This version of the form is not currently in use and is provided for reference only. Download this version of

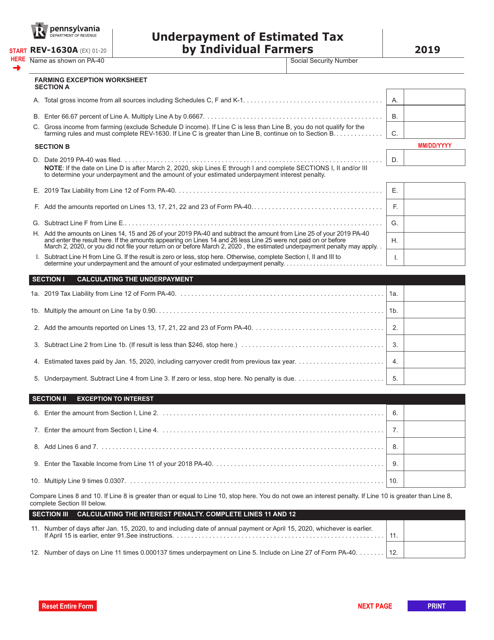

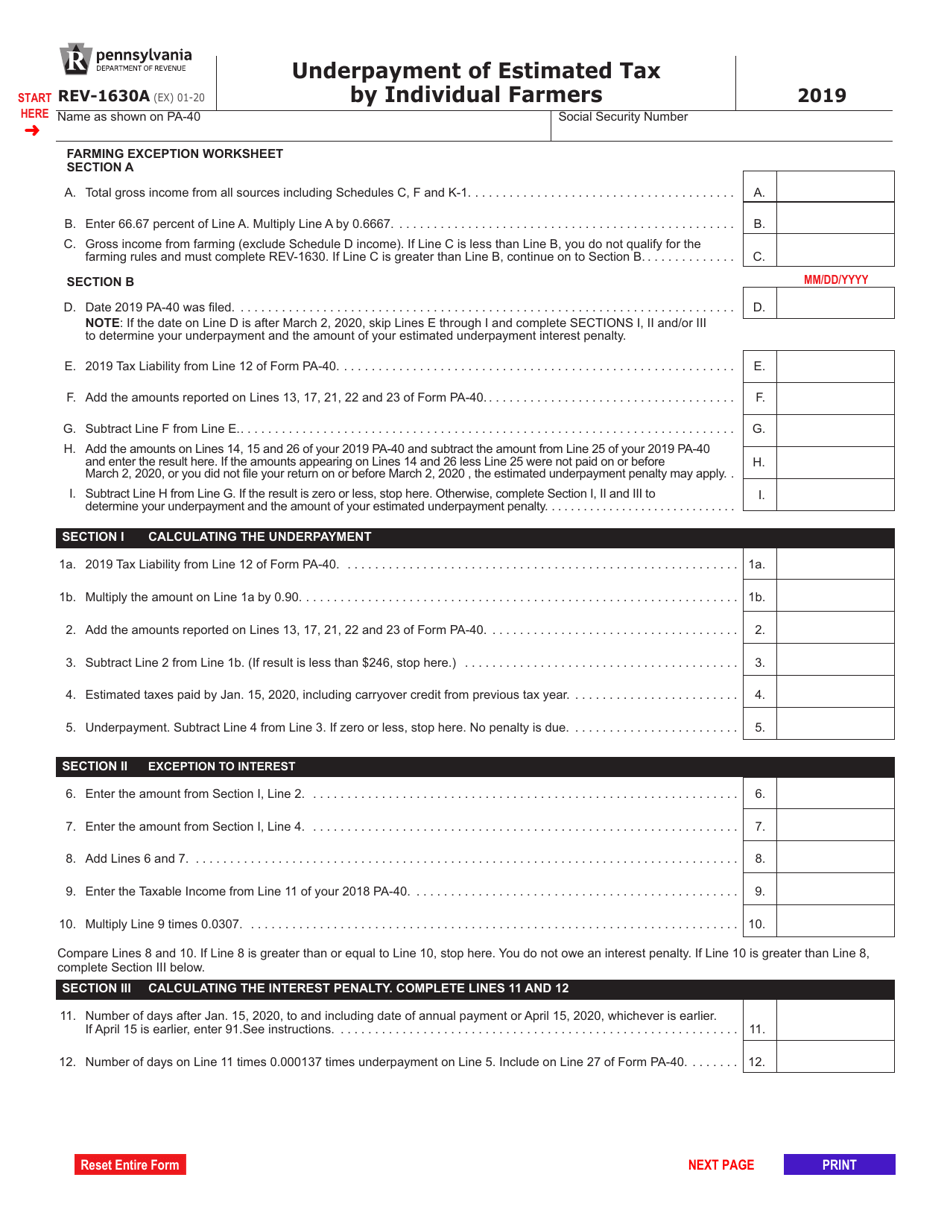

Form REV-1630A

for the current year.

