This version of the form is not currently in use and is provided for reference only. Download this version of

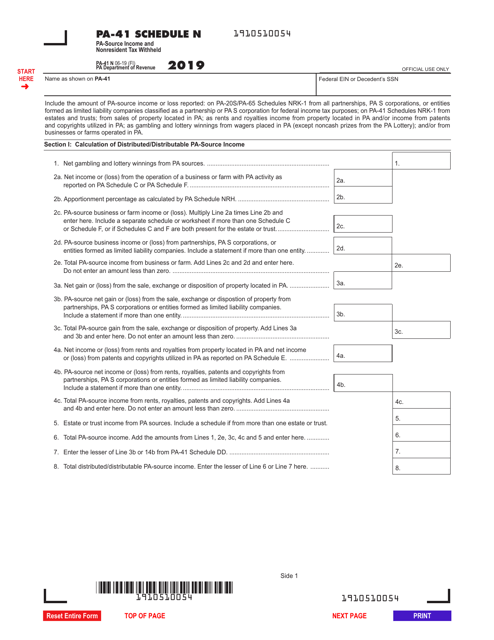

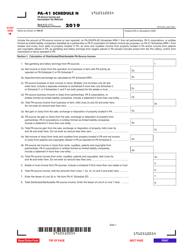

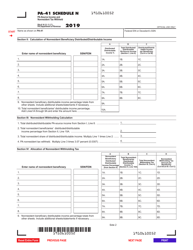

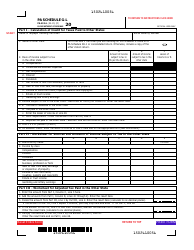

Form PA-41 Schedule N

for the current year.

