This version of the form is not currently in use and is provided for reference only. Download this version of

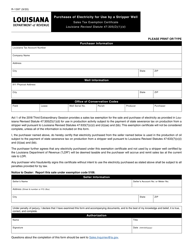

Form R-1150

for the current year.

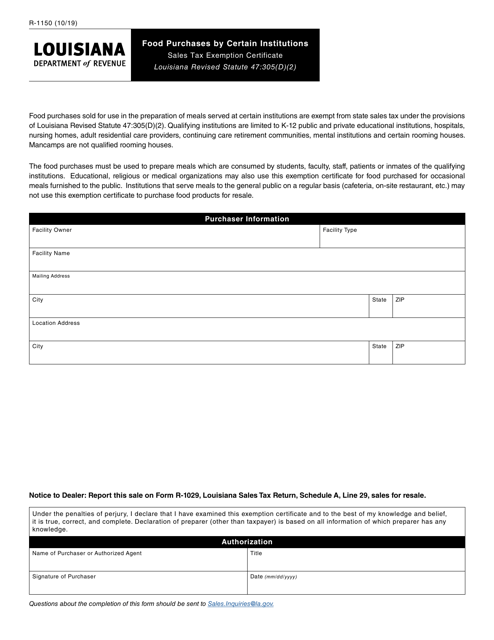

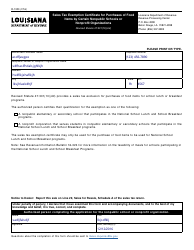

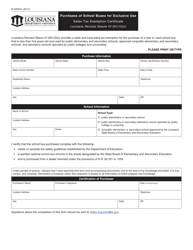

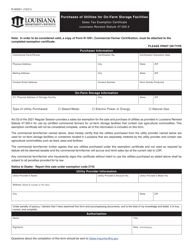

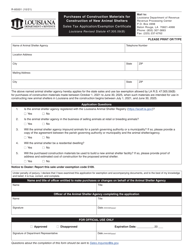

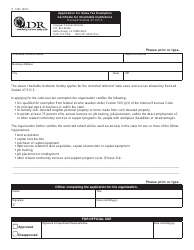

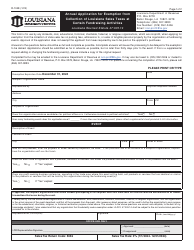

Form R-1150 Food Purchases by Certain Institutions Sales Tax Exemption Certificate - Louisiana

What Is Form R-1150?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1150?

A: Form R-1150 is a Sales Tax Exemption Certificate in Louisiana specifically for food purchases by certain institutions.

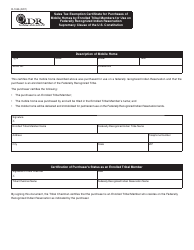

Q: Who is eligible to use Form R-1150?

A: Certain institutions in Louisiana are eligible to use Form R-1150 for tax-exempt food purchases. These institutions may include nonprofit organizations, schools, and government entities.

Q: What is the purpose of Form R-1150?

A: Form R-1150 is used to claim a sales tax exemption on food purchases made by eligible institutions in Louisiana.

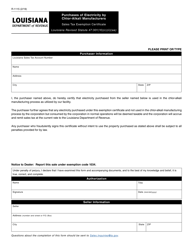

Q: What information is required on Form R-1150?

A: Form R-1150 requires information such as the institution's name, address, tax identification number, and a description of the food purchases being made.

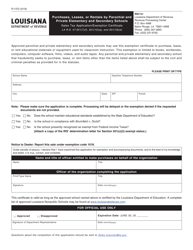

Q: How long does the sales tax exemption last with Form R-1150?

A: The sales tax exemption with Form R-1150 is valid for one year from the date of issuance.

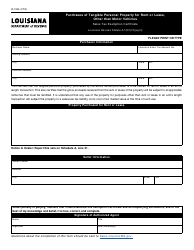

Q: Are there any limitations on the use of Form R-1150?

A: Yes, Form R-1150 can only be used for tax-exempt food purchases, and certain types of food may not qualify for exemption.

Q: Do I need to renew Form R-1150 every year?

A: Yes, Form R-1150 needs to be renewed annually to continue claiming the sales tax exemption on food purchases.

Q: Are there any penalties for misuse of Form R-1150?

A: Misuse of Form R-1150 may result in penalties, including fines and potential loss of the sales tax exemption benefits.

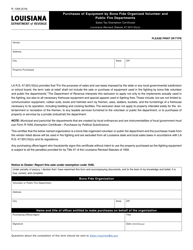

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1150 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.