This version of the form is not currently in use and is provided for reference only. Download this version of

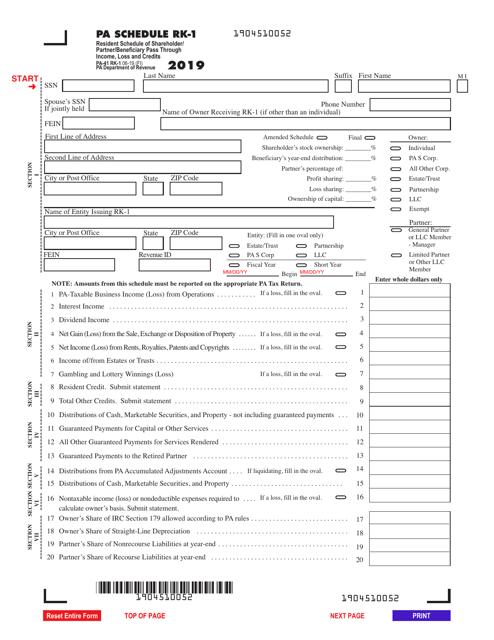

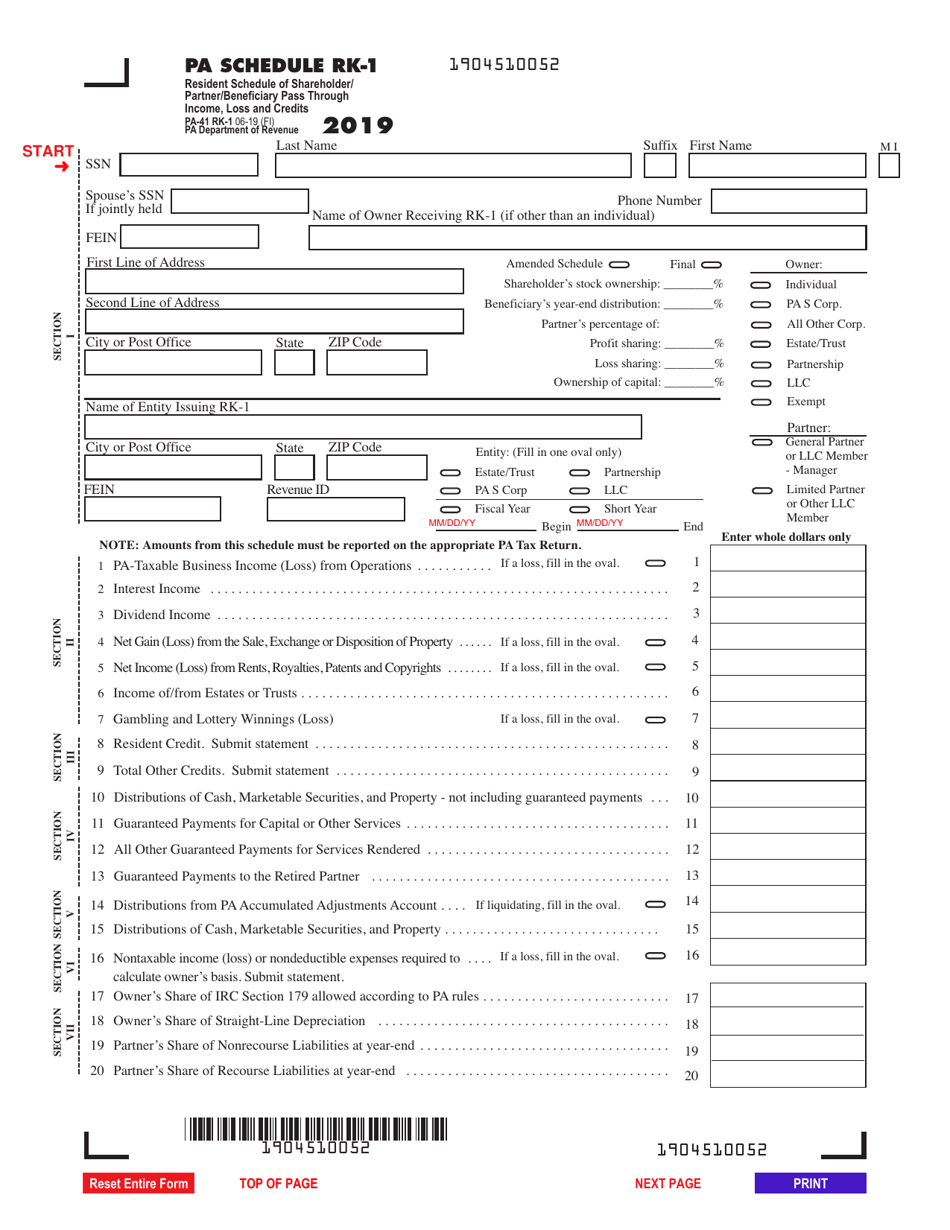

Form PA-41 Schedule RK-1

for the current year.

Form PA-41 Schedule RK-1 Resident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-41 Schedule RK-1?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-41 Schedule RK-1?

A: PA-41 Schedule RK-1 is the Resident Schedule of Shareholder/Partner/Beneficiary Pass Through Income, Loss and Credits form used in Pennsylvania.

Q: Who needs to file PA-41 Schedule RK-1?

A: PA-41 Schedule RK-1 needs to be filed by Pennsylvania residents who are shareholders, partners, or beneficiaries of pass-through entities.

Q: What information does PA-41 Schedule RK-1 require?

A: PA-41 Schedule RK-1 requires information about the resident's share of pass-through income, loss, and credits as reported by the pass-through entity.

Q: When is the deadline to file PA-41 Schedule RK-1?

A: The deadline to file PA-41 Schedule RK-1 is generally the same as the deadline to file the Pennsylvania personal income tax return, which is April 15th.

Q: Are there any penalties for not filing PA-41 Schedule RK-1?

A: Yes, there could be penalties for not filing PA-41 Schedule RK-1, including interest charges and late payment penalties.

Q: Can PA-41 Schedule RK-1 be e-filed?

A: Yes, PA-41 Schedule RK-1 can be e-filed using the Pennsylvania Department of Revenue's e-file system.

Q: Do I need to include any supporting documents with PA-41 Schedule RK-1?

A: You may need to include supporting documents such as Forms K-1 or other statements from the pass-through entity with PA-41 Schedule RK-1.

Q: Can I amend PA-41 Schedule RK-1 if I made a mistake?

A: Yes, you can amend PA-41 Schedule RK-1 if you made a mistake. You will need to file an amended return using Form PA-40X.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule RK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.