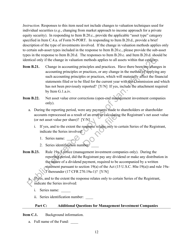

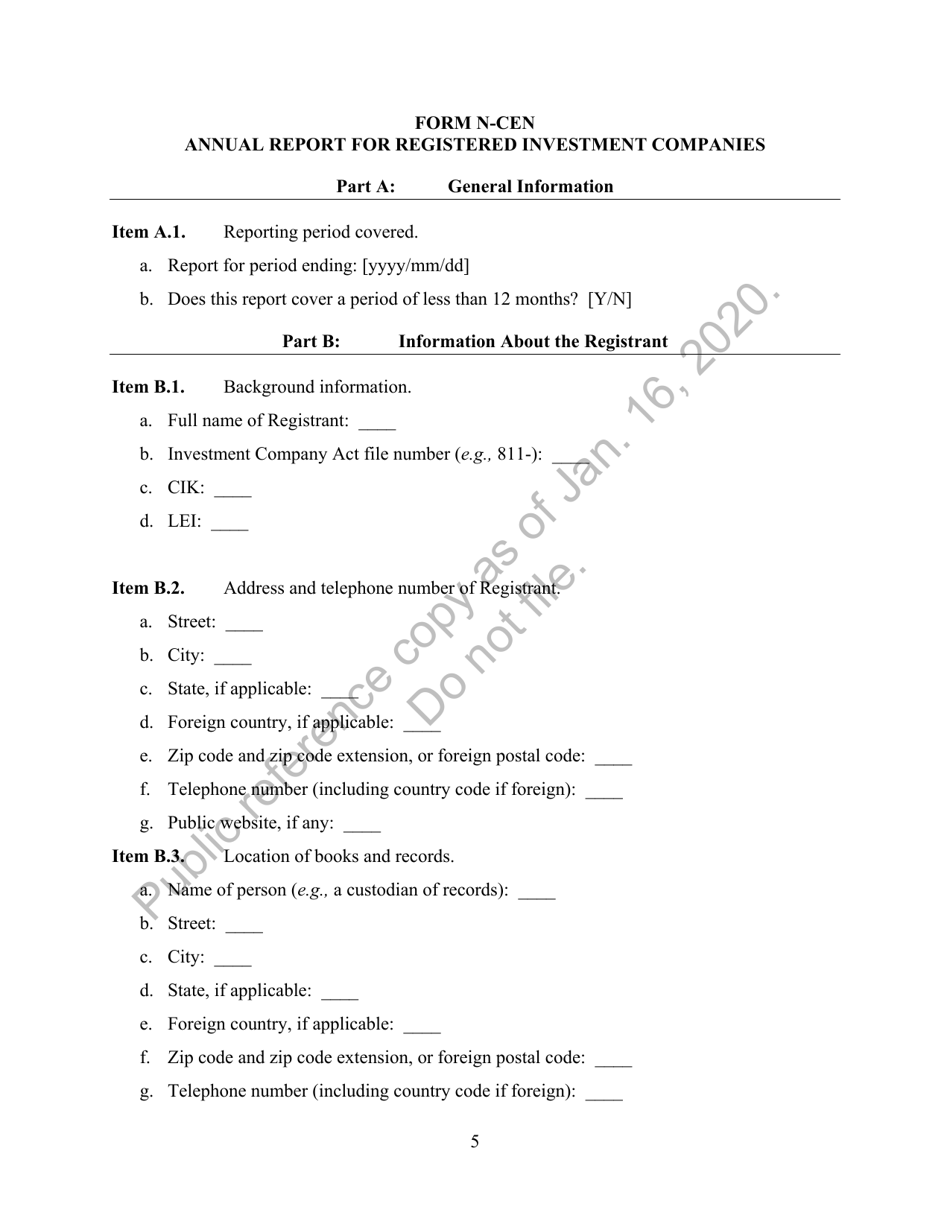

Form N-CEN Annual Report for Registered Investment Companies

What Is Form N-CEN?

This is a legal form that was released by the U.S. Securities and Exchange Commission and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-CEN?

A: Form N-CEN is an annual report that must be filed by registered investment companies.

Q: Who is required to file Form N-CEN?

A: Registered investment companies are required to file Form N-CEN.

