This version of the form is not currently in use and is provided for reference only. Download this version of

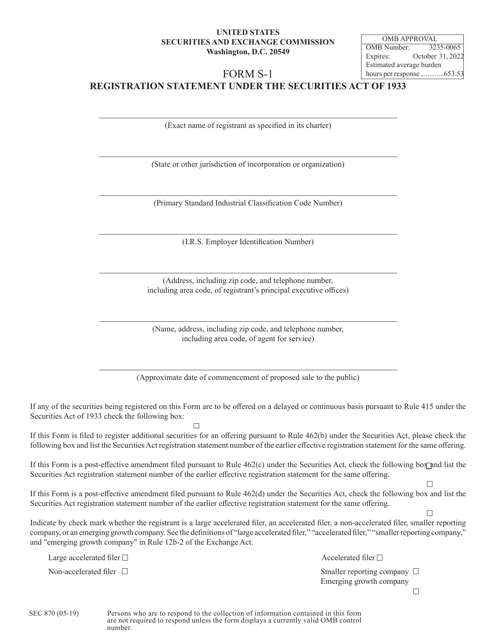

Form S-1 (SEC Form 870)

for the current year.

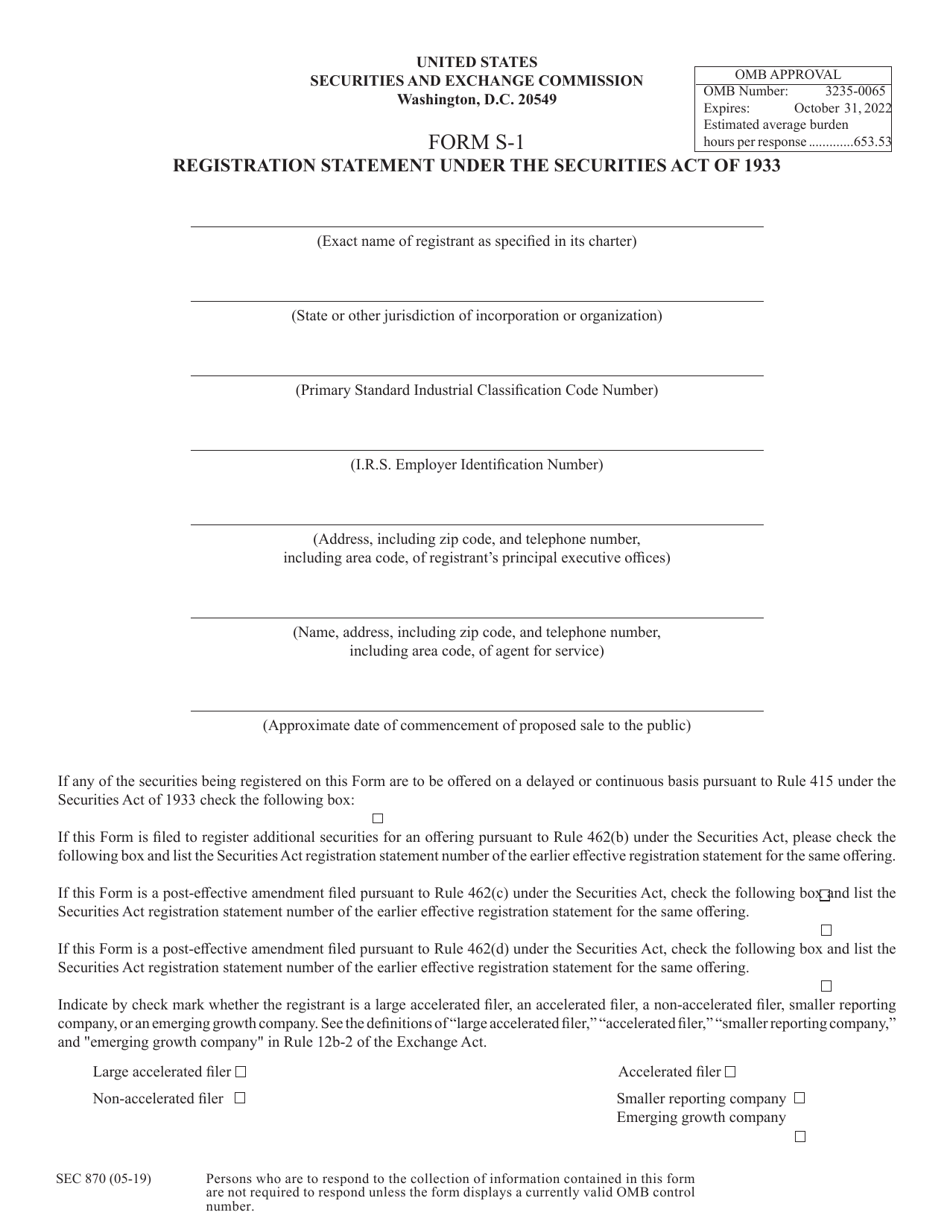

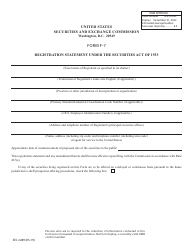

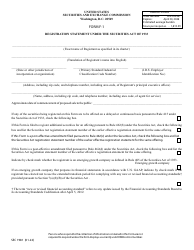

Form S-1 (SEC Form 870) Registration Statement Under the Securities Act of 1933

What Is Form S-1 (SEC Form 870)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on May 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-1?

