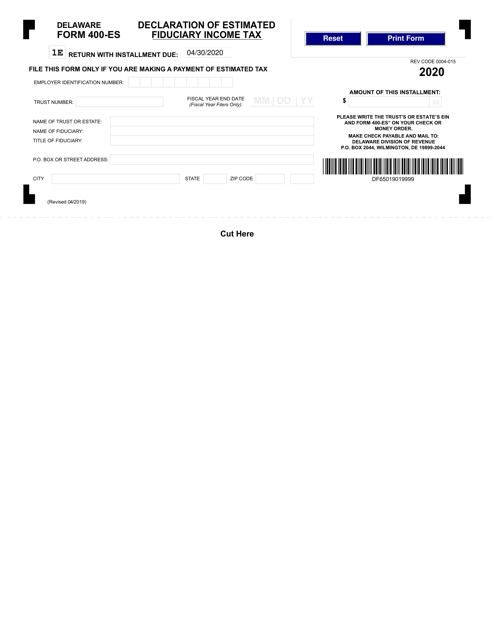

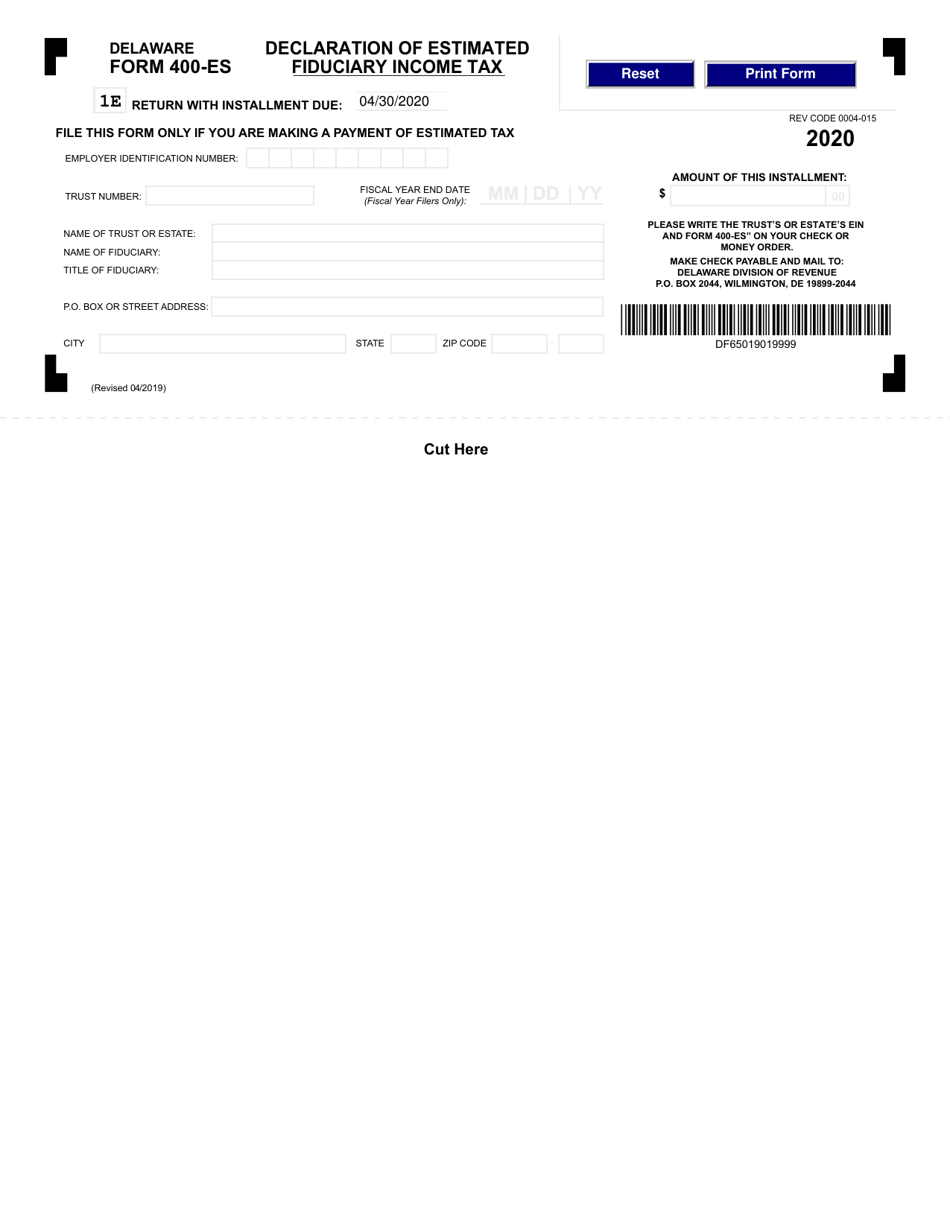

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 400-ES

for the current year.

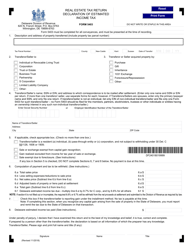

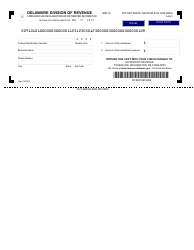

Form 400-ES Quarterly Declaration of Estimated Tax Return - Delaware

What Is Form 400-ES?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 400-ES?

A: Form 400-ES is the Quarterly Declaration of Estimated Tax Return for Delaware.

Q: Who needs to file Form 400-ES?

A: Individuals and businesses that are required to make estimated tax payments in Delaware need to file Form 400-ES.

Q: What is the purpose of Form 400-ES?

A: Form 400-ES is used to report and pay estimated income tax liability to the state of Delaware.

Q: How often do I need to file Form 400-ES?

A: Form 400-ES needs to be filed quarterly, as the name implies.

Q: What information do I need to provide on Form 400-ES?

A: You will need to provide your name, address, Social Security number or taxpayer ID, and estimate your taxable income and tax liability for the upcoming quarter.

Q: When is Form 400-ES due?

A: The due dates for filing Form 400-ES are April 30th, July 31st, October 31st, and January 31st of the following year.

Q: What happens if I don't file Form 400-ES or pay my estimated tax?

A: Failure to file Form 400-ES or pay your estimated tax can result in penalties and interest charges imposed by the state of Delaware.

Q: Can I make changes to my estimated tax payments?

A: Yes, if your estimated tax liability changes during the year, you can adjust your future payments on subsequent Form 400-ES filings.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 400-ES by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.