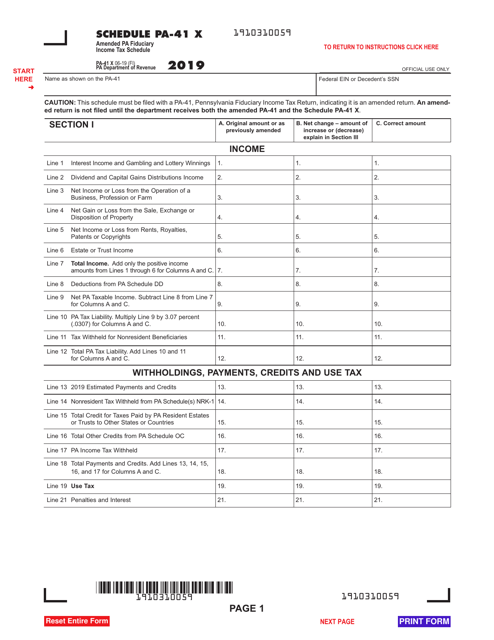

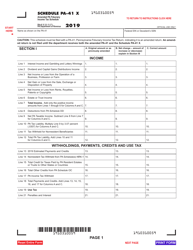

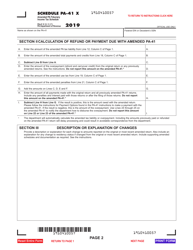

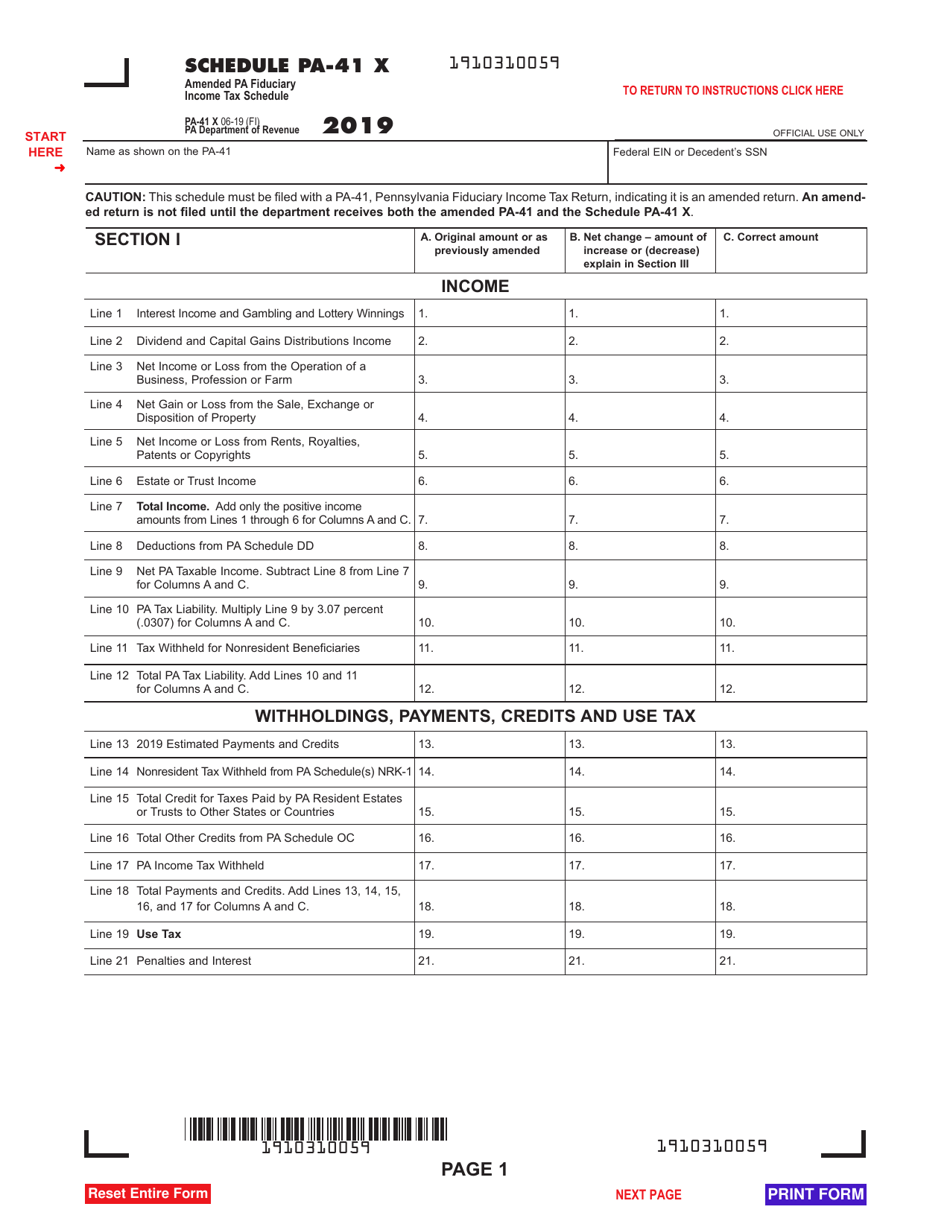

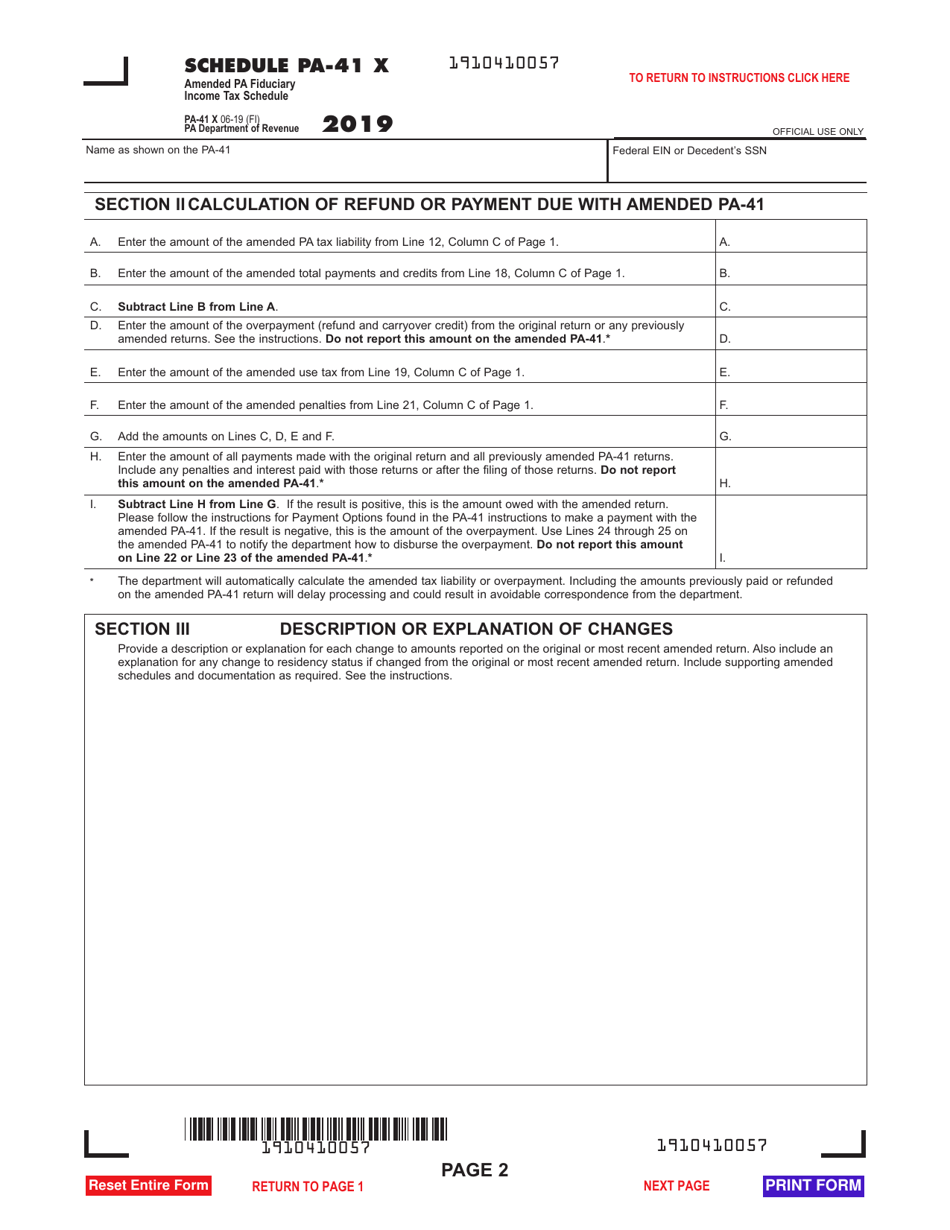

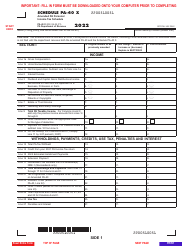

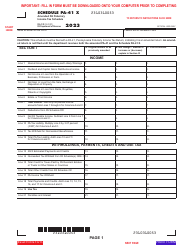

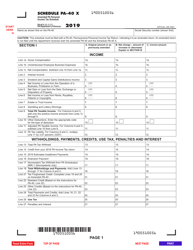

Schedule PA-41 X Amended Pa Fiduciary Income Tax Schedule - Pennsylvania

What Is Schedule PA-41 X?

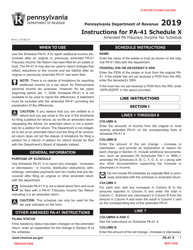

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule PA-41 X?

A: Schedule PA-41 X is an amended tax schedule for Pennsylvania Fiduciary Income Tax.

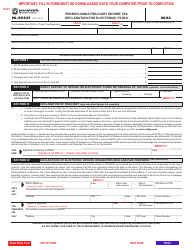

Q: Who needs to use Schedule PA-41 X?

A: Fiduciaries who need to amend their Pennsylvania Fiduciary Income Tax return need to use Schedule PA-41 X.

Q: What is the purpose of Schedule PA-41 X?

A: Schedule PA-41 X is used to report changes and corrections to a previously filed Pennsylvania Fiduciary Income Tax return.

Q: When is Schedule PA-41 X due?

A: The due date for Schedule PA-41 X is the same as the due date for the original Pennsylvania Fiduciary Income Tax return, which is generally April 15th.

Q: What information do I need to complete Schedule PA-41 X?

A: You will need information from your original Pennsylvania Fiduciary Income Tax return, as well as any changes or corrections that you need to report.

Q: Can I e-file Schedule PA-41 X?

A: No, Schedule PA-41 X cannot be e-filed. It must be mailed to the Pennsylvania Department of Revenue.

Q: Are there any penalties for filing an amended Pennsylvania Fiduciary Income Tax return?

A: Penalties may apply if the amended return results in additional tax due or if it is filed after the original due date.

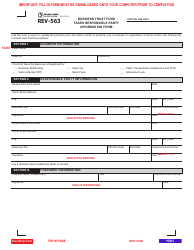

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule PA-41 X by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.