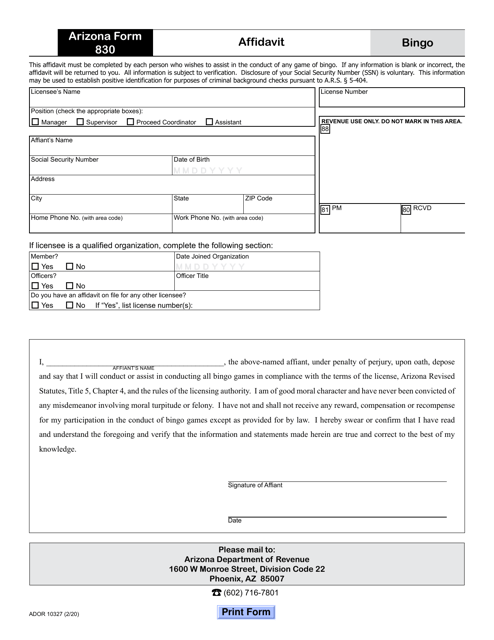

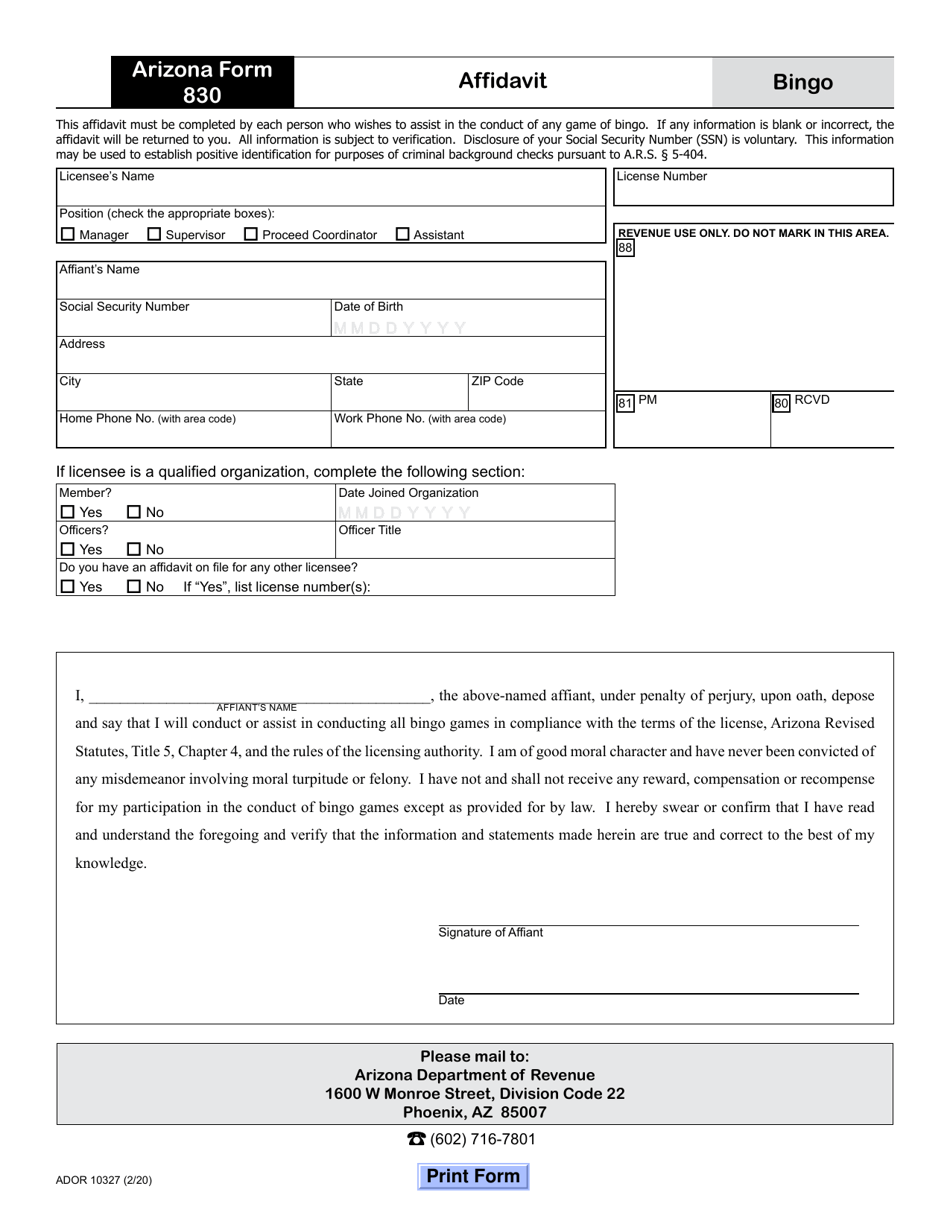

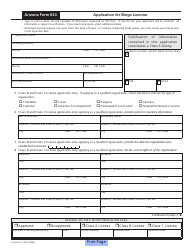

Arizona Form 830 (ADOR10327) Bingo Affidavit - Arizona

What Is Arizona Form 830 (ADOR10327)?

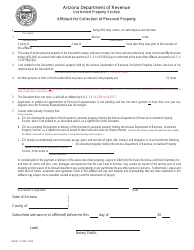

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 830?

A: Arizona Form 830 is a Bingo Affidavit.

Q: What is the purpose of Arizona Form 830?

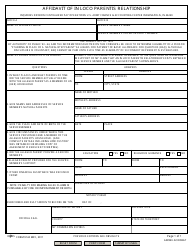

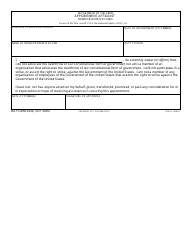

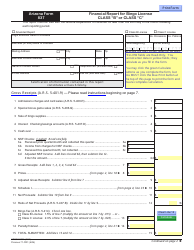

A: The purpose of Arizona Form 830 is to provide a declaration or affidavit related to bingo activities in Arizona.

Q: Who needs to complete Arizona Form 830?

A: Individuals or organizations involved in bingo activities in Arizona may need to complete Arizona Form 830.

Q: Is there a fee for filing Arizona Form 830?

A: There is no fee for filing Arizona Form 830.

Q: What information is required on Arizona Form 830?

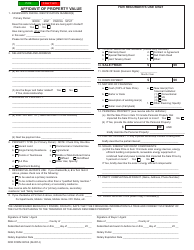

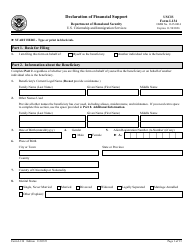

A: Arizona Form 830 requires information such as the name and address of the bingo organization, details of the bingo event, and the signatures of authorized personnel.

Q: Are there any penalties for not filing Arizona Form 830?

A: Failure to file Arizona Form 830 may result in penalties as determined by the Arizona Department of Revenue.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 830 (ADOR10327) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.