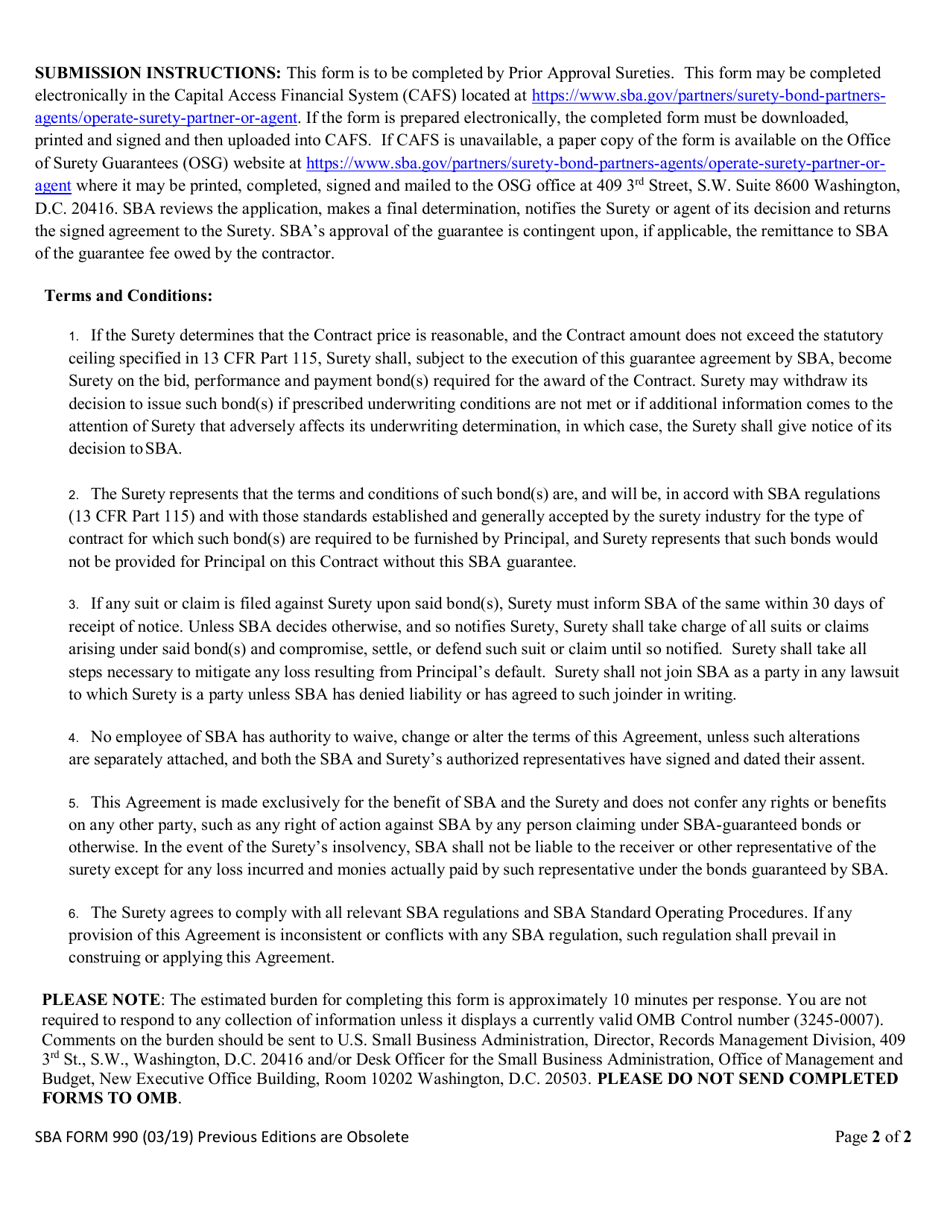

This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 990

for the current year.

