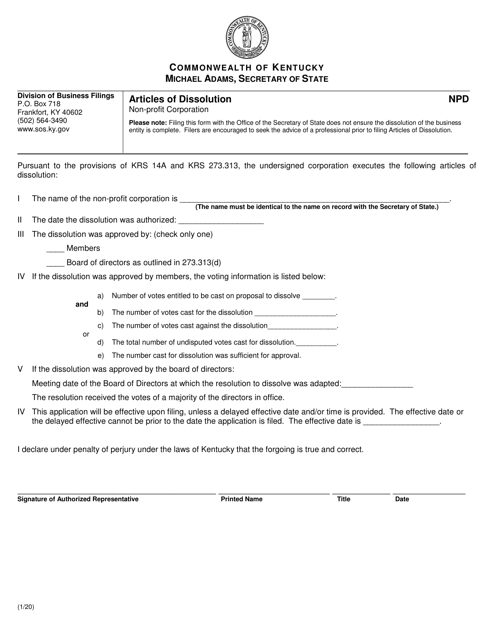

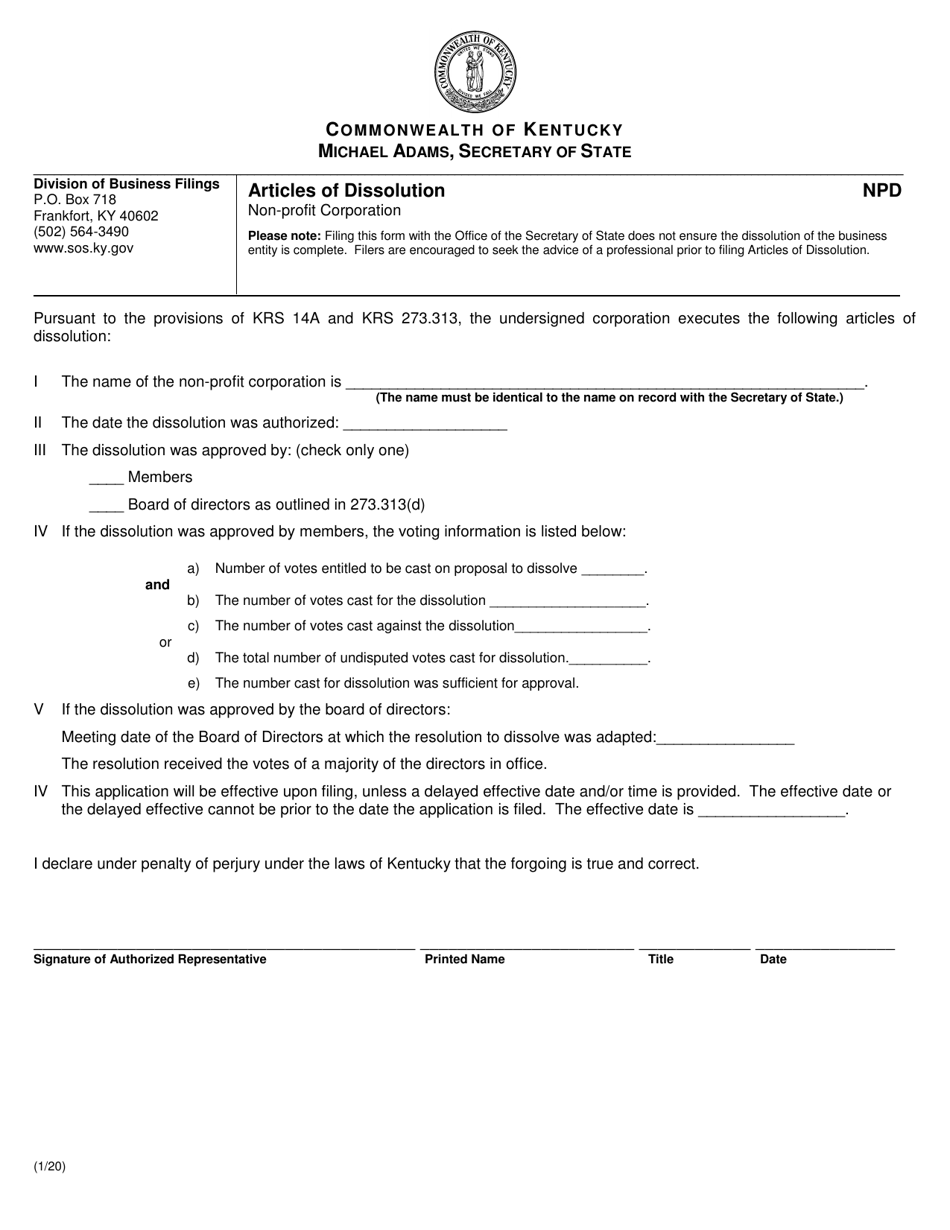

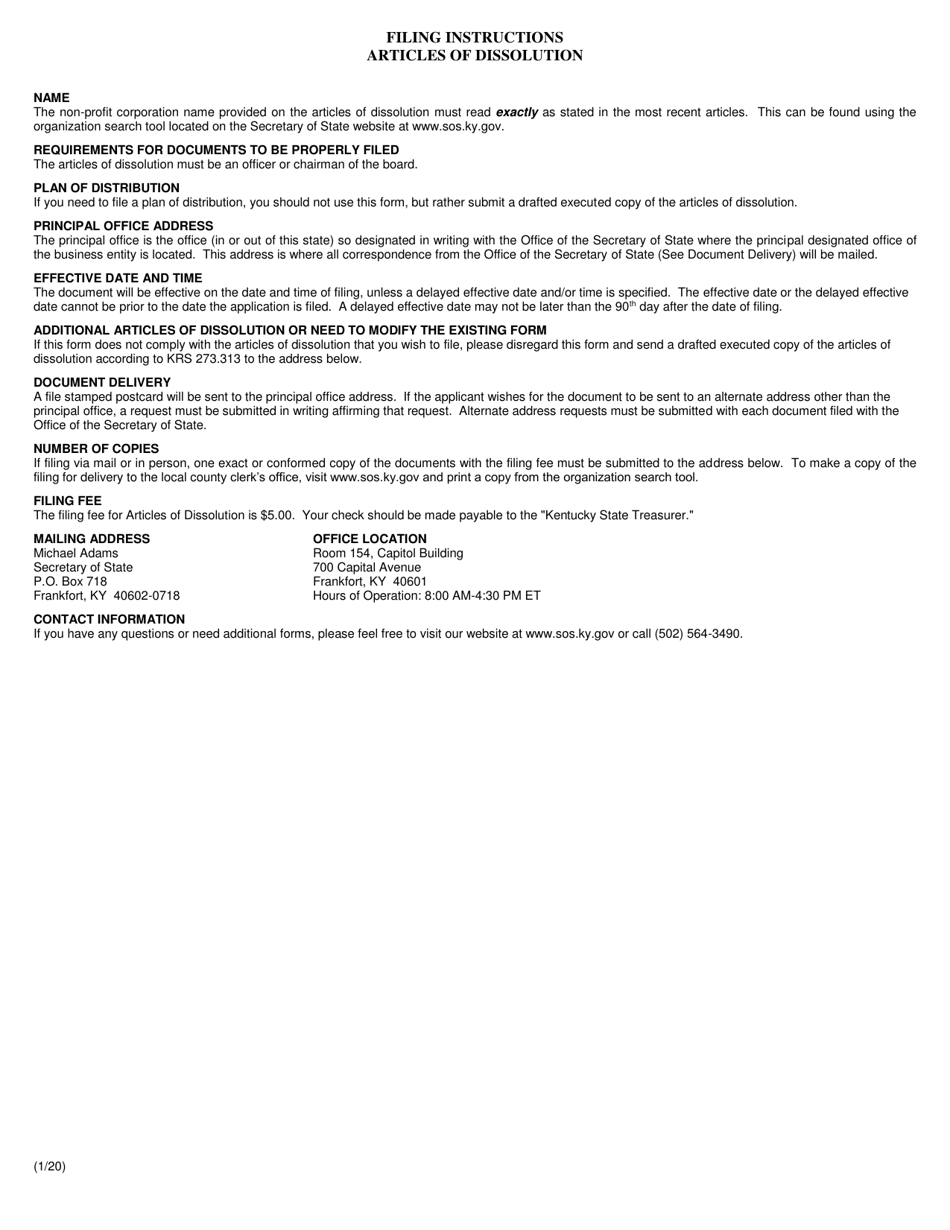

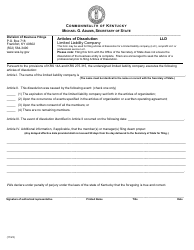

Articles of Dissolution - Non-profit Corporation - Kentucky

Articles of Dissolution - Non-profit Corporation is a legal document that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky.

FAQ

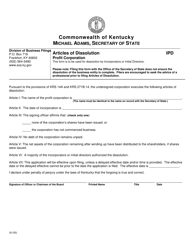

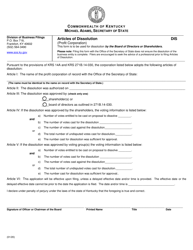

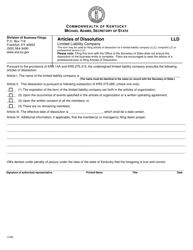

Q: What are Articles of Dissolution?

A: Articles of Dissolution are legal documents that are filed when a non-profit corporation in Kentucky wants to officially dissolve and cease its operations.

Q: Why would a non-profit corporation in Kentucky file Articles of Dissolution?

A: A non-profit corporation may file Articles of Dissolution in Kentucky if it is no longer able to continue its operations or if its members or board of directors decide to dissolve it.

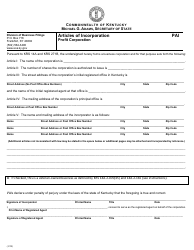

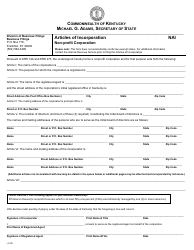

Q: What information is typically included in the Articles of Dissolution?