A: Form S-1 is a registration statement filed with the Securities and Exchange Commission (SEC) by companies that plan to go public and offer their securities to the public.

Q: What is SEC Form 870?

A: SEC Form 870 refers to the instructions for completing Form S-1.

Q: What is the Securities Act of 1933?

A: The Securities Act of 1933 is a federal law that regulates the offering and sale of securities to the public in the United States.

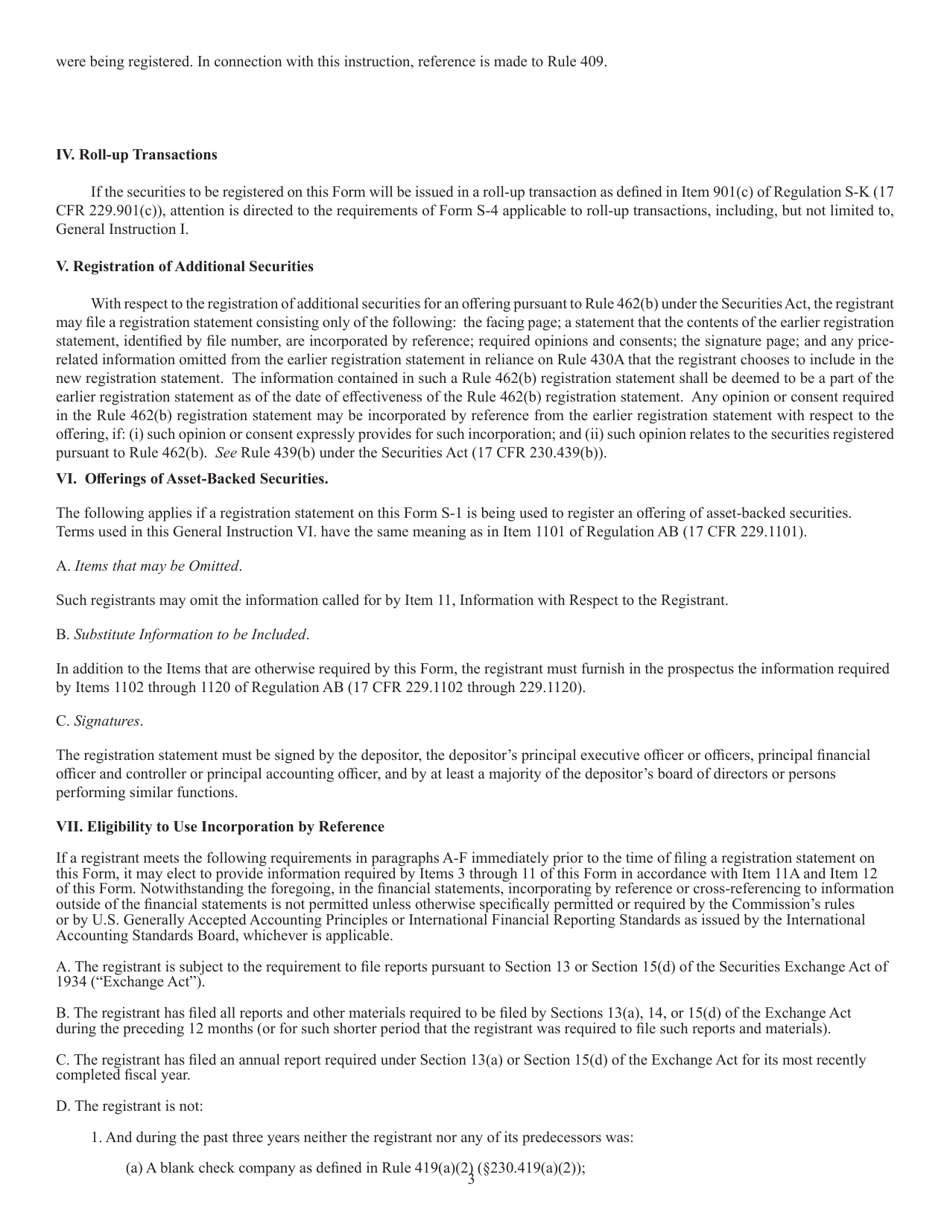

Q: Who can use Form S-1?

