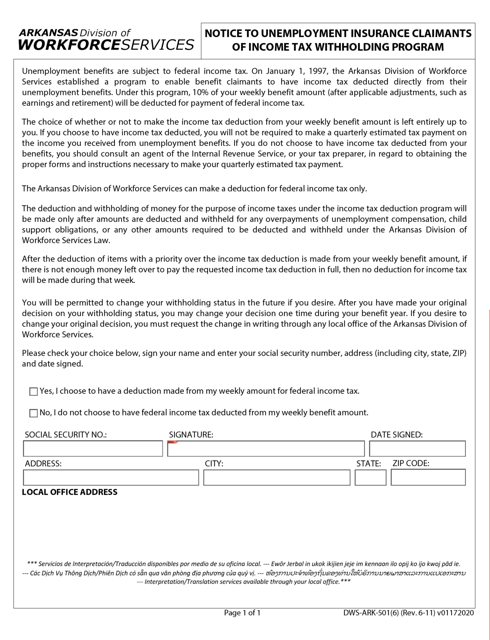

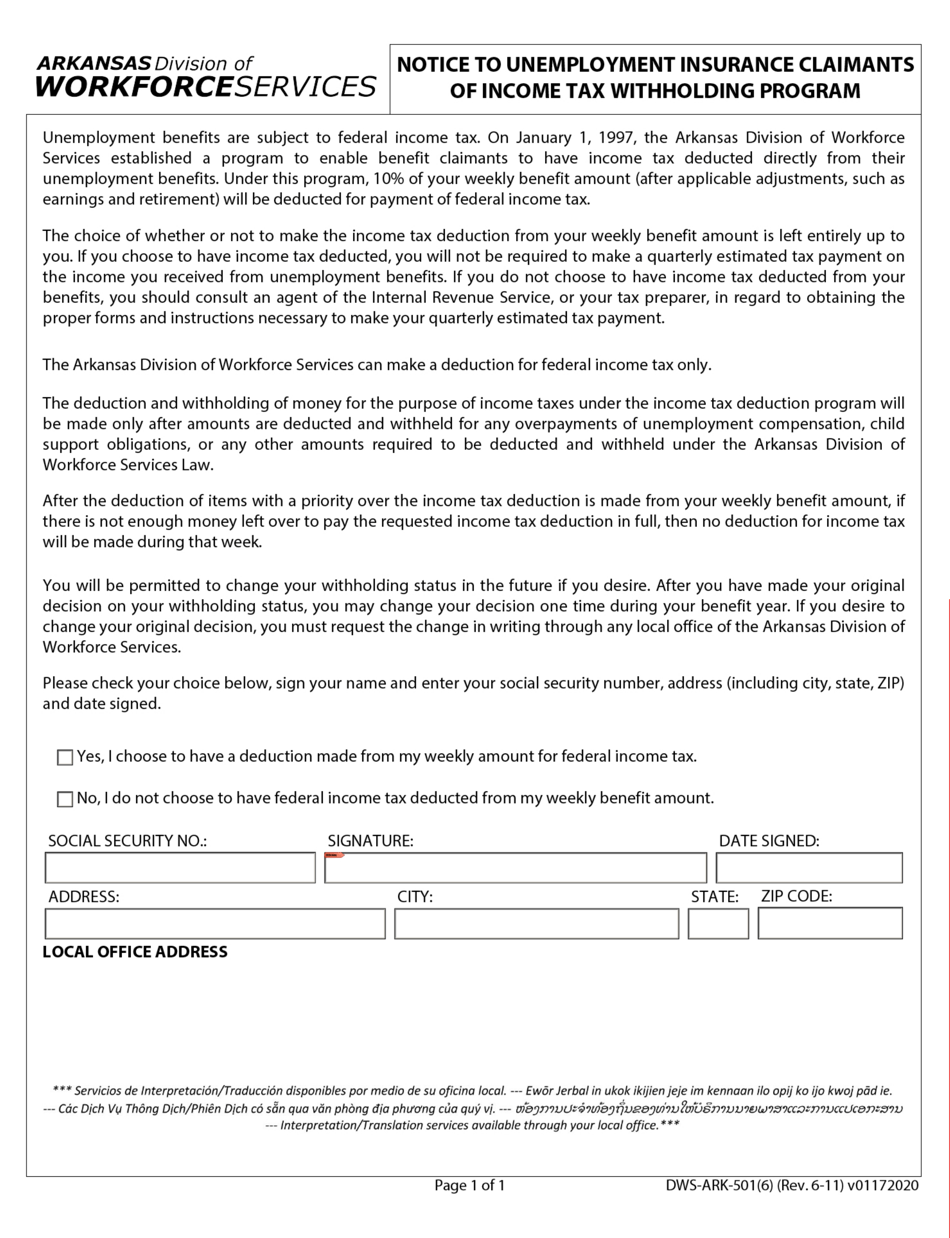

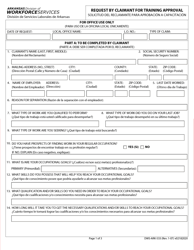

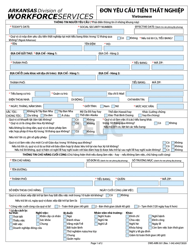

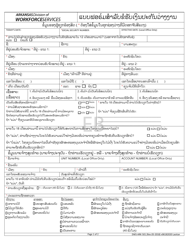

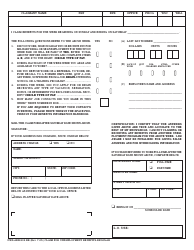

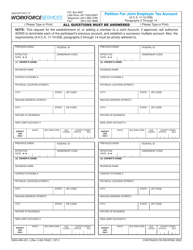

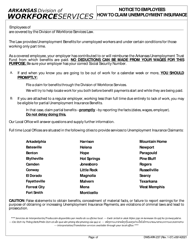

Form DWS-ARK-501.6 Notice of Unemployment Insurance Claimants of Income Tax Withholding Program - Arkansas

What Is Form DWS-ARK-501.6?

This is a legal form that was released by the Arkansas Department of Labor and Licensing - Division of Workforce Services - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

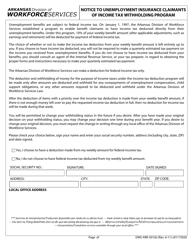

Q: What is Form DWS-ARK-501.6?

A: Form DWS-ARK-501.6 is the Notice of Unemployment Insurance Claimants of Income Tax Withholding Program in Arkansas.

Q: What is the purpose of Form DWS-ARK-501.6?

A: The purpose of Form DWS-ARK-501.6 is to inform unemployment insurance claimants in Arkansas about the option to have income tax withheld from their benefit payments.

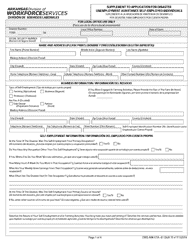

Q: Who is required to submit Form DWS-ARK-501.6?

A: Unemployment insurance claimants in Arkansas who want to have income tax withheld from their benefit payments are required to submit Form DWS-ARK-501.6.

Q: Are unemployment insurance claimants in Arkansas automatically enrolled in the Income Tax Withholding Program?

A: No, unemployment insurance claimants in Arkansas are not automatically enrolled in the Income Tax Withholding Program. They need to submit Form DWS-ARK-501.6 to opt into the program.

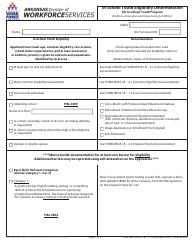