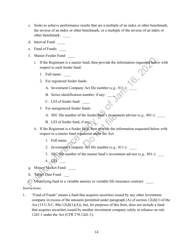

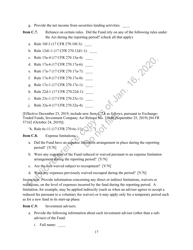

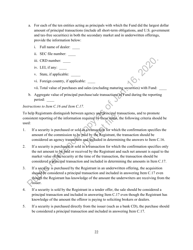

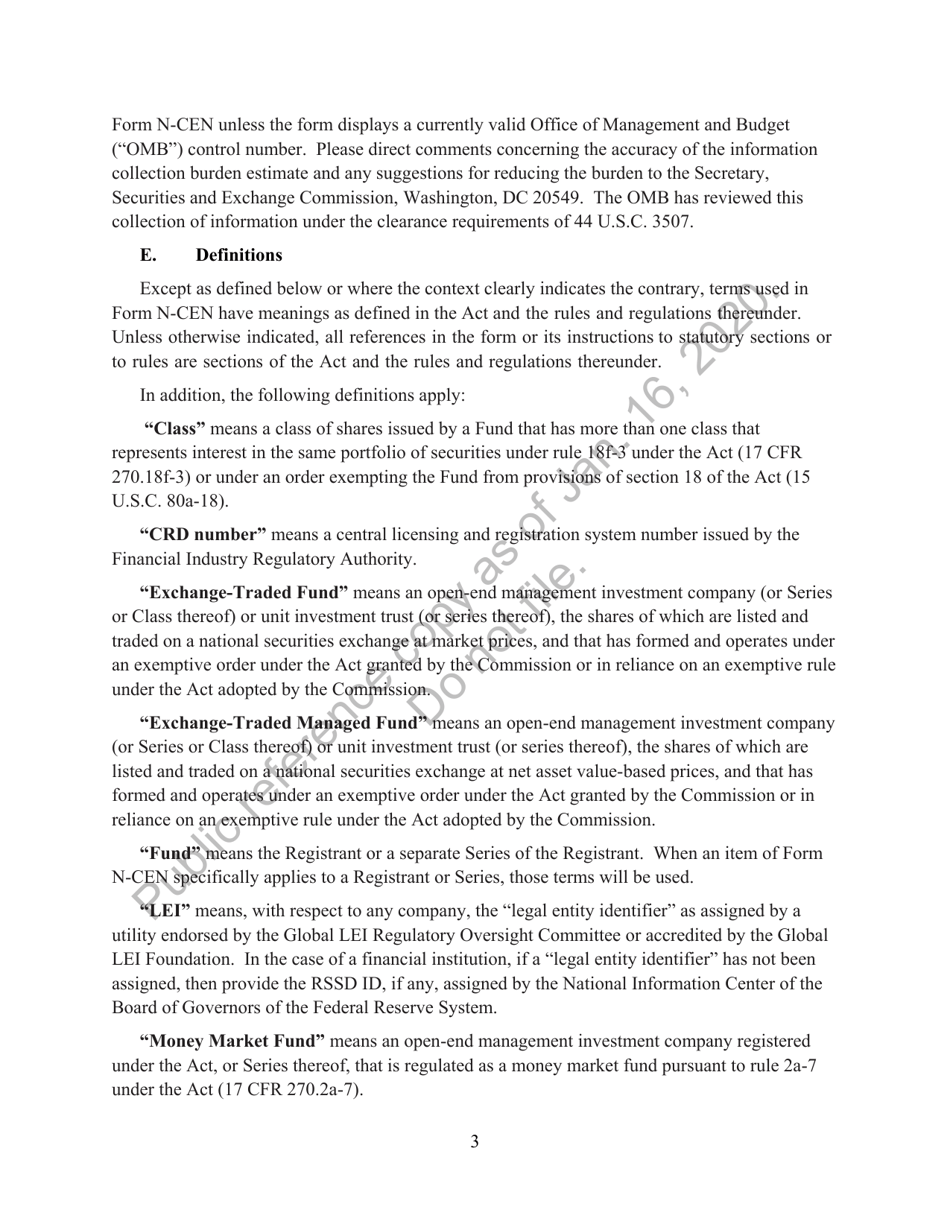

