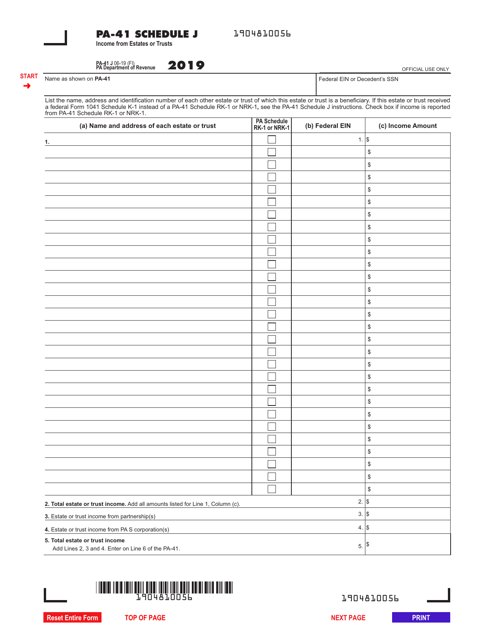

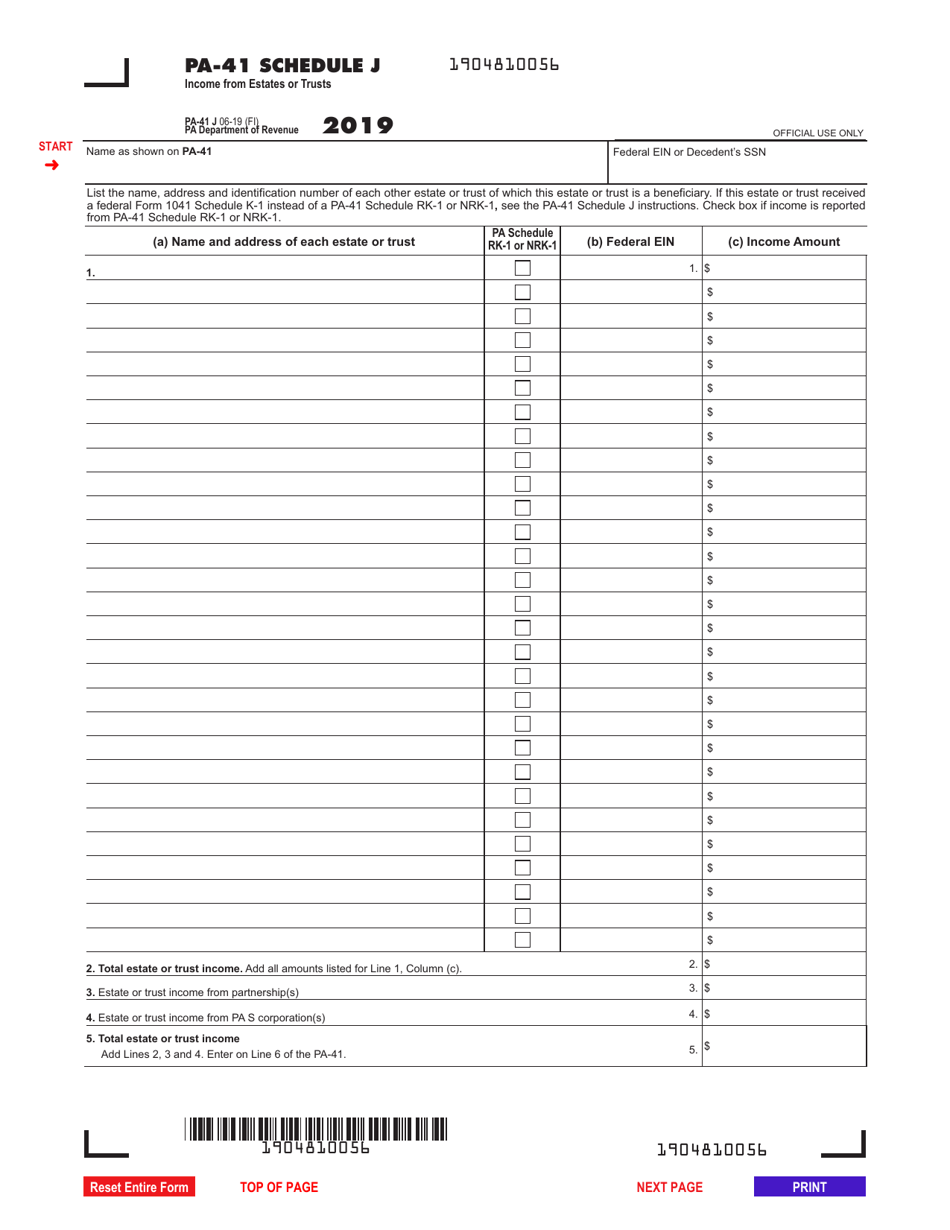

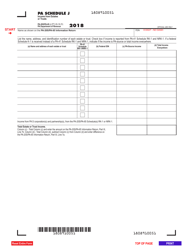

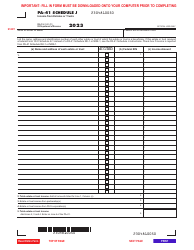

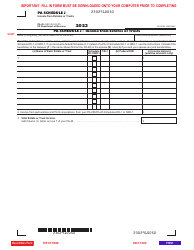

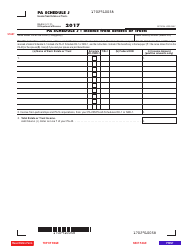

Form PA-41 Addendum J Income From Estates or Trusts - Pennsylvania

What Is Form PA-41 Addendum J?

