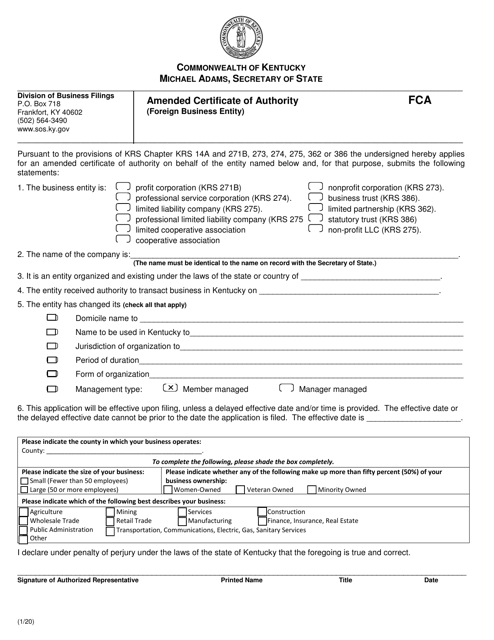

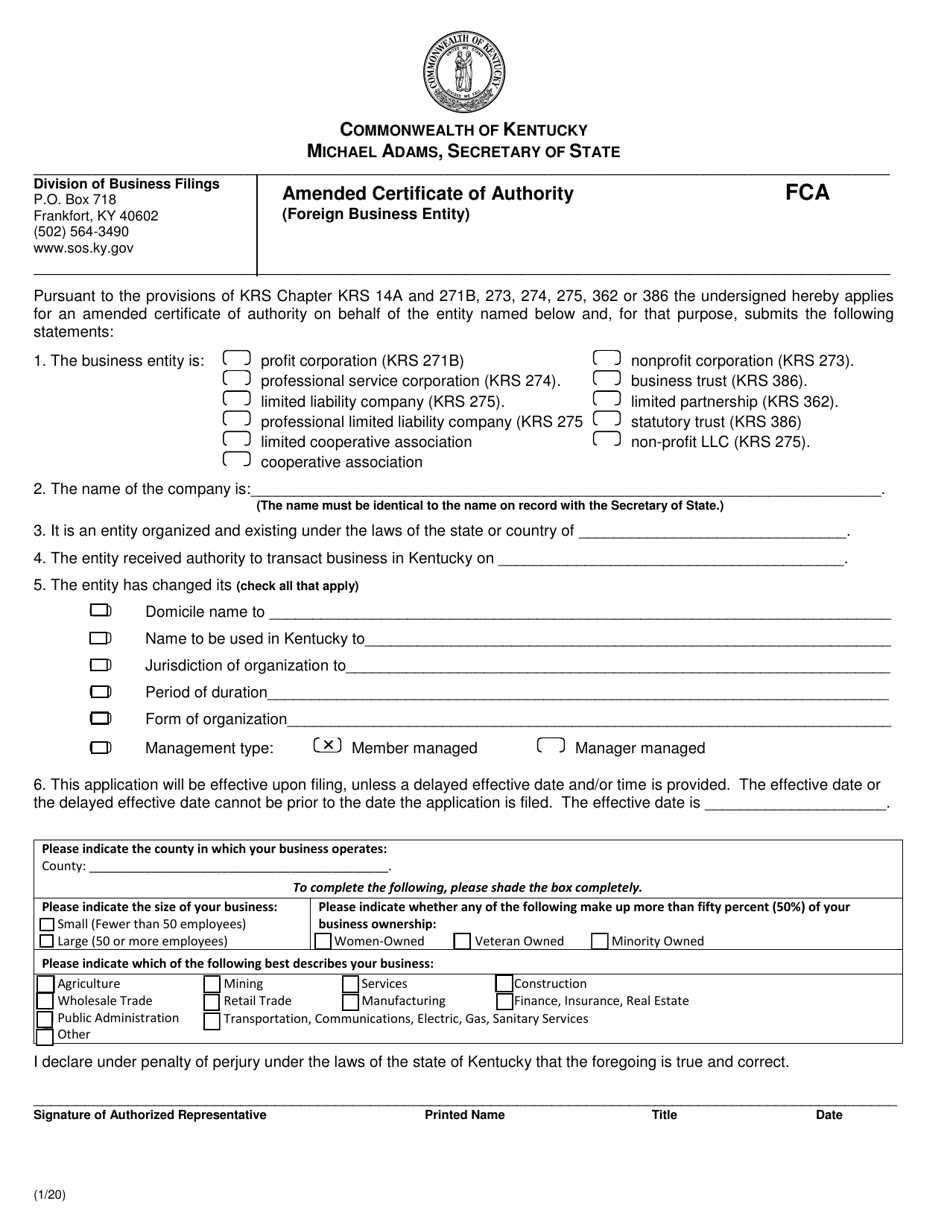

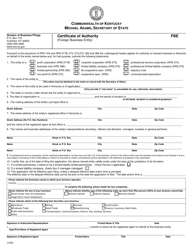

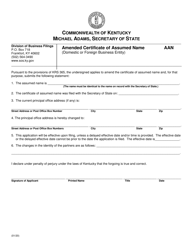

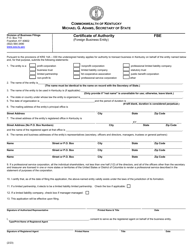

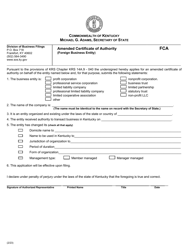

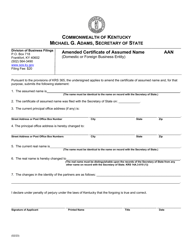

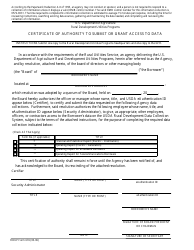

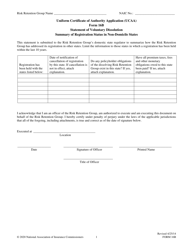

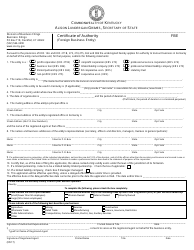

Amended Certificate of Authority (Foreign Business Entity) - Kentucky

Amended Certificate of Authority (Foreign Business Entity) is a legal document that was released by the Kentucky Secretary of State - a government authority operating within Kentucky.

FAQ

Q: What is an Amended Certificate of Authority?

A: An Amended Certificate of Authority is a document that represents a change or update to the existing Certificate of Authority of a foreign business entity in Kentucky.

Q: What is a foreign business entity?

A: A foreign business entity refers to any business that is formed or incorporated outside the state of Kentucky.

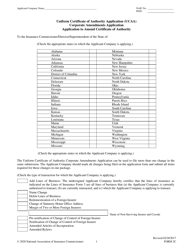

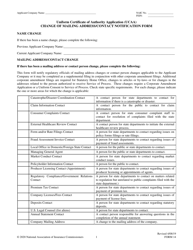

Q: Why would a foreign business entity need to file an Amended Certificate of Authority?

A: A foreign business entity needs to file an Amended Certificate of Authority if there are any changes or updates to its original business information, such as a change in name, address, or members/officers.