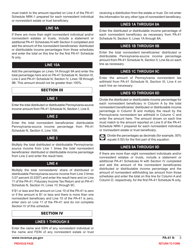

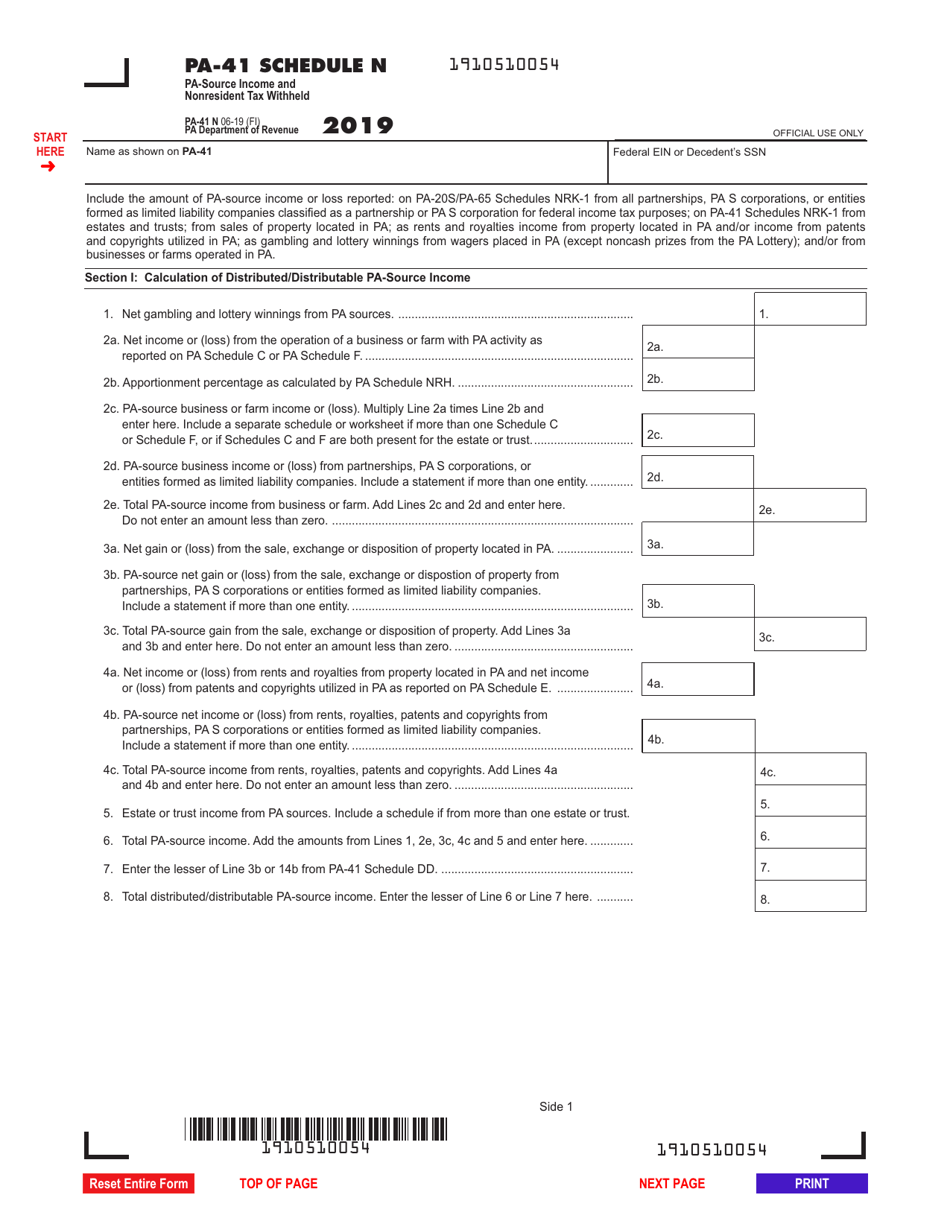

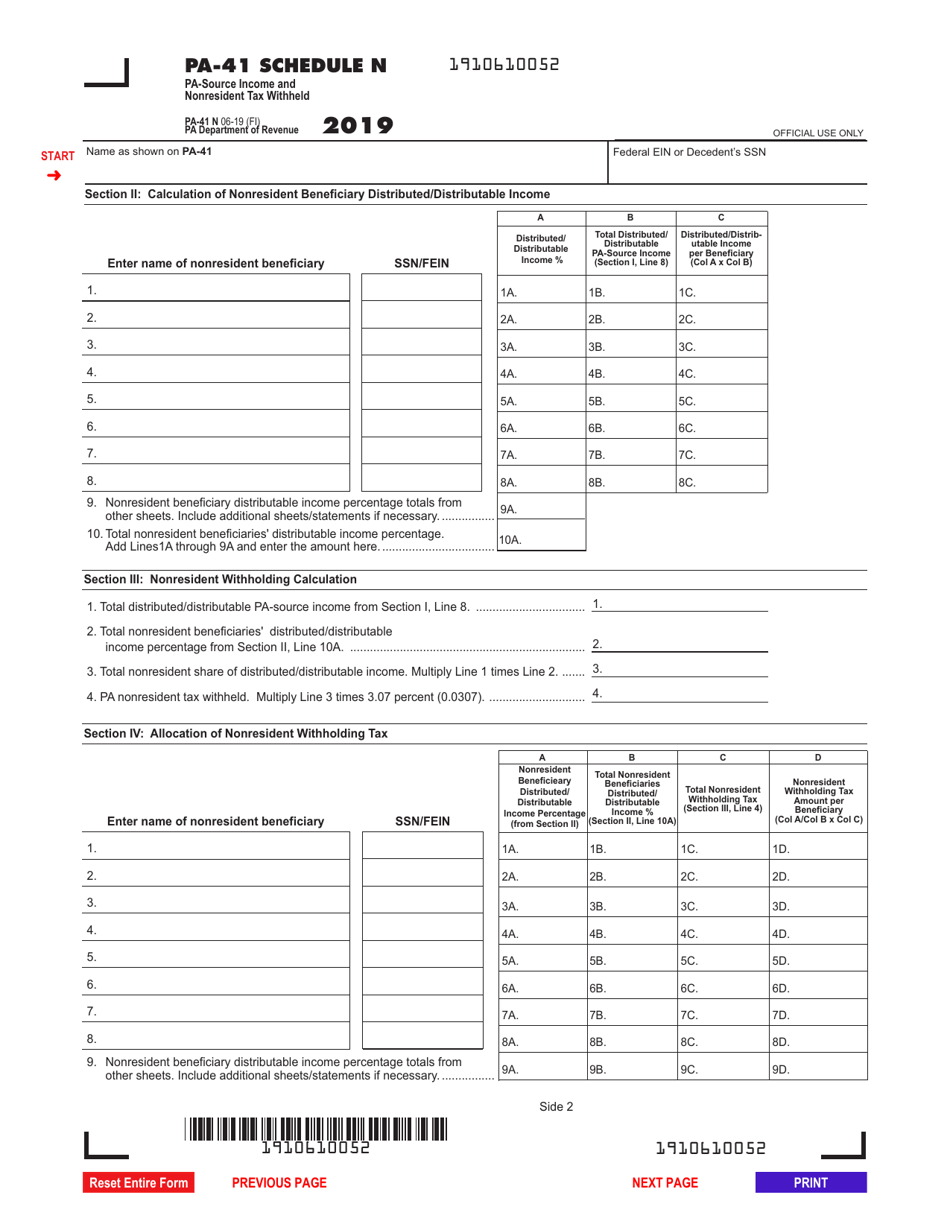

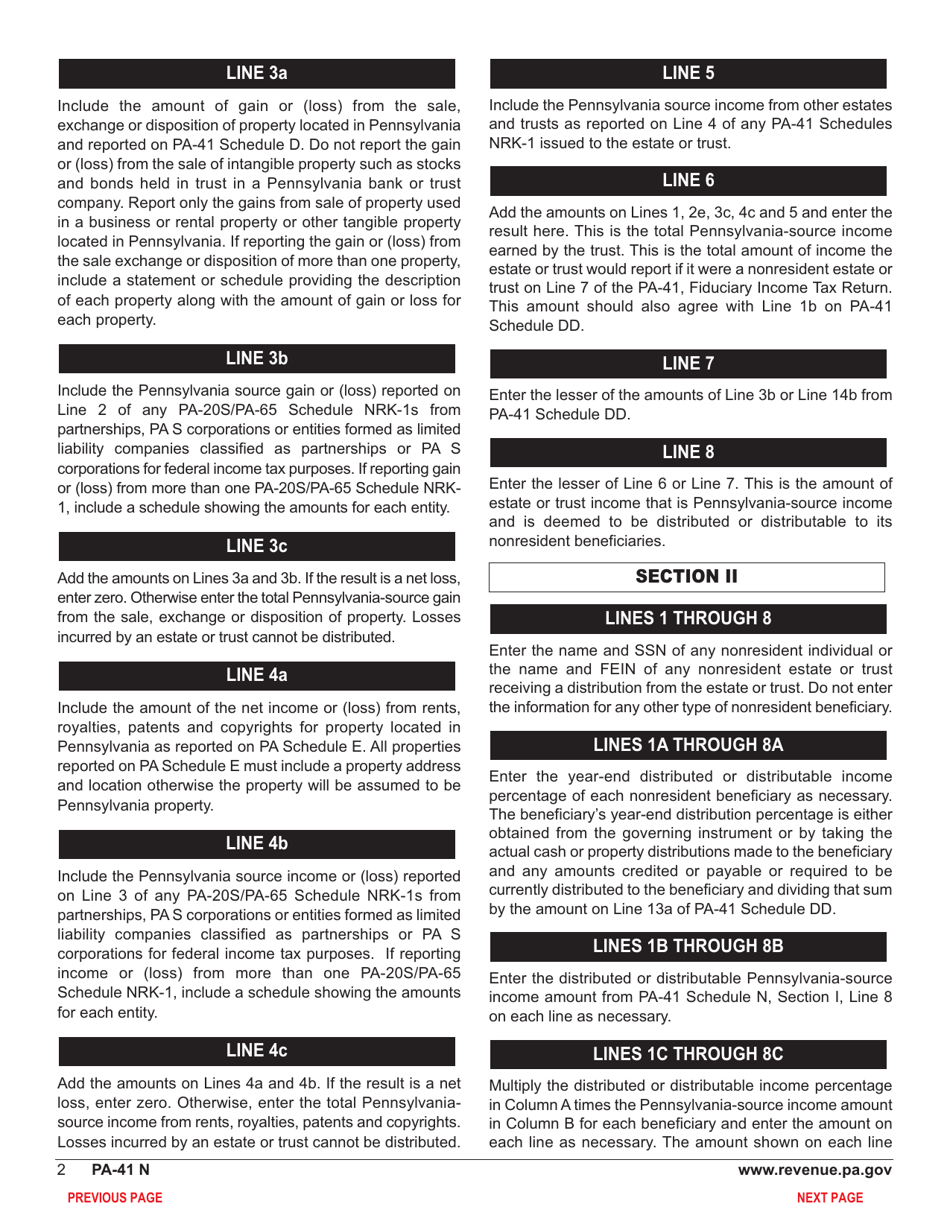

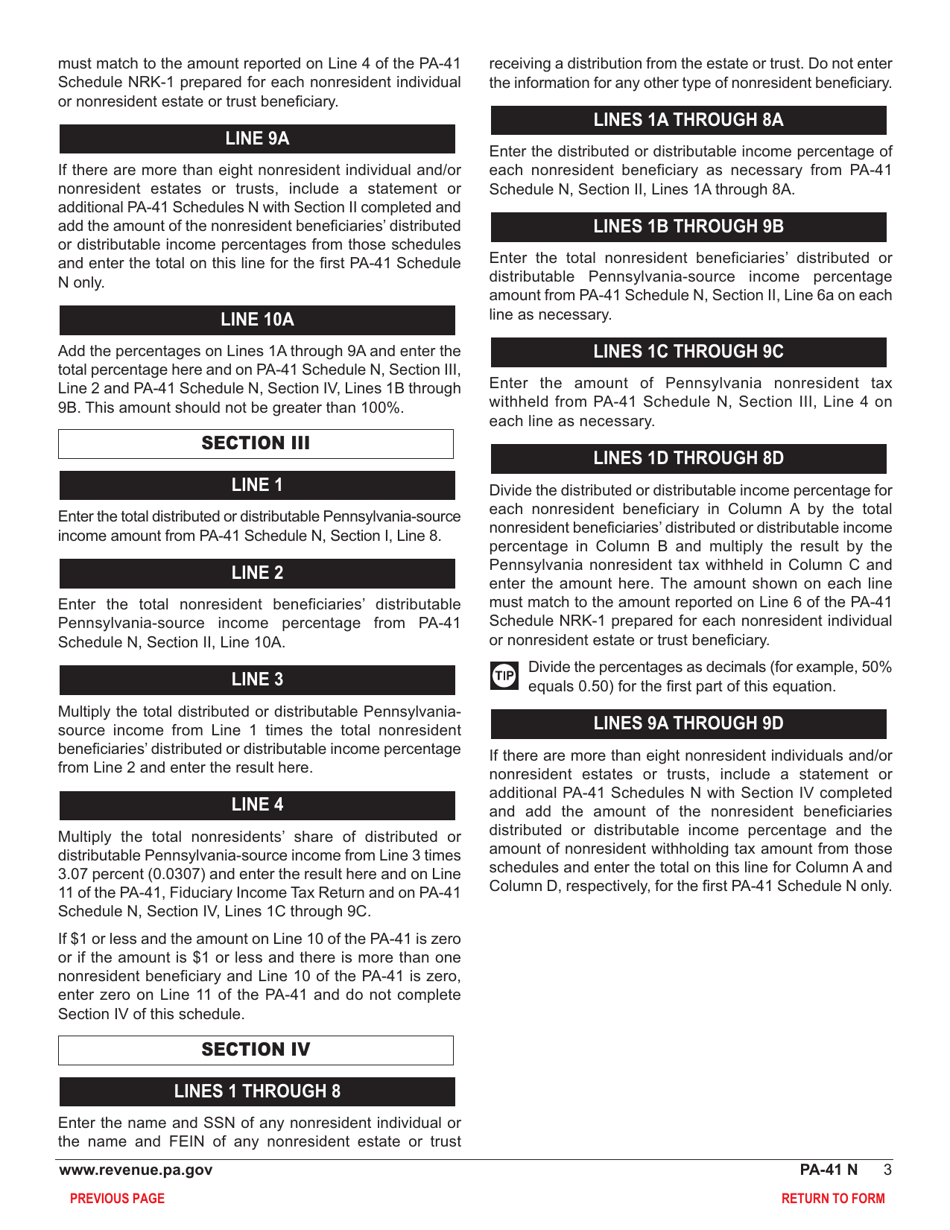

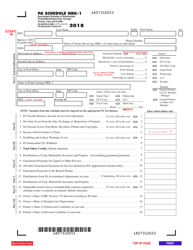

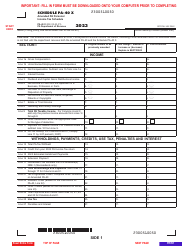

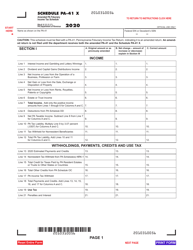

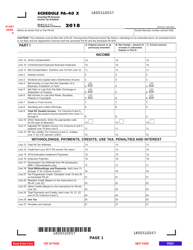

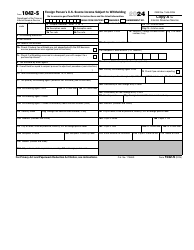

Form PA-41 Schedule N Pa-Source Income and Nonresident Tax Withheld - Pennsylvania

What Is Form PA-41 Schedule N?

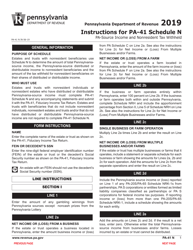