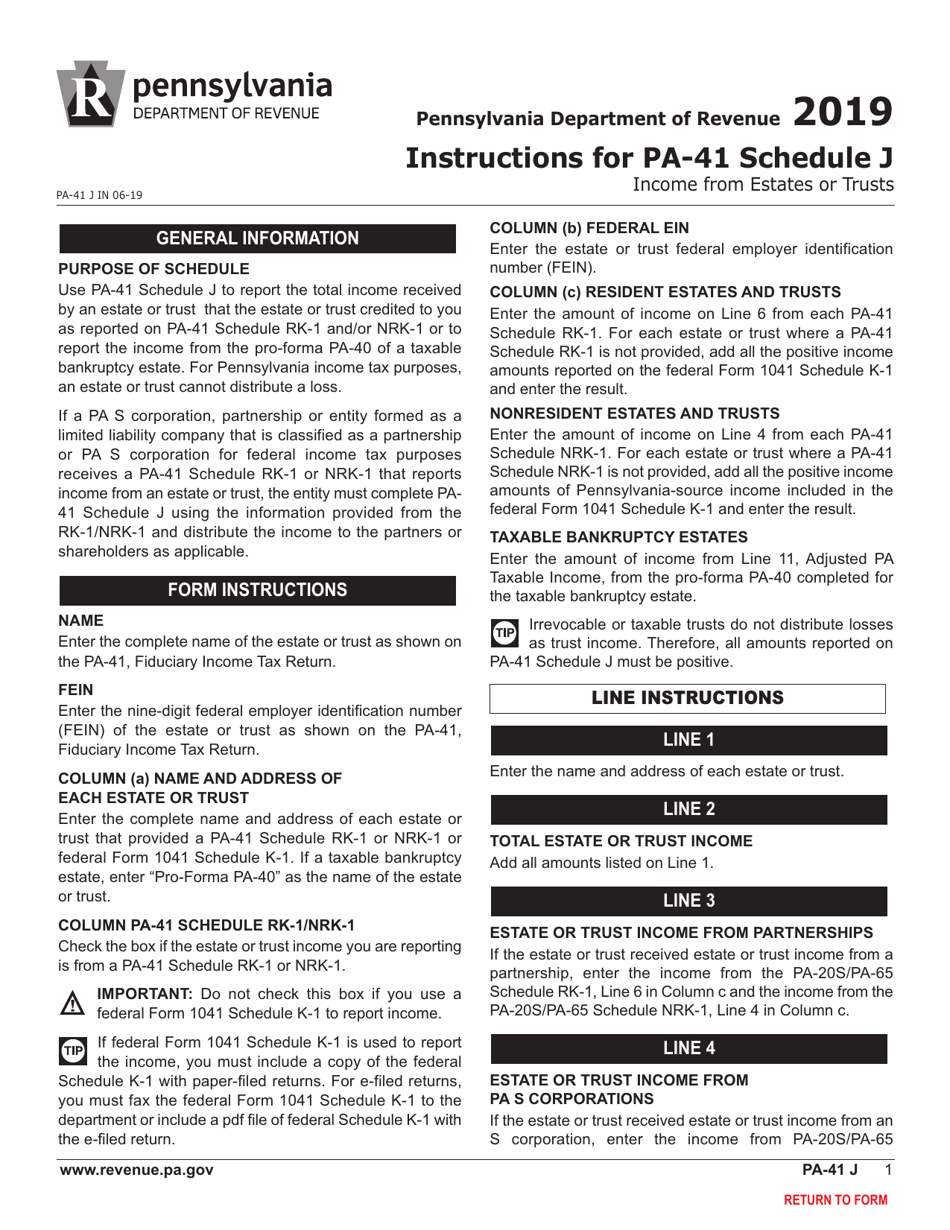

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Addendum J?

A: Form PA-41 Addendum J is a form used in Pennsylvania to report income from estates or trusts.

Q: Who needs to file Form PA-41 Addendum J?

A: Individuals who receive income from estates or trusts in Pennsylvania need to file Form PA-41 Addendum J.

