This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 2483

for the current year.

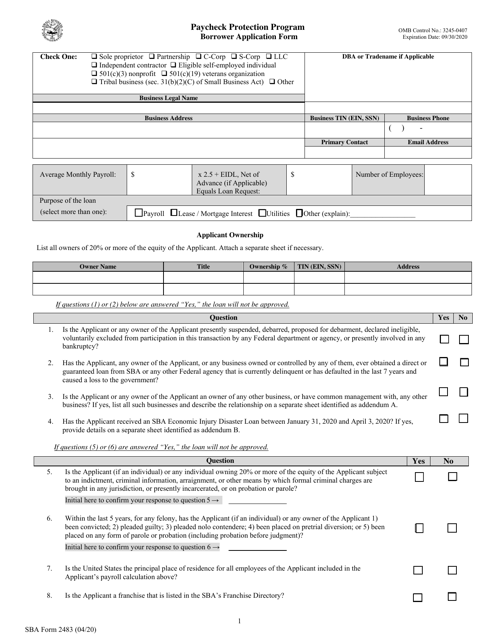

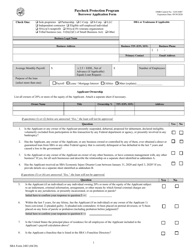

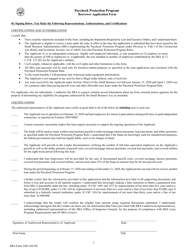

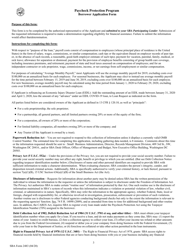

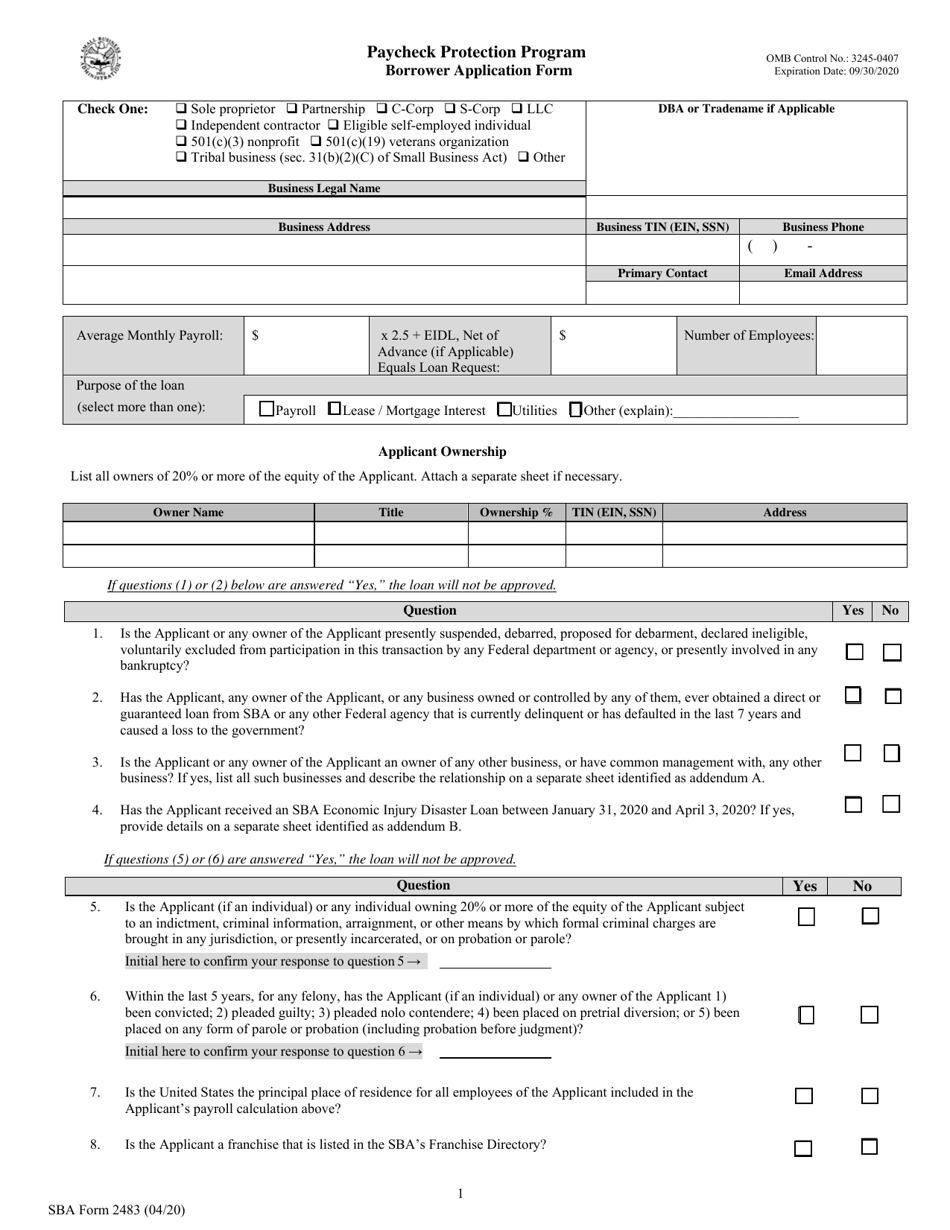

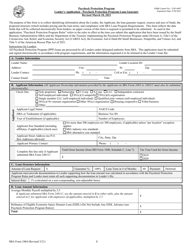

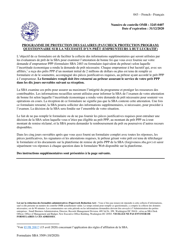

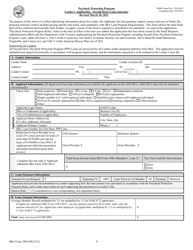

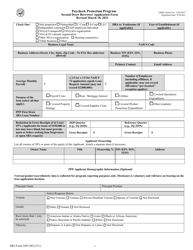

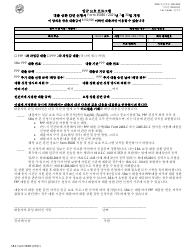

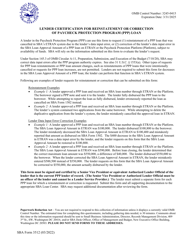

SBA Form 2483 Paycheck Protection Program Borrower Application Form

What Is SBA Form 2483?

This is a legal form that was released by the U.S. Small Business Administration on April 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

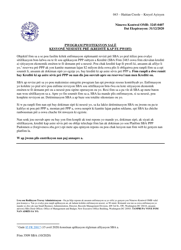

Q: What is SBA Form 2483?

A: SBA Form 2483 is the Paycheck Protection Program Borrower Application Form.

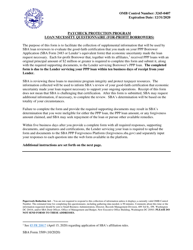

Q: What is the Paycheck Protection Program?

