This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 46373 (DLGF RC-1)

for the current year.

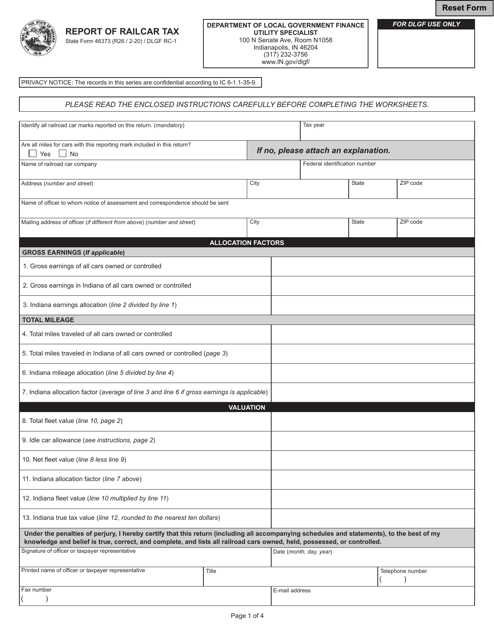

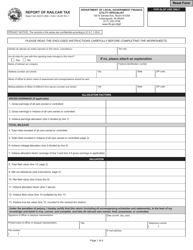

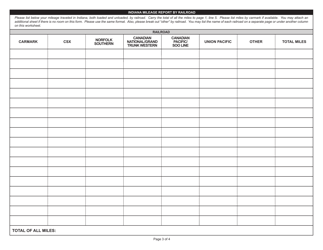

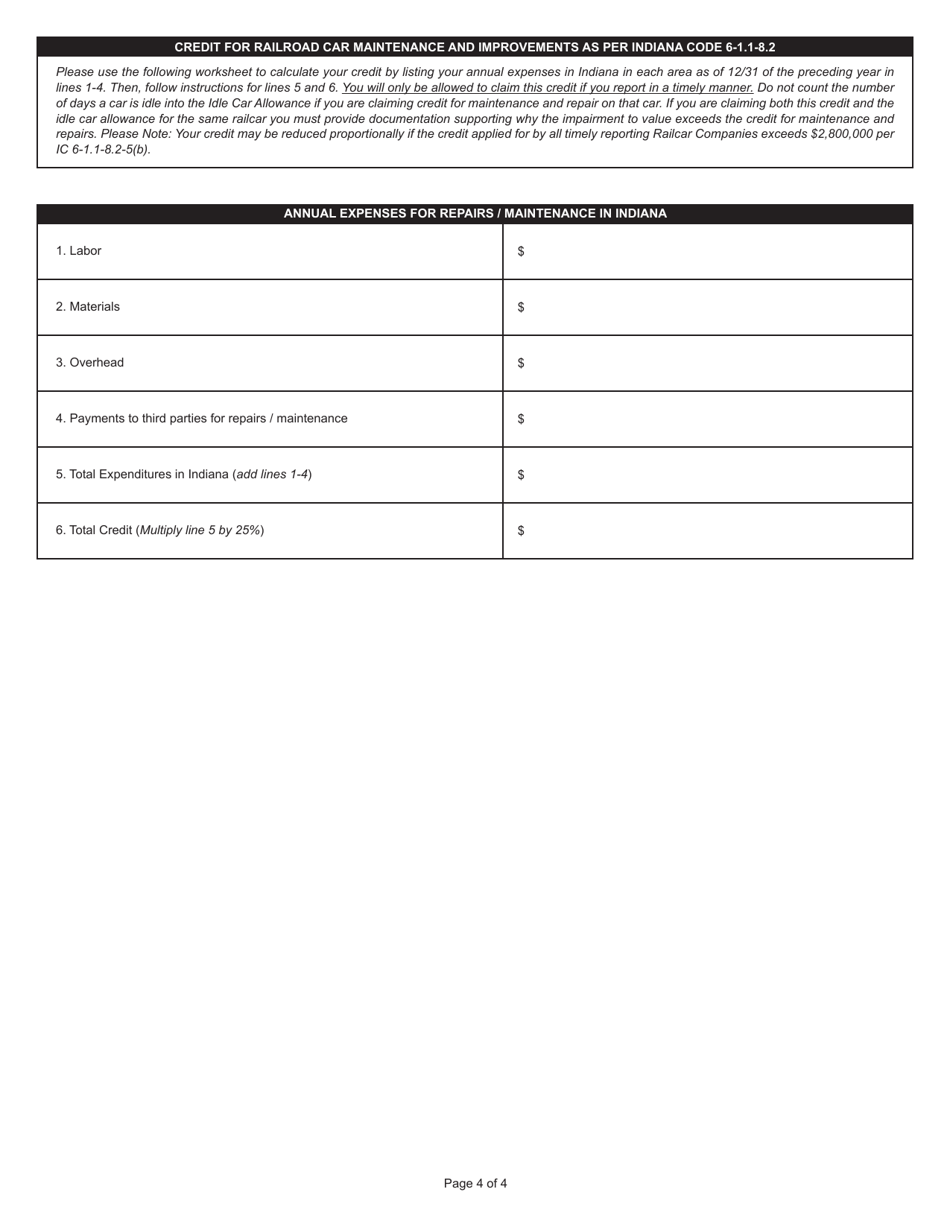

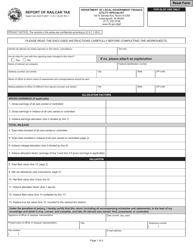

State Form 46373 (DLGF RC-1) Report of Railcar Tax - Indiana

What Is State Form 46373 (DLGF RC-1)?

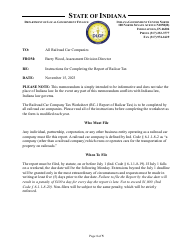

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 46373?

A: State Form 46373 is the DLGF RC-1, which is the Report of Railcar Tax form in Indiana.

Q: What is the purpose of State Form 46373?

A: The purpose of State Form 46373 is to report railcar tax in Indiana.

Q: Who needs to file State Form 46373?

A: Anyone who is required to pay railcar tax in Indiana needs to file State Form 46373.

Q: When is State Form 46373 due?

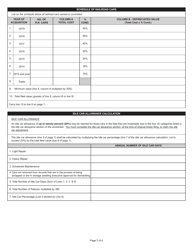

A: The due date for State Form 46373 varies and is typically indicated on the form itself.

Q: Are there any penalties for not filing State Form 46373?

A: Failure to file State Form 46373 or filing it late may result in penalties and interest charges.