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule N?

A: Form PA-41 Schedule N is a supplemental form to the Pennsylvania Personal Income Tax Return (Form PA-40) that is used to report income earned from sources within Pennsylvania and any nonresident tax withheld.

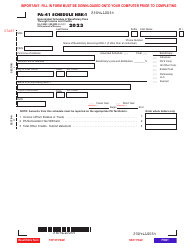

Q: When is Form PA-41 Schedule N required?

A: Form PA-41 Schedule N is required if you have earned income from sources within Pennsylvania and have had nonresident tax withheld.

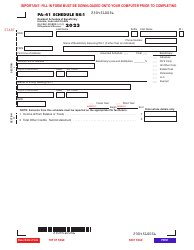

Q: What is considered Pa-source income?

A: Pa-source income refers to any income that is earned from sources within Pennsylvania, such as wages, salaries, commissions, rental income, and business or professional income.

Q: What is nonresident tax withholding?

A: Nonresident tax withholding is a requirement for employers who pay wages or other compensation to nonresident individuals for services performed within Pennsylvania. The employer must withhold a percentage of the payment as Pennsylvania income tax for the nonresident employee.

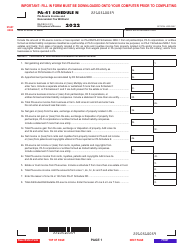

Q: How do I fill out Form PA-41 Schedule N?

A: To fill out Form PA-41 Schedule N, you will need to provide information about your pa-source income, any nonresident tax withheld, and calculate the appropriate Pennsylvania income tax due.

Q: Do I need to include Form PA-41 Schedule N with my Pennsylvania Personal Income Tax Return?

A: Yes, if you have pa-source income and have had nonresident tax withheld, you must include Form PA-41 Schedule N with your Pennsylvania Personal Income Tax Return (Form PA-40).

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule N by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.