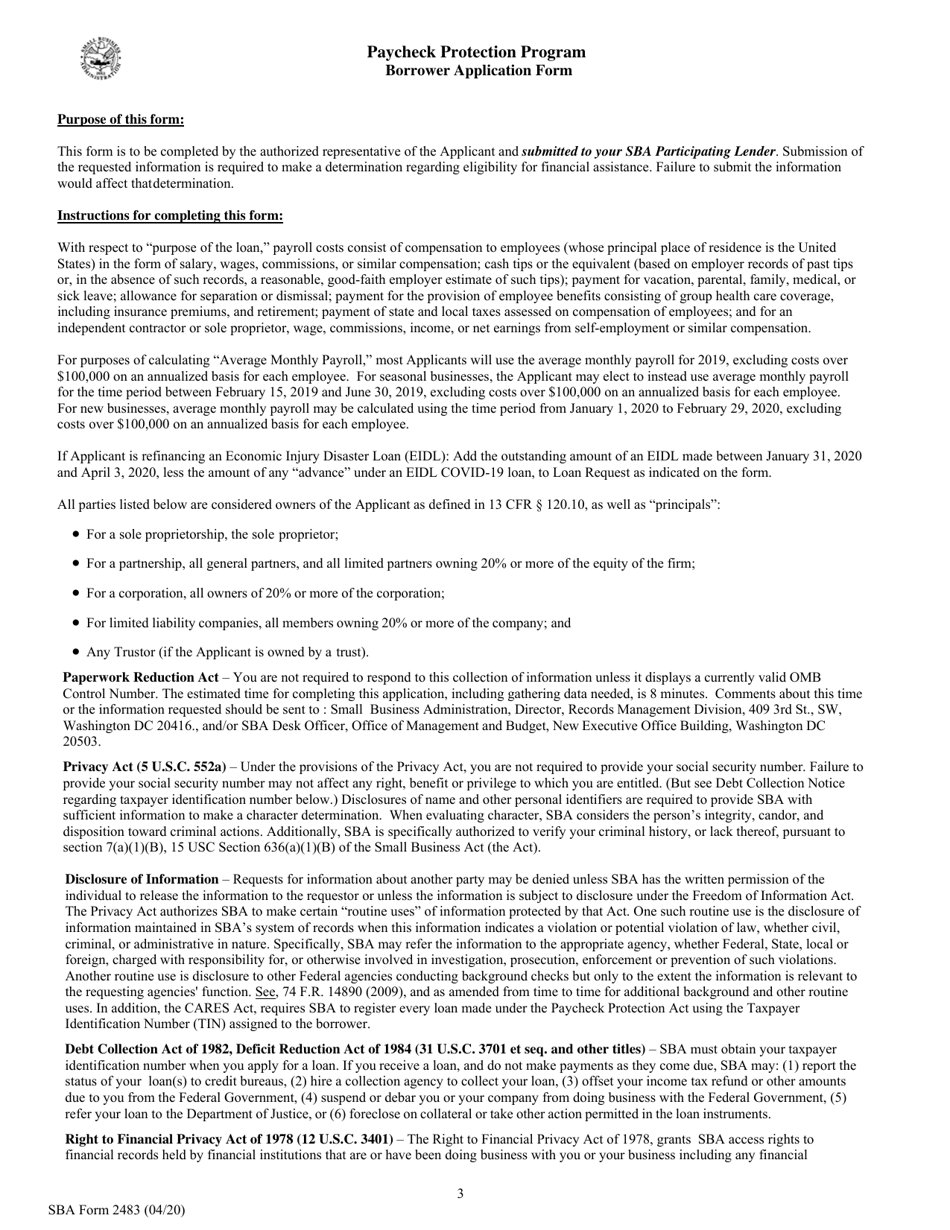

A: The Paycheck Protection Program is a federal loan program designed to provide financial assistance to small businesses during the COVID-19 pandemic.

Q: Who can use SBA Form 2483?

A: Small businesses, nonprofits, veterans organizations, self-employed individuals, and independent contractors can use SBA Form 2483 to apply for the Paycheck Protection Program.

Q: What information is required on SBA Form 2483?

A: SBA Form 2483 requires information about the borrower's business, payroll costs, number of employees, and other financial details.

Q: Are there any fees to apply for the Paycheck Protection Program?

A: No, there are no fees to apply for the Paycheck Protection Program.

Q: What can the Paycheck Protection Program funds be used for?

A: The funds from the Paycheck Protection Program can be used for payroll costs, rent, mortgage interest, and utilities.

