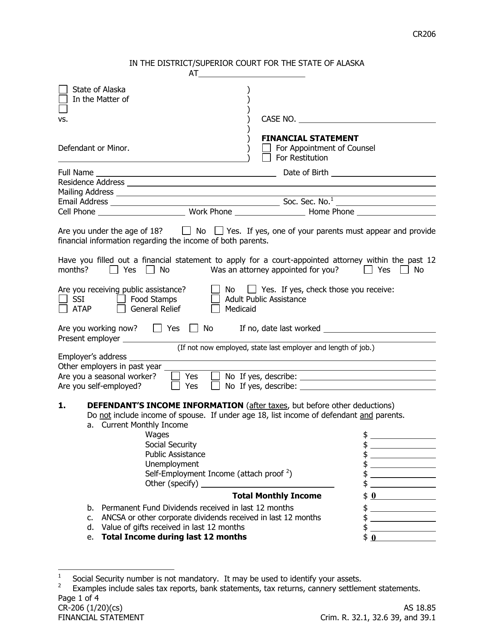

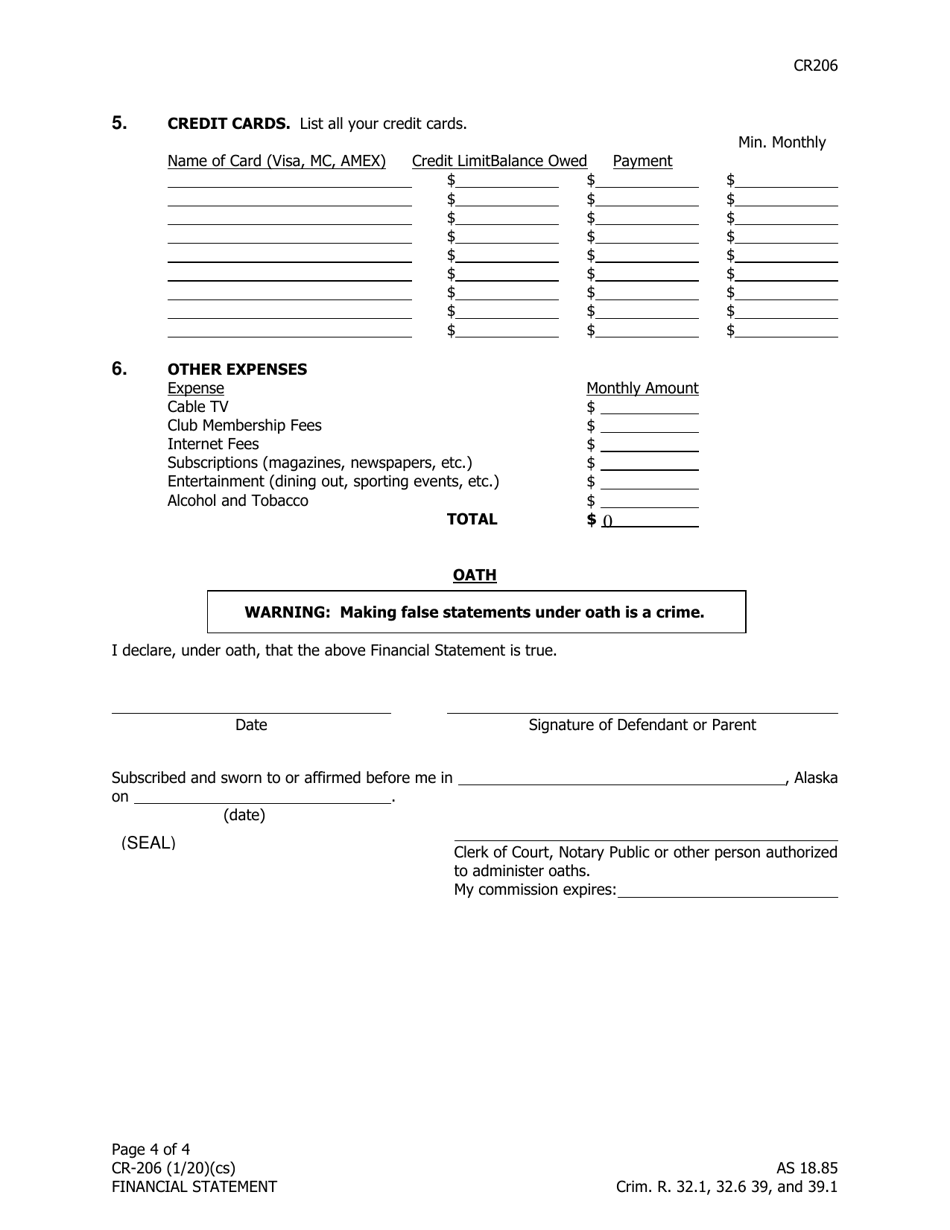

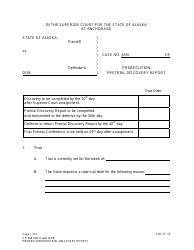

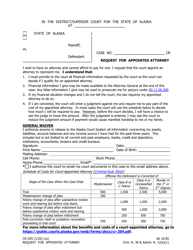

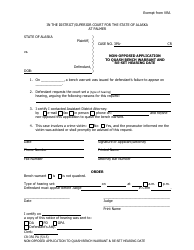

Form CR-206 Financial Statement - Alaska

What Is Form CR-206?

This is a legal form that was released by the Alaska Court System - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-206?

A: Form CR-206 is a Financial Statement used in Alaska.

Q: Who uses Form CR-206?

A: Form CR-206 is used by individuals or businesses in Alaska to provide a detailed overview of their financial situation.