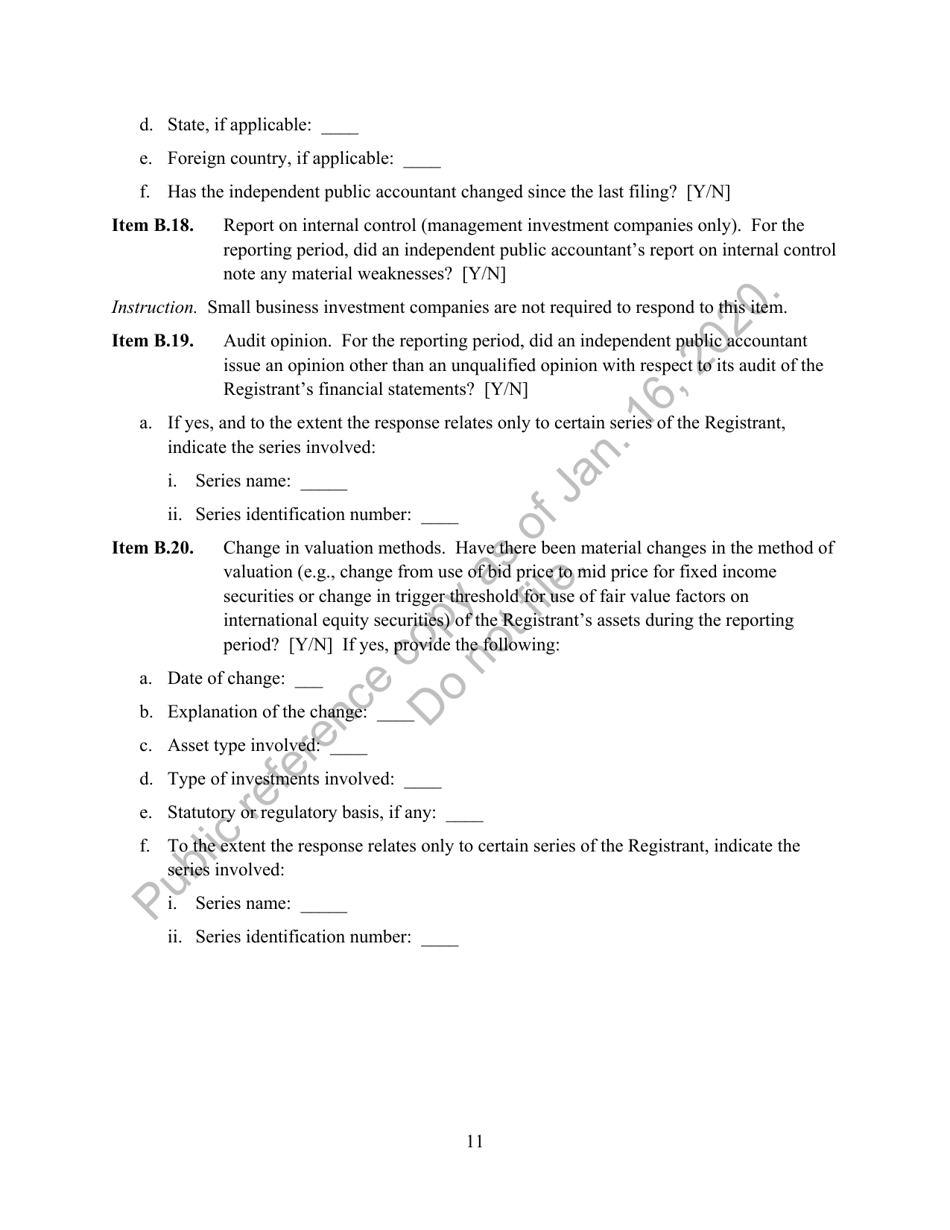

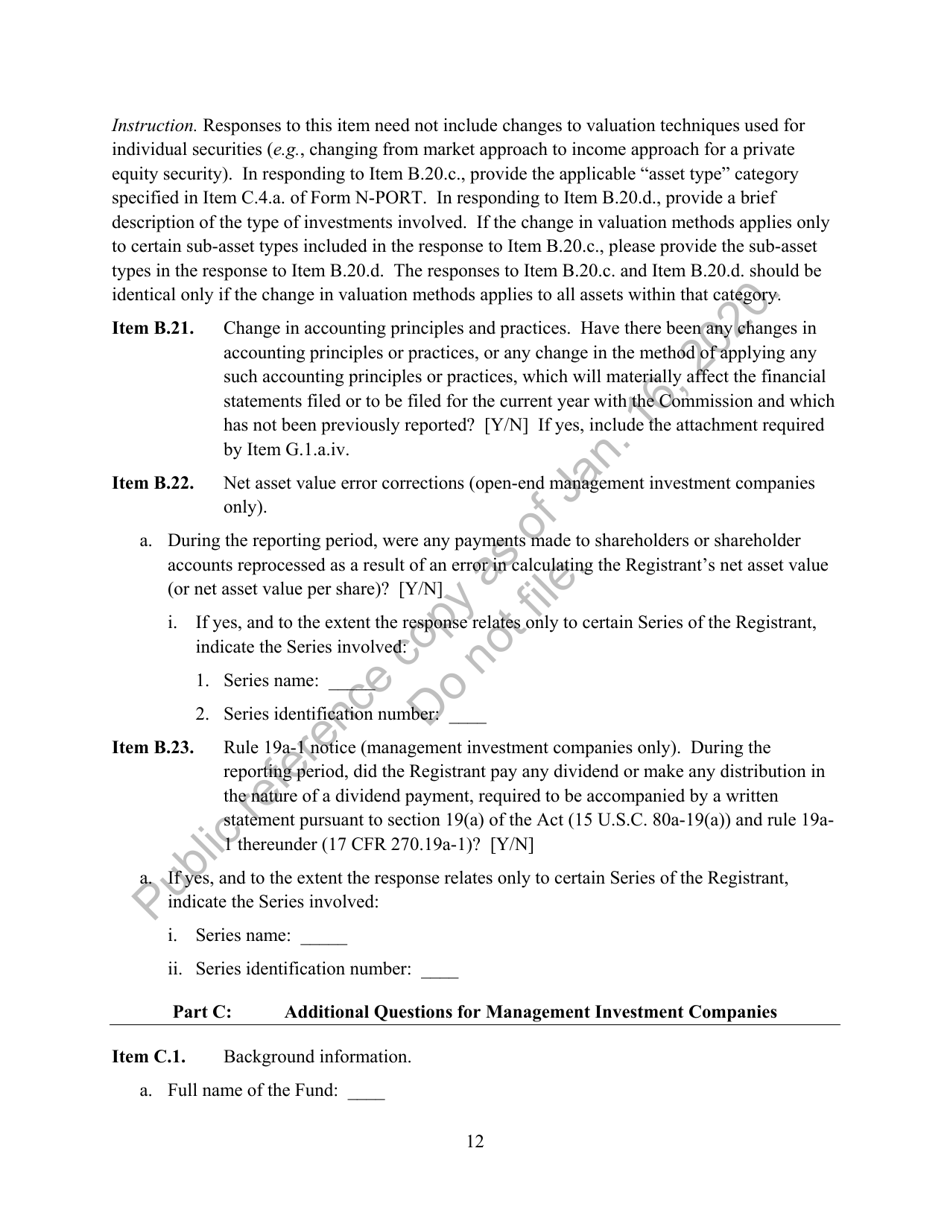

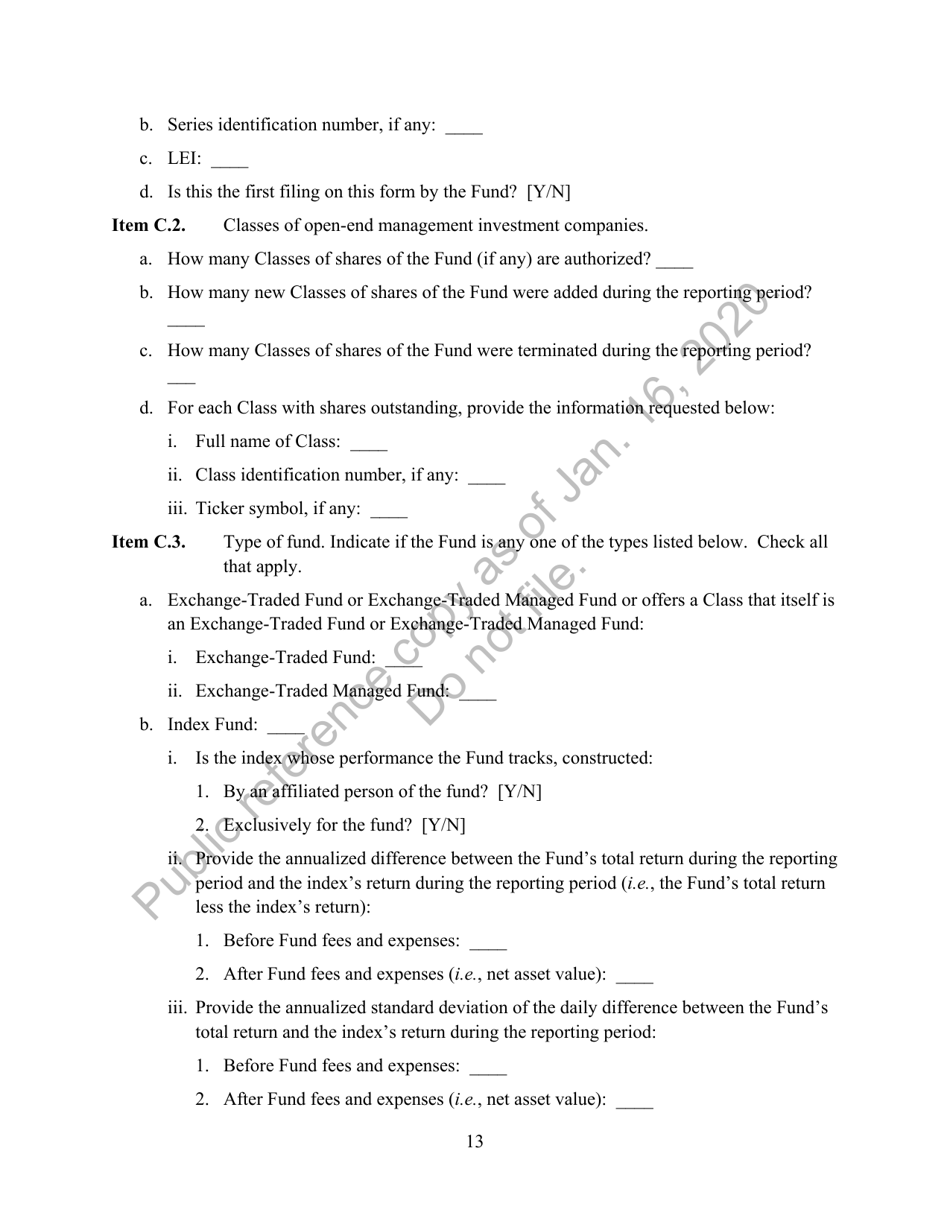

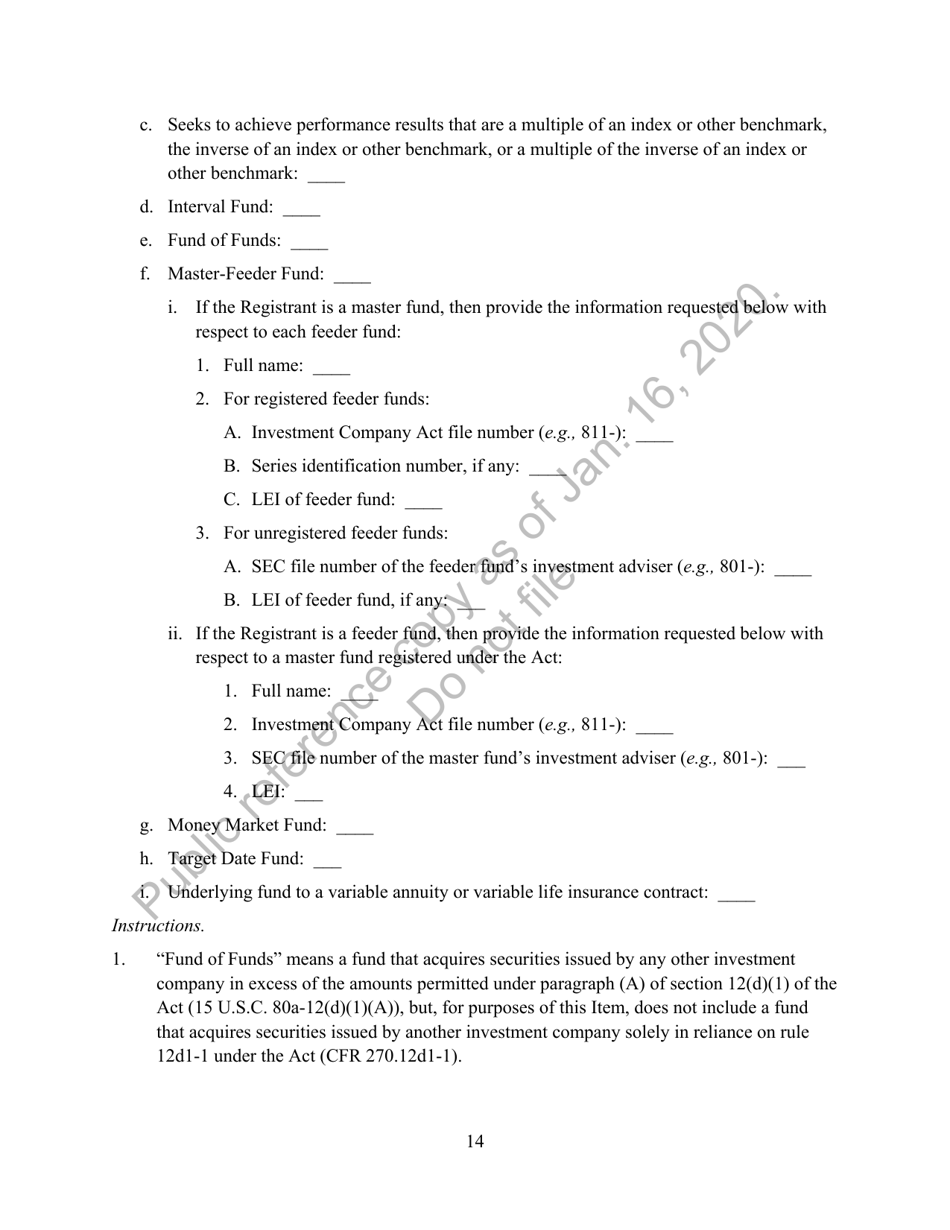

