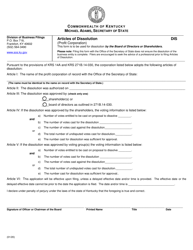

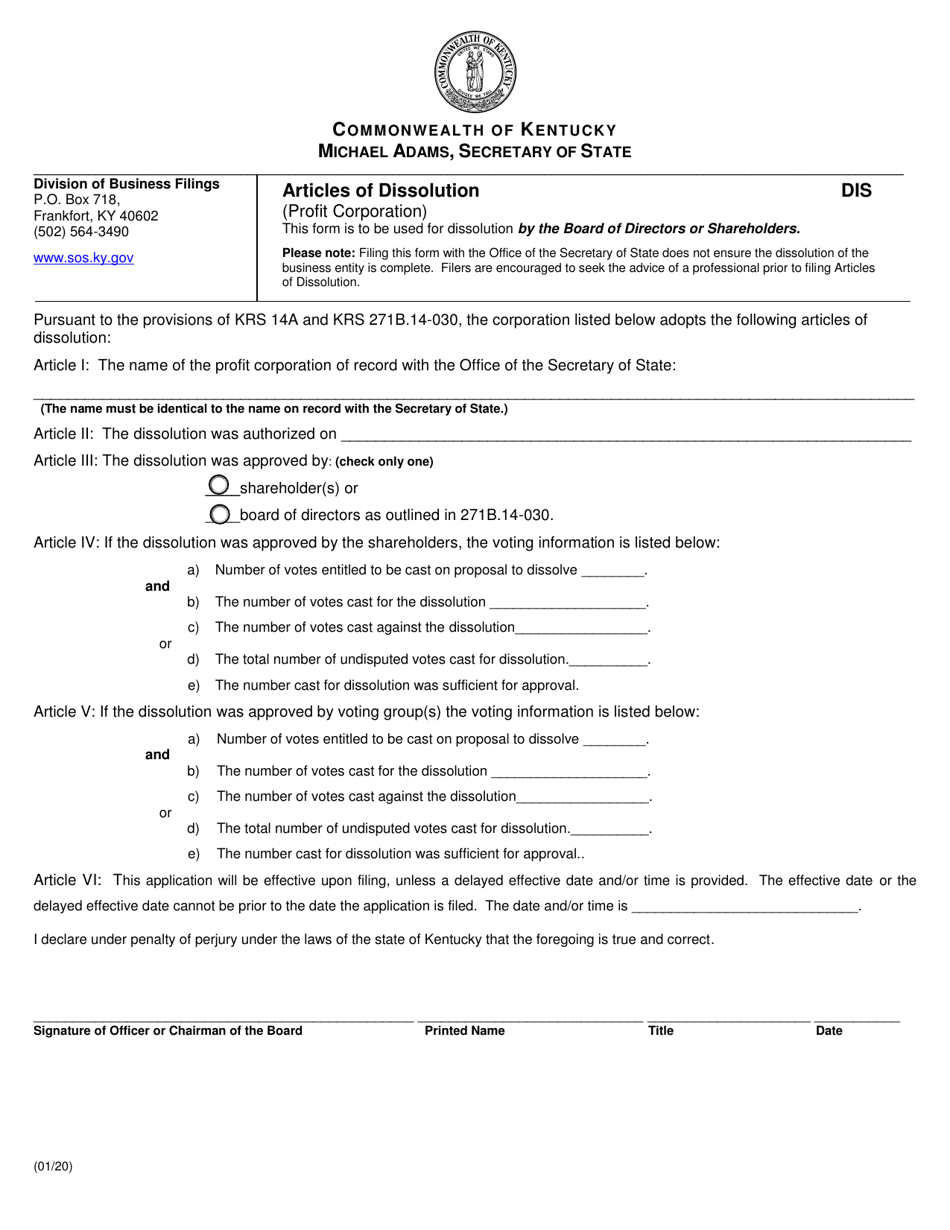

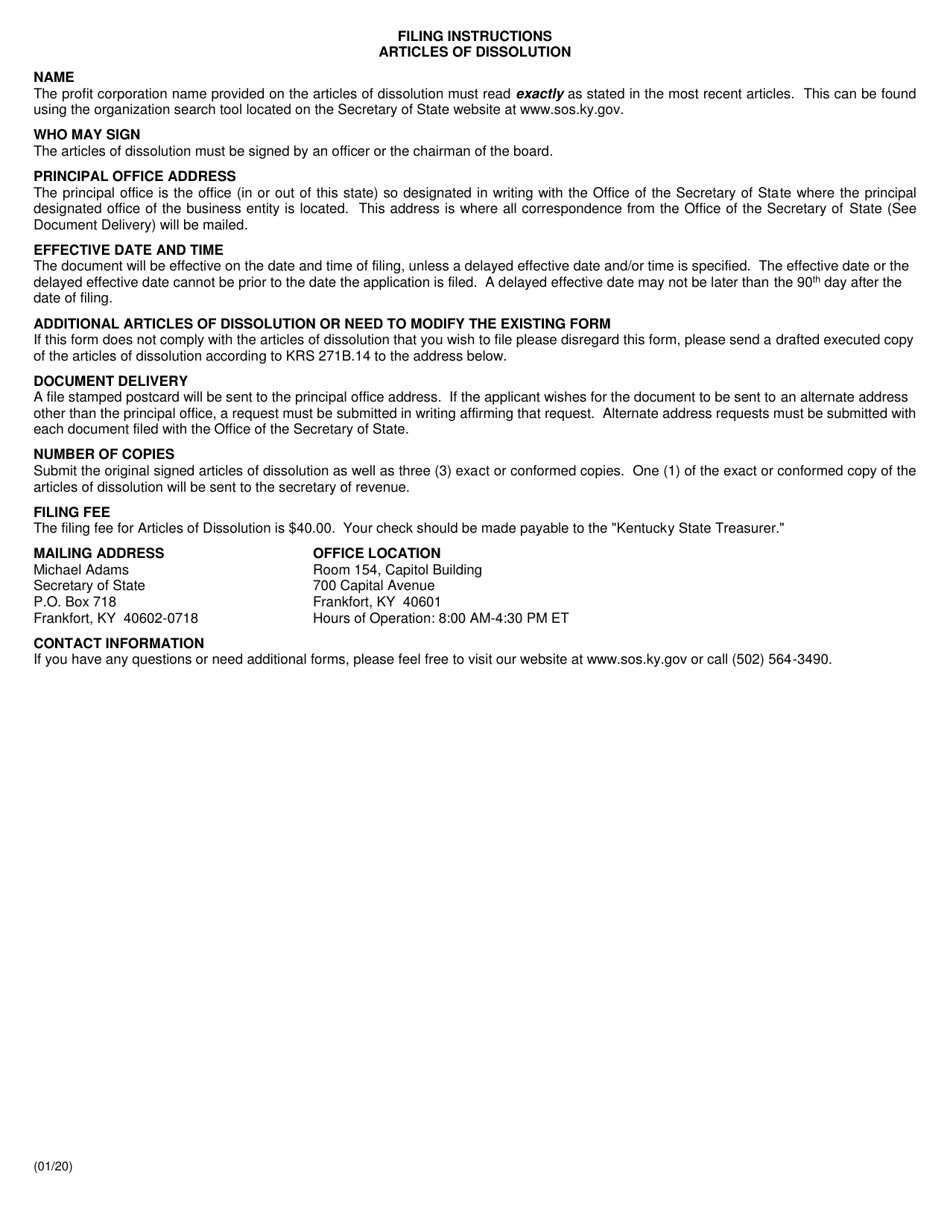

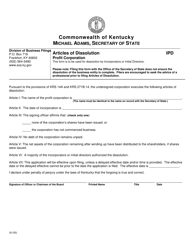

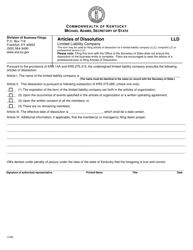

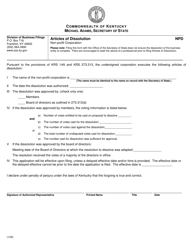

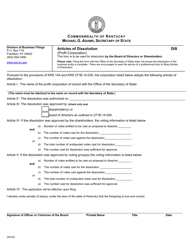

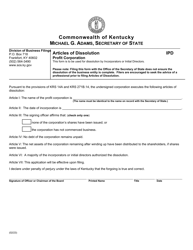

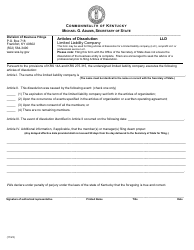

Articles of Dissolution (Profit Corporation) - Kentucky

Articles of Dissolution (Profit Corporation) is a legal document that was released by the Kentucky Secretary of State - a government authority operating within Kentucky.

FAQ

Q: What is an Articles of Dissolution?

A: Articles of Dissolution is a legal document that officially terminates the existence of a profit corporation.

Q: Why would a profit corporation file Articles of Dissolution?

A: A profit corporation may file Articles of Dissolution if they no longer wish to continue their business operations or if they have fulfilled their purpose.

Q: How can a profit corporation file Articles of Dissolution in Kentucky?

A: A profit corporation can file Articles of Dissolution in Kentucky by submitting the completed form to the Kentucky Secretary of State along with the required filing fee.

Q: What information is required in the Articles of Dissolution?

A: The Articles of Dissolution should include the name of the corporation, the reason for dissolution, and a statement verifying that the dissolution has been approved by the board of directors and shareholders.

Q: Are there any fees associated with filing Articles of Dissolution?

A: Yes, there is a filing fee that must be paid to the Kentucky Secretary of State when submitting the Articles of Dissolution.

Q: Is there a deadline for filing Articles of Dissolution?

A: There is no specific deadline for filing Articles of Dissolution, but it is recommended to file the document as soon as the decision to dissolve the corporation has been made.

Q: What happens after the Articles of Dissolution are filed?

A: Once the Articles of Dissolution are filed and approved by the Kentucky Secretary of State, the corporation is officially dissolved and no longer exists as a legal entity.

Q: Is there a way to revoke the dissolution of a profit corporation?

A: Yes, a profit corporation may be able to revoke the dissolution by filing a Certificate of Revocation of Dissolution with the Kentucky Secretary of State before the dissolution becomes effective.

Q: Are there any other requirements or steps to take when dissolving a profit corporation?

A: In addition to filing Articles of Dissolution, a profit corporation may need to settle any outstanding debts, distribute any remaining assets, and comply with any other legal obligations before the dissolution is complete.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Kentucky Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.