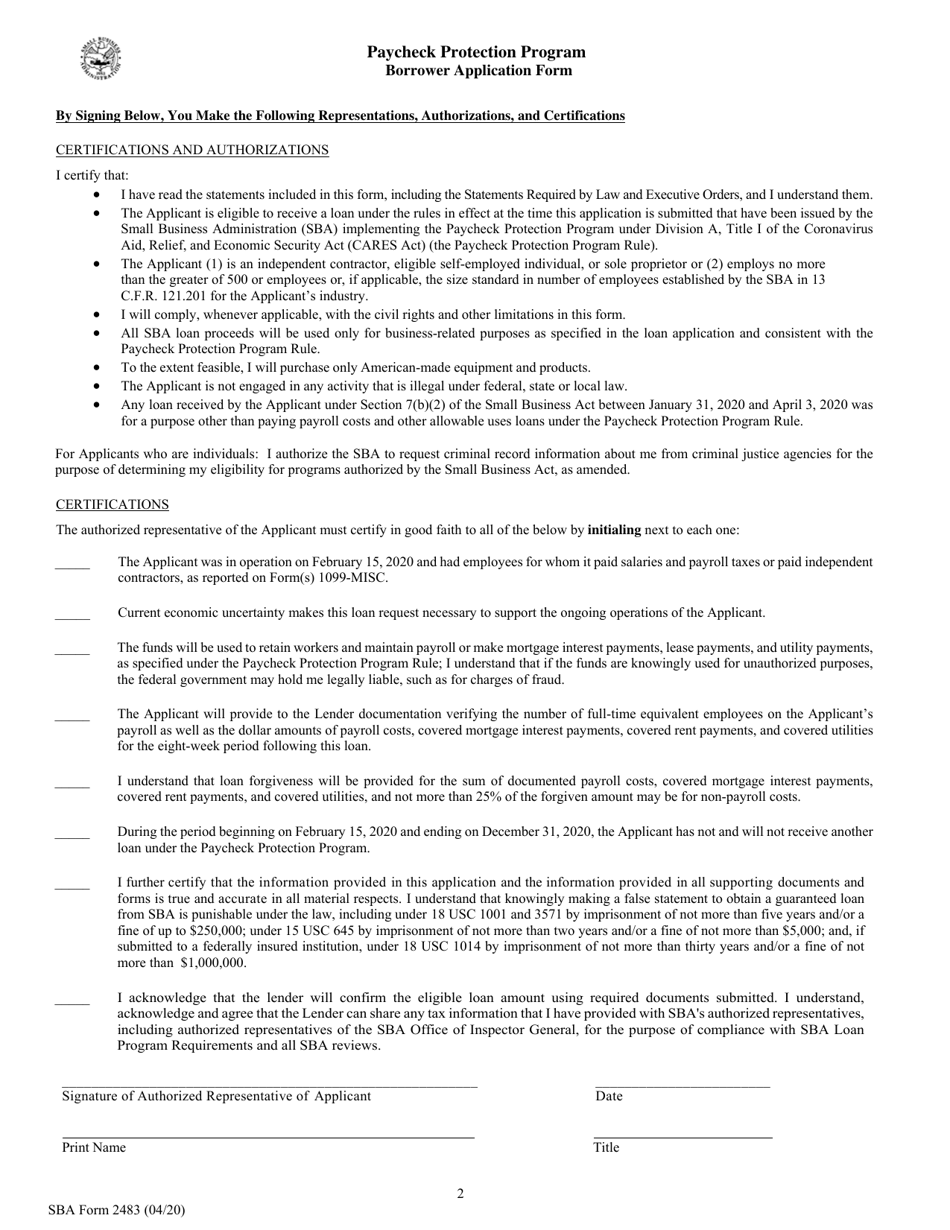

Q: Is the Paycheck Protection Program forgivable?

A: Yes, the Paycheck Protection Program loans may be forgiven if certain conditions are met, including using the funds for eligible expenses.

Q: How long does it take to process SBA Form 2483?

A: The processing time for SBA Form 2483 may vary, but lenders are encouraged to process the applications as quickly as possible.

Q: Is there a deadline to apply for the Paycheck Protection Program?

A: Yes, the Paycheck Protection Program had a deadline of August 8, 2020, but it was extended to August 8, 2023, allowing more time for eligible businesses to apply.

Form Details:

- Released on April 1, 2020;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2483 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.