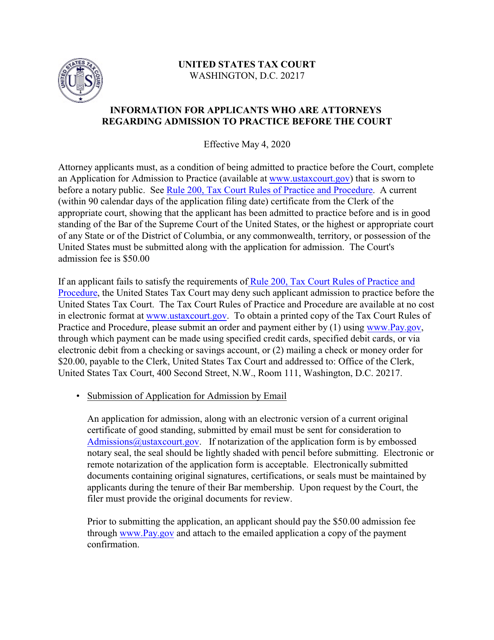

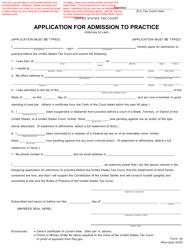

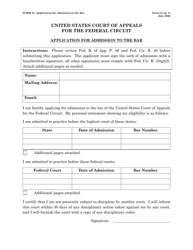

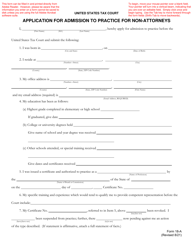

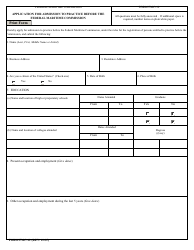

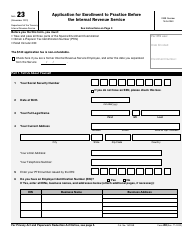

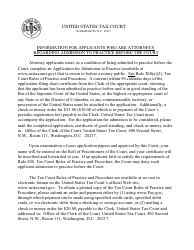

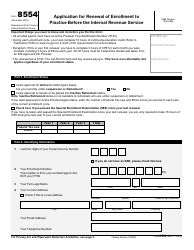

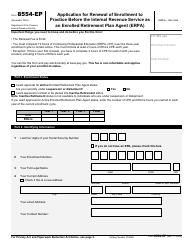

Form 30 Application for Admission to Practice

What Is Form 30?

This is a legal form that was released by the United States Tax Court on May 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

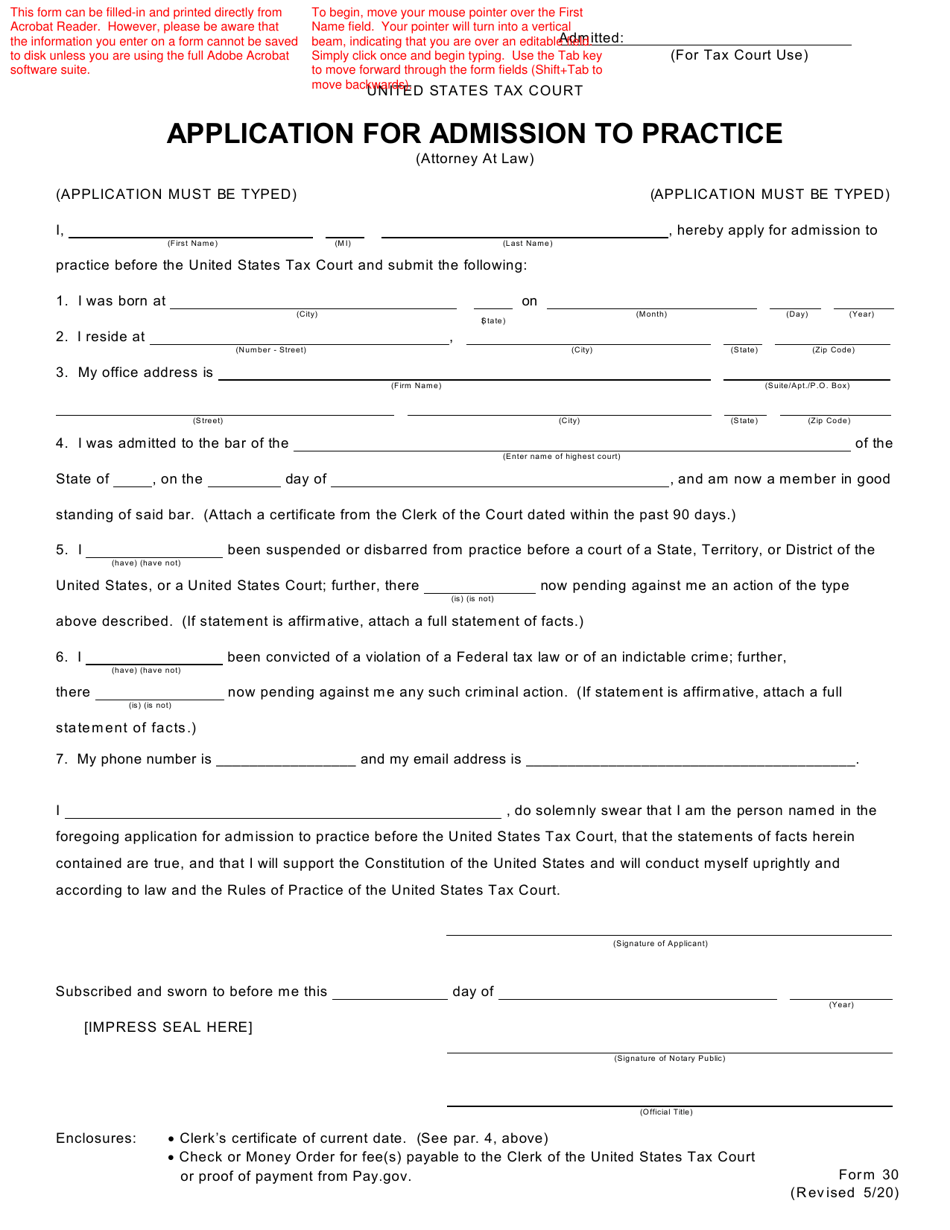

Q: What is Form 30?