Q: What are the benefits of participating in the Income Tax Withholding Program?

A: Participating in the Income Tax Withholding Program allows unemployment insurance claimants in Arkansas to have income tax withheld from their benefit payments, which can help them meet their tax obligations.

Q: Can unemployment insurance claimants in Arkansas change their decision to participate in the Income Tax Withholding Program?

A: Yes, unemployment insurance claimants in Arkansas can change their decision to participate in the Income Tax Withholding Program at any time by submitting a new Form DWS-ARK-501.6.

Q: Is participation in the Income Tax Withholding Program mandatory for unemployment insurance claimants in Arkansas?

A: No, participation in the Income Tax Withholding Program is not mandatory for unemployment insurance claimants in Arkansas. It is optional.

Q: Are there any deadlines for submitting Form DWS-ARK-501.6?

A: There are no specific deadlines mentioned for submitting Form DWS-ARK-501.6. However, it is recommended to submit the form as soon as possible after filing an unemployment insurance claim.

Q: Are there any fees associated with participating in the Income Tax Withholding Program?

A: No, there are no fees associated with participating in the Income Tax Withholding Program for unemployment insurance claimants in Arkansas.

Form Details:

- Released on January 17, 2020;

- The latest edition provided by the Arkansas Department of Labor and Licensing - Division of Workforce Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DWS-ARK-501.6 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Labor and Licensing - Division of Workforce Services.