This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule W

for the current year.

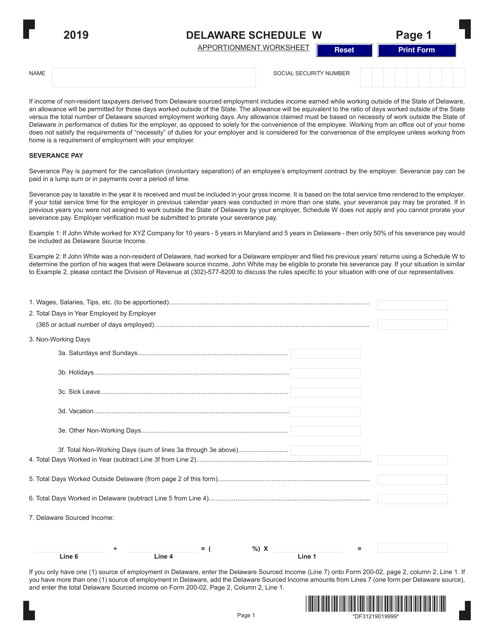

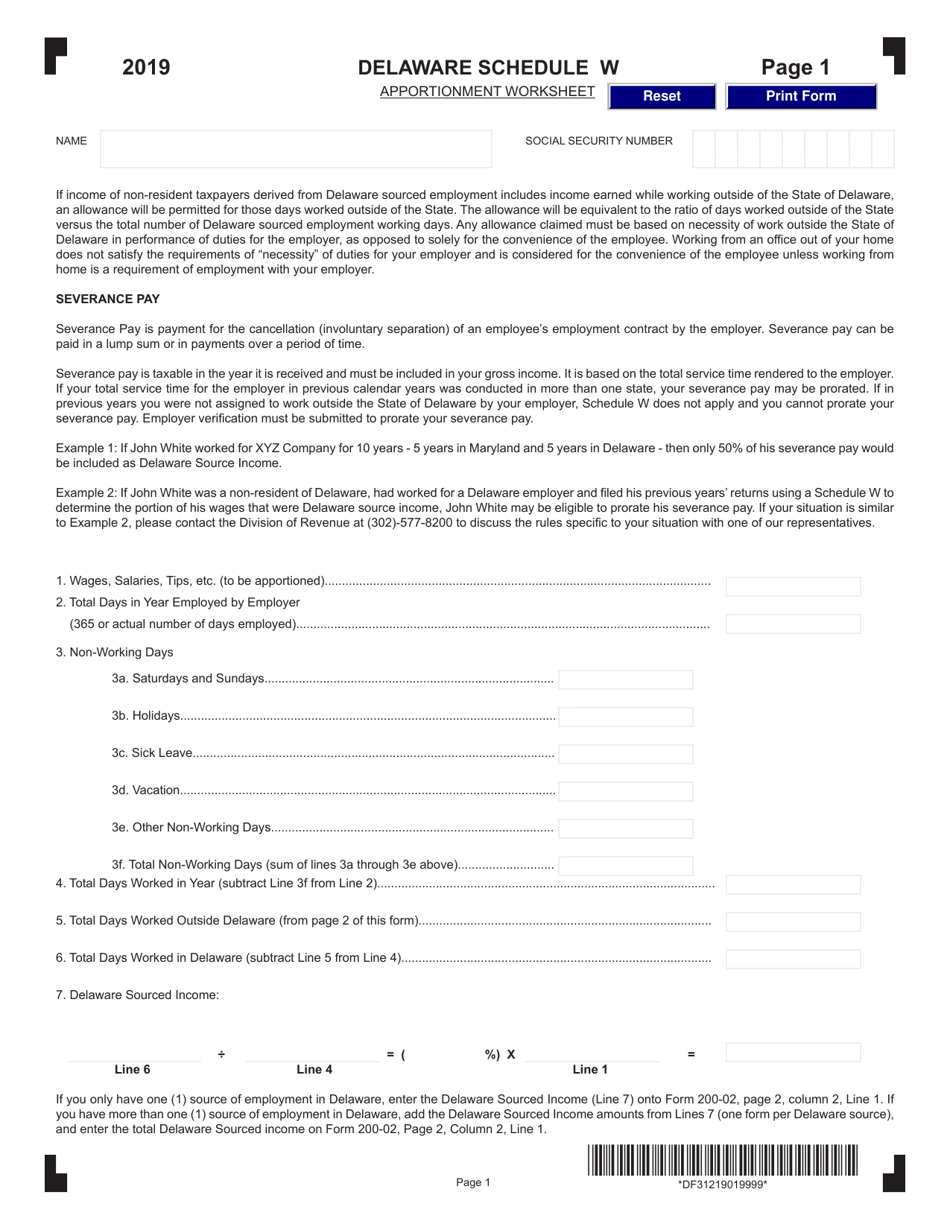

Schedule W Apportionment Worksheet - Delaware

What Is Schedule W?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule W Apportionment Worksheet?