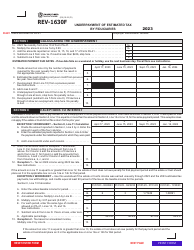

Form REV-1630A Underpayment of Estimated Tax by Individual Farmers - Pennsylvania

What Is Form REV-1630A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

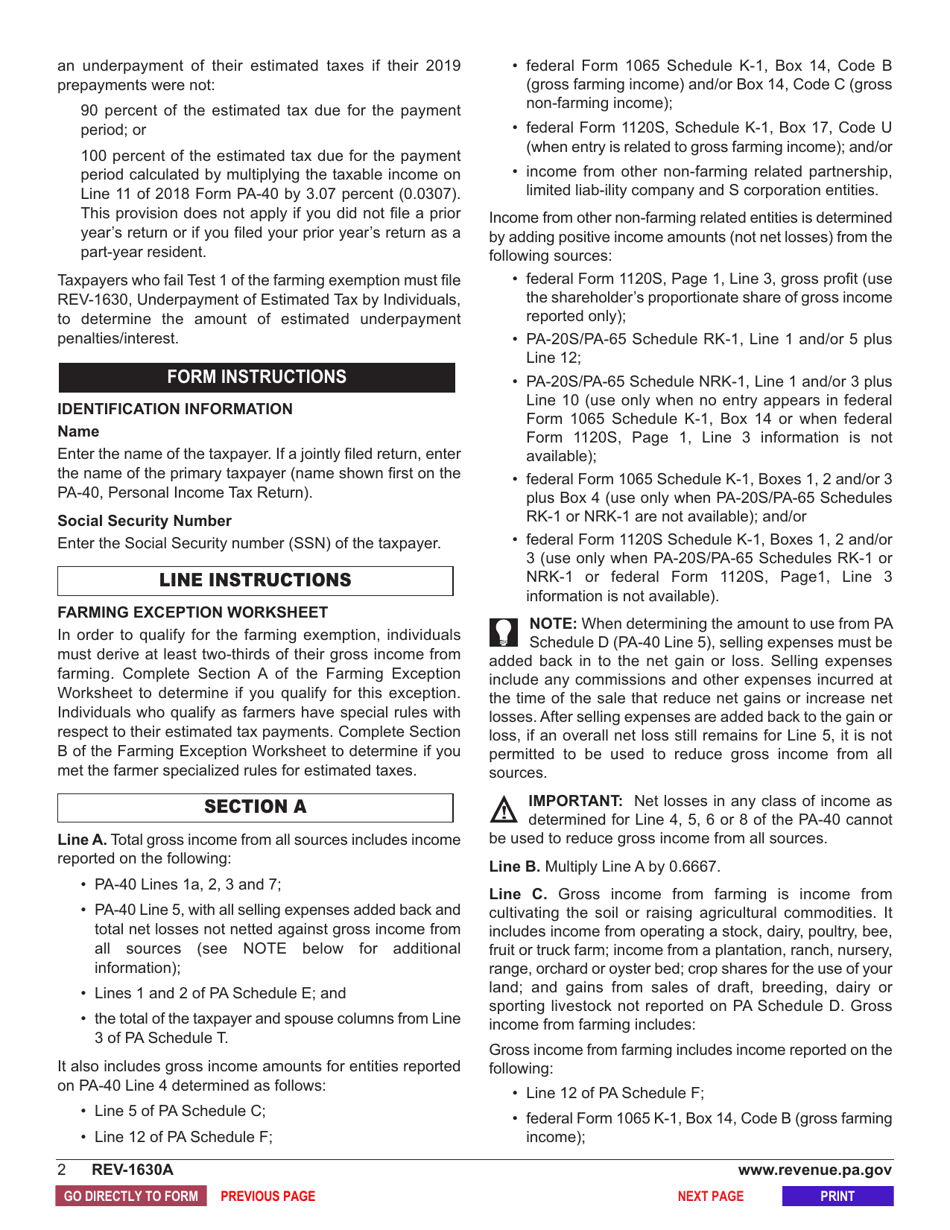

Q: What is Form REV-1630A?