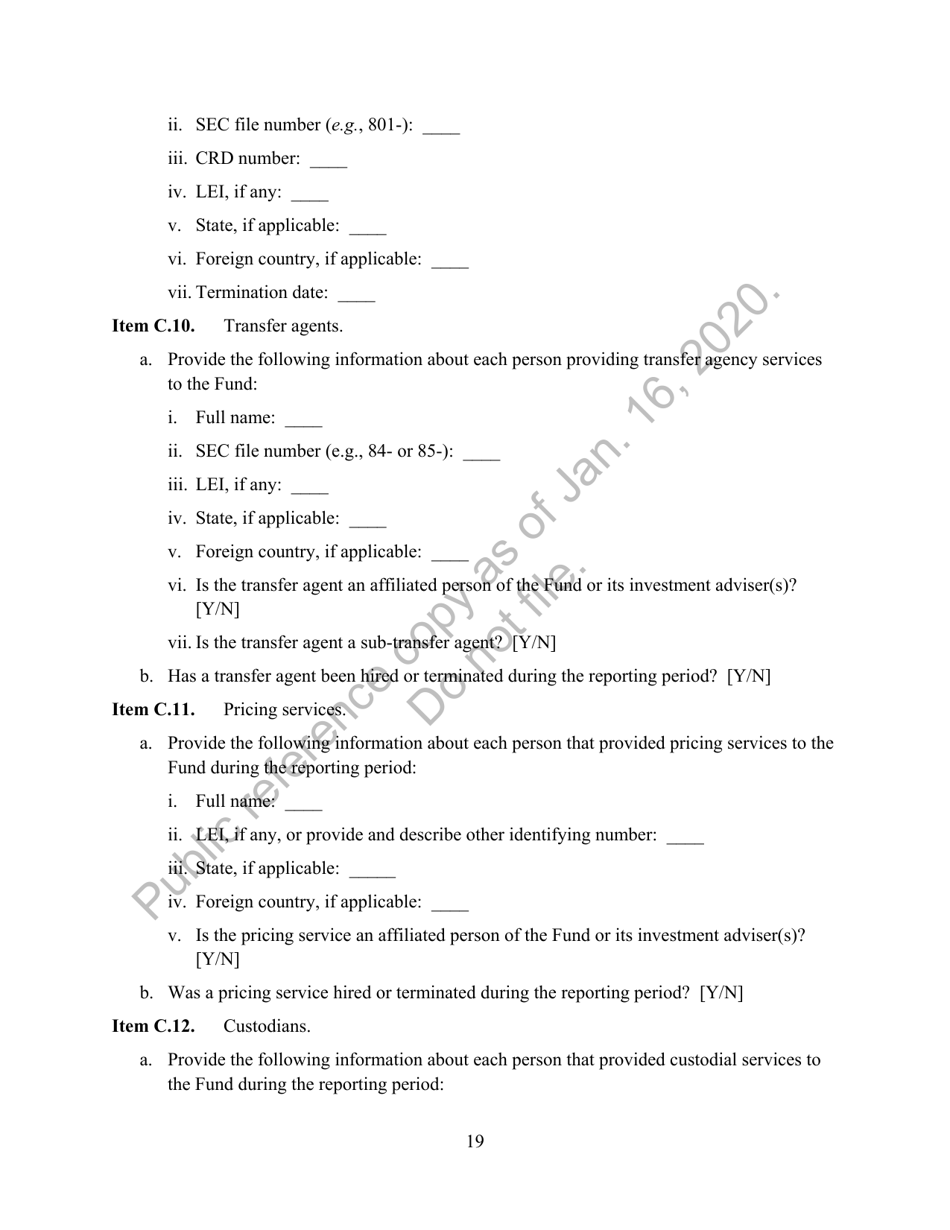

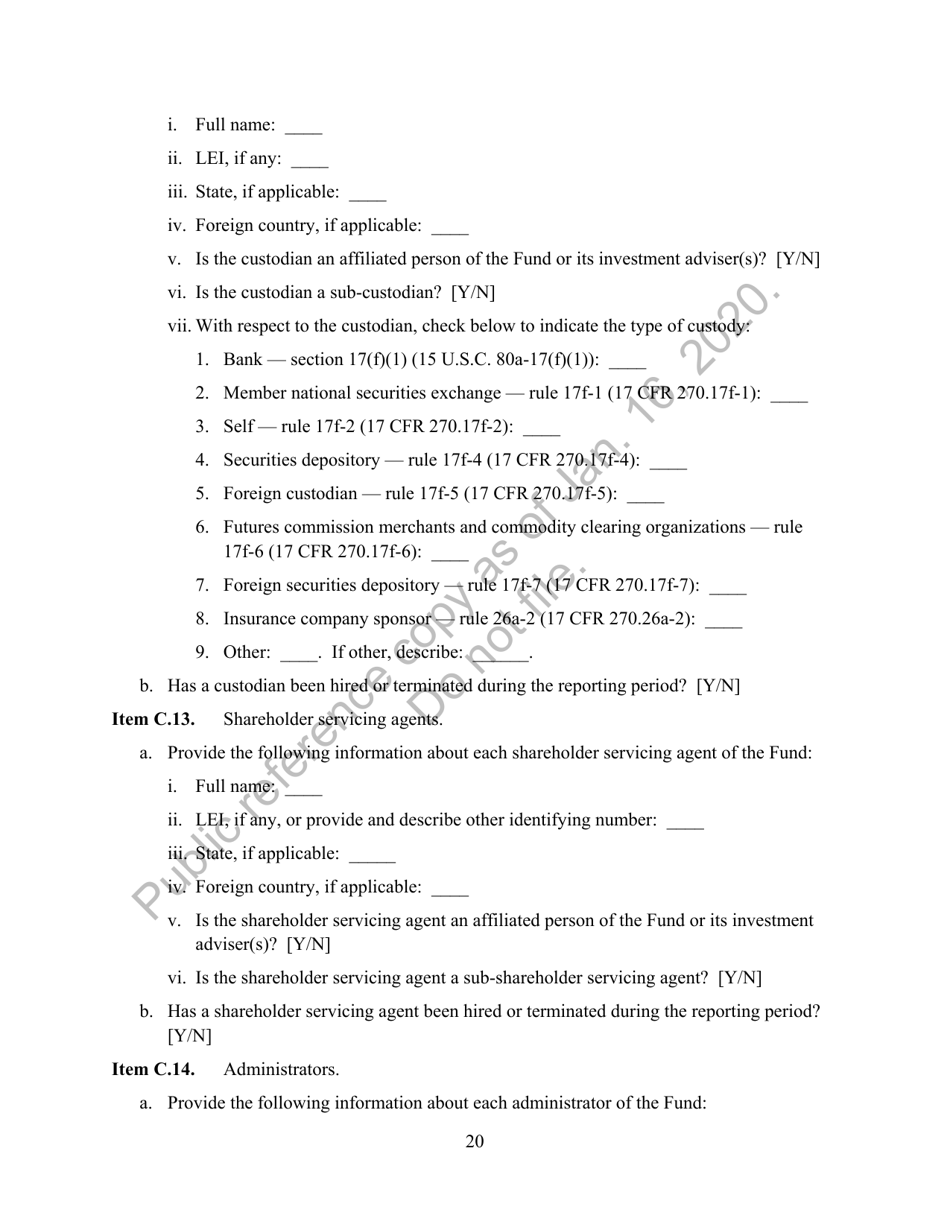

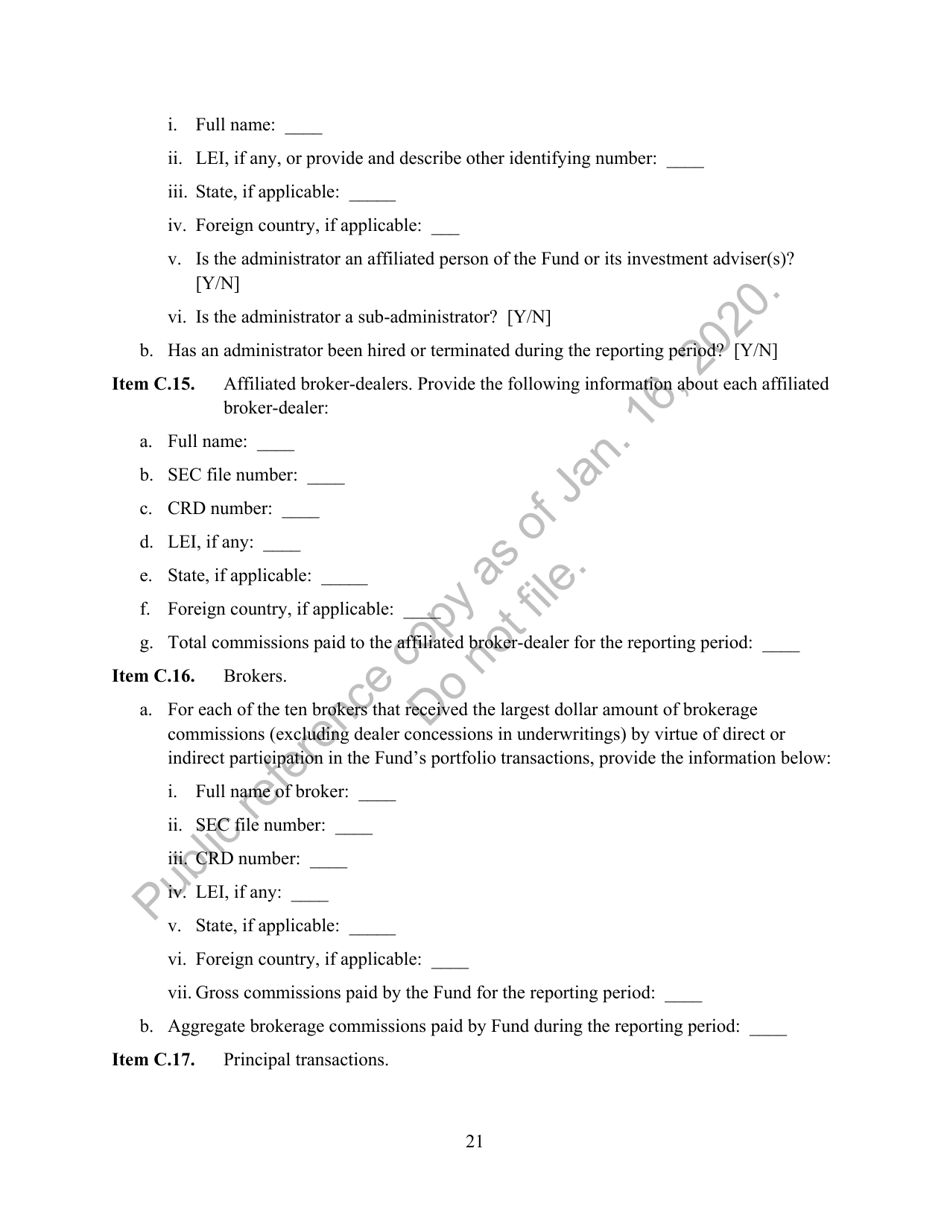

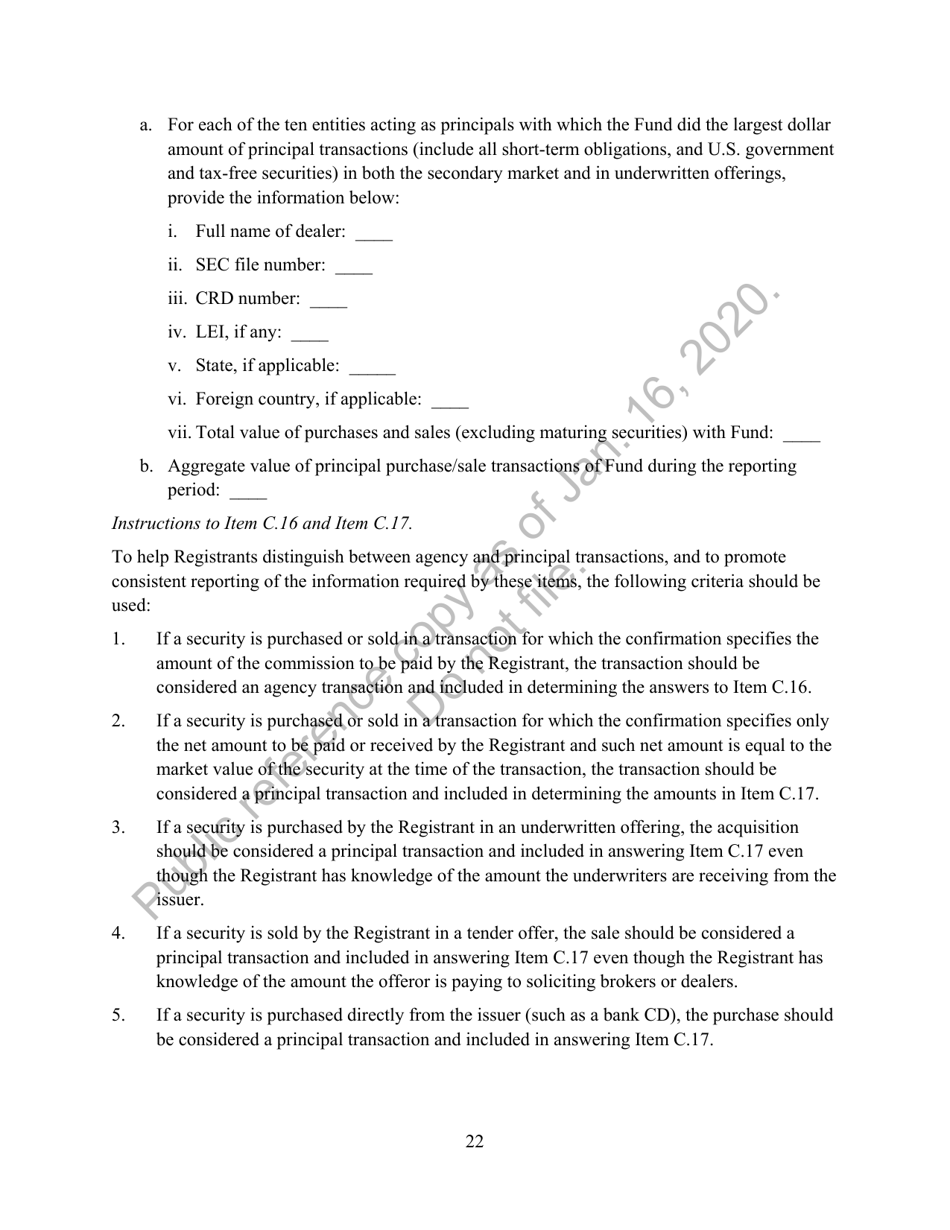

