This version of the form is not currently in use and is provided for reference only. Download this version of

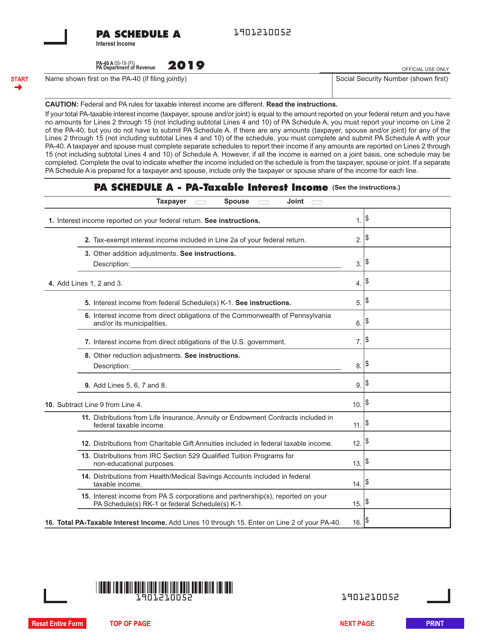

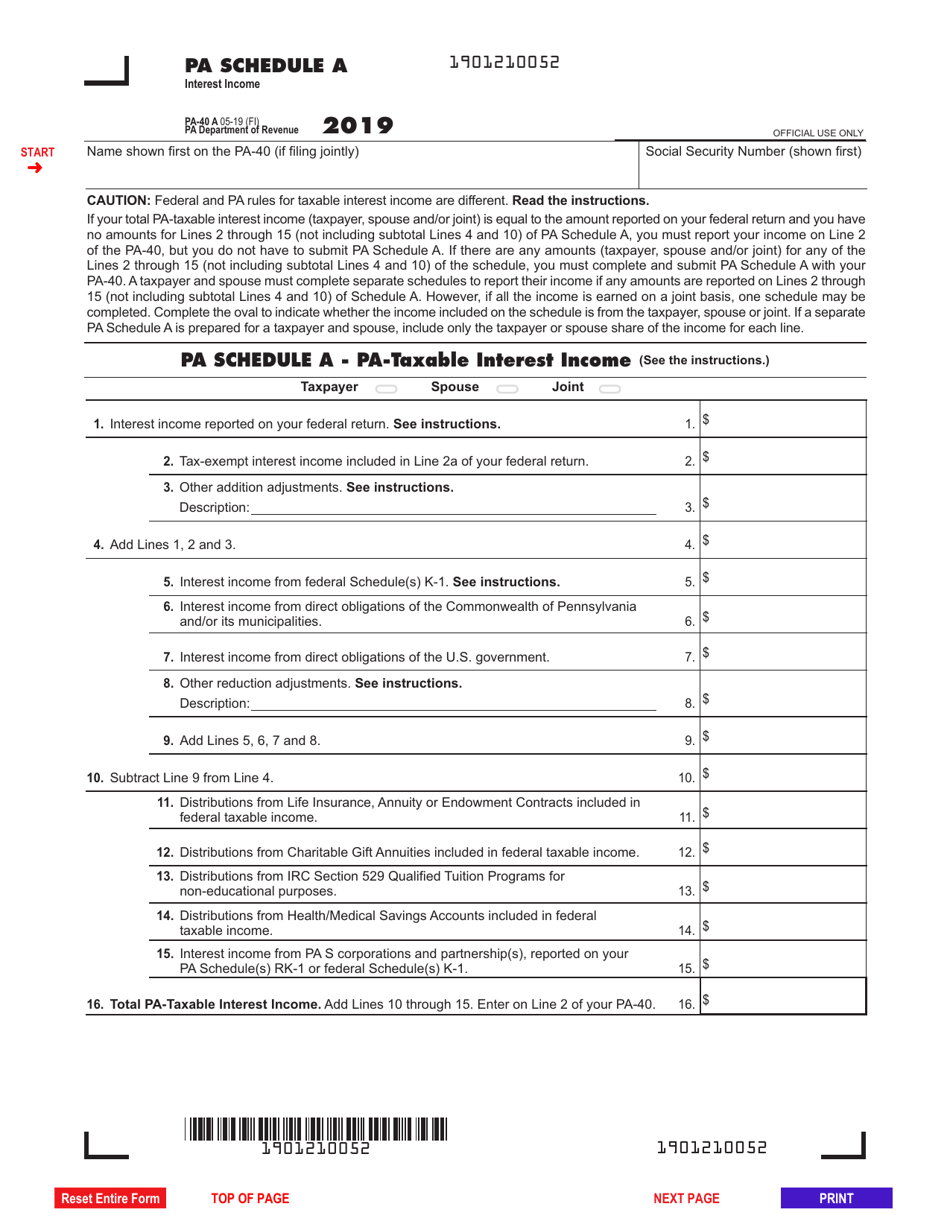

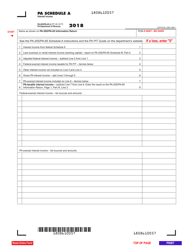

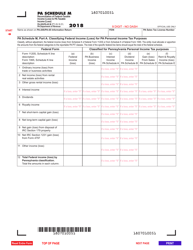

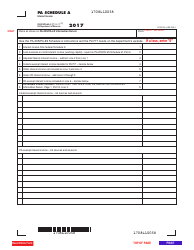

Form PA-40 Schedule A

for the current year.