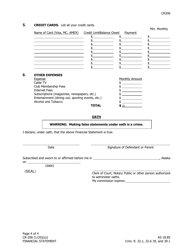

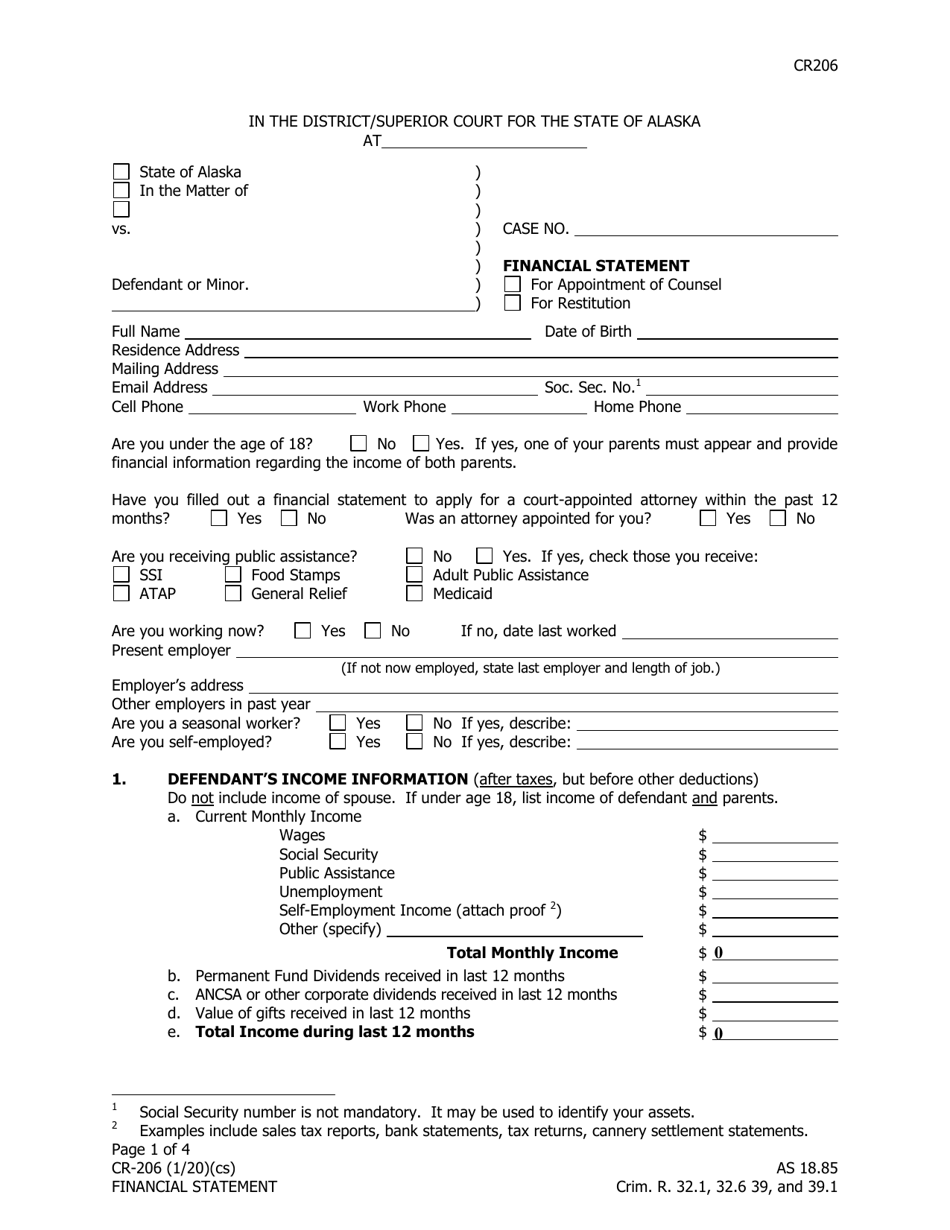

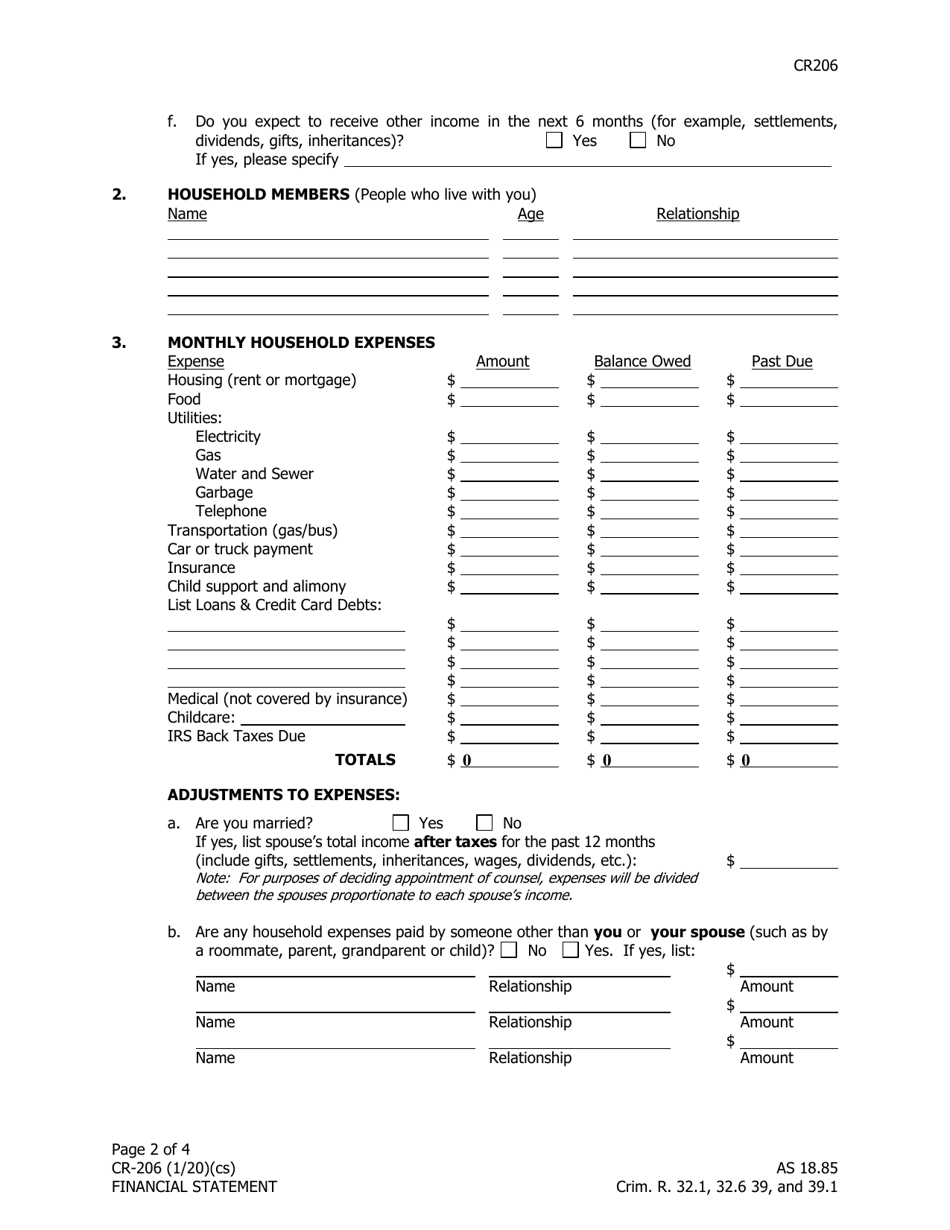

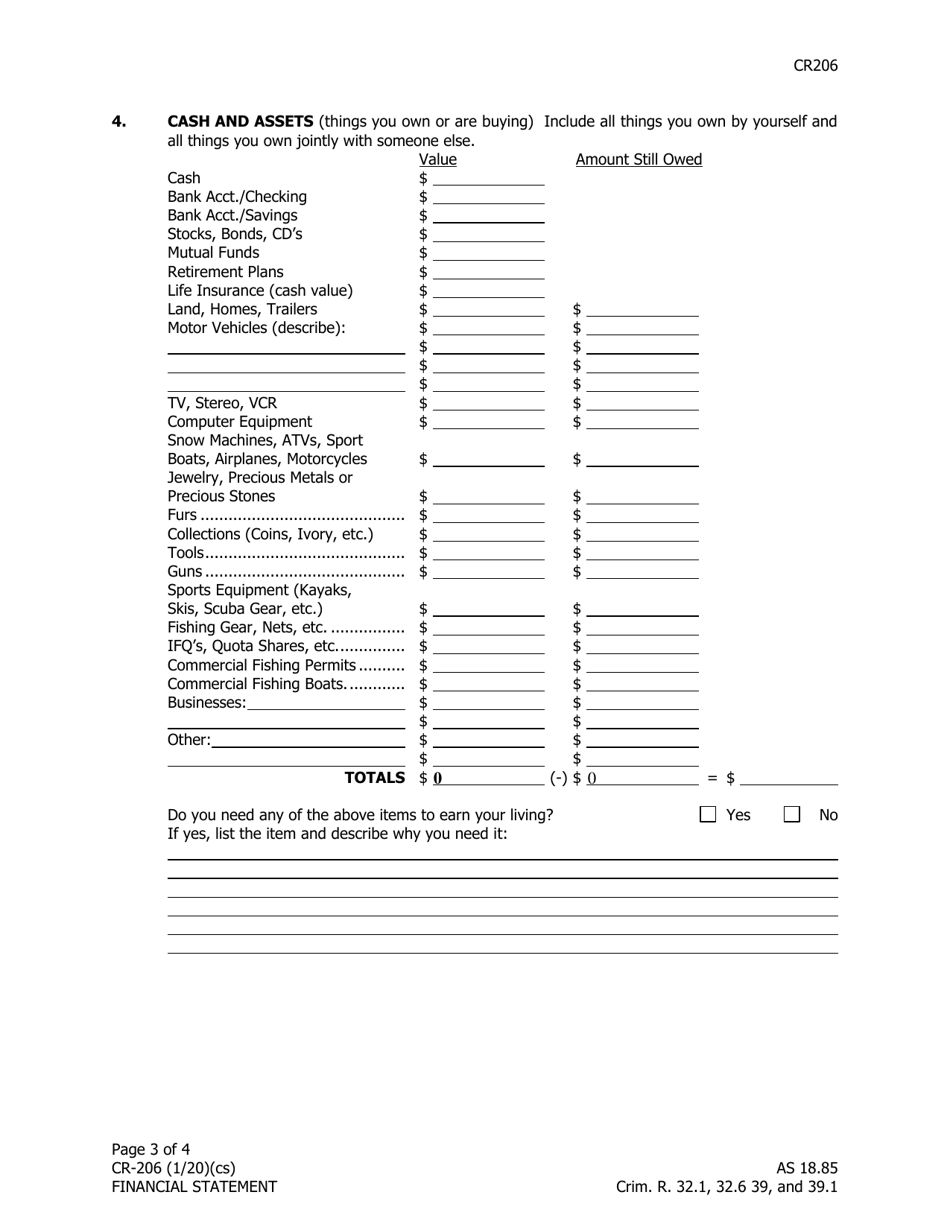

Q: What information is required on Form CR-206?

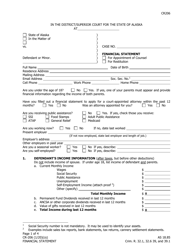

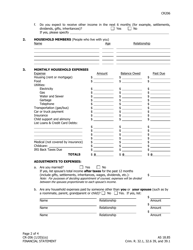

A: Form CR-206 requires information about income, expenses, assets, and liabilities.

Q: Why is Form CR-206 important?

A: Form CR-206 is important for various legal purposes, such as divorce proceedings, child support, and determining eligibility for public assistance.

Q: Are there any fees associated with filing Form CR-206?

A: There may be filing fees associated with submitting Form CR-206, depending on the specific circumstances.

Q: Can I seek legal assistance to complete Form CR-206?

A: Yes, you can seek legal assistance to help you complete Form CR-206 accurately and efficiently.

Q: How often do I need to update my Form CR-206?

A: You should update your Form CR-206 whenever there are significant changes in your financial situation or as required by the court.

Q: Is Form CR-206 specific to Alaska?

A: Yes, Form CR-206 is specific to Alaska and may have different versions or requirements in other states.

Q: What should I do if I need help completing Form CR-206?

A: If you need help completing Form CR-206, you can consult with an attorney or seek assistance from the court clerk.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Alaska Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-206 by clicking the link below or browse more documents and templates provided by the Alaska Court System.