A: Form S-1 can be used by companies that are not eligible to use other, simplified registration forms such as Form S-3 or Form S-4.

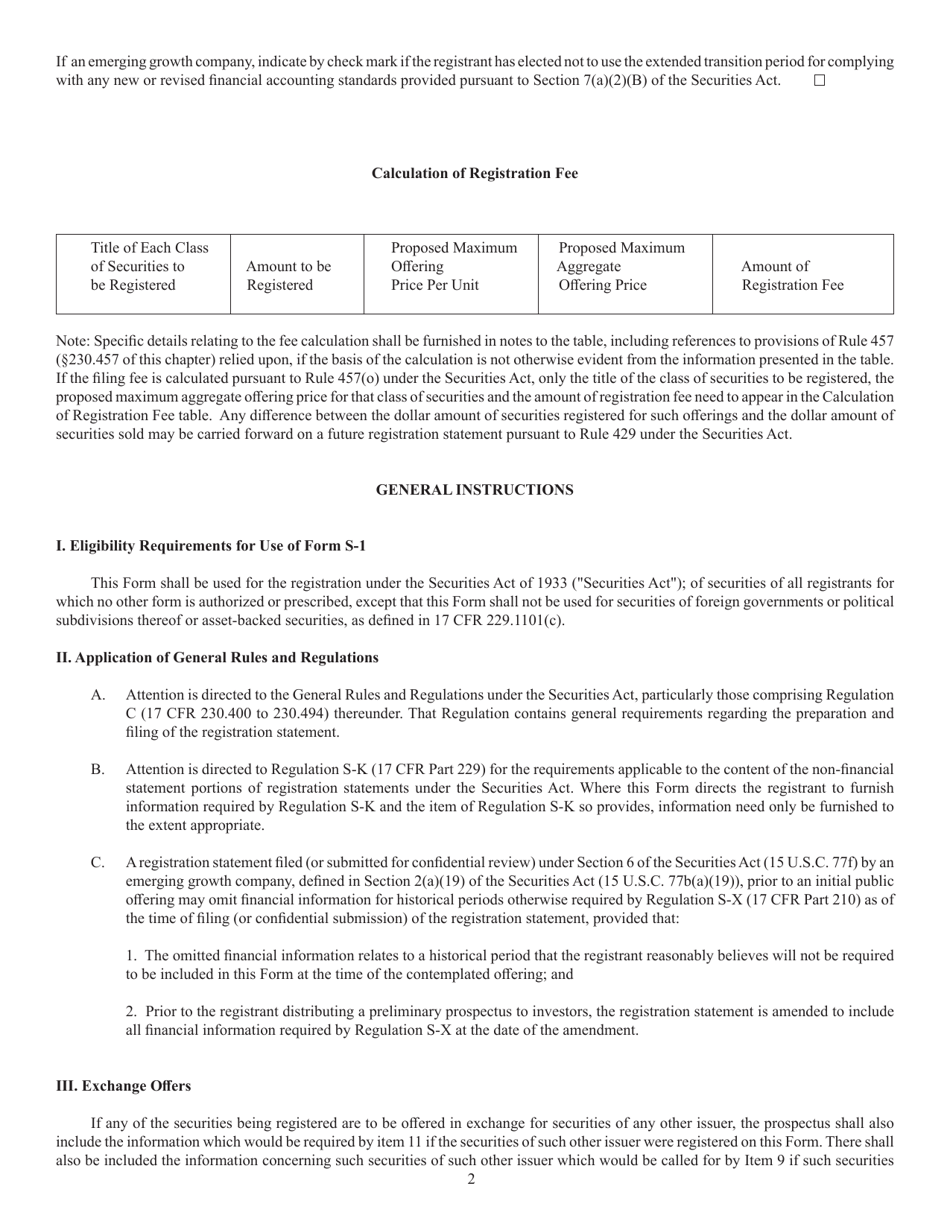

Q: What information is included in Form S-1?

A: Form S-1 requires companies to provide detailed information about their business, financial statements, risk factors, and other relevant information.

Q: Why is Form S-1 important?

A: Form S-1 is important because it allows investors to make informed decisions about whether to invest in a company's securities.

Q: Is filing Form S-1 a guarantee of success?

A: No, filing Form S-1 does not guarantee that a company's offering will be successful or that its securities will be approved for sale.

Q: Can companies make changes to Form S-1 after filing?

A: Yes, companies can make changes to Form S-1 after filing by filing amendments with the SEC.

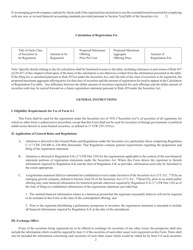

Q: Are there any filing fees for Form S-1?

A: Yes, there are filing fees associated with Form S-1, which vary depending on the size of the offering.

Form Details:

- Released on May 1, 2019;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-1 (SEC Form 870) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.