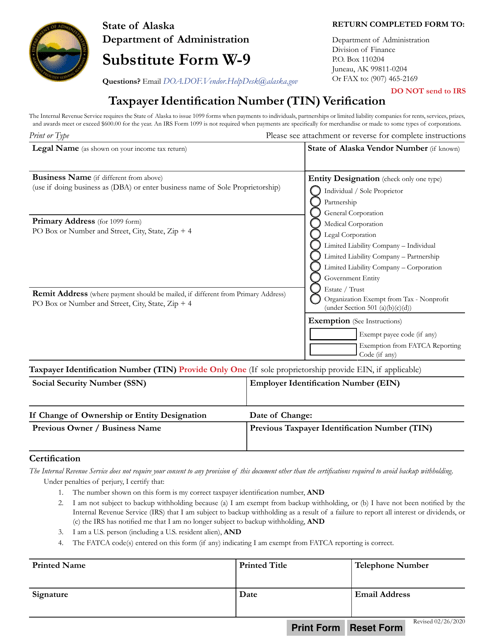

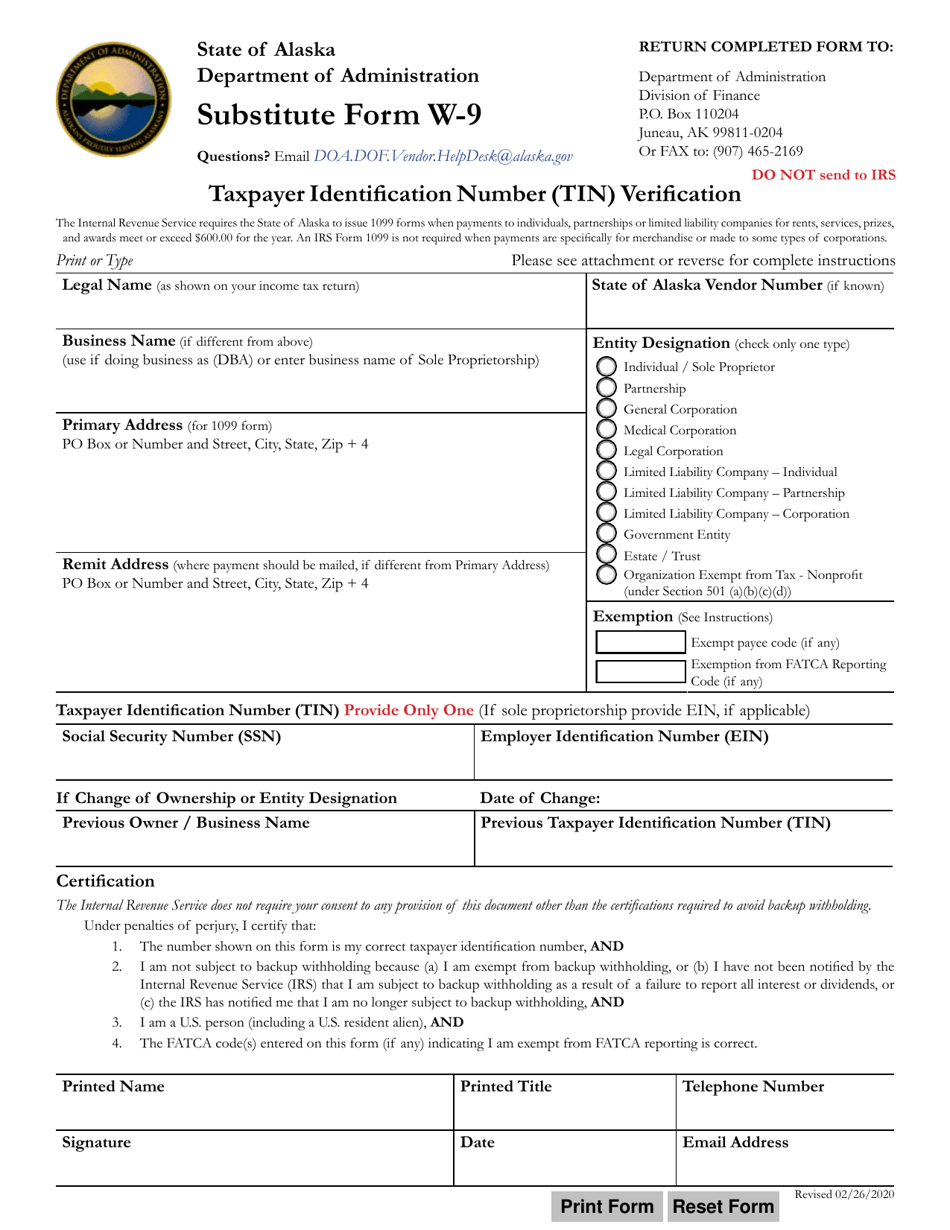

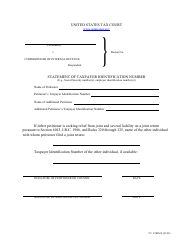

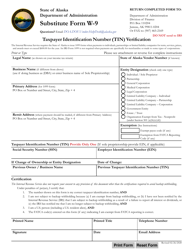

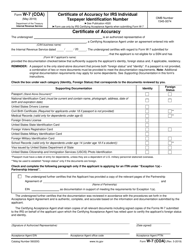

Form W-9 Taxpayer Identification Number (Tin) Verification - Alaska

What Is Form W-9?

