This version of the form is not currently in use and is provided for reference only. Download this version of

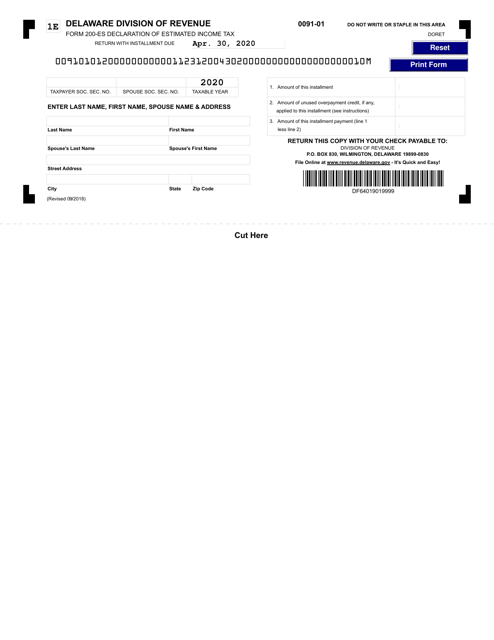

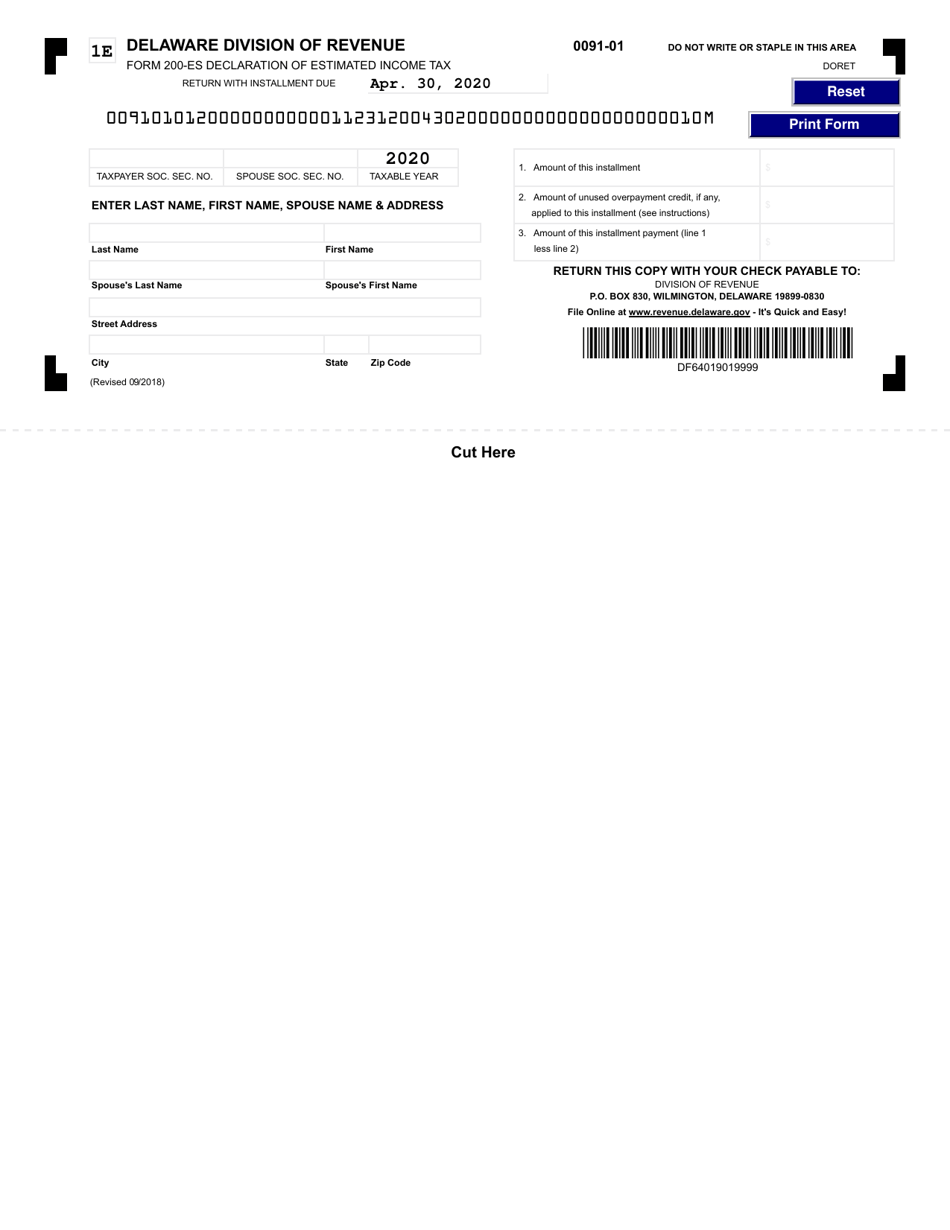

Form 200-ES

for the current year.

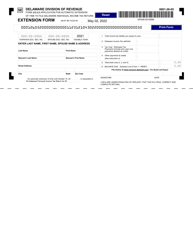

Form 200-ES Delaware Estimated Income Tax Voucher - Delaware

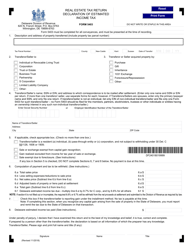

What Is Form 200-ES?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200-ES?

A: Form 200-ES is a Delaware Estimated Income Tax Voucher.

Q: What is a Delaware Estimated Income Tax Voucher used for?

A: The Delaware Estimated Income Tax Voucher is used to make estimated tax payments for individuals or businesses in Delaware.

Q: Do I have to use Form 200-ES to make estimated tax payments in Delaware?

A: Yes, using Form 200-ES is required for individuals and businesses making estimated tax payments in Delaware.

Q: When are estimated tax payments due in Delaware?

A: Estimated tax payments for individuals are due on a quarterly basis, while businesses may have different due dates depending on their fiscal year.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-ES by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.