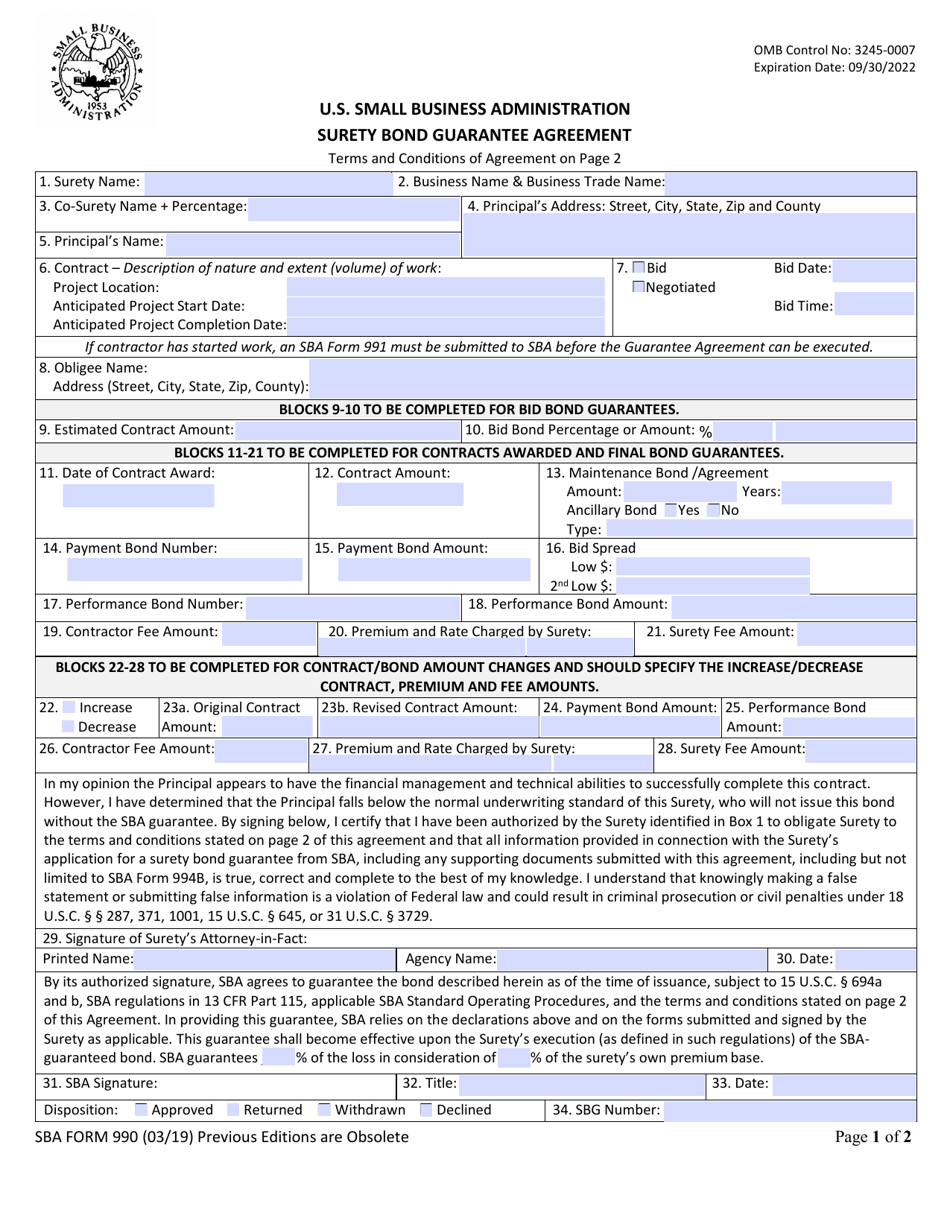

SBA Form 990 Surety Bond Guarantee Agreement

What Is SBA Form 990?

This is a legal form that was released by the U.S. Small Business Administration on March 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

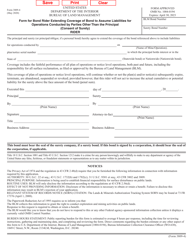

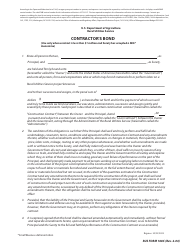

Q: What is the SBA Form 990 Surety Bond Guarantee Agreement?

A: The SBA Form 990 Surety Bond Guarantee Agreement is a document used by the Small Business Administration (SBA) to guarantee surety bonds for eligible small businesses.

Q: Who can use the SBA Form 990 Surety Bond Guarantee Agreement?

A: Small businesses that meet the eligibility criteria set by the SBA can use the SBA Form 990 Surety Bond Guarantee Agreement.

Q: What is the purpose of the SBA Form 990 Surety Bond Guarantee Agreement?

A: The purpose of the SBA Form 990 Surety Bond Guarantee Agreement is to provide a guarantee from the SBA to surety bond issuers, which enables small businesses to obtain surety bonds that they may not qualify for otherwise.

Q: How does the SBA Form 990 Surety Bond Guarantee Agreement work?

A: Under the SBA Form 990 Surety Bond Guarantee Agreement, the SBA guarantees a percentage of the surety bond amount to the surety bond issuer, reducing the risk for the issuer and making it easier for small businesses to obtain surety bonds.

Q: What are the benefits of using the SBA Form 990 Surety Bond Guarantee Agreement?

A: The benefits of using the SBA Form 990 Surety Bond Guarantee Agreement include increased access to surety bonds for small businesses, improved bonding capacity, and reduced bonding costs.

Q: How can small businesses apply for the SBA Form 990 Surety Bond Guarantee Agreement?

A: Small businesses can apply for the SBA Form 990 Surety Bond Guarantee Agreement through a participating surety bond agent or a participating lender.

Form Details:

- Released on March 1, 2019;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 990 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.