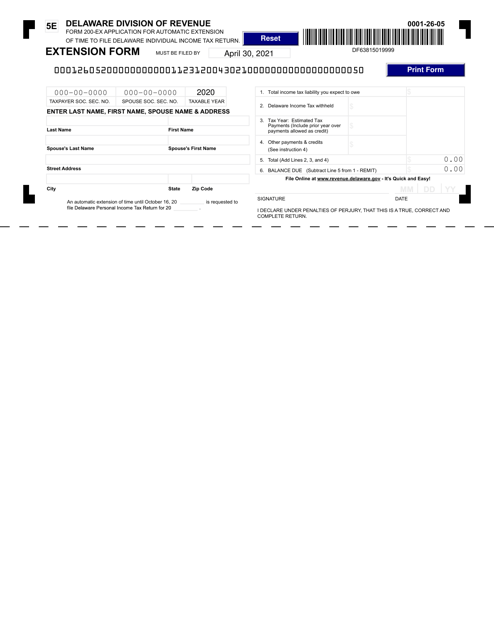

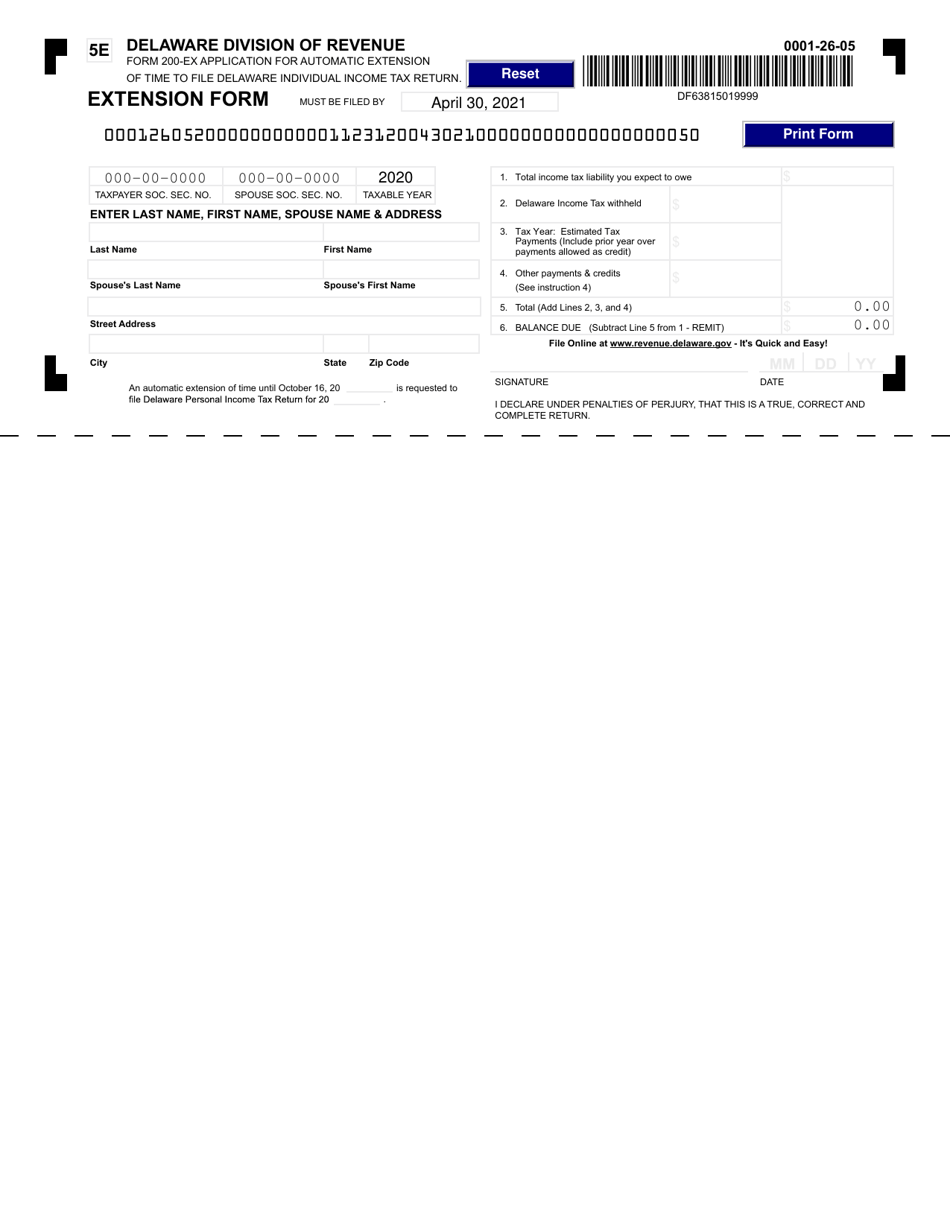

This version of the form is not currently in use and is provided for reference only. Download this version of

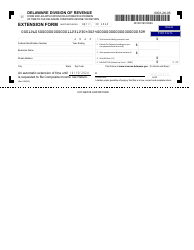

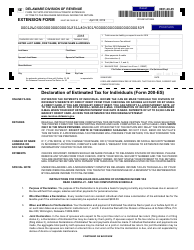

Form 200-EX

for the current year.

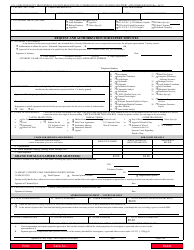

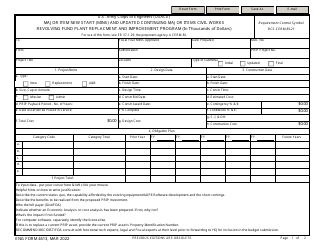

Form 200-EX Request for Extension - Delaware

What Is Form 200-EX?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

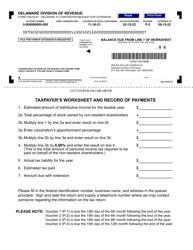

Q: What is Form 200-EX?

A: Form 200-EX is the Request for Extension form for the state of Delaware.

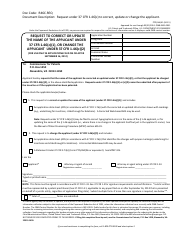

Q: Why would I need to file Form 200-EX?

A: You would need to file Form 200-EX if you are unable to file your Delaware tax return by the original due date and need an extension.

Q: What is the deadline to file Form 200-EX?

A: The deadline to file Form 200-EX is the same as the original due date of the Delaware tax return, which is typically April 30th.

Q: How long is the extension granted by Form 200-EX?

A: Form 200-EX grants a six-month extension, which generally extends the filing deadline to October 31st.

Q: Is there a penalty for filing Form 200-EX?

A: There is no penalty for filing Form 200-EX as long as you file it by the original due date of your Delaware tax return and pay any estimated taxes owed.

Q: Can I file Form 200-EX if I owe taxes?

A: Yes, you can file Form 200-EX even if you owe taxes. However, any unpaid taxes after the original due date may be subject to penalties and interest.

Q: Can I file Form 200-EX if I have already filed my Delaware tax return?

A: No, Form 200-EX is specifically for requesting an extension to file your Delaware tax return. If you have already filed your return, you do not need to file Form 200-EX.

Form Details:

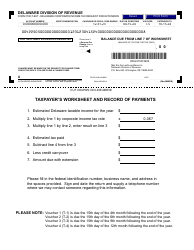

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-EX by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.