This version of the form is not currently in use and is provided for reference only. Download this version of

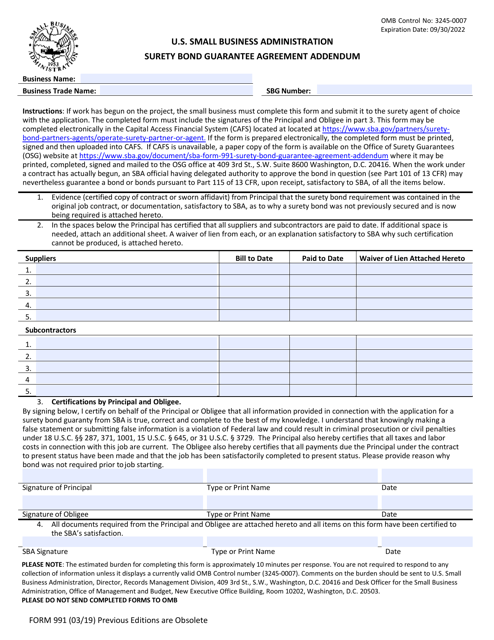

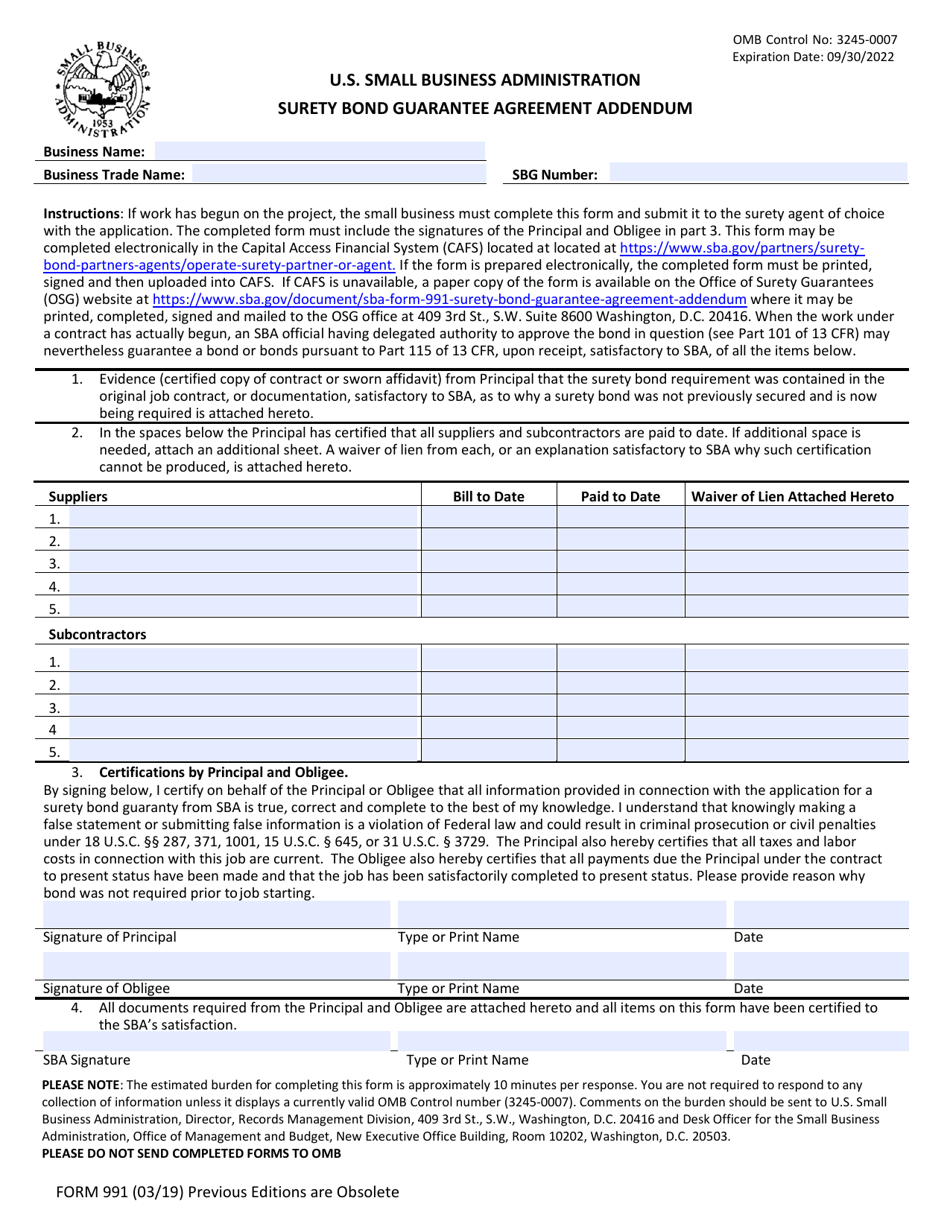

SBA Form 991

for the current year.

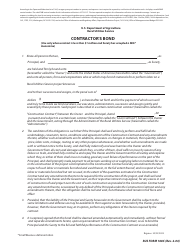

SBA Form 991 Surety Bond Guarantee Agreement Addendum

What Is SBA Form 991?

This is a legal form that was released by the U.S. Small Business Administration on March 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 991?

A: SBA Form 991 is the Surety BondGuarantee Agreement Addendum.

Q: What is the purpose of SBA Form 991?

A: The purpose of SBA Form 991 is to provide additional information for the Surety Bond Guarantee Agreement.

Q: Who needs to fill out SBA Form 991?

A: SBA Form 991 needs to be filled out by the surety and the bond principal.

Q: What information is required in SBA Form 991?

A: SBA Form 991 requires information such as the bond amount, project description, and the surety's contact information.

Q: Is SBA Form 991 mandatory?

A: Yes, if you are applying for a surety bond through the SBA's Surety Bond Guarantee Program, you will need to fill out SBA Form 991.

Q: Are there any fees associated with SBA Form 991?

A: There may be fees associated with the surety bond guarantee program, but the specific fees will depend on the bond amount and other factors. It is best to check with the SBA or your surety provider for more information.

Q: How long does it take to process SBA Form 991?

A: The processing time for SBA Form 991 can vary, but it usually takes a few weeks for the SBA to review and approve the application.

Q: Can I make changes to SBA Form 991 after submission?

A: Once SBA Form 991 has been submitted, changes may be possible but it will depend on the specific circumstances. It is best to contact the SBA or your surety provider for assistance.

Form Details:

- Released on March 1, 2019;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 991 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.