Q: What information is included in Form N-CEN?

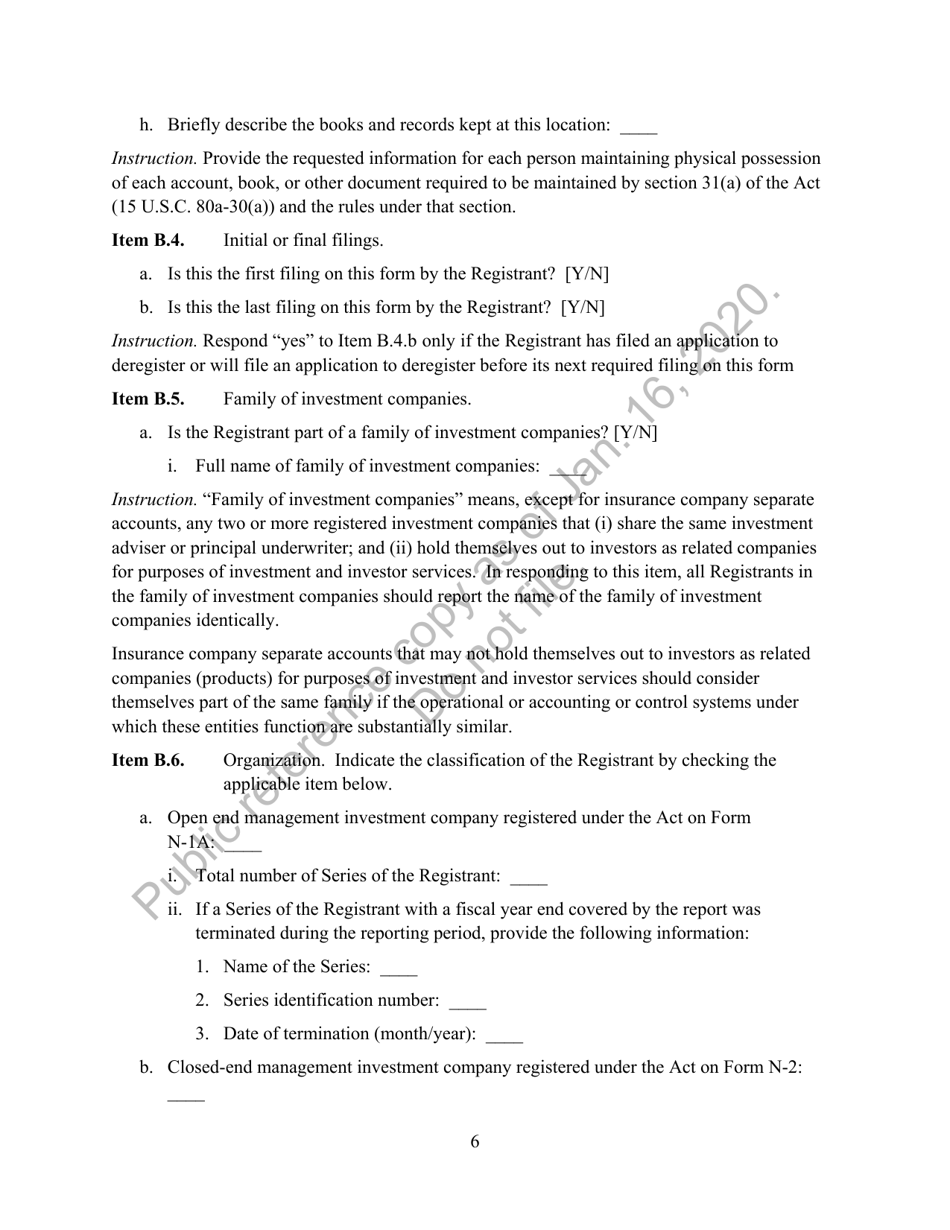

A: Form N-CEN includes information about the company's operations, investment activities, and service providers.

Q: When is Form N-CEN due?

A: Form N-CEN is due within 75 days after the close of the company's fiscal year.

Q: Are there any filing fees for Form N-CEN?

A: No, there are no filing fees for Form N-CEN.

Q: What happens if a registered investment company fails to file Form N-CEN?

A: Failure to file Form N-CEN may result in penalties or regulatory action by the SEC.

Form Details:

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form N-CEN by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.