This version of the form is not currently in use and is provided for reference only. Download this version of

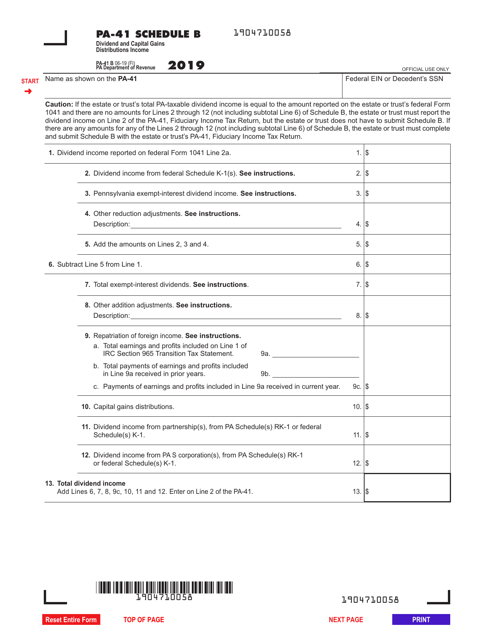

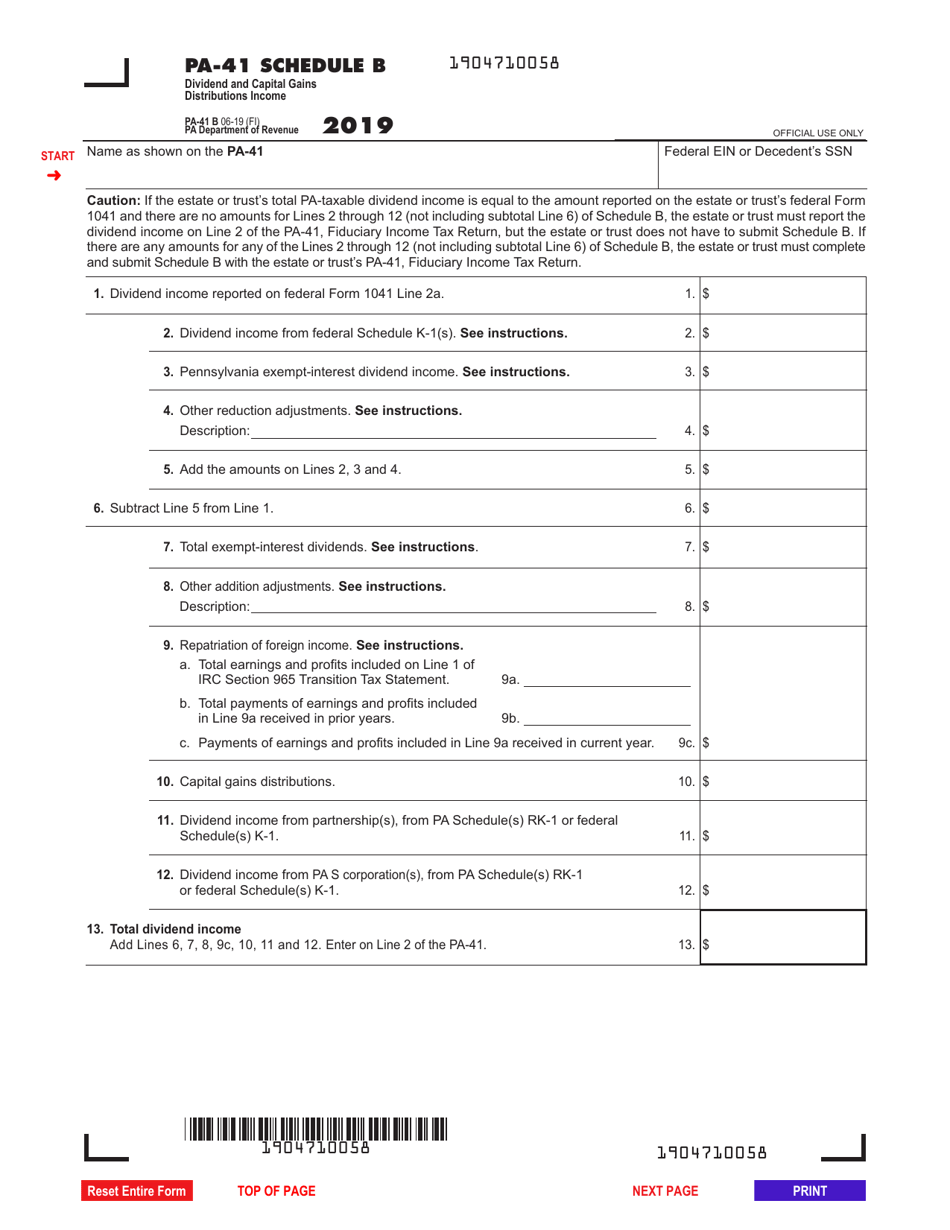

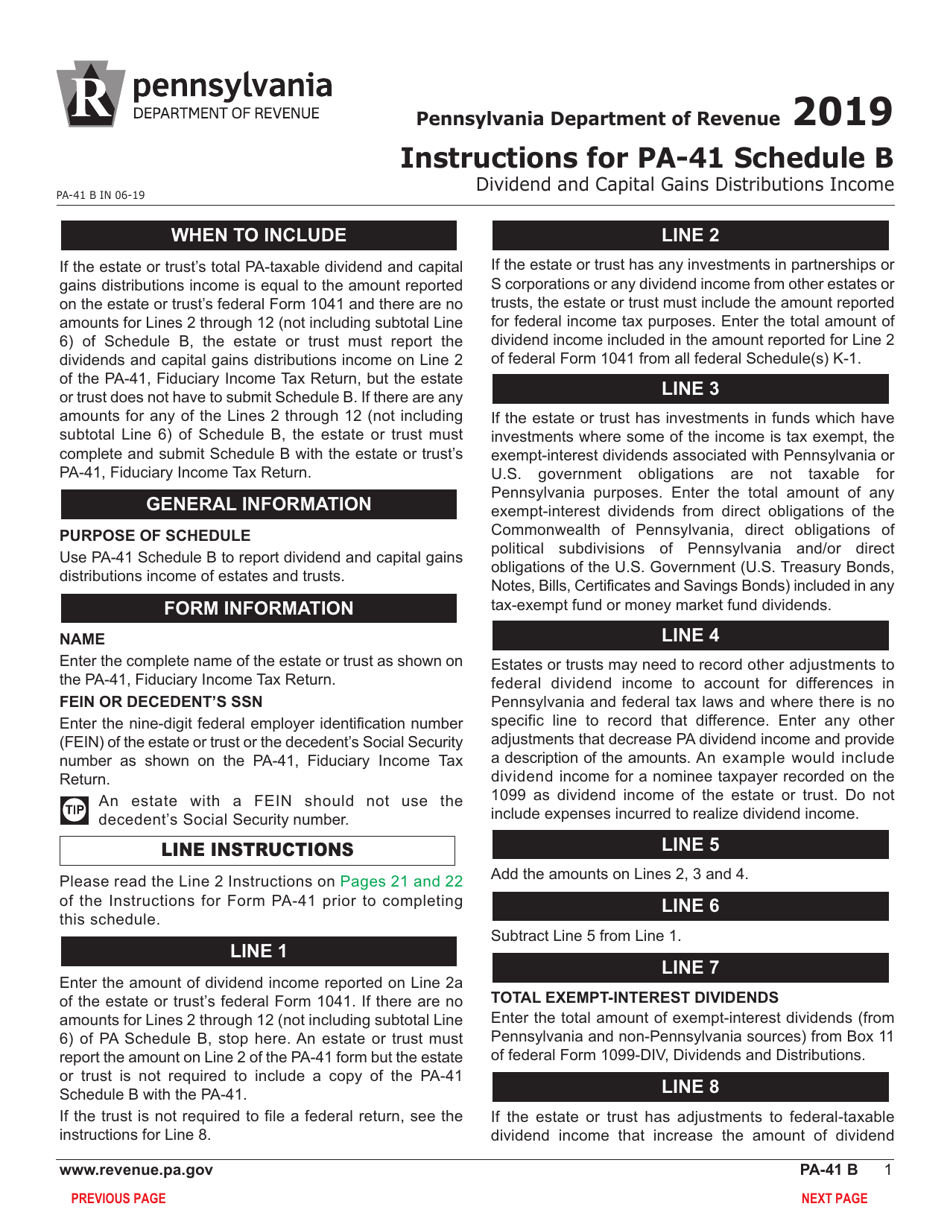

Form PA-41 Schedule B

for the current year.

Form PA-41 Schedule B Dividend and Capital Gains Distributions Income - Pennsylvania

What Is Form PA-41 Schedule B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule B?

A: Form PA-41 Schedule B is a form used to report Dividend and Capital Gains Distributions income in Pennsylvania.

Q: Who needs to file Form PA-41 Schedule B?

A: Anyone who received Dividend and Capital Gains Distributions income in Pennsylvania needs to file Form PA-41 Schedule B.

Q: What is Dividend income?

A: Dividend income is the money paid to shareholders by a corporation as a distribution of profits.

Q: What are Capital Gains Distributions?

A: Capital Gains Distributions are distributions of capital gains from mutual funds, real estate investment trusts (REITs), and regulated investment companies (RICs).

Q: Do I have to pay taxes on Dividend and Capital Gains Distributions income?

A: Yes, Dividend and Capital Gains Distributions income is generally subject to federal and state income taxes.

Q: What is the purpose of reporting this income on Form PA-41 Schedule B?

A: The purpose of reporting Dividend and Capital Gains Distributions income on Form PA-41 Schedule B is to calculate your taxable income in Pennsylvania.

Q: When is the deadline to file Form PA-41 Schedule B?

A: The deadline to file Form PA-41 Schedule B is the same as the deadline for filing your Pennsylvania state income tax return, which is typically April 15th.

Q: What are the penalties for not filing Form PA-41 Schedule B?

A: The penalties for not filing Form PA-41 Schedule B can include late filing penalties and interest on any unpaid tax liability.

Q: Should I consult a tax professional to help me with Form PA-41 Schedule B?

A: If you are unsure about how to fill out Form PA-41 Schedule B or have complex income sources, it may be beneficial to consult a tax professional for assistance.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.