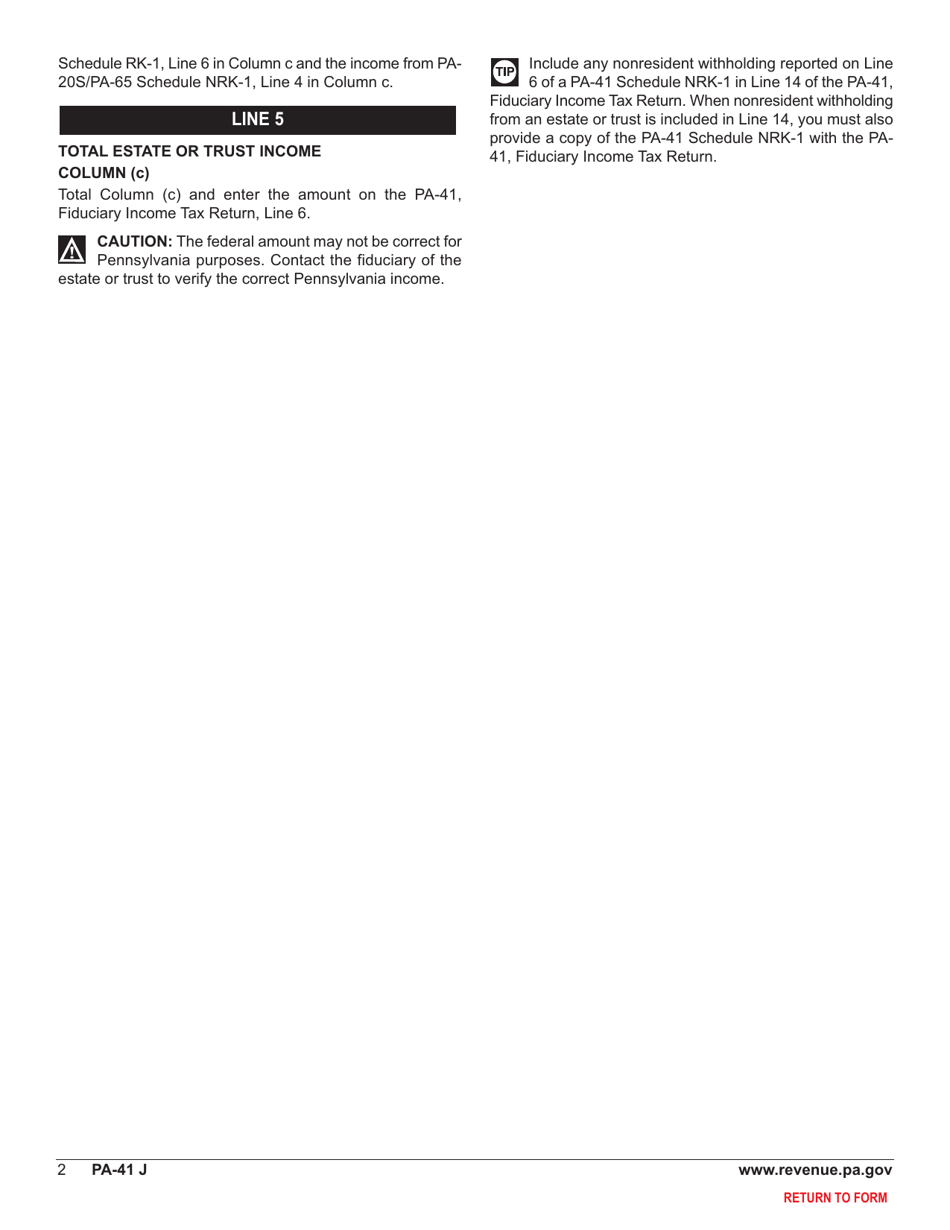

Q: What information do I need to complete Form PA-41 Addendum J?

A: To complete Form PA-41 Addendum J, you will need information about the estate or trust that generated the income, as well as information about your own income from the estate or trust.

Q: When is the deadline to file Form PA-41 Addendum J?

A: The deadline to file Form PA-41 Addendum J is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any exceptions to filing Form PA-41 Addendum J?

A: There may be certain exceptions to filing Form PA-41 Addendum J. It is recommended to consult the instructions or a tax professional for specific guidance.

Q: Can I file Form PA-41 Addendum J electronically?

A: Yes, you can file Form PA-41 Addendum J electronically if you are filing your Pennsylvania state tax return electronically.

Q: What should I do if I made a mistake on Form PA-41 Addendum J?

A: If you made a mistake on Form PA-41 Addendum J, you should file an amended return using Form PA-40, and explain the mistake on the amended return.

Q: Is there a fee to file Form PA-41 Addendum J?

A: No, there is no fee to file Form PA-41 Addendum J.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Addendum J by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.