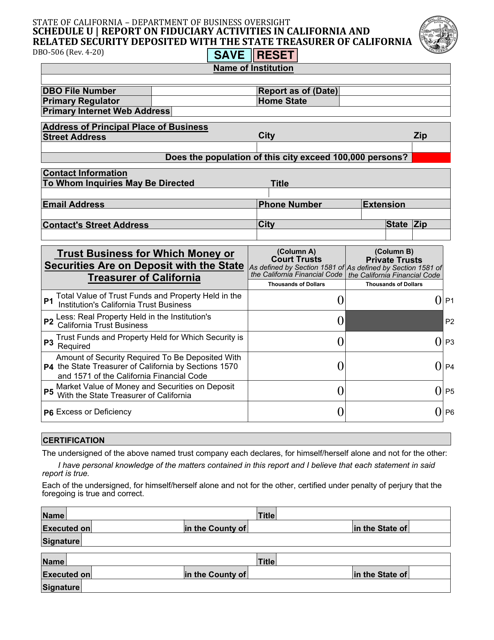

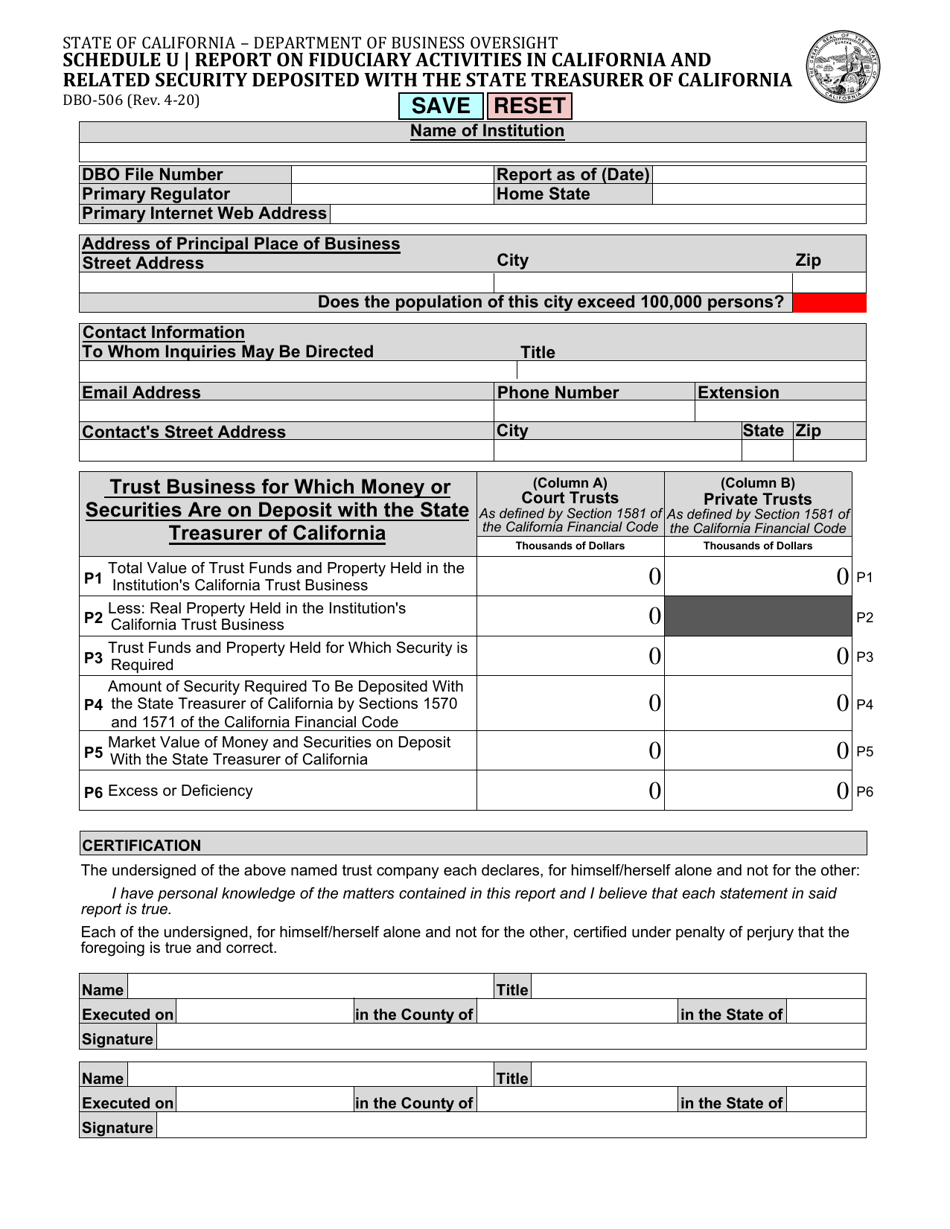

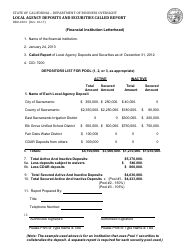

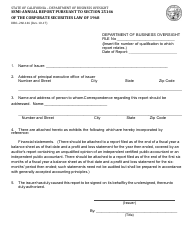

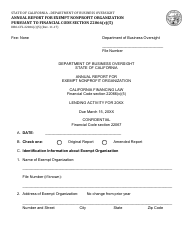

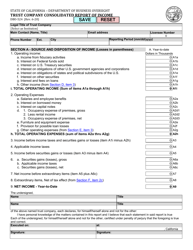

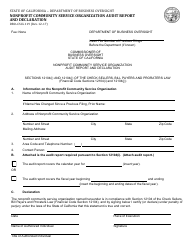

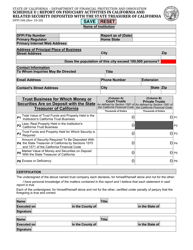

Form DBO-506 Schedule U Report on Fiduciary Activities in California and Related Security Deposited With the State Treasurer of California - California

What Is Form DBO-506 Schedule U?

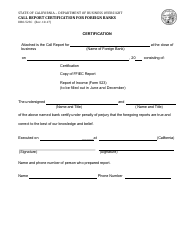

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DBO-506?

A: Form DBO-506 is a report on fiduciary activities in California and related security deposited with the State Treasurer of California.

Q: What is the purpose of Form DBO-506?

A: The purpose of Form DBO-506 is to provide information about fiduciary activities and related security deposited with the State Treasurer of California.

Q: Who is required to file Form DBO-506?

A: Anyone who engages in fiduciary activities in California and has related security deposited with the State Treasurer of California is required to file Form DBO-506.

Q: How often is Form DBO-506 filed?

A: Form DBO-506 is required to be filed annually.

Q: Is there a filing fee for Form DBO-506?

A: There is no filing fee for Form DBO-506.

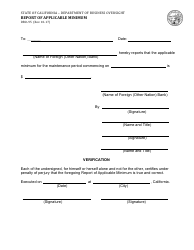

Q: What information is required to be included in Form DBO-506?

A: Form DBO-506 requires information about fiduciary activities in California, related security deposited with the State Treasurer, and certain other financial information.

Q: Are there any penalties for not filing Form DBO-506?

A: Failure to file Form DBO-506 may result in penalties and enforcement actions by the California Department of Business Oversight.

Q: Are there any exceptions to filing Form DBO-506?

A: There are limited exceptions to filing Form DBO-506. It is recommended to consult the California Department of Business Oversight for specific details.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-506 Schedule U by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.