Form PA-40 Schedule A Interest Income - Pennsylvania

What Is Form PA-40 Schedule A?

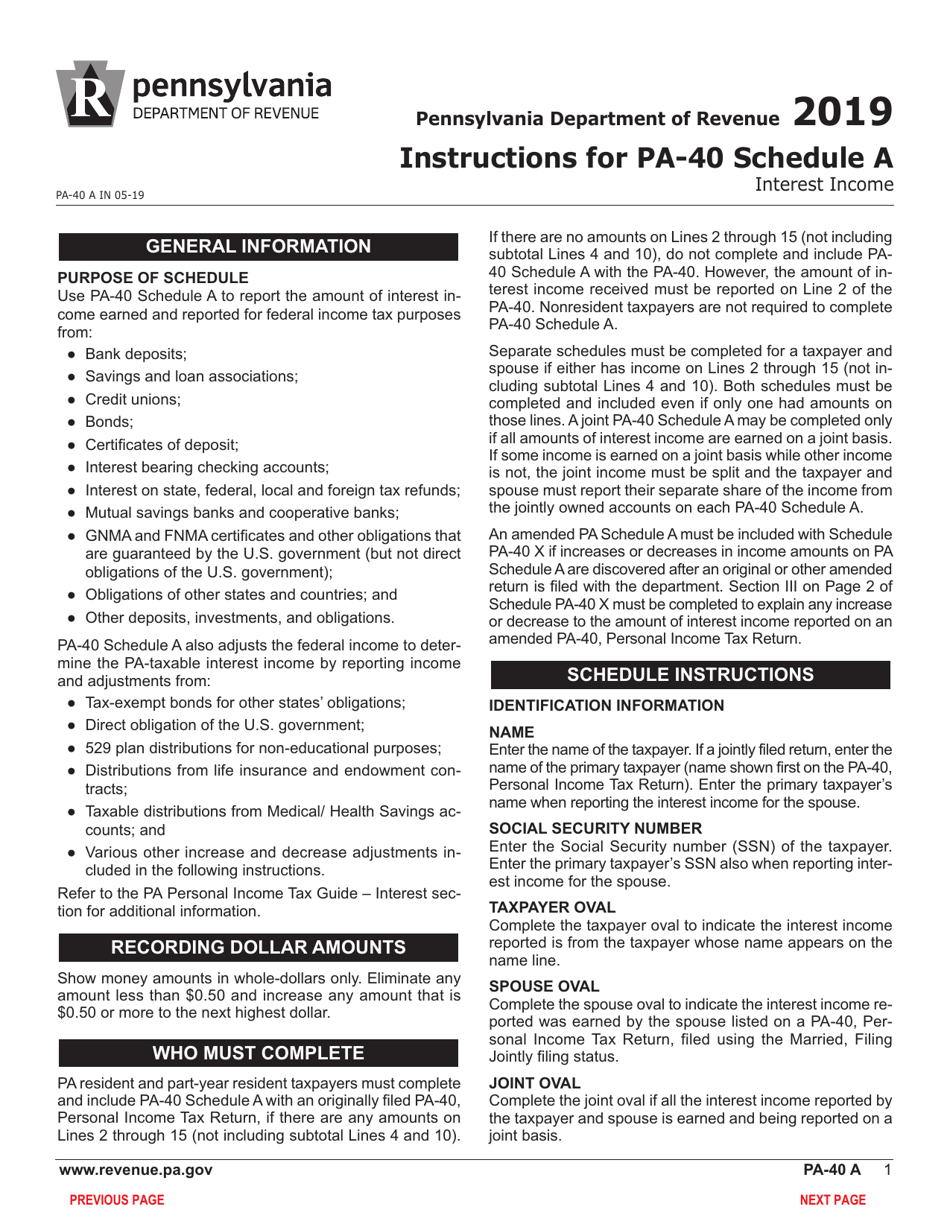

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule A?

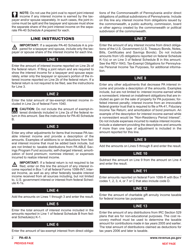

A: PA-40 Schedule A is a tax form used in Pennsylvania to report interest income.

Q: What is interest income?

A: Interest income is the money earned from interest on savings accounts, certificates of deposit (CDs), bonds, or other investments.

Q: Why is it important to report interest income?

A: It is important to report interest income because it is taxable and you may owe taxes on the money you earned.

Q: Who needs to file PA-40 Schedule A?

A: Anyone who earned interest income in Pennsylvania during the tax year must file PA-40 Schedule A.

Q: What information do I need to complete PA-40 Schedule A?

A: You will need to gather your financial statements that show the interest income you earned during the tax year.

Q: When is the deadline to file PA-40 Schedule A?

A: The deadline to file PA-40 Schedule A is the same as the deadline to file your Pennsylvania state income tax return, which is usually April 15th.

Q: Can I e-file PA-40 Schedule A?

A: Yes, you can e-file PA-40 Schedule A if you are filing your Pennsylvania state income tax return electronically.

Q: What happens if I don't file PA-40 Schedule A?

A: If you don't file PA-40 Schedule A or report your interest income, you may face penalties or additional taxes owed.

Q: Can I deduct any expenses on PA-40 Schedule A?

A: No, PA-40 Schedule A is used only to report interest income and does not allow for deductions or expenses.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.