This version of the form is not currently in use and is provided for reference only. Download this version of

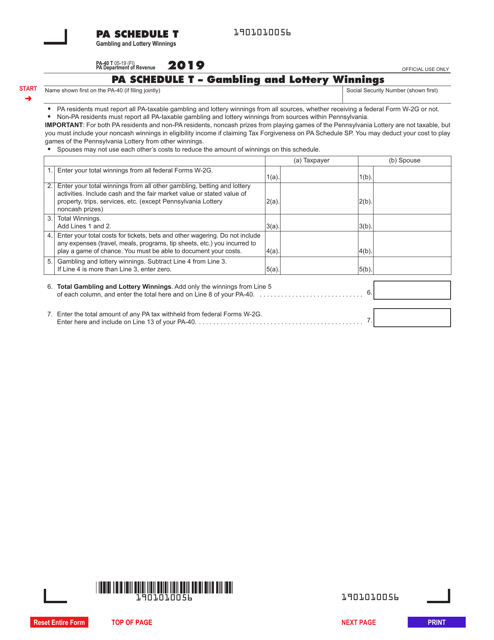

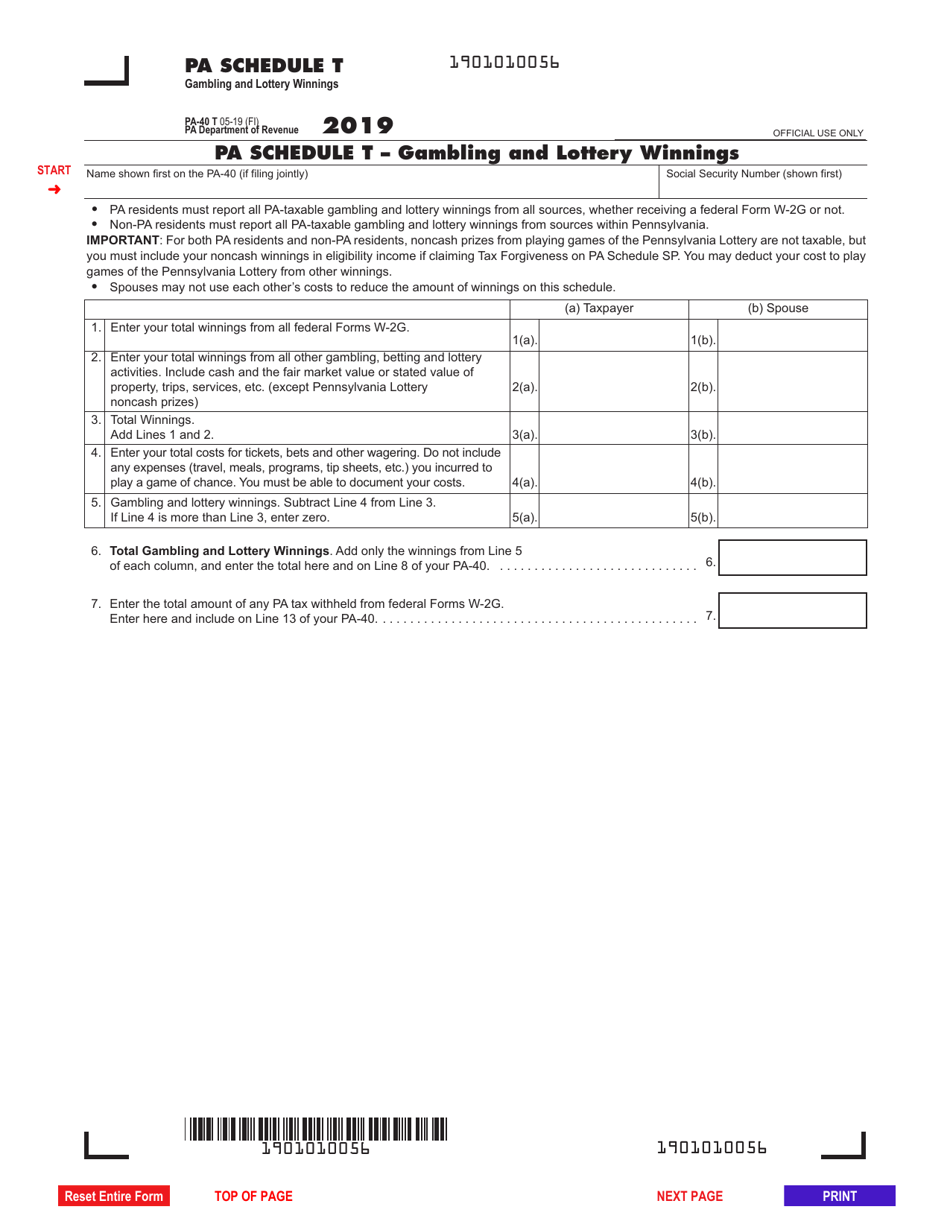

Form PA-40 Schedule T

for the current year.

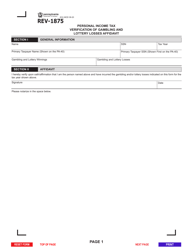

Form PA-40 Schedule T Gambling and Lottery Winnings - Pennsylvania

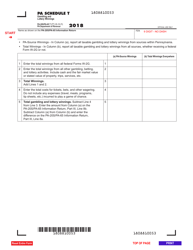

What Is Form PA-40 Schedule T?

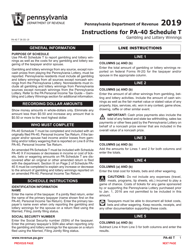

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule T?

A: PA-40 Schedule T is a form used by individuals in Pennsylvania to report gambling and lottery winnings.

Q: Do I need to file PA-40 Schedule T?

A: You need to file PA-40 Schedule T if you received gambling or lottery winnings in Pennsylvania.

Q: What types of winnings should be reported on PA-40 Schedule T?

A: You should report all gambling and lottery winnings, including those from casinos, racetracks, the Pennsylvania Lottery, and other sources.

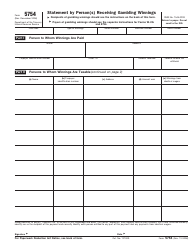

Q: What information do I need to complete PA-40 Schedule T?

A: You will need to provide details of your gambling and lottery winnings, including the name and address of the payer, the type of game or activity, and the amount won.

Q: When is the deadline for filing PA-40 Schedule T?

A: The deadline for filing PA-40 Schedule T is the same as the deadline for filing your annual Pennsylvania state tax return, which is usually April 15th.

Q: Can I e-file PA-40 Schedule T?

A: Yes, you can e-file PA-40 Schedule T if you are filing your annual Pennsylvania state tax return electronically.

Q: Do I need to include supporting documents with PA-40 Schedule T?

A: You do not need to submit supporting documents with PA-40 Schedule T, but you should keep them for your records in case of an audit.

Q: What penalties can I face for not filing PA-40 Schedule T if I had gambling or lottery winnings?

A: Failure to file PA-40 Schedule T and report gambling or lottery winnings may result in penalties, such as interest charges and possible audits.

Q: Who can I contact for more information about PA-40 Schedule T?

A: For more information about PA-40 Schedule T and filing requirements, you can contact the Pennsylvania Department of Revenue or consult a tax professional.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule T by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.