A: Form 30 is an application for admission to practice.

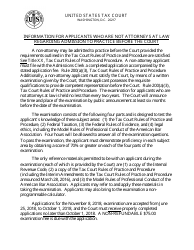

Q: Who needs to fill out Form 30?

A: Form 30 needs to be filled out by individuals seeking admission to practice.

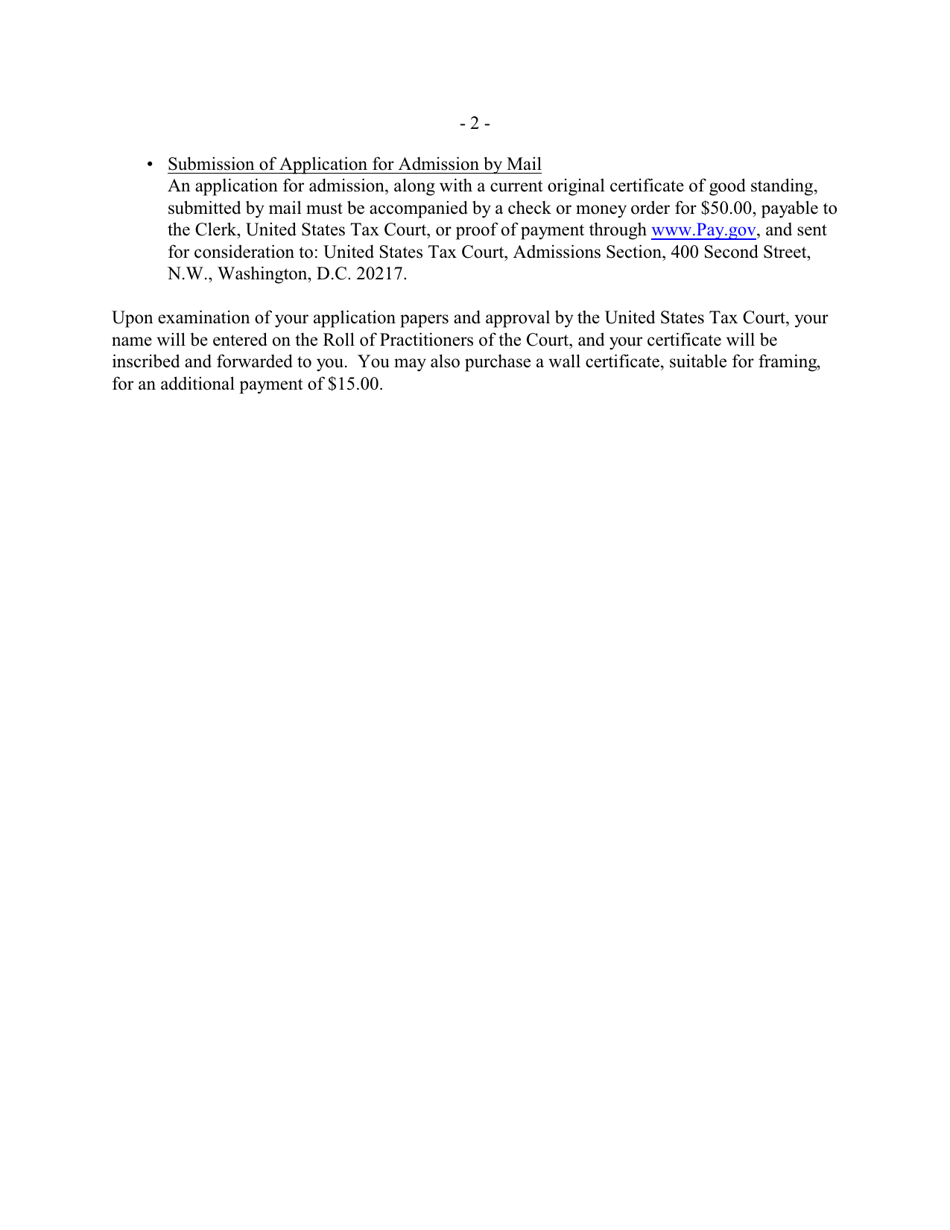

Q: What information is required on Form 30?

A: Form 30 typically requires information such as personal details, educational background, and professional experience.

Q: Are there any fees associated with Form 30?

A: There may be fees associated with submitting Form 30, depending on the jurisdiction or regulatory body.

Q: What documents should be included with Form 30?

A: Documents such as transcripts, certificates, and supporting letters may need to be included with Form 30.

Q: How long does it take for the application to be processed?

A: The processing time for Form 30 varies depending on the jurisdiction or regulatory body, but it can take several weeks to several months.

Q: What happens after the application is approved?

A: After the application is approved, the individual may be granted admission to practice and receive a license or certificate.

Q: What if the application is denied?

A: If the application is denied, the individual may have the option to appeal the decision or reapply at a later time.

Q: Can I practice without completing Form 30?

A: No, completing Form 30 is typically a requirement for obtaining authorization to practice in a particular jurisdiction.

Form Details:

- Released on May 1, 2020;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 30 by clicking the link below or browse more documents and templates provided by the United States Tax Court.