This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR1778

for the current year.

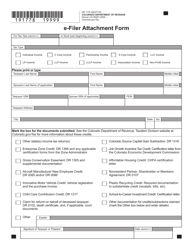

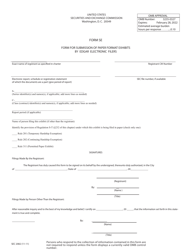

Form DR1778 E-Filer Attachment Form - Colorado

What Is Form DR1778?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

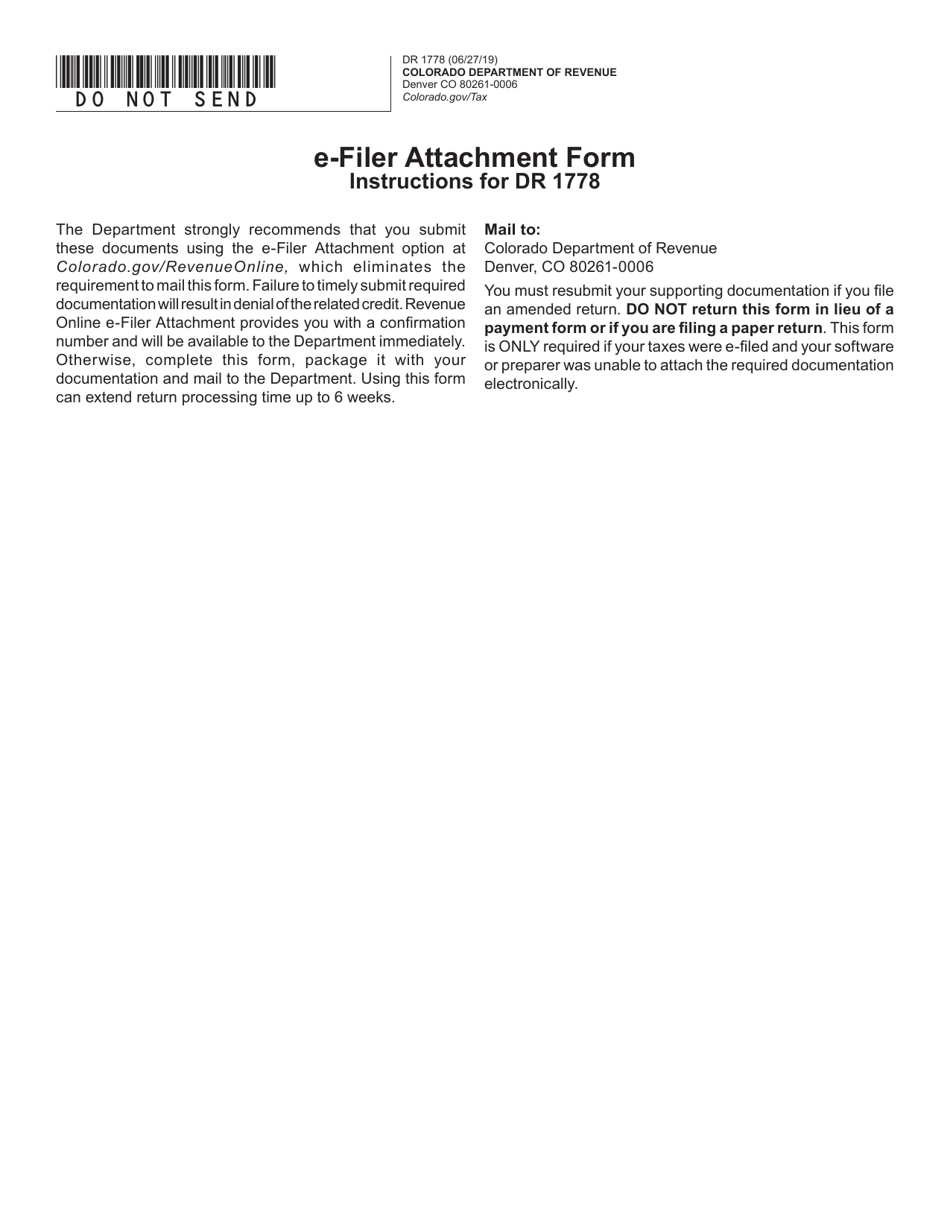

Q: What is the Form DR1778 E-Filer Attachment Form?

A: The Form DR1778 E-Filer Attachment Form is a form used in the state of Colorado for electronically filing supplemental information with your tax return.

Q: When is the Form DR1778 E-Filer Attachment Form used?

A: The Form DR1778 E-Filer Attachment Form is used when you need to provide additional information that cannot be entered directly on your tax return.

Q: How do I fill out the Form DR1778 E-Filer Attachment Form?

A: You need to fill out the required fields on the form, which may include your personal information, details of the attached documents, and any additional explanations or calculations.

Q: Can I file the Form DR1778 E-Filer Attachment Form electronically?

A: Yes, the Form DR1778 E-Filer Attachment Form is specifically designed for electronic filing and should be submitted along with your electronically filed tax return.

Form Details:

- Released on June 27, 2019;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR1778 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.