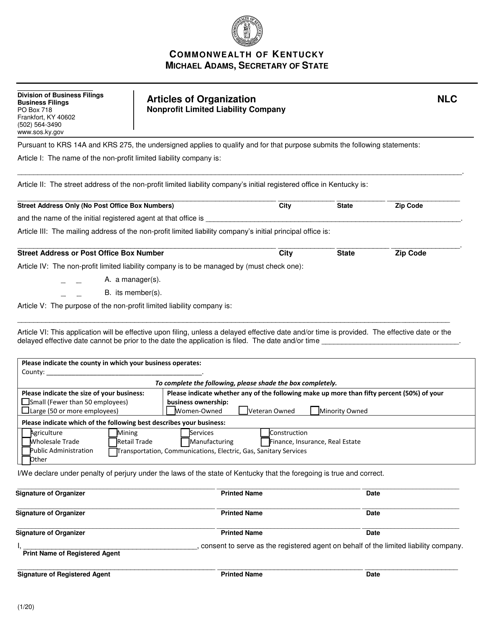

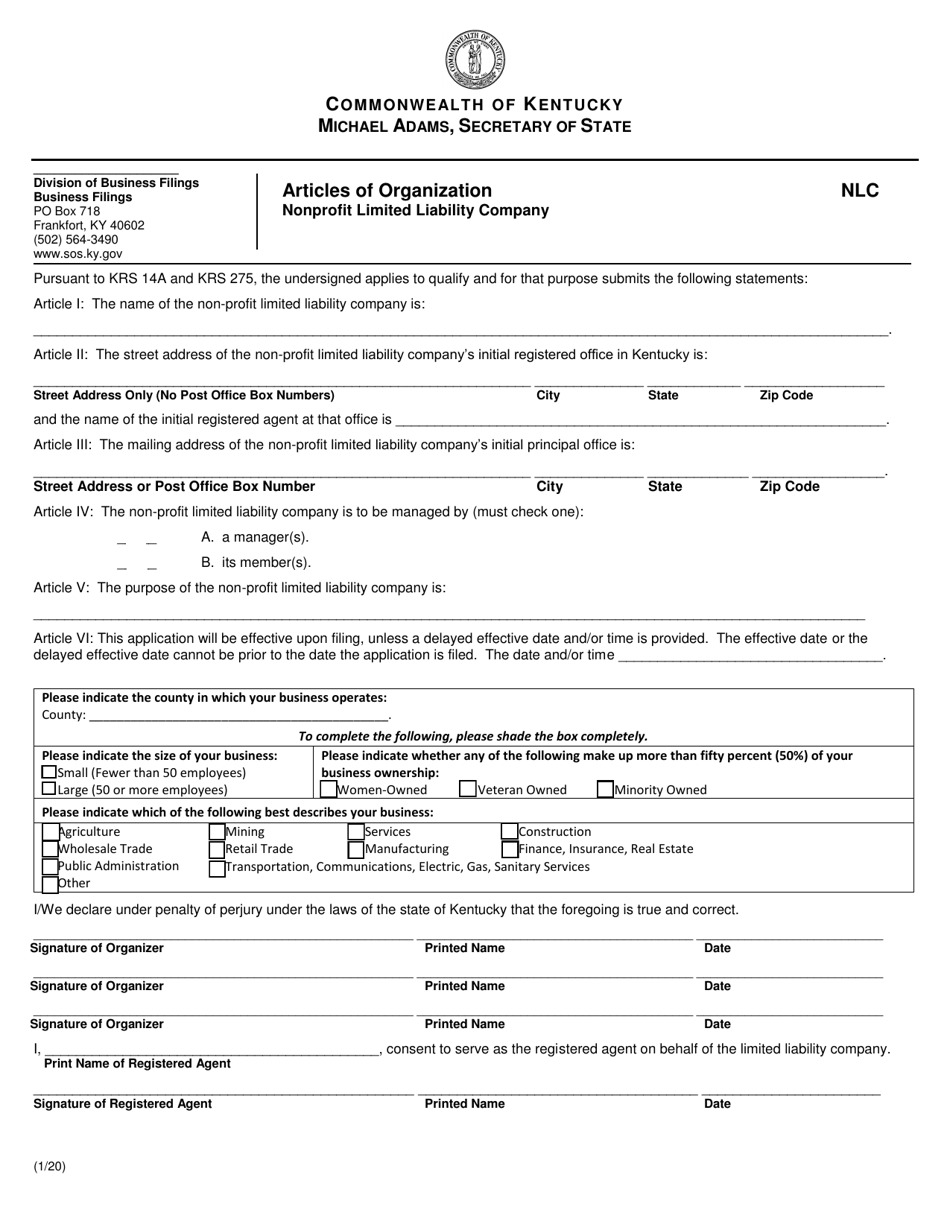

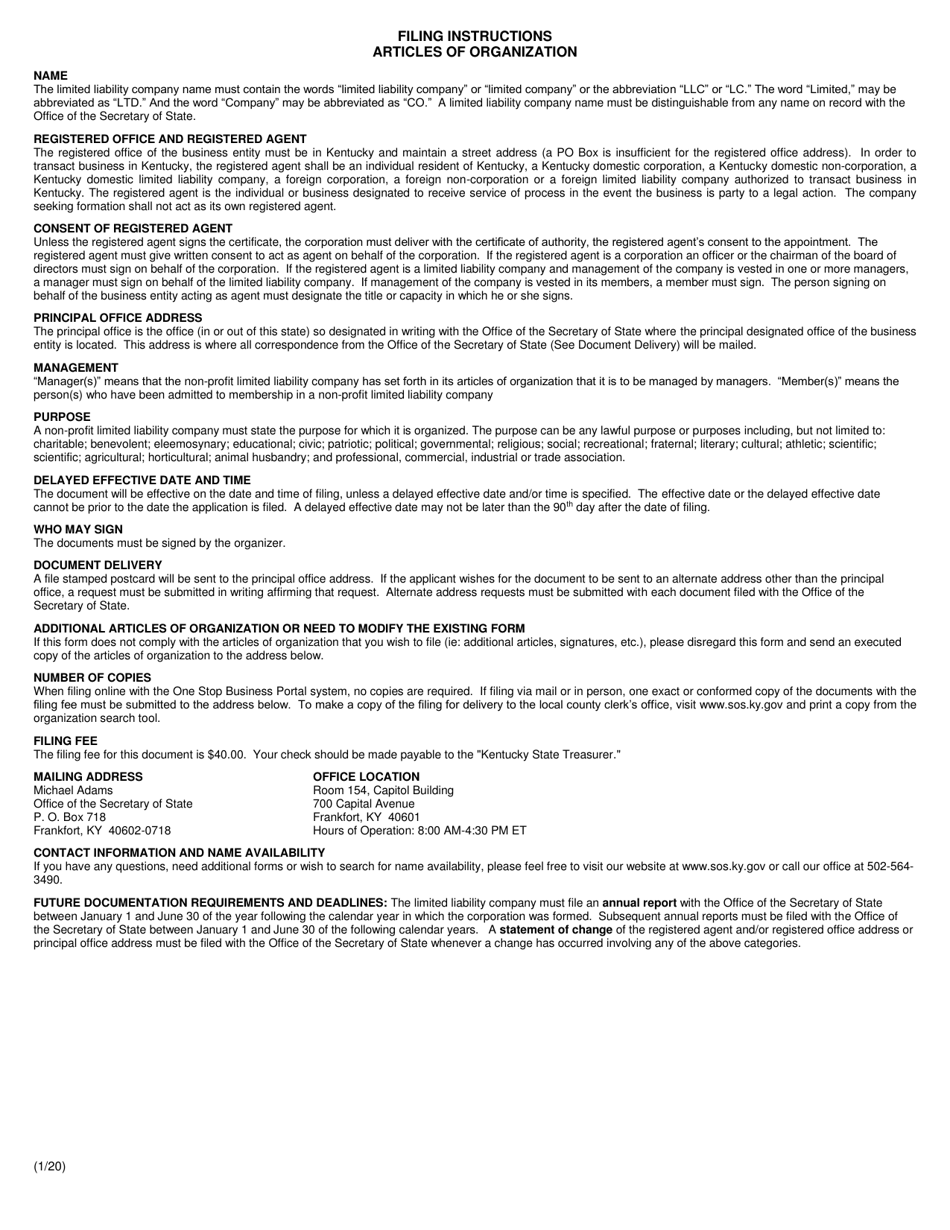

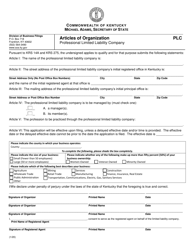

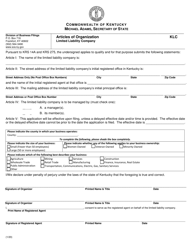

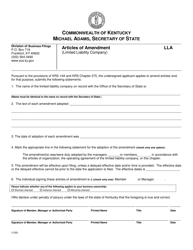

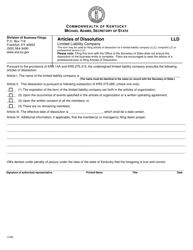

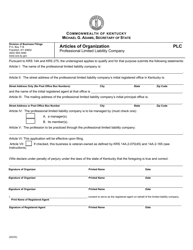

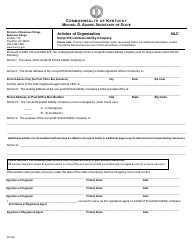

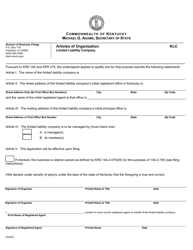

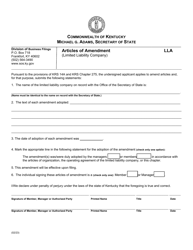

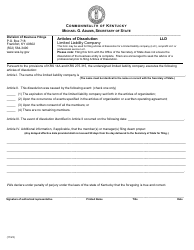

Articles of Organization - Nonprofit Limited Liability Company - Kentucky

Articles of Organization - Nonprofit Limited Liability Company is a legal document that was released by the Kentucky Secretary of State - a government authority operating within Kentucky.

FAQ

Q: What is a nonprofit limited liability company?

A: A nonprofit limited liability company is a type of legal structure that combines the benefits of a limited liability company (LLC) with the tax advantages and charitable purposes of a nonprofit organization.

Q: What are the requirements to form a nonprofit limited liability company in Kentucky?

A: To form a nonprofit limited liability company in Kentucky, you must submit Articles of Organization to the Kentucky Secretary of State's office, along with the required filing fee.

Q: What information is required in the Articles of Organization for a nonprofit LLC in Kentucky?

A: The Articles of Organization for a nonprofit LLC in Kentucky must include the name of the LLC, its principal office address, the name and address of the registered agent, and a statement of purpose indicating that the LLC will operate for a nonprofit purpose.

Q: What are the benefits of forming a nonprofit LLC in Kentucky?

A: Forming a nonprofit LLC in Kentucky allows for limited liability protection for its members, along with the ability to engage in activities with a charitable or educational purpose while being taxed as a nonprofit organization.

Q: Can a nonprofit LLC in Kentucky make a profit?

A: While a nonprofit LLC in Kentucky can generate revenue, any excess revenue must be used to further the organization's nonprofit mission, rather than distributing it to its members as profits.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Kentucky Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.