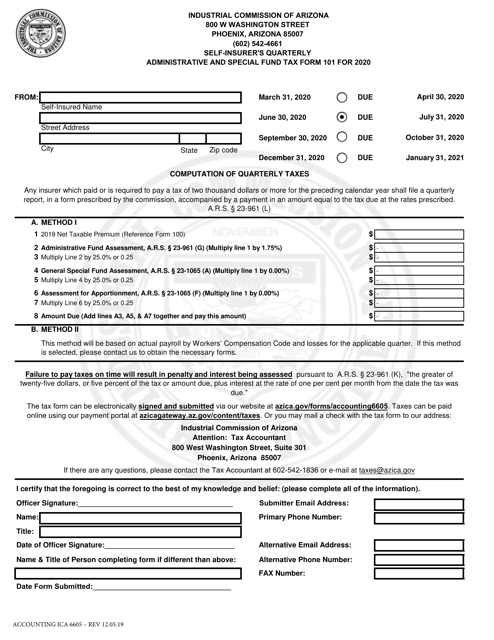

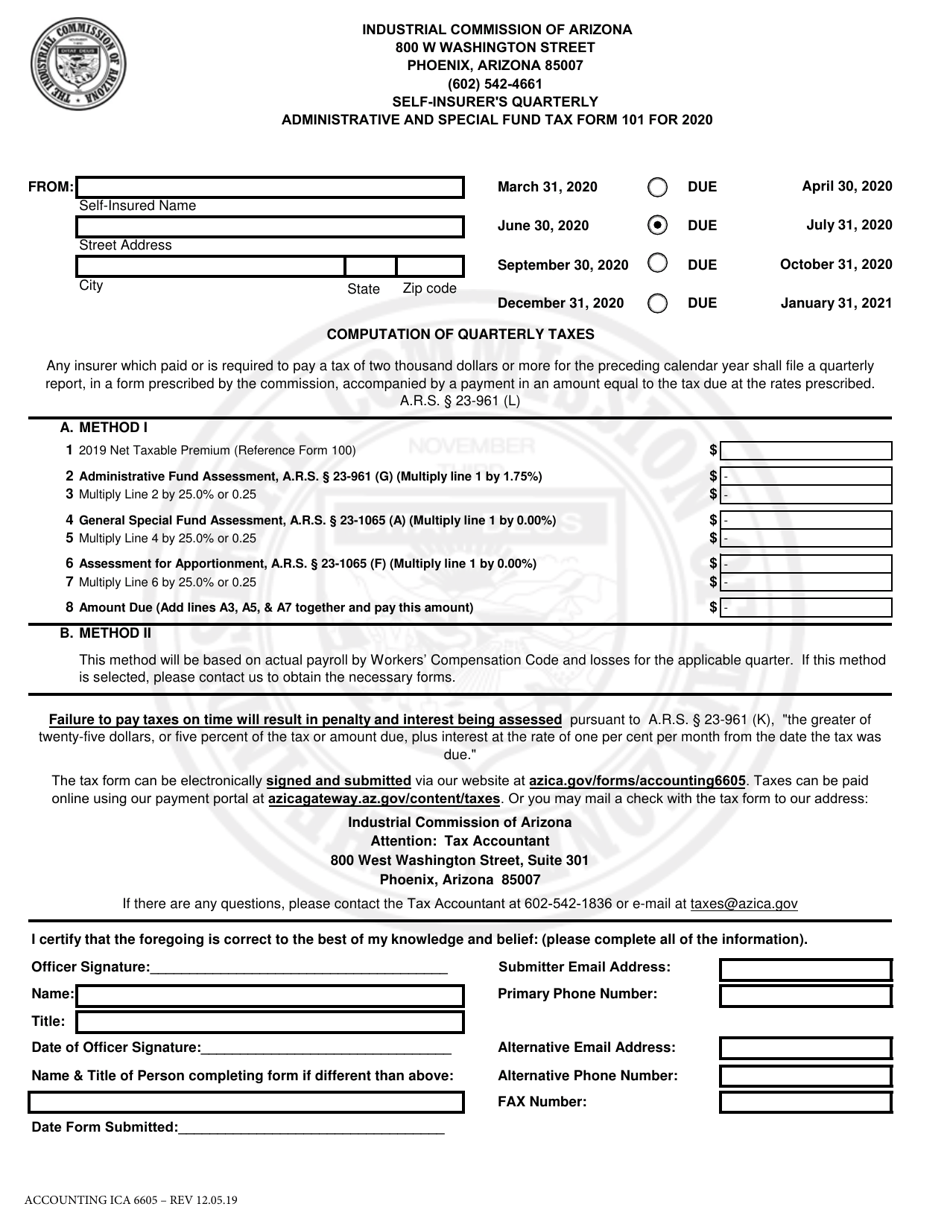

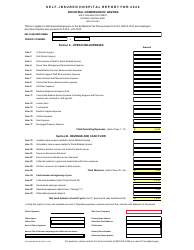

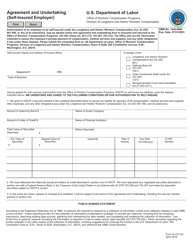

Form Accounting ICA6605 (101) Self-insured Employer - Quarterly Tax Form - Arizona

What Is Form Accounting ICA6605 (101)?

This is a legal form that was released by the Industrial Commission of Arizona - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

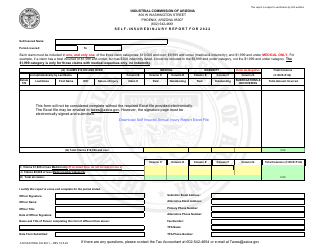

Q: What is Accounting ICA6605 (101)?

A: Accounting ICA6605 (101) is a form used by self-insured employers in Arizona to report their quarterly taxes.

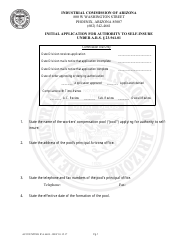

Q: Who needs to use this form?

A: Self-insured employers in Arizona need to use this form to report their quarterly taxes.

Q: What is a self-insured employer?

A: A self-insured employer is an employer who assumes the financial risk for providing health insurance to its employees.

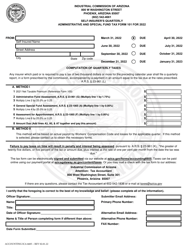

Q: What are quarterly taxes?

A: Quarterly taxes are taxes paid by businesses on a quarterly basis, which are based on their income and other factors.

Q: Can all employers use this form?

A: No, only self-insured employers in Arizona can use this form.

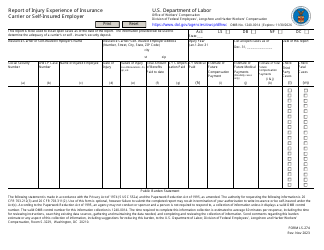

Q: When is this form due?

A: The due date for this form varies, but it is usually due within 30 days after the end of each calendar quarter.

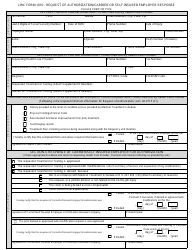

Q: What information do I need to fill out this form?

A: You will need to provide information about your business, including your tax identification number, income, and other relevant financial information.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there may be penalties for late or incorrect filing. It is important to file this form accurately and on time to avoid penalties.

Q: Is this form specific to Arizona?

A: Yes, this form is specific to self-insured employers in Arizona.

Q: Do I need to file this form every quarter?

A: Yes, self-insured employers in Arizona need to file this form every quarter to report their quarterly taxes.

Form Details:

- Released on December 5, 2019;

- The latest edition provided by the Industrial Commission of Arizona;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Accounting ICA6605 (101) by clicking the link below or browse more documents and templates provided by the Industrial Commission of Arizona.