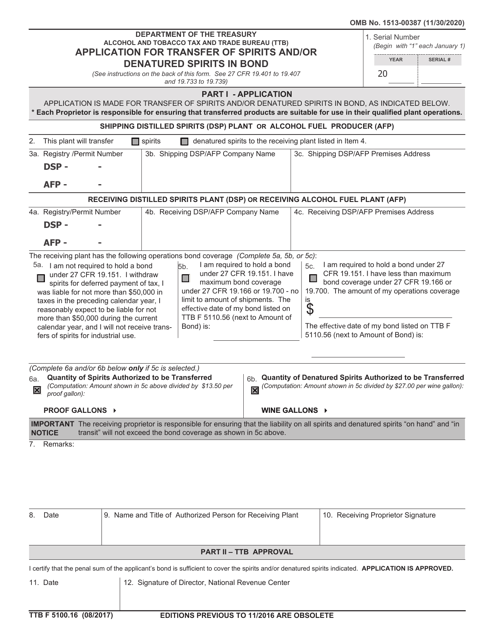

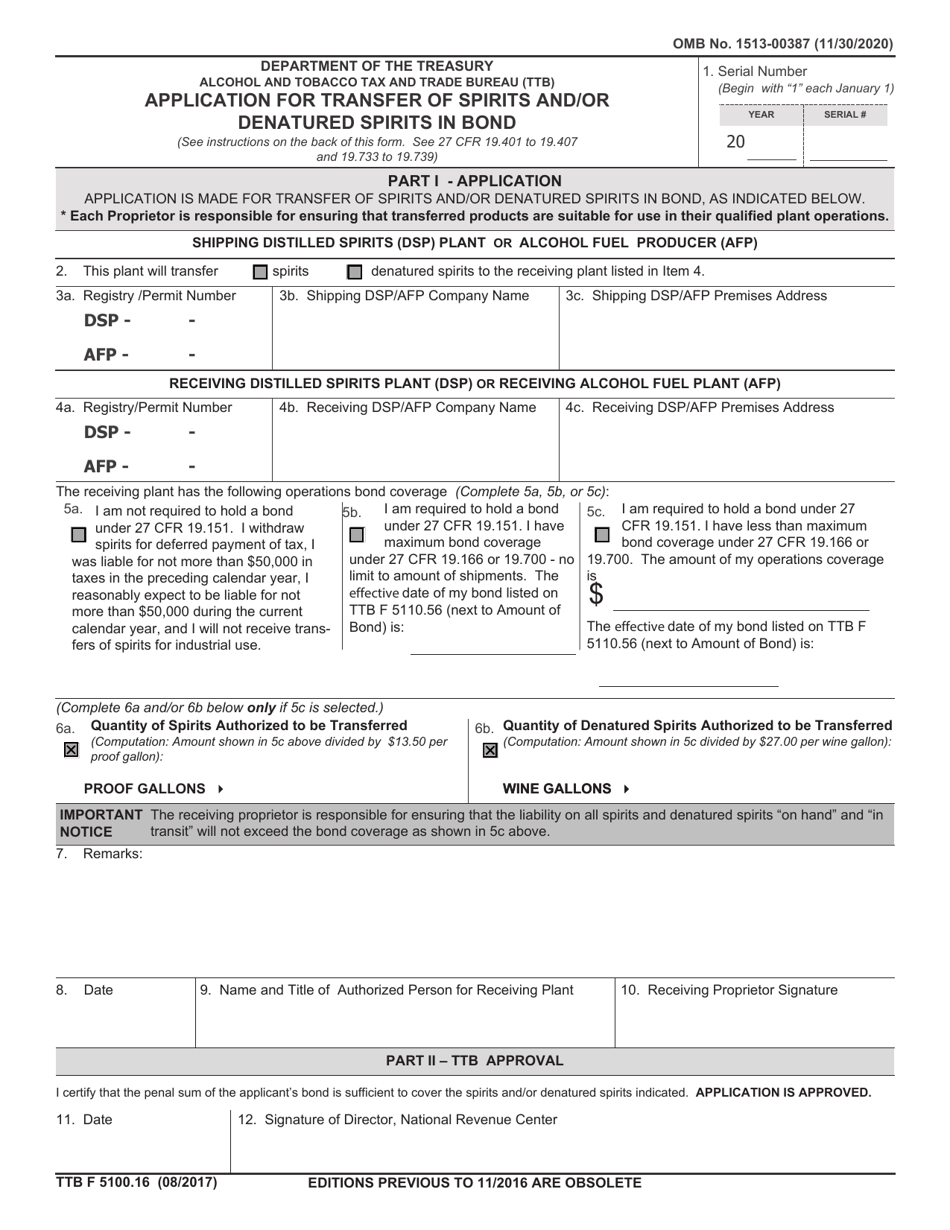

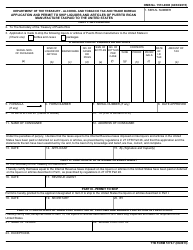

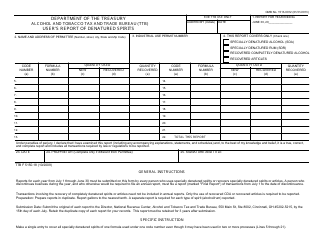

TTB Form 5100.16 Application for Transfer of Spirits and / or Denatured Spirits in Bond

What Is TTB Form 5100.16?

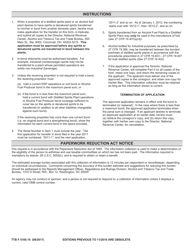

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on August 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5100.16?

A: TTB Form 5100.16 is an application for the transfer of spirits and/or denatured spirits in bond.

Q: What does 'transfer of spirits in bond' mean?

A: 'Transfer of spirits in bond' refers to the movement of alcohol between bonded premises, such as from a distillery to a warehouse.

Q: What is denatured spirits?

A: Denatured spirits are alcohol products that have been rendered unfit for human consumption by adding substances to make them toxic or unpalatable.

Q: Who needs to fill out TTB Form 5100.16?

A: Any person or entity engaged in the production, sale, or distribution of spirits or denatured spirits may need to fill out this form.

Q: Is there a fee for submitting TTB Form 5100.16?

A: Yes, there is a fee associated with the submission of TTB Form 5100.16. The fee amount may vary and should be checked with the TTB.

Q: What information is required on TTB Form 5100.16?

A: The form requires information such as the quantity and type of spirits being transferred, the location of the transfer, and details about the parties involved.

Q: What is the purpose of TTB Form 5100.16?

A: The purpose of TTB Form 5100.16 is to ensure the proper documentation and legal transfer of spirits and denatured spirits in bond.

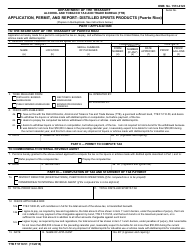

Q: Are there any additional forms or requirements associated with TTB Form 5100.16?

A: Depending on the specific circumstances, additional forms or requirements may be necessary, such as permits or bonds.

Form Details:

- Released on August 1, 2017;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5100.16 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.