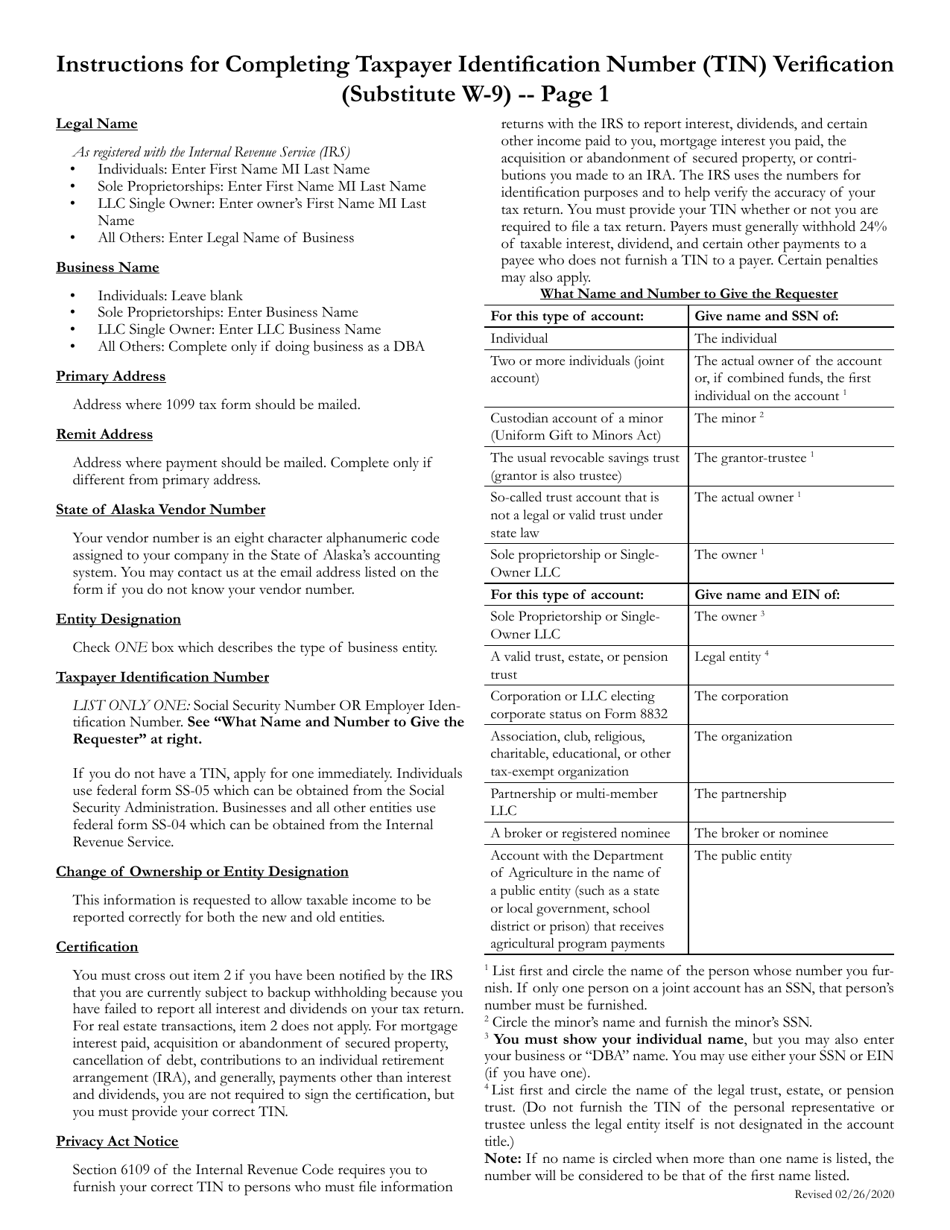

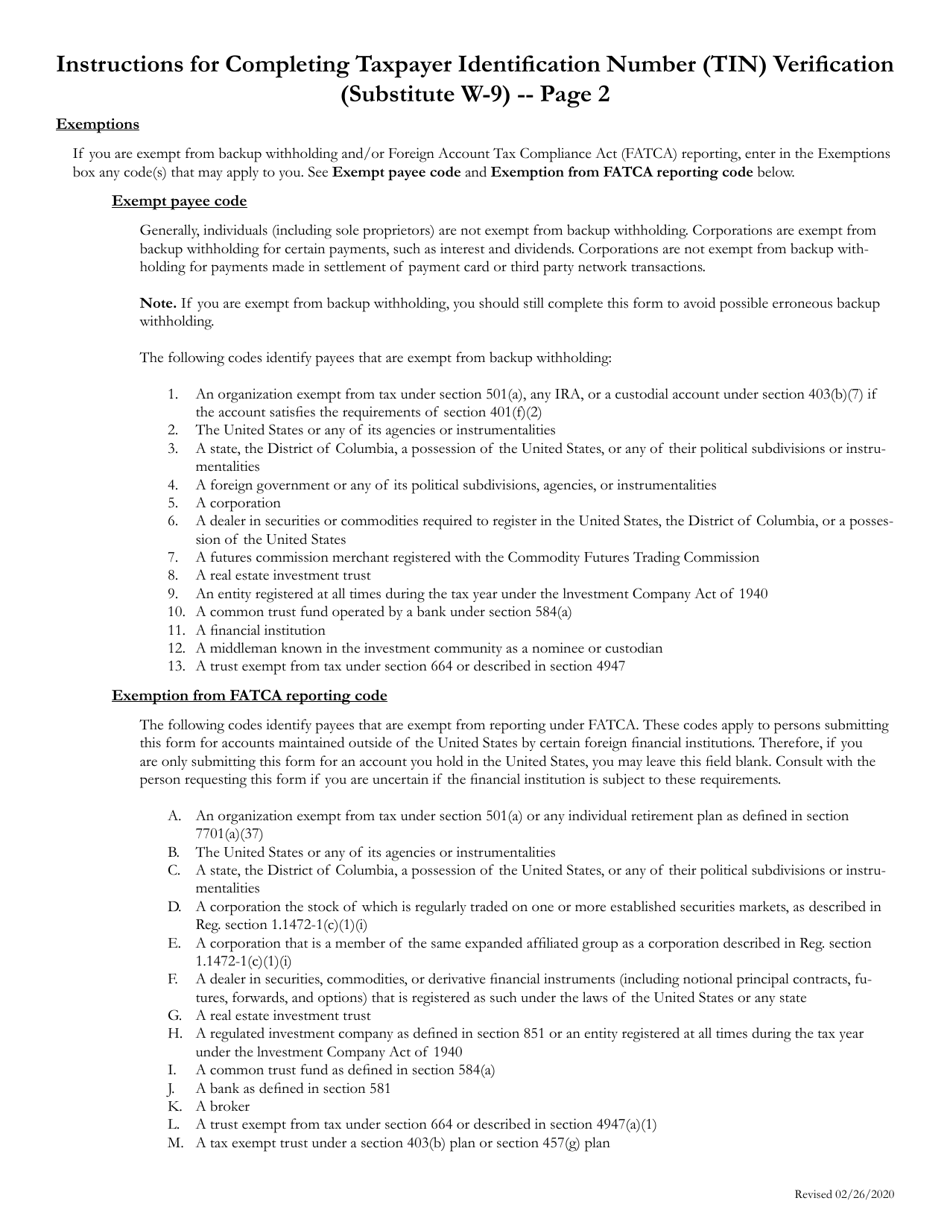

This is a legal form that was released by the Alaska Department of Administration - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

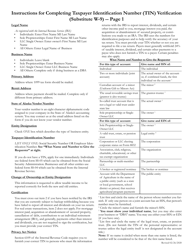

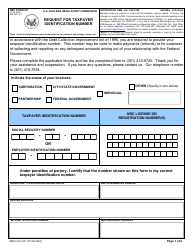

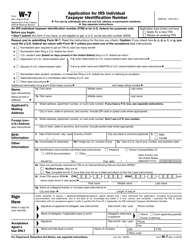

Q: What is Form W-9?

A: Form W-9 is a tax form used to request the taxpayer identification number (TIN) of an individual or business.

Q: Why is Form W-9 used?

A: Form W-9 is used by businesses to collect the TIN of a vendor or independent contractor for tax reporting purposes.

Q: What is a taxpayer identification number (TIN)?

A: A taxpayer identification number (TIN) is a unique identifier assigned to individuals or businesses by the Internal Revenue Service (IRS) for tax purposes.

Q: Who should fill out Form W-9?

A: Anyone who is required to provide their TIN to a business for tax reporting purposes should fill out Form W-9.

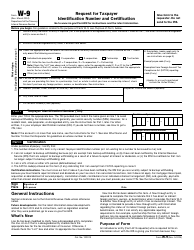

Q: Is Form W-9 specific to Alaska?

A: No, Form W-9 is a federal tax form and is used across all states, including Alaska.

Form Details:

- Released on February 26, 2020;

- The latest edition provided by the Alaska Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-9 by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.