A: Form REV-1630A is a form used by individual farmers in Pennsylvania to report underpayment of estimated tax.

Q: Who should use Form REV-1630A?

A: Individual farmers in Pennsylvania who have underpaid their estimated tax should use Form REV-1630A.

Q: What is the purpose of Form REV-1630A?

A: The purpose of Form REV-1630A is to calculate and report the underpayment of estimated tax by individual farmers.

Q: When is Form REV-1630A due?

A: Form REV-1630A is due on the same date as the individual income tax return, usually on April 15th.

Q: What happens if I don't file Form REV-1630A?

A: If you don't file Form REV-1630A and you owe underpaid estimated tax, you may be subject to penalties and interest.

Q: Can I file Form REV-1630A electronically?

A: Currently, Form REV-1630A cannot be filed electronically. It must be filed by mail or in person.

Q: What supporting documentation do I need to include with Form REV-1630A?

A: You should include copies of your federal income tax returns and any other relevant tax documents with Form REV-1630A.

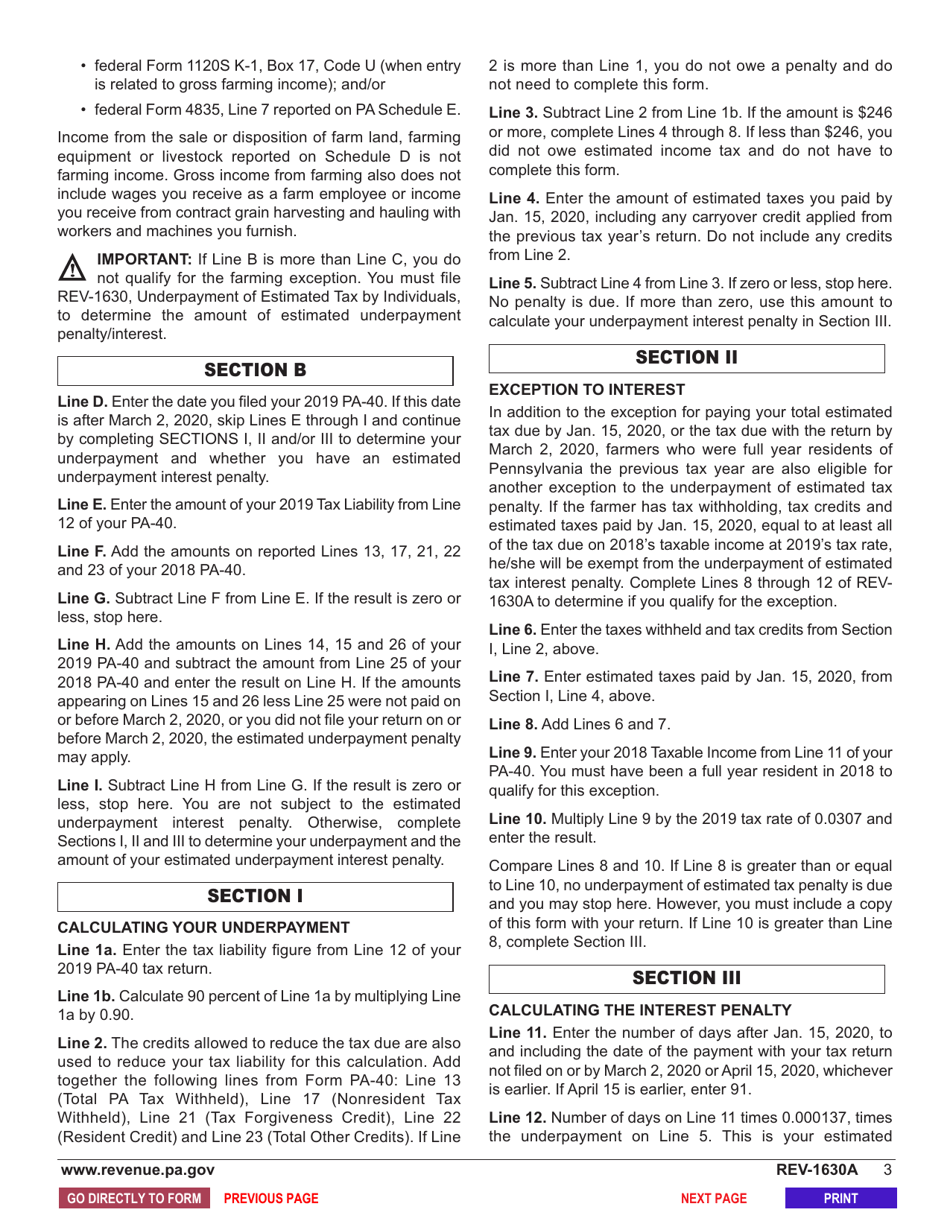

