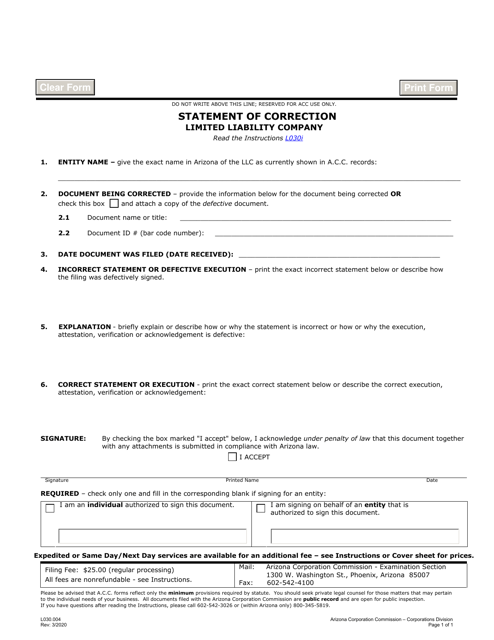

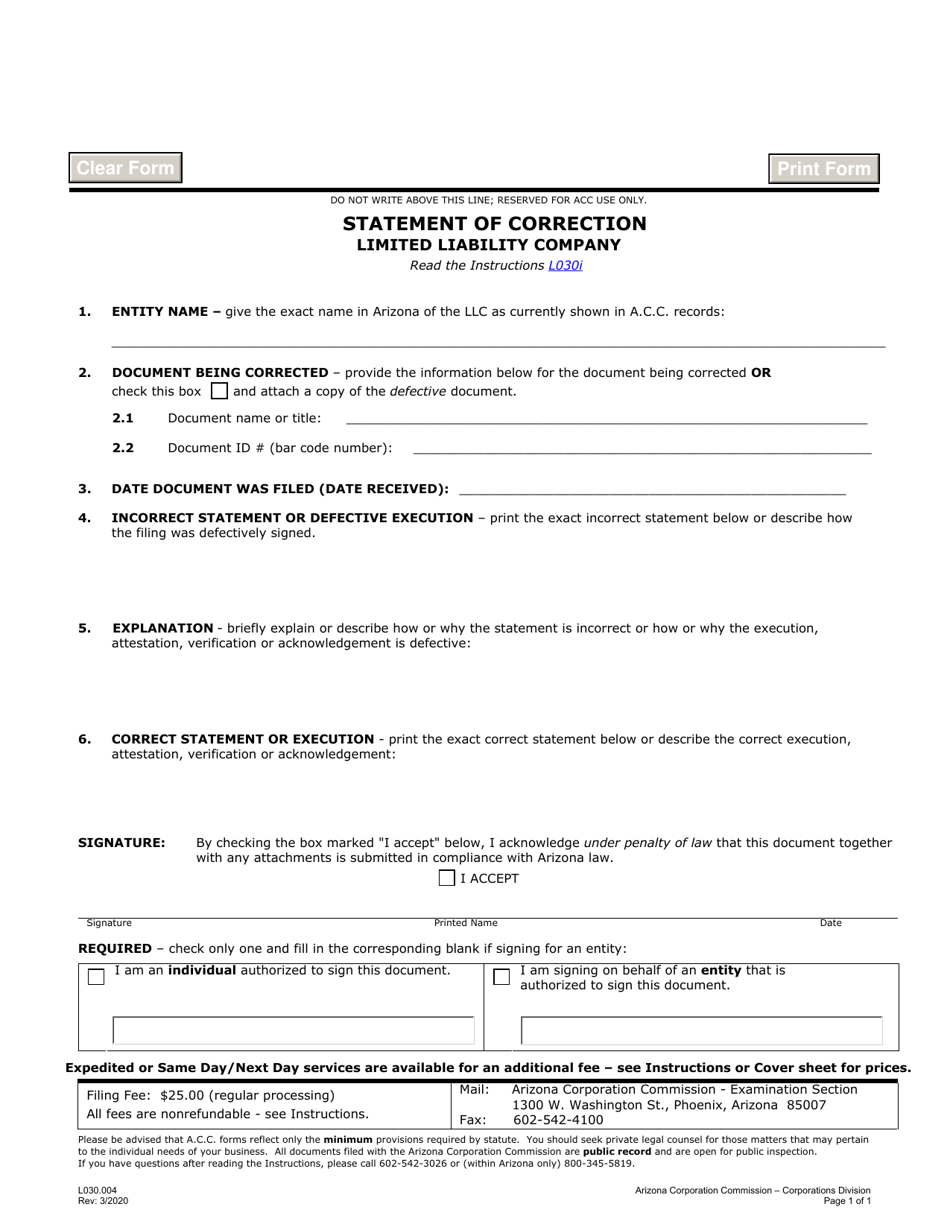

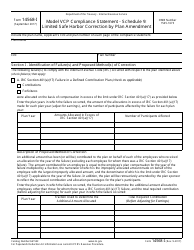

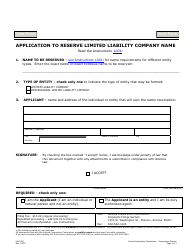

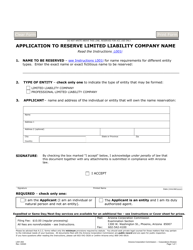

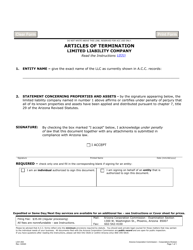

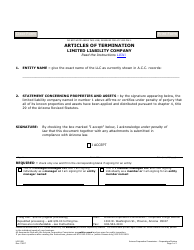

Form L030.004 Statement of Correction Limited Liability Company - Arizona

What Is Form L030.004?

This is a legal form that was released by the Arizona Corporation Commission - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form L030.004?

A: Form L030.004 is the Statement of Correction for a Limited Liability Company in Arizona.

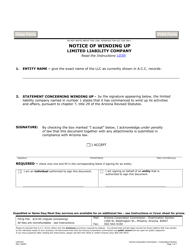

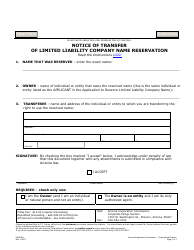

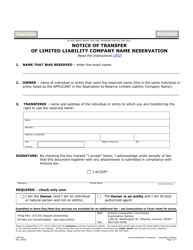

Q: What is the purpose of Form L030.004?

A: The purpose of Form L030.004 is to correct any errors or omissions in the original filing of a Limited Liability Company in Arizona.

Q: How do I use Form L030.004?

A: To use Form L030.004, you need to provide the correct information that needs to be corrected, along with the LLC name and the date of the original filing. You must complete the form accurately and sign it.

Q: Do I need to file Form L030.004 if there are no errors or omissions in my LLC filing?

A: No, you do not need to file Form L030.004 if there are no errors or omissions in your LLC filing.

Q: Are there any deadlines for filing Form L030.004?

A: There are no specific deadlines for filing Form L030.004. However, it is recommended to file the form as soon as possible after discovering the errors or omissions.

Q: Can I make multiple corrections on one Form L030.004?

A: Yes, you can make multiple corrections on one Form L030.004. Just make sure to provide all the necessary information for each correction.

Q: What happens after filing Form L030.004?

A: After filing Form L030.004, the Arizona Corporation Commission will review it and update their records accordingly. You will receive a copy of the corrected filing for your records.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Arizona Corporation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L030.004 by clicking the link below or browse more documents and templates provided by the Arizona Corporation Commission.