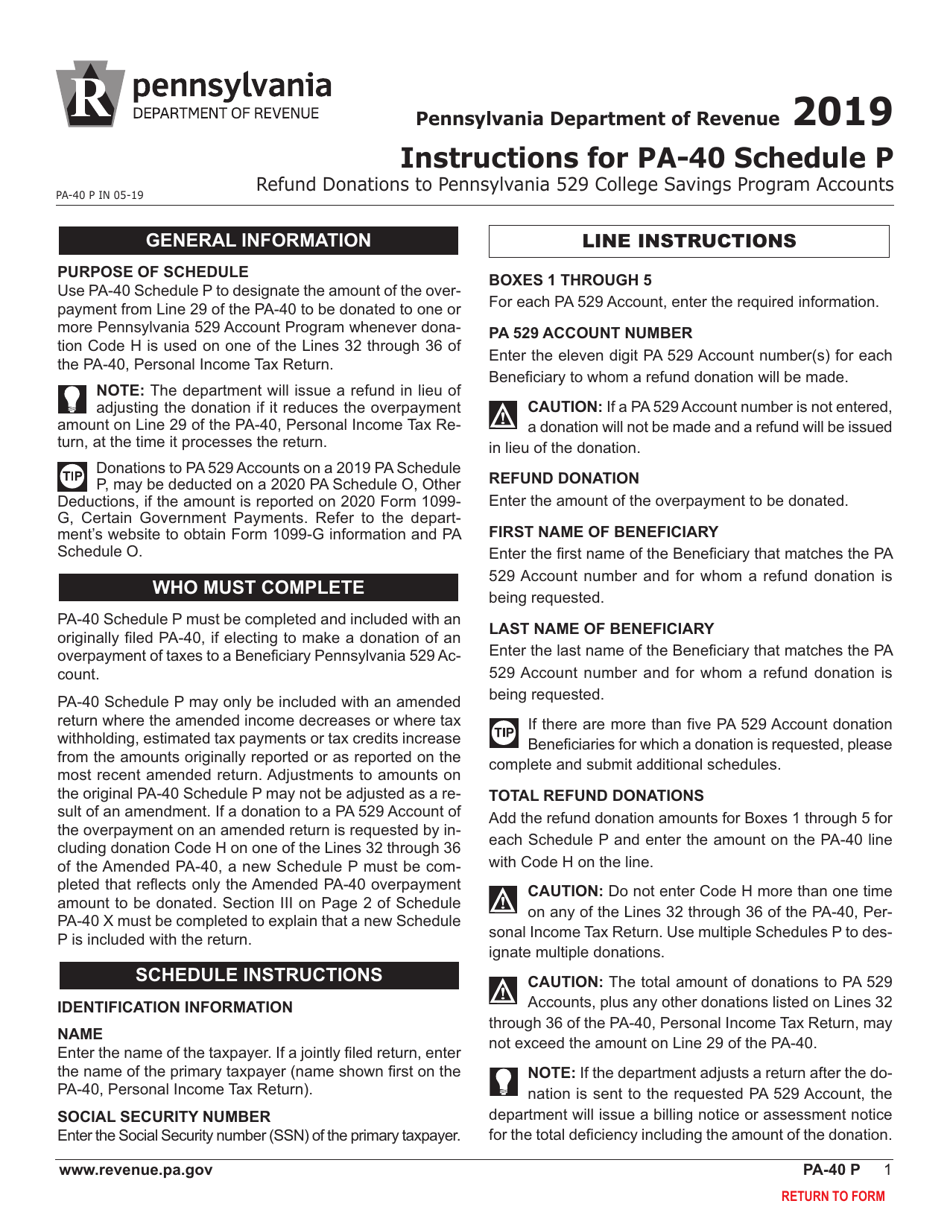

This version of the form is not currently in use and is provided for reference only. Download this version of