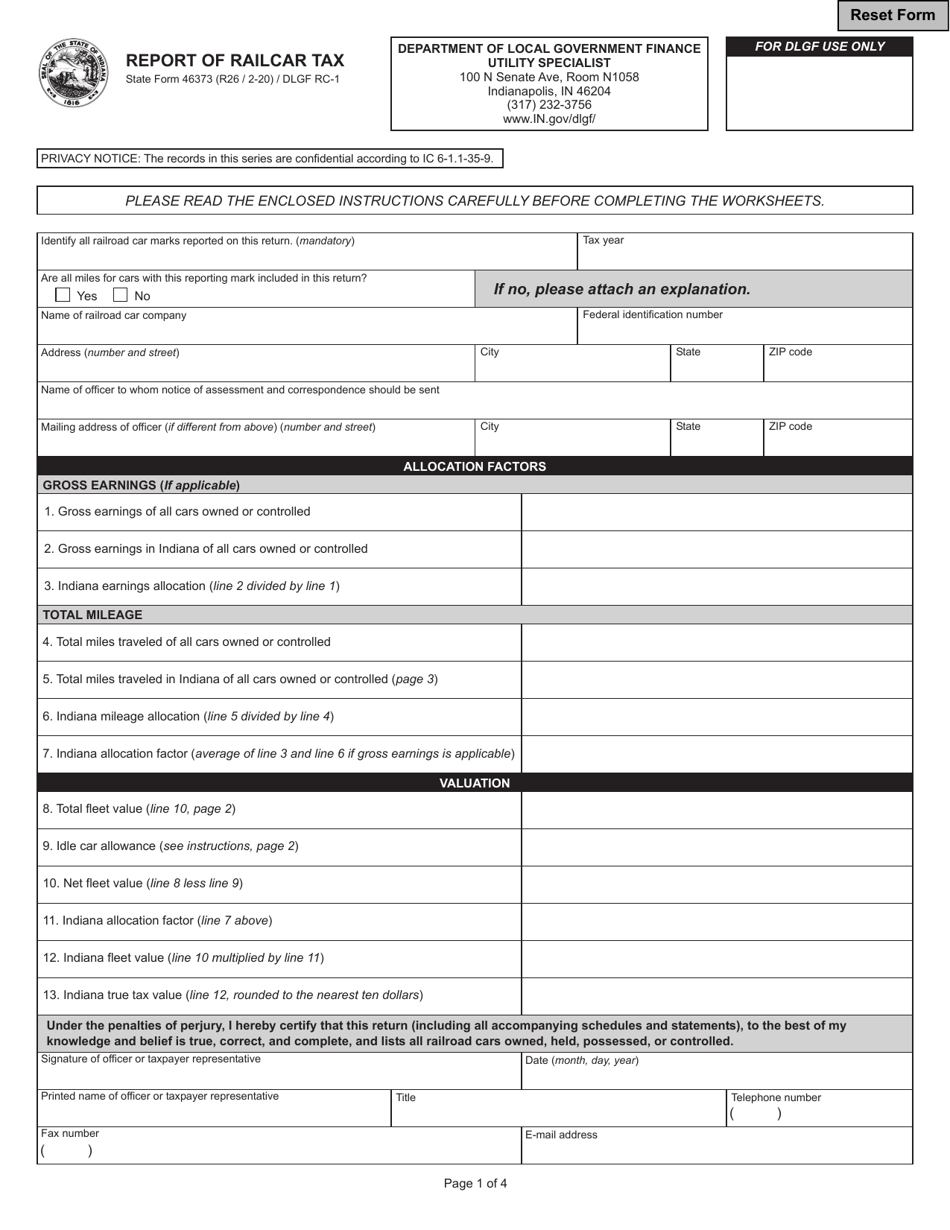

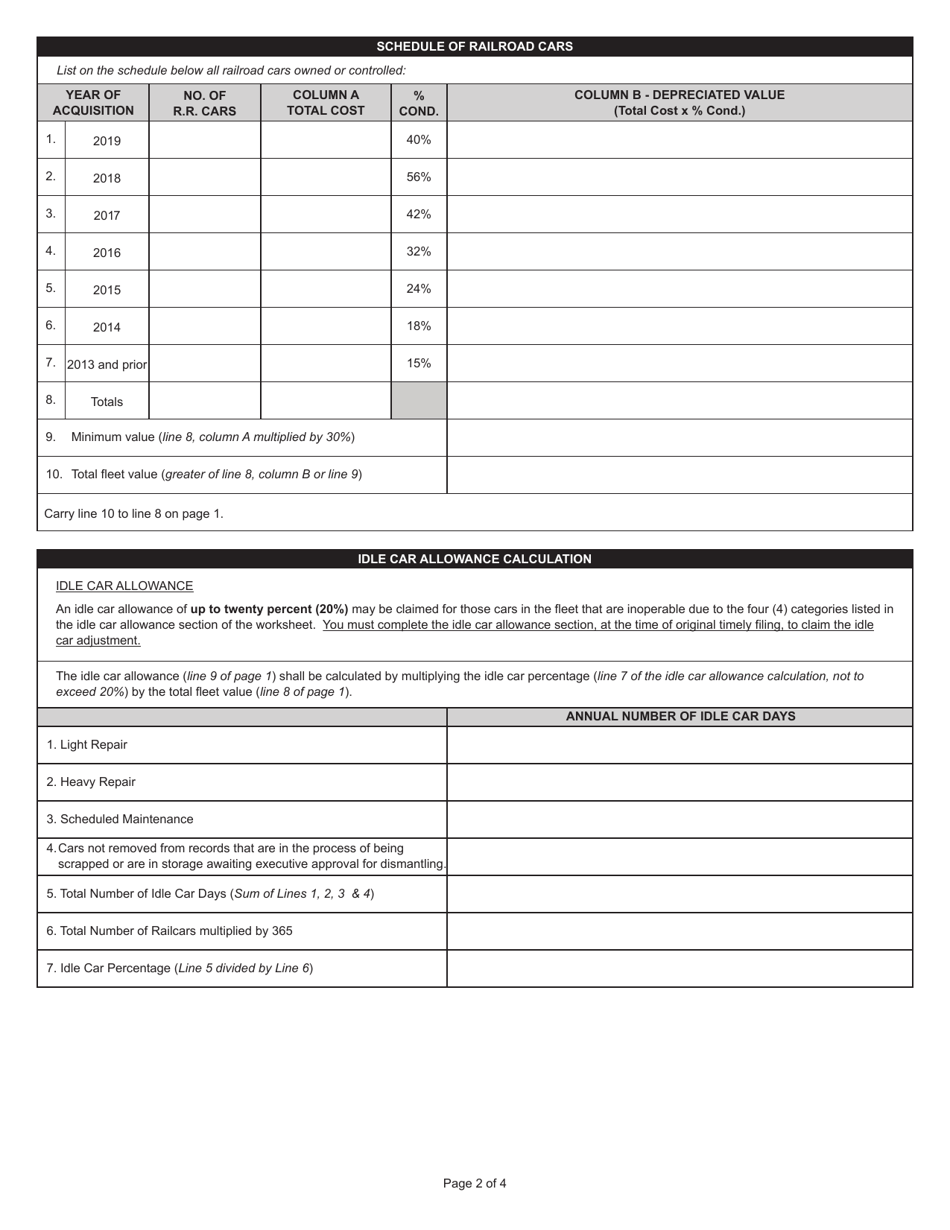

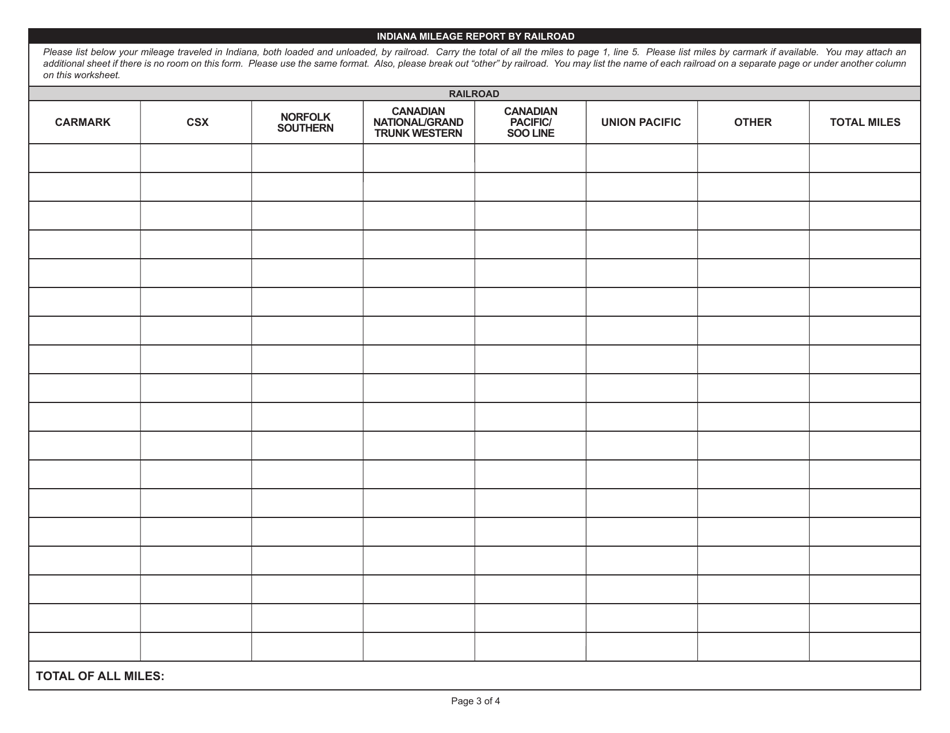

Q: What information is required on State Form 46373?

A: State Form 46373 requires information such as railcar details, ownership information, and the amount of tax owed.

Q: Can I mail State Form 46373?

A: Yes, you can also mail State Form 46373 to the DLGF using the address provided on the form.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 46373 (DLGF RC-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.