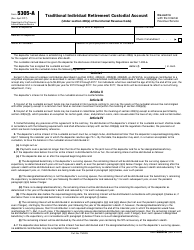

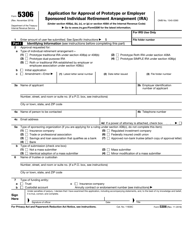

This version of the form is not currently in use and is provided for reference only. Download this version of

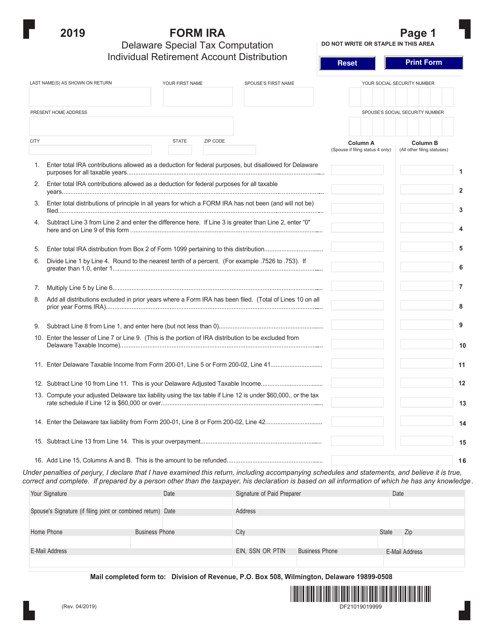

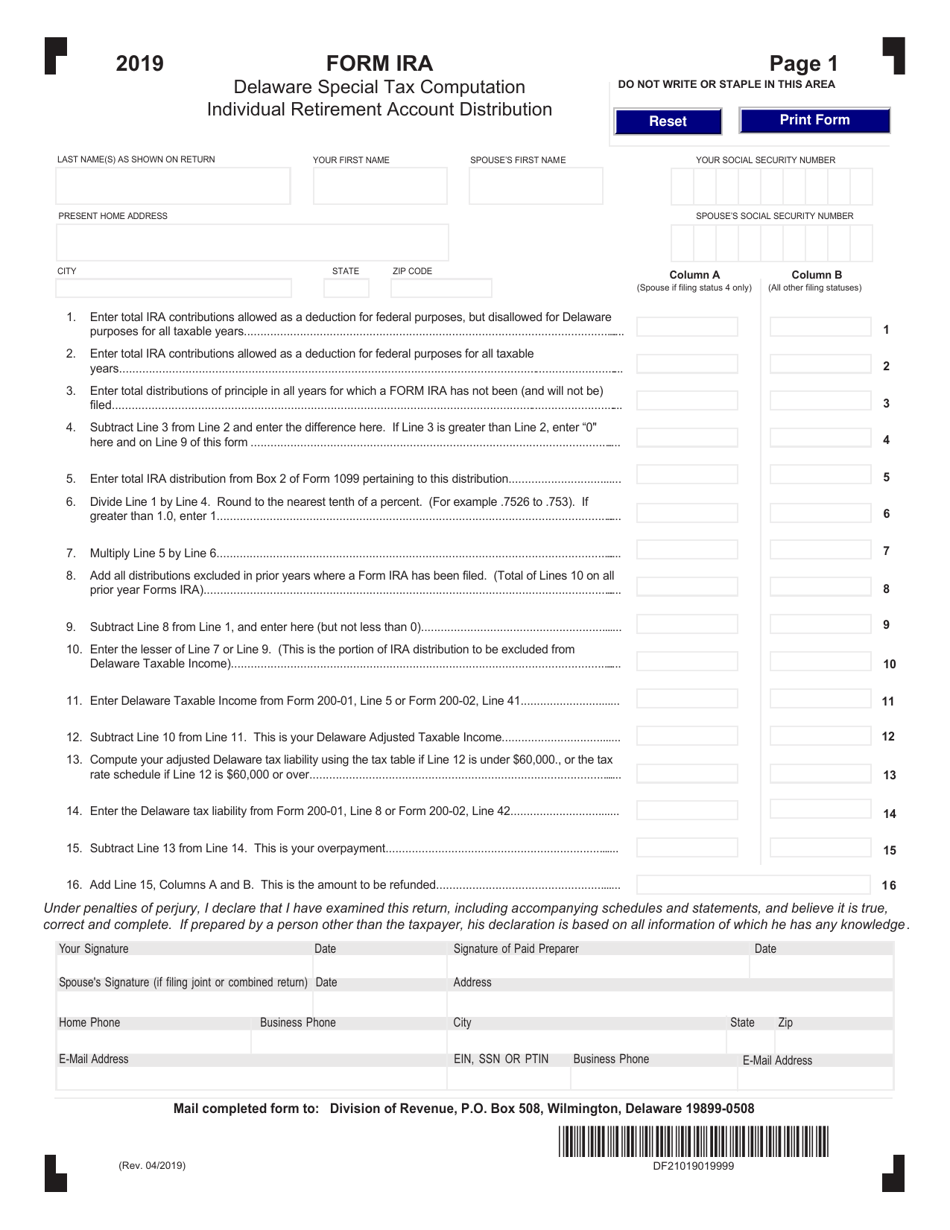

Form IRA

for the current year.

Form IRA Delaware Special Tax Computation Individual Retirement Account Distribution - Delaware

What Is Form IRA?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an IRA?

A: An IRA is an Individual Retirement Account that allows individuals to save for retirement with certain tax advantages.

Q: What is a Delaware Special Tax Computation?

A: Delaware Special Tax Computation refers to a specific calculation method used for taxation purposes in the state of Delaware.

Q: What is an IRA distribution?

A: An IRA distribution refers to the withdrawal of funds from an Individual Retirement Account.

Q: Why would someone need to compute taxes for an IRA distribution in Delaware?

A: If you reside in Delaware and have taken a distribution from your IRA, you may need to compute taxes according to the state's regulations.

Q: Are IRA distributions taxable in Delaware?

A: Yes, IRA distributions are generally subject to taxation in Delaware.

Q: What is the purpose of the Delaware Special Tax Computation for IRA distributions?

A: The purpose of the Delaware Special Tax Computation is to determine the specific amount of taxes owed on an IRA distribution in compliance with the state's tax laws.

Q: Are there any special rules or exemptions related to IRA distributions in Delaware?

A: Yes, Delaware may have specific rules or exemptions related to IRA distributions. It is advisable to consult the state's tax regulations or seek guidance from a tax professional for accurate information.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IRA by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.