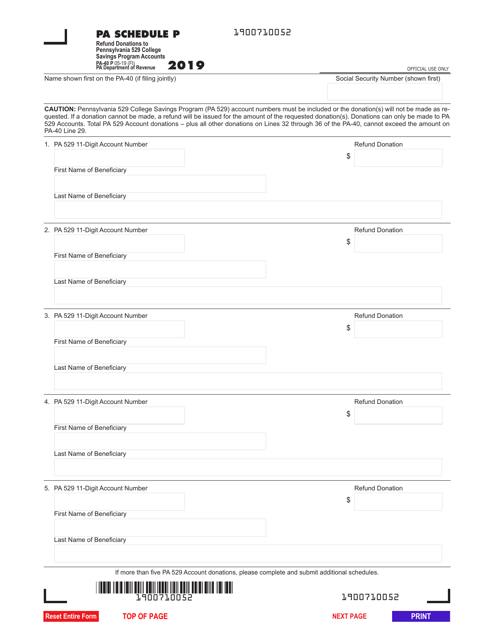

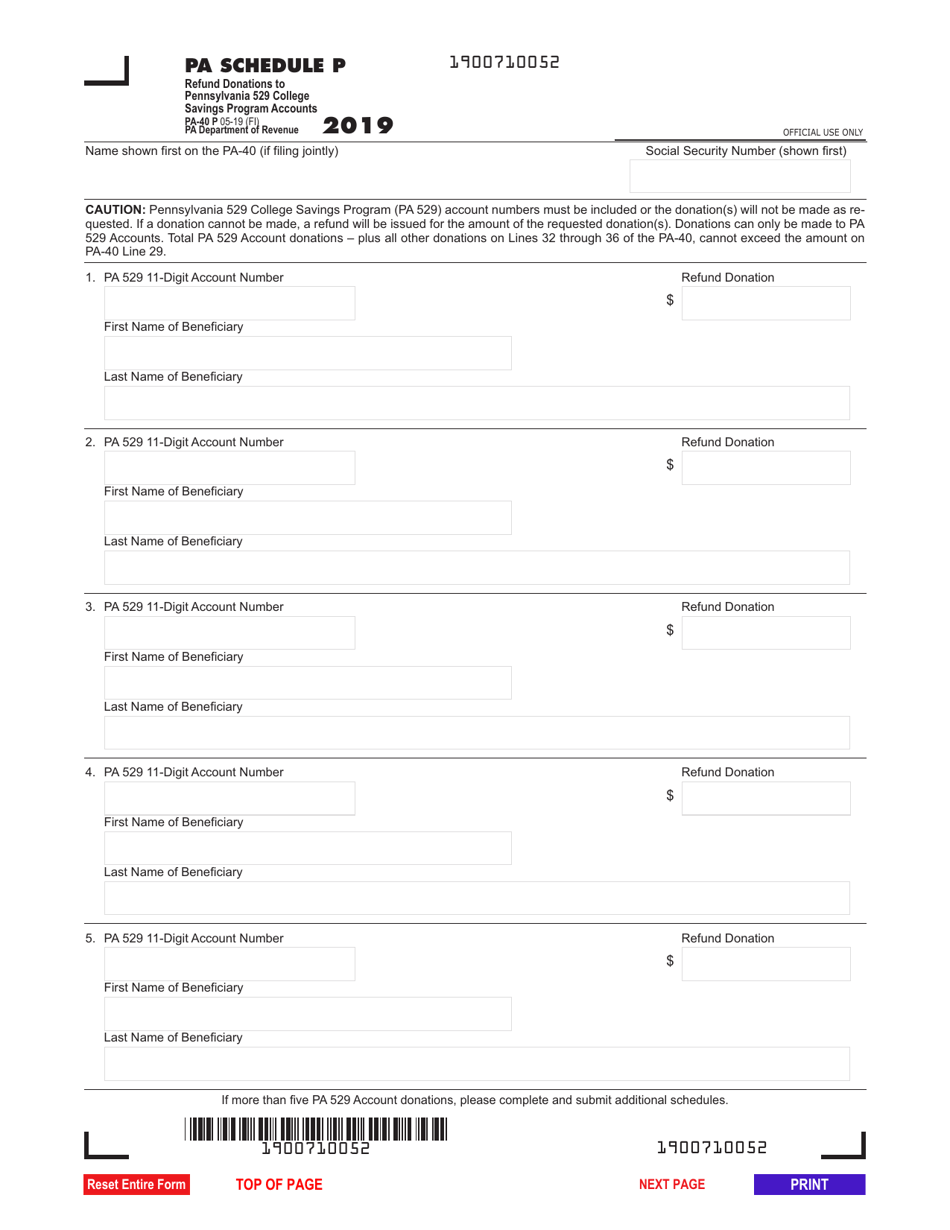

Form PA-40 Schedule P

for the current year.

Form PA-40 Schedule P Refund Donations to Pennsylvania 529 College Savings Program Accounts - Pennsylvania

What Is Form PA-40 Schedule P?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule P?

A: Form PA-40 Schedule P is a tax form used to report donations made to Pennsylvania 529 College Savings Program accounts.

Q: What are donations to Pennsylvania 529 College Savings Program accounts?

A: Donations to Pennsylvania 529 College Savings Program accounts are contributions made to a college savings account for the purpose of funding higher education expenses.

Q: Why would someone make donations to Pennsylvania 529 College Savings Program accounts?

A: People may make donations to Pennsylvania 529 College Savings Program accounts to save money for higher education expenses, such as tuition, room and board, or textbooks.

Q: Is there a tax benefit for making donations to Pennsylvania 529 College Savings Program accounts?

A: Yes, there is a tax benefit for making donations to Pennsylvania 529 College Savings Program accounts. The donated amount may be deducted from taxable income on the Pennsylvania state income tax return.

Q: Do I need to fill out Form PA-40 Schedule P if I made donations to Pennsylvania 529 College Savings Program accounts?

A: Yes, if you made donations to Pennsylvania 529 College Savings Program accounts, you need to fill out Form PA-40 Schedule P to report those donations.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule P by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.