A: Schedule W Apportionment Worksheet is a form used in Delaware to determine how much income is apportioned to the state for tax purposes.

Q: Who needs to complete Schedule W Apportionment Worksheet?

A: Businesses that have income from multiple states and operate in Delaware need to complete Schedule W Apportionment Worksheet.

Q: What is the purpose of Schedule W Apportionment Worksheet?

A: The purpose of Schedule W Apportionment Worksheet is to determine the portion of a business's income that should be allocated to Delaware for tax calculation.

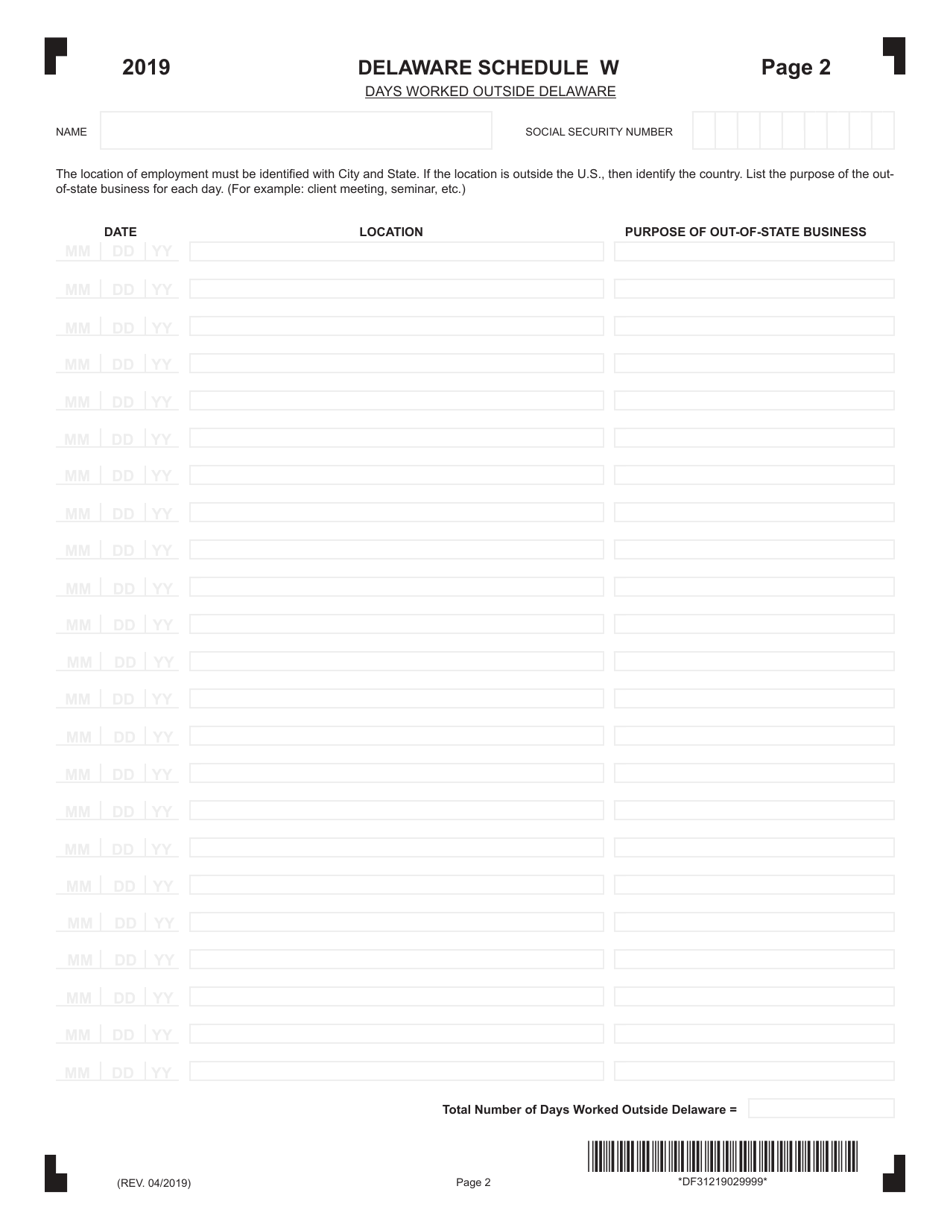

Q: What information is needed to complete Schedule W Apportionment Worksheet?

A: To complete Schedule W Apportionment Worksheet, you will need information such as total sales, property values, and payroll expenses from both Delaware and other states.

Q: What is the deadline for filing Schedule W Apportionment Worksheet?

A: The deadline for filing Schedule W Apportionment Worksheet is typically the same as the deadline for filing the Delaware corporate income tax return, which is usually on or before April 30th of each year.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule W by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.