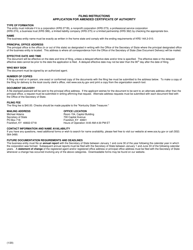

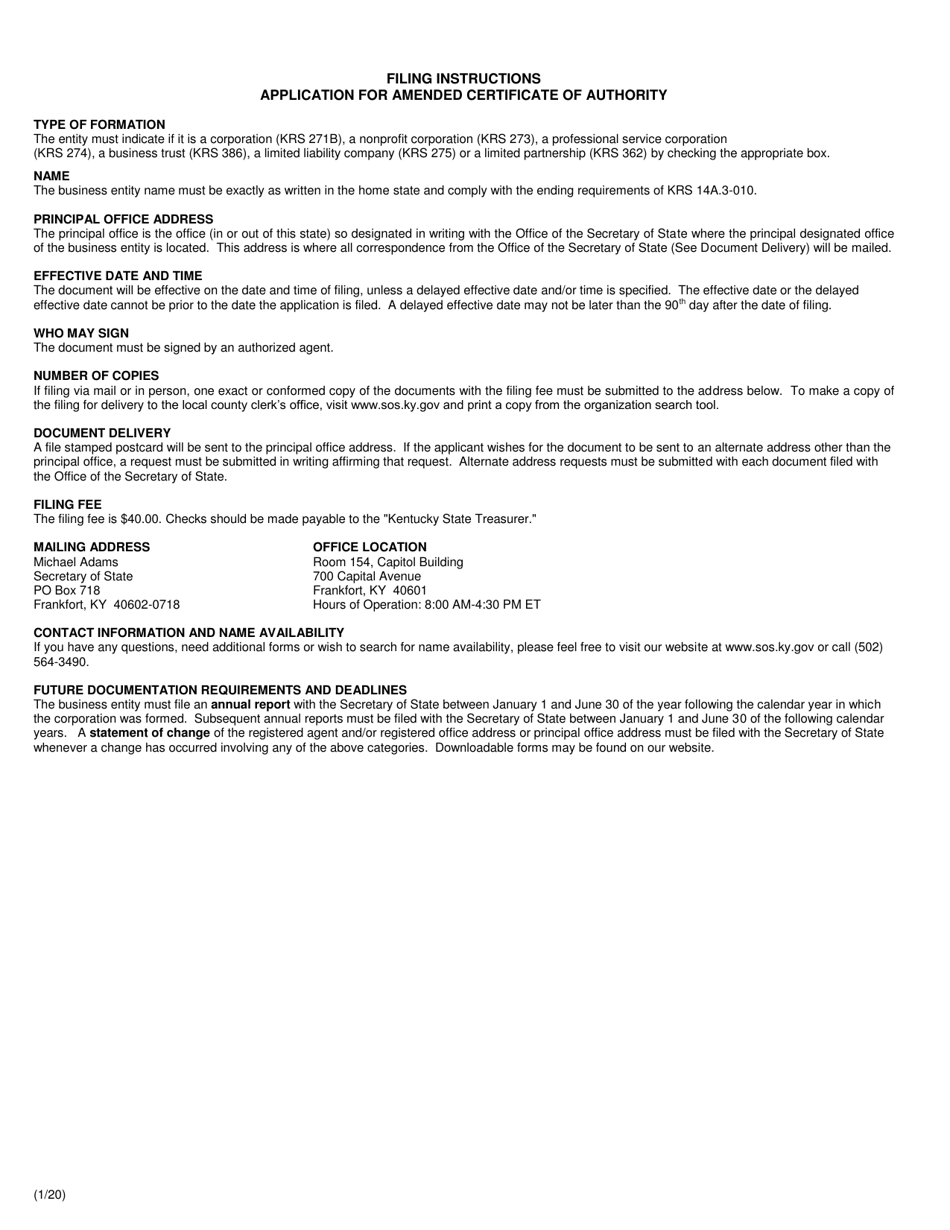

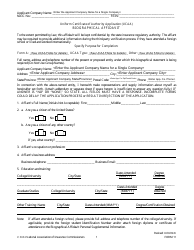

Q: How can I file an Amended Certificate of Authority in Kentucky?

A: To file an Amended Certificate of Authority, you need to complete the necessary form provided by the Kentucky Secretary of State's office and submit it along with the applicable fees.

Q: What happens if a foreign business entity does not file an Amended Certificate of Authority?

A: Failure to file an Amended Certificate of Authority may result in penalties or the loss of the entity's legal standing in Kentucky.

Q: How long does it take to process an Amended Certificate of Authority in Kentucky?

A: The processing time for an Amended Certificate of Authority may vary, but it is typically within a few weeks.

Q: Are there any specific requirements for filing an Amended Certificate of Authority?

A: Yes, you must meet the specific requirements outlined by the Kentucky Secretary of State's office, which may include providing certain supporting documents or information.

Q: Can I obtain a copy of an Amended Certificate of Authority?

A: Yes, you can request a copy of an Amended Certificate of Authority from the Kentucky Secretary of State's office by submitting a request and paying the applicable fees.

Q: Does filing an Amended Certificate of Authority change the entity's tax obligations?

A: Filing an Amended Certificate of Authority does not directly impact the entity's tax obligations. The entity will still need to comply with the tax laws and regulations of Kentucky.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Kentucky Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.