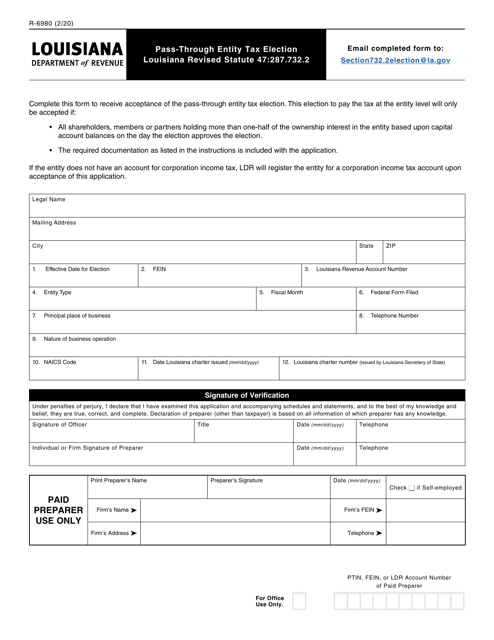

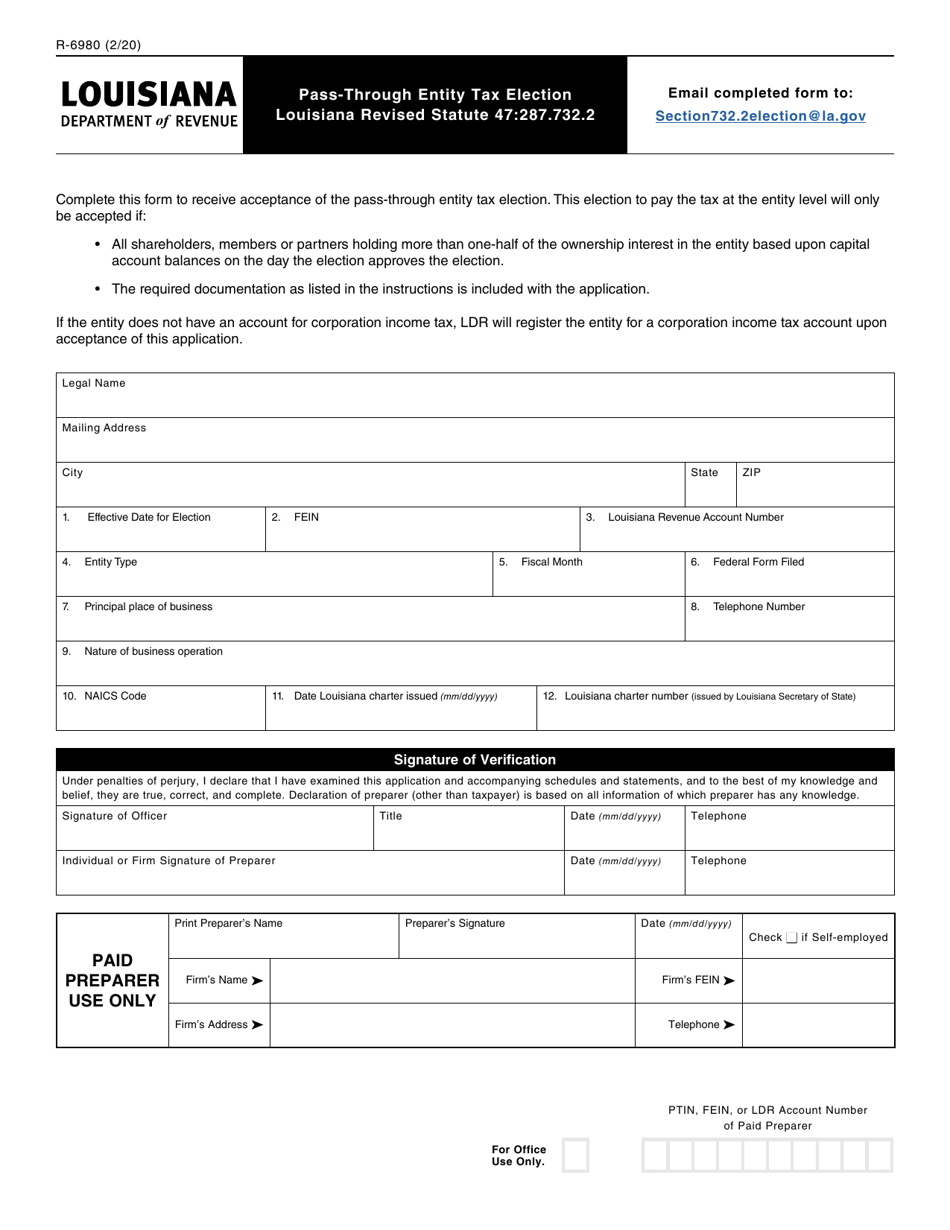

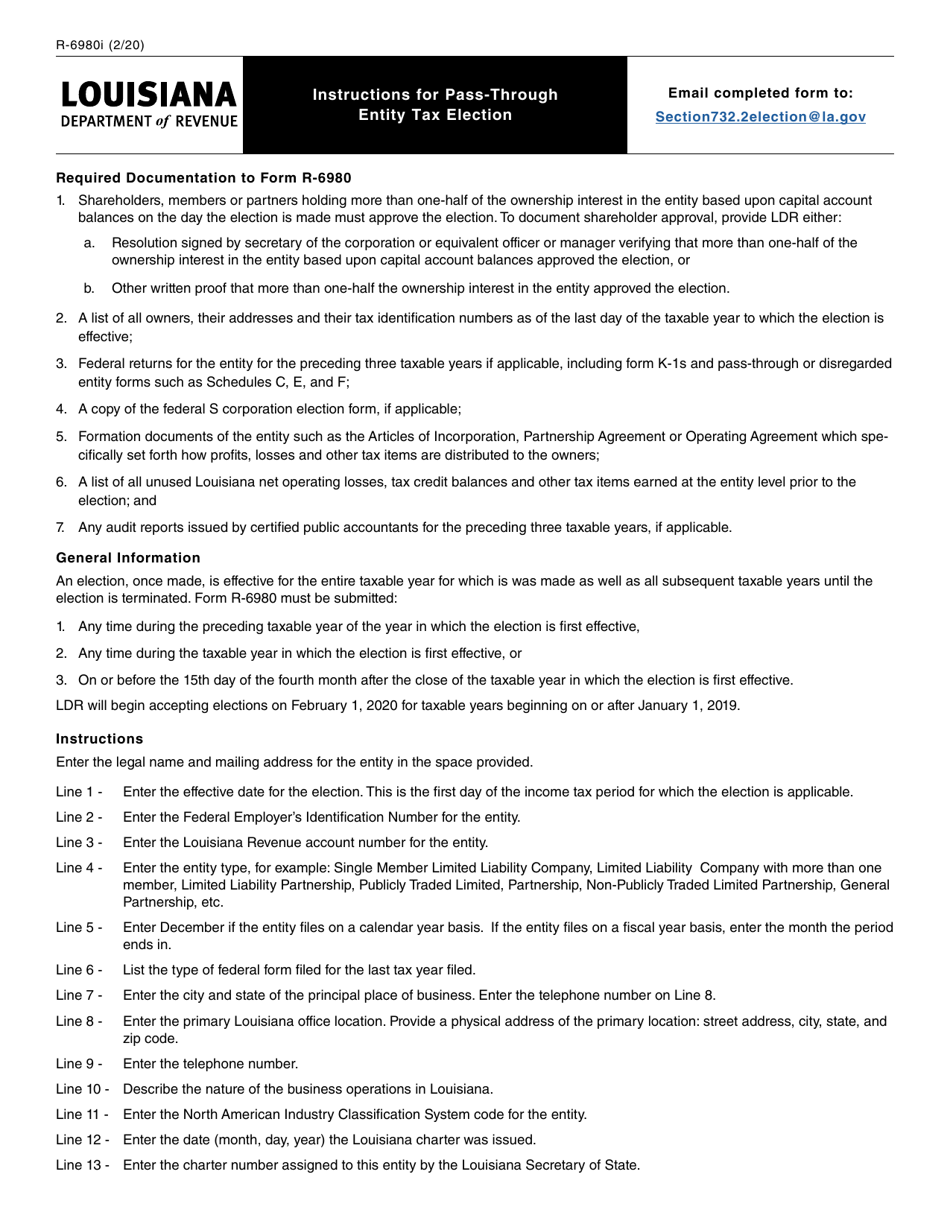

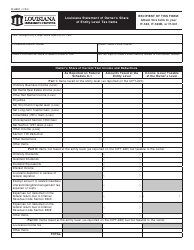

Form R-6980 Pass-Through Entity Tax Election - Louisiana

What Is Form R-6980?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6980?

A: Form R-6980 is the Pass-Through Entity Tax Election form in Louisiana.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay taxes itself, but passes its income, deductions, and credits through to its owners.

Q: Why would I need to file Form R-6980?

A: You would need to file Form R-6980 if you want your pass-through entity to be taxed at the entity level instead of the individual owner level.

Q: Who can file Form R-6980?

A: Any pass-through entity registered in the state of Louisiana can file Form R-6980.

Q: What are the benefits of filing Form R-6980?

A: Filing Form R-6980 allows the pass-through entity to be taxed at a lower tax rate than the individual owner level.

Q: What is the deadline for filing Form R-6980?

A: Form R-6980 must be filed annually by the 15th day of the fourth month following the close of the pass-through entity's tax year.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6980 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.