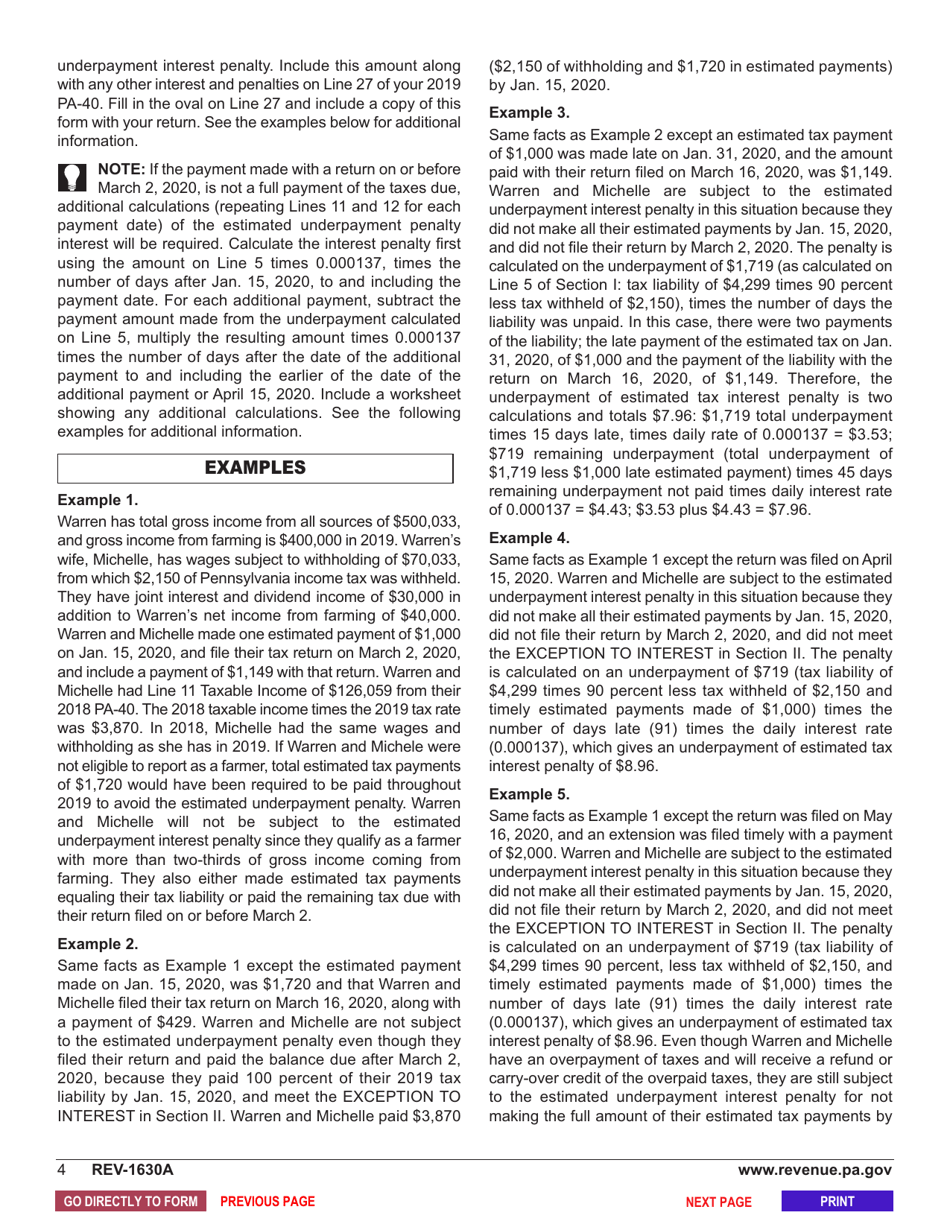

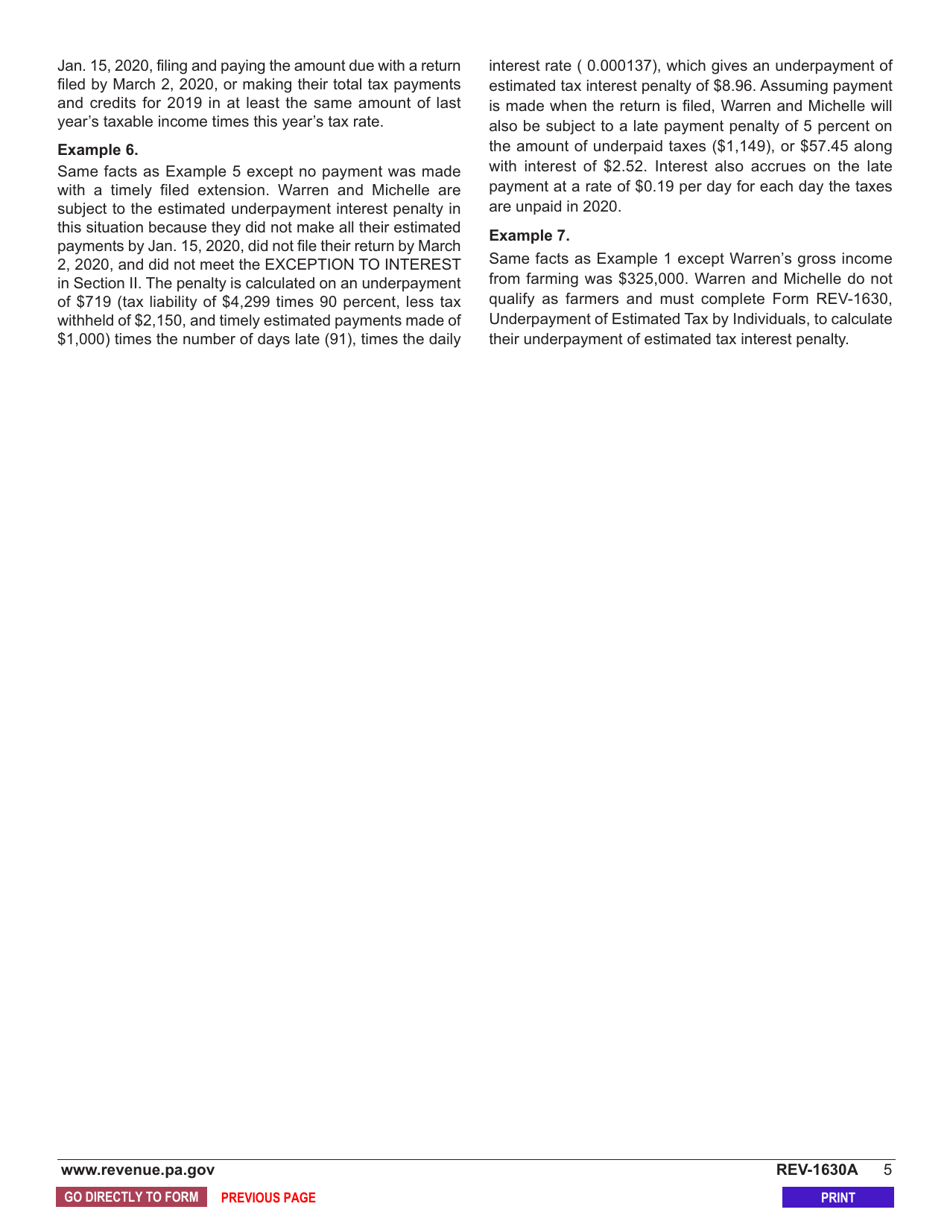

Q: How do I calculate the underpayment penalty?

A: The underpayment penalty can be calculated using the worksheets provided in the instructions for Form REV-1630A.

Q: Is Form REV-1630A only for farmers?

A: Yes, Form REV-1630A is specifically designed for individual farmers in Pennsylvania to report underpayment of estimated tax.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1630A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.