A: The Articles of Dissolution typically include the name and contact information of the non-profit corporation, the reason for dissolution, and the signature of an authorized representative.

Q: Are there any fees associated with filing Articles of Dissolution for a non-profit corporation in Kentucky?

A: Yes, there is a fee associated with filing Articles of Dissolution in Kentucky. The fee amount may vary, so it is advisable to check with the Kentucky Secretary of State's office for the current fee schedule.

Q: What is the effect of filing Articles of Dissolution for a non-profit corporation in Kentucky?

A: Filing Articles of Dissolution officially terminates the existence of the non-profit corporation in Kentucky. It will no longer be able to conduct business or engage in any legal activities.

Q: Is there a specific time frame for filing Articles of Dissolution for a non-profit corporation in Kentucky?

A: There is no specific time frame for filing Articles of Dissolution in Kentucky. However, it is recommended to file the dissolution documents as soon as the decision to dissolve the non-profit corporation is made.

Q: Can a non-profit corporation in Kentucky revoke its Articles of Dissolution?

A: Yes, a non-profit corporation in Kentucky may be able to revoke its Articles of Dissolution under certain circumstances. It is advisable to consult with an attorney or legal professional for guidance on the process.

Q: What other steps may be required after filing Articles of Dissolution for a non-profit corporation in Kentucky?

A: After filing Articles of Dissolution, a non-profit corporation in Kentucky may need to fulfill other obligations, such as notifying creditors, distributing remaining assets, and filing final tax returns. It is important to consult with legal and tax professionals for guidance.

Q: Is legal representation required for filing Articles of Dissolution for a non-profit corporation in Kentucky?

A: Legal representation is not required for filing Articles of Dissolution in Kentucky. However, it is recommended to consult with an attorney or legal professional to ensure compliance with all laws and regulations.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Kentucky Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.