This version of the form is not currently in use and is provided for reference only. Download this version of

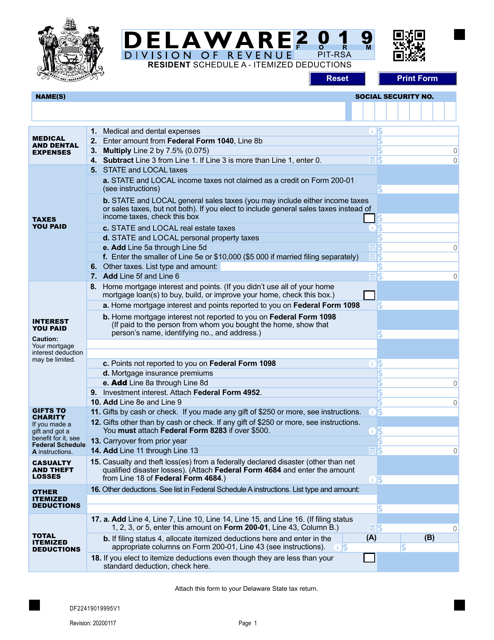

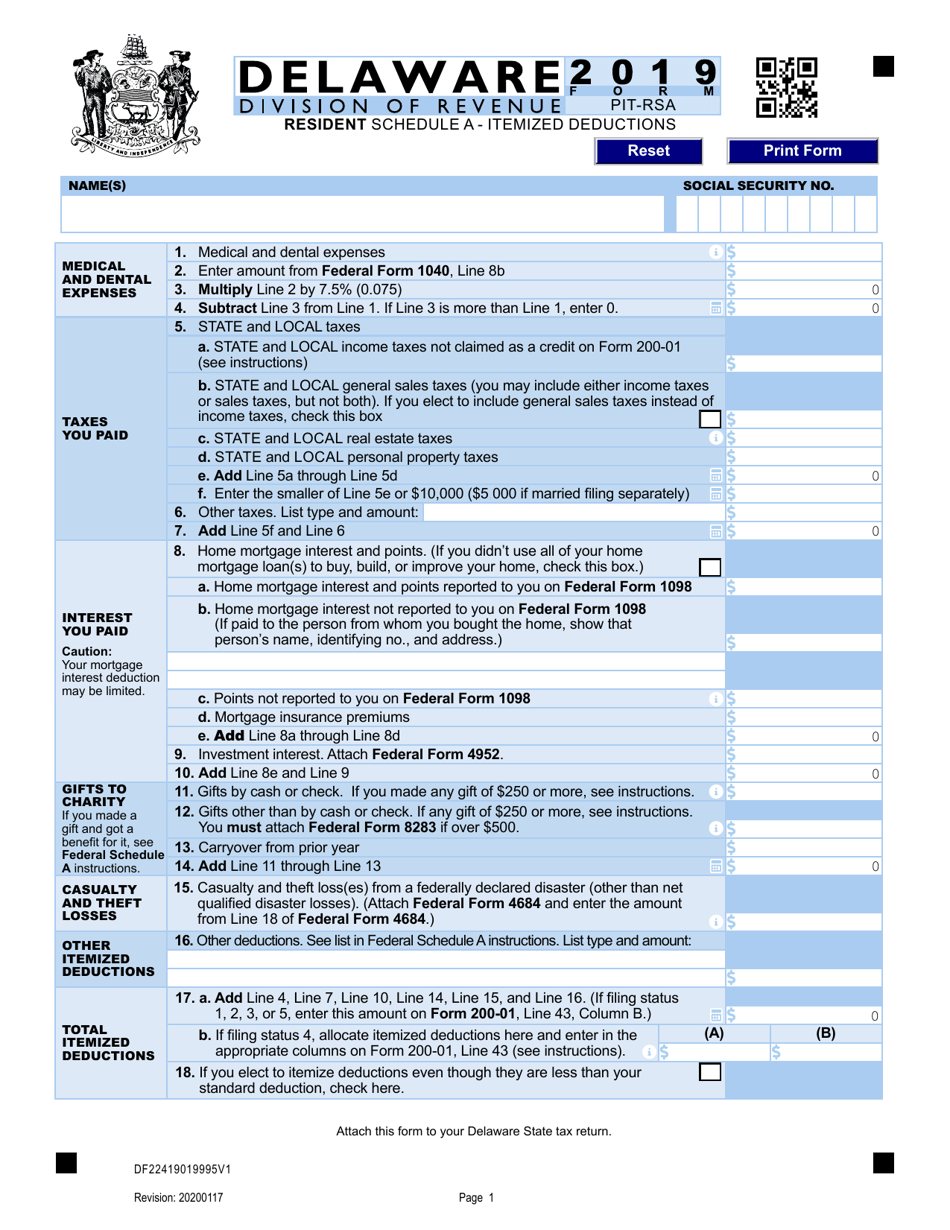

Form PIT-RSA Schedule A

for the current year.

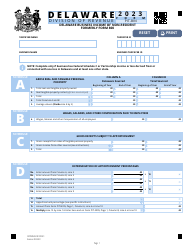

Form PIT-RSA Schedule A Delaware Resident Schedule - Delaware

What Is Form PIT-RSA Schedule A?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PIT-RSA Schedule A?

A: The PIT-RSA Schedule A is a tax form specific to Delaware residents.

Q: What is the purpose of the PIT-RSA Schedule A?

A: The purpose of the PIT-RSA Schedule A is to report certain deductions and adjustments to your Delaware state income taxes.

Q: Who needs to file the PIT-RSA Schedule A?

A: Delaware residents who have eligible deductions or adjustments to report on their state income taxes need to file the PIT-RSA Schedule A.

Q: What deductions and adjustments can be reported on the PIT-RSA Schedule A?

A: Deductions and adjustments such as medical expenses, real estate taxes, mortgage interest, and certain other expenses can be reported on the PIT-RSA Schedule A.

Q: When is the deadline for filing the PIT-RSA Schedule A?

A: The deadline for filing the PIT-RSA Schedule A is the same as the deadline for filing your Delaware state income tax return, usually April 30th.

Q: Do I need to include the PIT-RSA Schedule A with my federal tax return?

A: No, the PIT-RSA Schedule A is only for reporting deductions and adjustments on your Delaware state income tax return and does not need to be submitted with your federal tax return.

Q: What happens if I don't file the PIT-RSA Schedule A?

A: If you have eligible deductions or adjustments to report and fail to file the PIT-RSA Schedule A, you may miss out on potential tax savings and may be subject to penalties or fines.

Q: Can I e-file the PIT-RSA Schedule A?

A: Yes, you can e-file the PIT-RSA Schedule A along with your Delaware state income tax return.

Q: Is there a fee to submit the PIT-RSA Schedule A?

A: No, there is no fee to submit the PIT-RSA Schedule A form.

Form Details:

- Released on January 17, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-RSA Schedule A by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.